Form 7004 - Section 1.6081-5

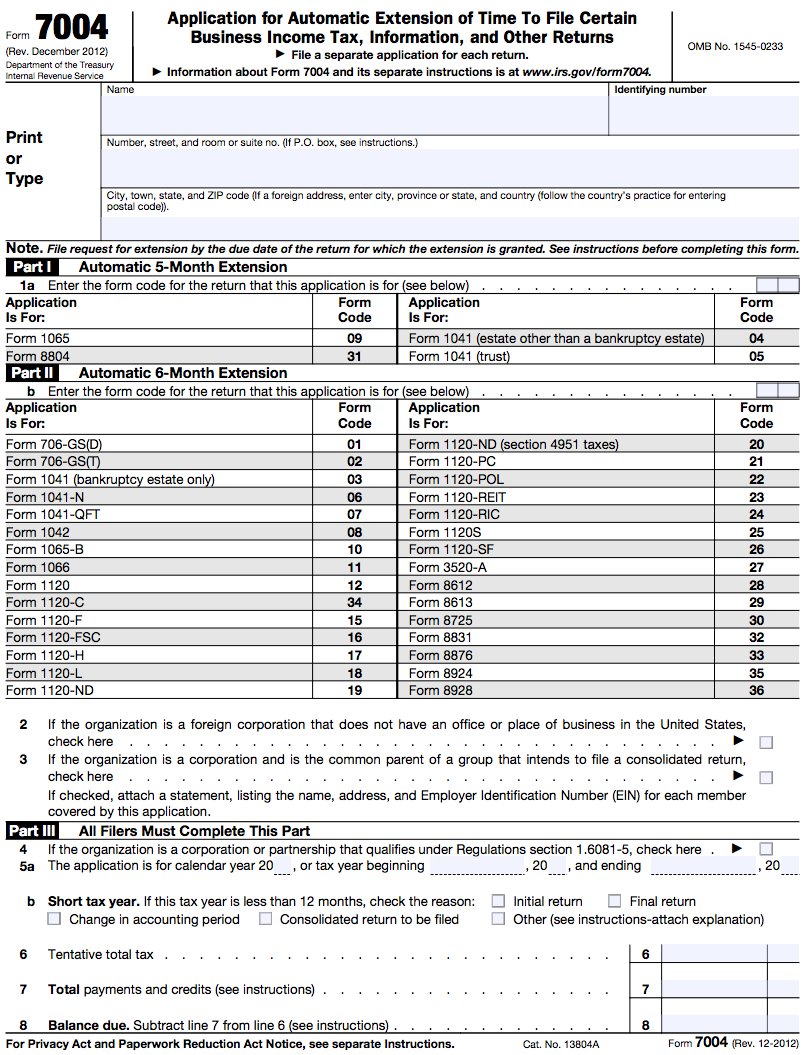

Form 7004 - Section 1.6081-5 - Application for automatic extension of time to file certain business income tax,. Web certain foreign and domestic corporations and certain partnerships are entitled to an automatic extension of time to file and pay under regulations section. Signature.—the person authorized by the corporation. (a) an extension of time for filing returns of income and for paying. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any. (a) an extension of time for filing returns of income and for paying. Instead, attach a statement tothe. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. November 2011) department of the treasury internal revenue service. Web this section is applicable for applications for an automatic extension of time to file an individual income tax return filed after july 1, 2008.

( a ) an extension of time for filing returns of income and for. (a) an extension of time for filing returns of income and for paying. Web form 7004 can be filed electronically for most returns. 9407, 73 fr 37366, july 1,. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. You do not need to submit form 7004 for. November 2011) department of the treasury internal revenue service. For further guidance regarding the. Application for automatic extension of time to file certain business income tax,. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any.

(a) an extension of time for filing returns of income and for paying. Signature.—the person authorized by the corporation. This section is used by foreign corporations,. You do not need to submit form 7004 for. (a) an extension of time for filing returns of income and for paying. November 2011) department of the treasury internal revenue service. Web this section is applicable for applications for an automatic extension of time to file an individual income tax return filed after july 1, 2008. Web form 7004 can be filed electronically for most returns. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address.

Where to file Form 7004 Federal Tax TaxUni

You do not need to submit form 7004 for. ( a ) an extension of time for filing returns of income and for. Signature.—the person authorized by the corporation. (a) an extension of time for filing returns of income and for paying. Web form 7004 can be filed electronically for most returns.

