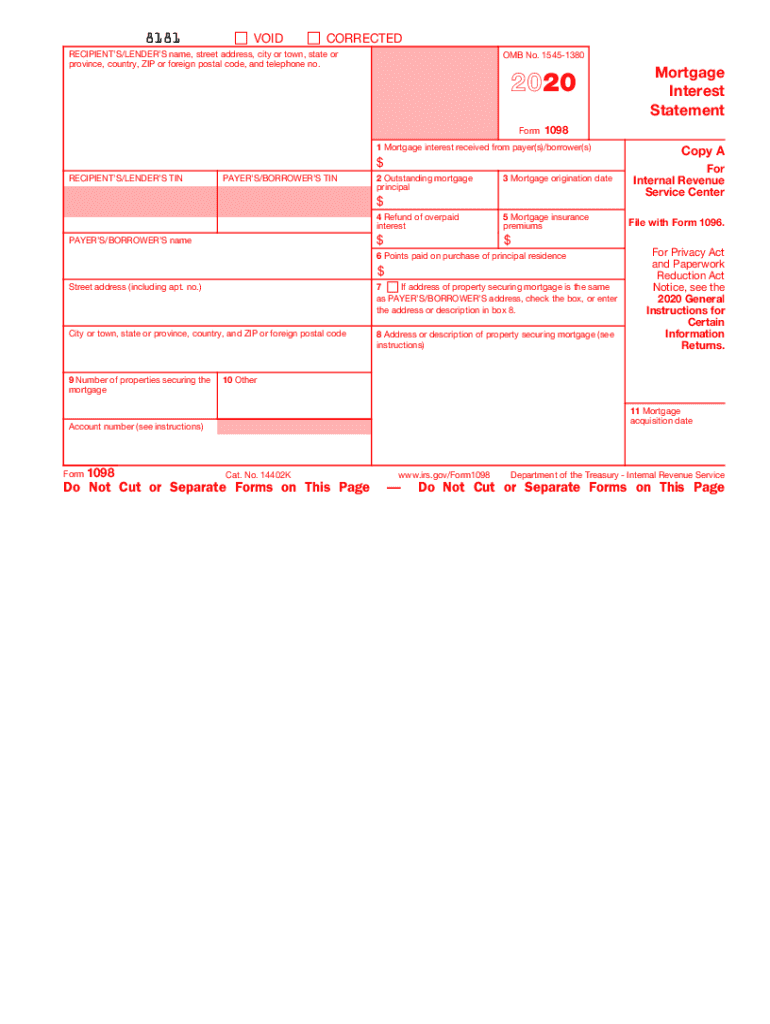

1098 -T Form

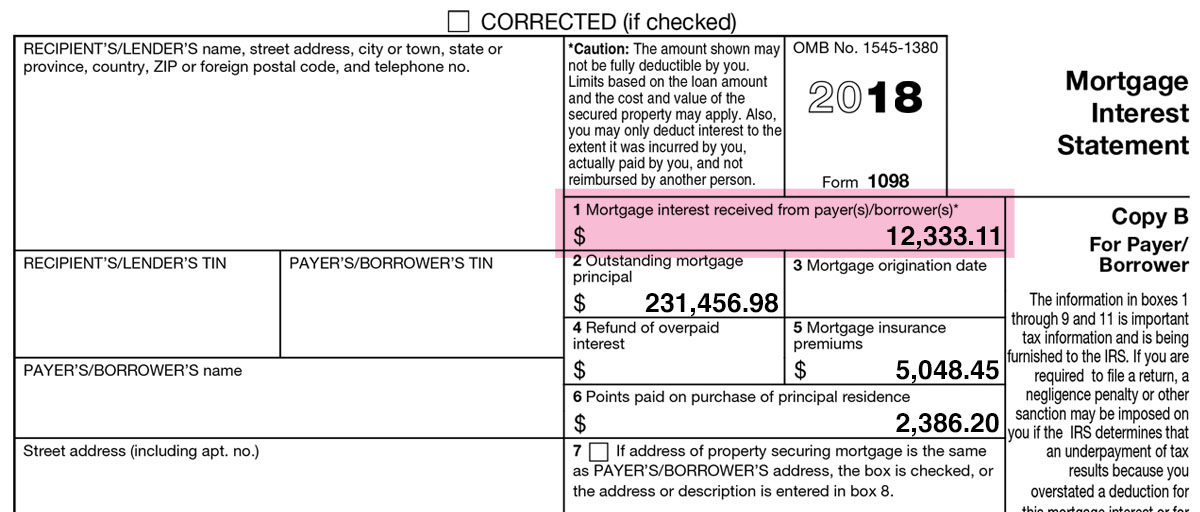

1098 -T Form - The irs form 1098 informs you how much interest you paid on your mortgage loan for the last tax year. Web form 1098 is a form that is used to report mortgage interest paid. Web definition irs form 1098 is a mortgage interest statement. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. This box reports the total amount. Complete, edit or print tax forms instantly. To print your tax forms, go to your banner. It provides the total dollar amount paid by the student for what is. The 1098t forms are now available for students to print. Payments received for qualified tuition and related expenses.

The irs form 1098 informs you how much interest you paid on your mortgage loan for the last tax year. Web on your 1098 tax form is the following information: Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Ad complete irs tax forms online or print government tax documents. This box reports the total amount. The 1098t forms are now available for students to print. It outlines the tuition expenses you paid for college, which may entitle you to an adjustment to income. Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. Payments received for qualified tuition and related expenses. Referred to as the mortgage interest statement, the 1098 tax form allows business to notify the irs of.