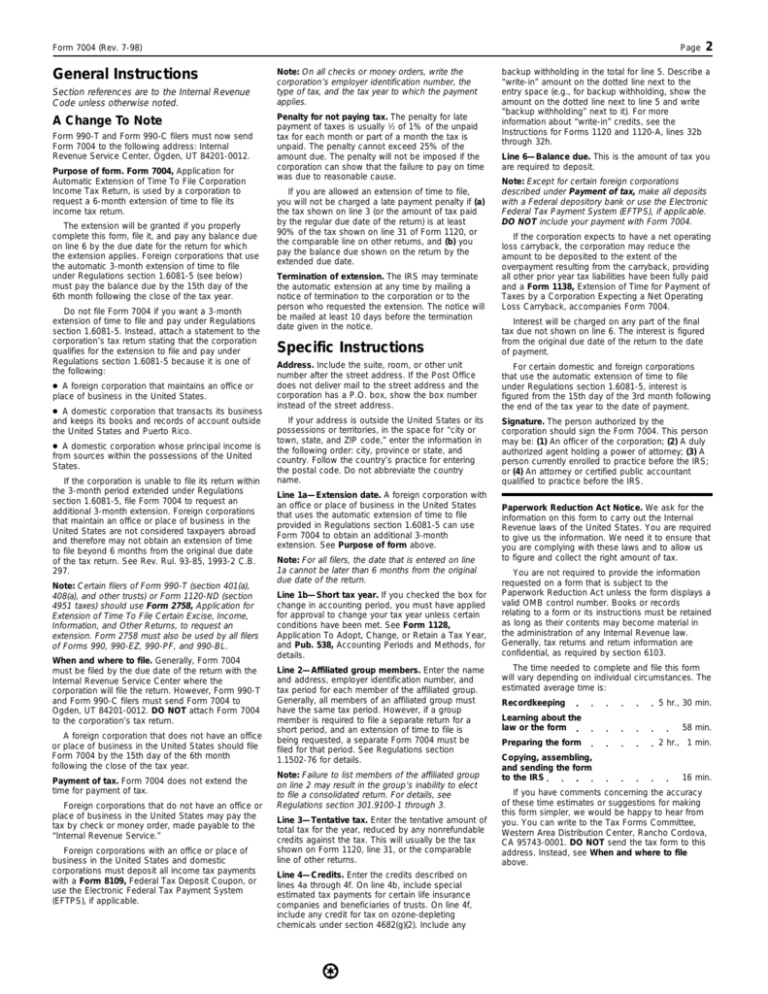

Form 7004 (Rev. July 1998)

This section is used by foreign corporations,. 9407, 73 fr 37366, july 1,. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. Web certain foreign and domestic corporations and certain partnerships are entitled to an automatic extension of time to file and pay under.

Form 7004 For Form 1065 Nina's Soap

For further guidance regarding the. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any. Application for automatic extension of time to file certain business income tax,. ( a ) an extension of time for filing returns of income and for. This.

E File Form 7004 Online Universal Network

You do not need to submit form 7004 for. (a) an extension of time for filing returns of income and for paying. This section is used by foreign corporations,. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. Web form 7004 can be filed.

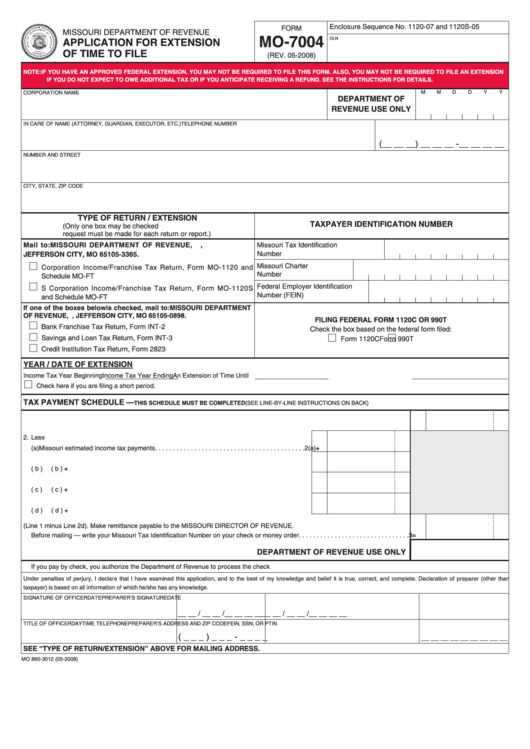

Fillable Form Mo7004 Application For Extension Of Time To File

November 2011) department of the treasury internal revenue service. Web certain foreign and domestic corporations and certain partnerships are entitled to an automatic extension of time to file and pay under regulations section. This section is used by foreign corporations,. Web this section is applicable for applications for an automatic extension of time to file an individual income tax return.