The irs form 1098 informs you how much interest you paid on your mortgage loan for the last tax year. The 1098t forms are now available for students to print. It outlines the tuition expenses you paid for college, which may entitle you to an adjustment to income. It provides the total dollar amount paid by the student for what is. It's a tax form used by businesses and lenders to report mortgage interest paid to them of $600 or more. Web definition irs form 1098 is a mortgage interest statement. Web what is irs tax form 1098, mortgage interest statement? To print your tax forms, go to your banner. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Please follow the instructions below.

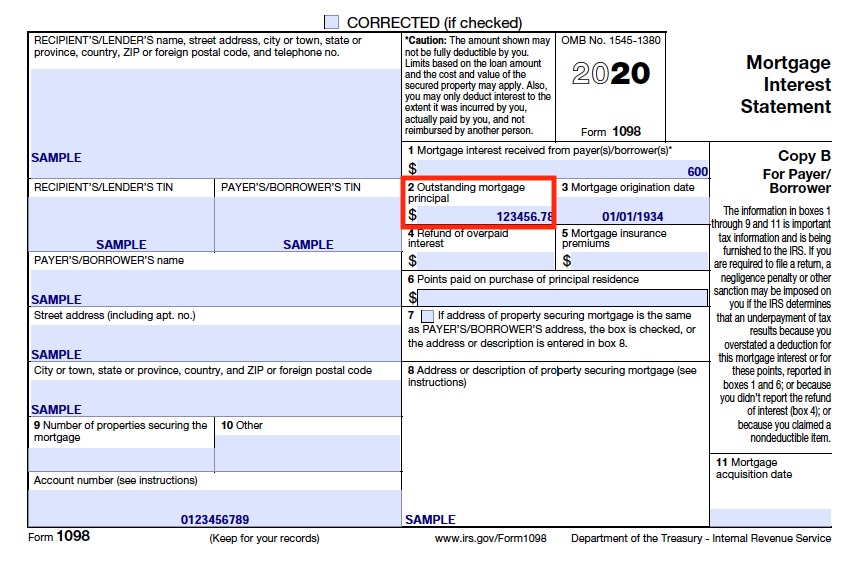

End of Year Form 1098 changes Peak Consulting

Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web on your 1098 tax form is the following information: To print your tax forms, go to your banner. Web each borrower is entitled to deduct only the amount.

Form 1098 Mortgage Interest Statement Definition

It outlines the tuition expenses you paid for college, which may entitle you to an adjustment to income. The irs form 1098 informs you how much interest you paid on your mortgage loan for the last tax year. Ad complete irs tax forms online or print government tax documents. This box reports the total amount. Web form 1098 is a.

Form 1098 and Your Mortgage Interest Statement

Edit, sign and save irs tuition statement form. Ad complete irs tax forms online or print government tax documents. Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. It shows how much the borrower pays in a. This box reports the total amount.

Form 1098 Mortgage Interest Statement and How to File

Web definition irs form 1098 is a mortgage interest statement. Web what is irs tax form 1098, mortgage interest statement? Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. Payments received for qualified tuition and related expenses. Web on your 1098 tax form is the.

2020 Form IRS 1098 Fill Online, Printable, Fillable, Blank pdfFiller

To print your tax forms, go to your banner. Please follow the instructions below. Web on your 1098 tax form is the following information: Web what is irs tax form 1098, mortgage interest statement? Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share.

How to Print and File Tax Form 1098C, Contributions of Motor Vehicles

Payments received for qualified tuition and related expenses. This box reports the total amount. The 1098t forms are now available for students to print. Web what is irs tax form 1098, mortgage interest statement? It shows how much the borrower pays in a.

1098T Information Bursar's Office Office of Finance UTHSC

Web what is irs tax form 1098, mortgage interest statement? Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. Payments received for qualified tuition and related expenses. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or.

1098 Mortgage Interest Forms United Bank of Union

Payments received for qualified tuition and related expenses. Ad complete irs tax forms online or print government tax documents. Web definition irs form 1098 is a mortgage interest statement. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as.

Form 1098T Information Student Portal

It shows how much the borrower pays in a. The irs form 1098 informs you how much interest you paid on your mortgage loan for the last tax year. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as.

Form 1098T Still Causing Trouble for Funded Graduate Students

It shows how much the borrower pays in a. Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. Please follow the instructions below. Payments received for qualified tuition and related expenses. Web definition irs form 1098 is a mortgage interest statement.

Payments Received For Qualified Tuition And Related Expenses.

Web what is irs tax form 1098, mortgage interest statement? Web on your 1098 tax form is the following information: Web a mortgage interest statement or form 1098 is filled out by the lender to report the amount of mortgage interest during the year. Referred to as the mortgage interest statement, the 1098 tax form allows business to notify the irs of.

It Shows How Much The Borrower Pays In A.

Ad complete irs tax forms online or print government tax documents. Edit, sign and save irs tuition statement form. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or.

It Outlines The Tuition Expenses You Paid For College, Which May Entitle You To An Adjustment To Income.

Web definition irs form 1098 is a mortgage interest statement. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. This box reports the total amount. The irs form 1098 informs you how much interest you paid on your mortgage loan for the last tax year.

It Provides The Total Dollar Amount Paid By The Student For What Is.

Please follow the instructions below. It's a tax form used by businesses and lenders to report mortgage interest paid to them of $600 or more. Complete, edit or print tax forms instantly. To print your tax forms, go to your banner.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)

/Form1098-5c57730f46e0fb00013a2bee.jpg)