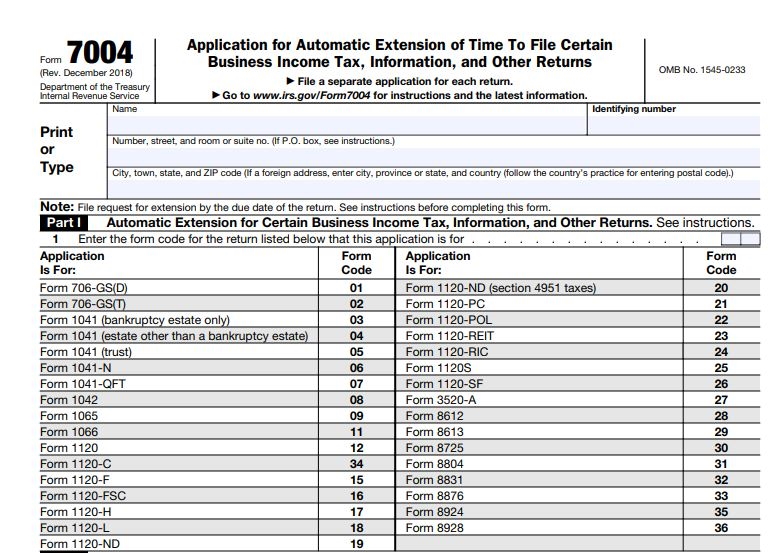

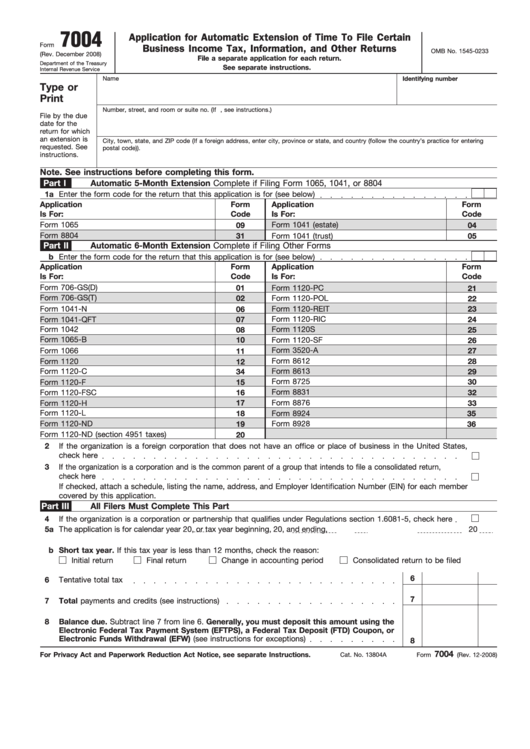

Fillable Form 7004 (Rev. December 2008) printable pdf download

November 2011) department of the treasury internal revenue service. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. This section is used by foreign corporations,. For further guidance regarding the. Instead, attach a statement tothe.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Signature.—the person authorized by the corporation. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. Instead, attach a statement tothe. Web form 7004 can be filed electronically for most returns. ( a ) an extension of time for filing returns of income and for.

Irs Form 7004 amulette

You do not need to submit form 7004 for. 9407, 73 fr 37366, july 1,. (a) an extension of time for filing returns of income and for paying. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any. Instead, attach a statement.

How to file an LLC extension Form 7004 YouTube

Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address. November 2011) department of the treasury internal revenue service. (a) an extension of time for filing returns of income and for paying. 9407, 73 fr 37366, july 1,. Web this section is applicable for applications.

How to Fill Out IRS Form 7004

Web certain foreign and domestic corporations and certain partnerships are entitled to an automatic extension of time to file and pay under regulations section. 9407, 73 fr 37366, july 1,. You do not need to submit form 7004 for. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership.

(A) An Extension Of Time For Filing Returns Of Income And For Paying.

Web form 7004 can be filed electronically for most returns. Web certain foreign and domestic corporations and certain partnerships are entitled to an automatic extension of time to file and pay under regulations section. November 2011) department of the treasury internal revenue service. Web the commissioner must mail the notice of termination to the address shown on the form 7004 or to the partnership 's last known address.

For Further Guidance Regarding The.

This section is used by foreign corporations,. ( a ) an extension of time for filing returns of income and for. Application for automatic extension of time to file certain business income tax,. Web (1) submit a complete application on form 7004, “application for automatic extension of time to file certain business income tax, information, and other returns,” or in any.

Web This Section Is Applicable For Applications For An Automatic Extension Of Time To File An Individual Income Tax Return Filed After July 1, 2008.

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Signature.—the person authorized by the corporation. 9407, 73 fr 37366, july 1,. (a) an extension of time for filing returns of income and for paying.

You Do Not Need To Submit Form 7004 For.

Instead, attach a statement tothe.