How To Get Tax Form From Crypto.com App

How To Get Tax Form From Crypto.com App - Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021. The platform is entirely free of charge and can be used by. Web easily handle your cash app tax reporting. Type “ csv ” in the search bar and click csv file import in the search results. You may refer to this section on how to set up your tax. Web crypto.com tax can provide users with an estimation of taxable gains and losses on crypto transactions. Import your cash app trades automatically, generate your tax forms, and file your taxes. Person who has earned usd $600 or more in rewards from crypto.com. We’re excited to share that u.s. Web this is done in just seconds and at no cost.

We’re excited to share that u.s. Web here’s how to report crypto purchases on your tax form. Web 2 [deleted] • 1 yr. Web in this video, we show how you can create crypto tax reports using crypto.com tax. This online tax tool helps you to import your transactions from a wide. Login to taxact and click help center in the top right corner. Ago mi_census_nrfu • 1 yr. Web crypto.com tax can provide users with an estimation of taxable gains and losses on crypto transactions. Does crypto.com report to the irs? Crypto.com provides american customers with a form.

Web here’s how to report crypto purchases on your tax form. Web complete free solution for every cryptocurrency owner crypto.com tax is entirely free for anyone who needs to prepare their crypto taxes. Ago mi_census_nrfu • 1 yr. Person who has earned usd $600 or more in rewards from crypto.com. No matter how many transactions you. Web examples include selling your cryptocurrency or trading it for another cryptocurrency. You can then download those transactions for tax filing. Web download the taxact csv file under your tax reports page in crypto.com tax. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. Type “ csv ” in the search bar and click csv file import in the search results.

Best Country For Crypto Tax Vincendes

Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. What’s more, this detailed crypto tax report includes the user’s transaction history and full record of capital gains and. Web here’s how to report crypto purchases on your tax form. Type “ csv ”.

Crypto Tax Calculator Free Crypto Com Tax Get Your Crypto Taxes Done

And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Login to taxact and click help center in the top right corner. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. Type “ csv.

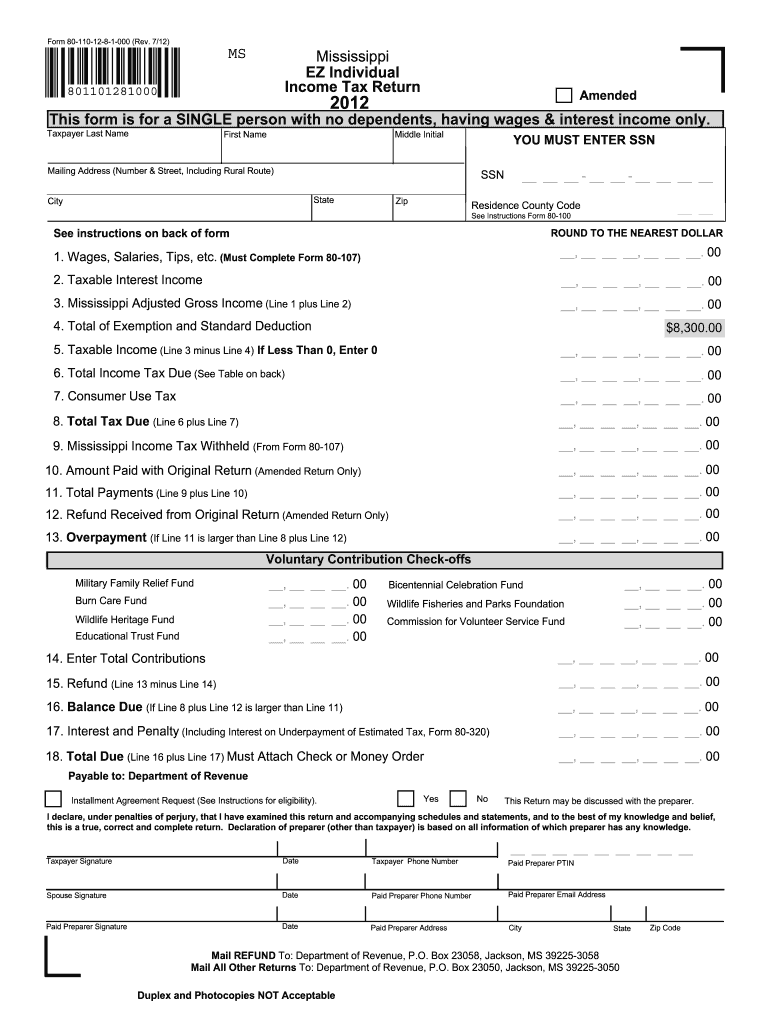

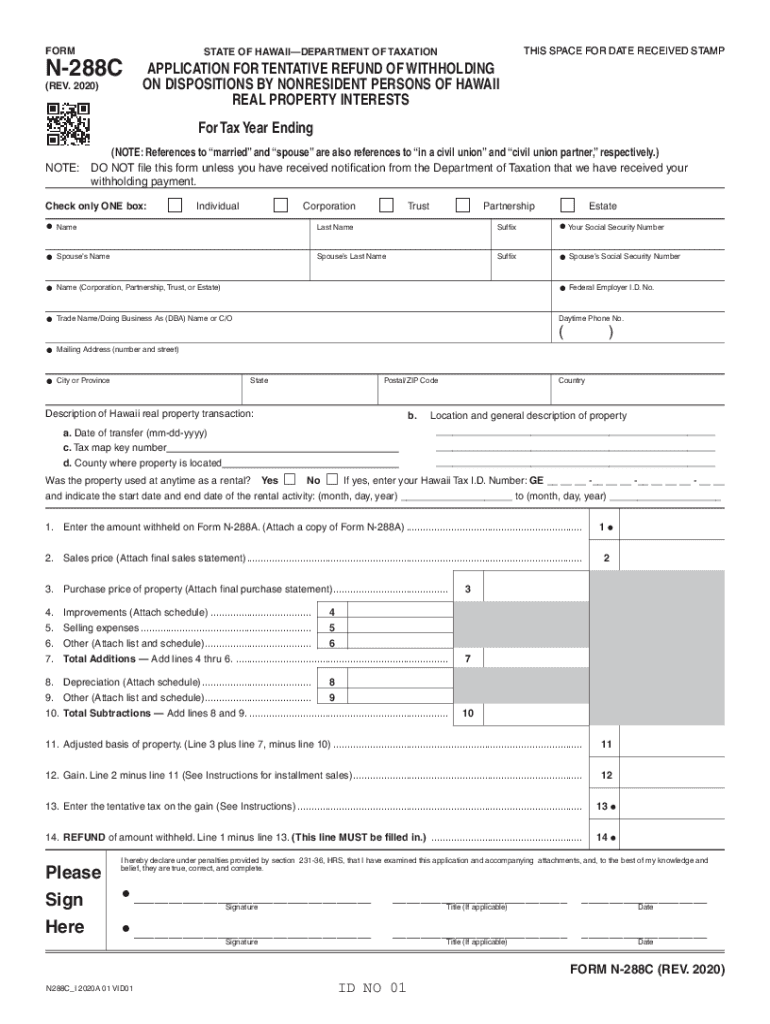

State Tax Forms Fill Out and Sign Printable PDF Template signNow

Web in this video, we show how you can create crypto tax reports using crypto.com tax. Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021. The platform is entirely free of charge and can be used by. Web this is done in just seconds and at no cost..

Printable 4730591 Rev A / Form 8879 Rev January Internal Revenue

Web jan 26, 2022. The platform is entirely free of charge and can be used by. We’re excited to share that u.s. This online tax tool helps you to import your transactions from a wide. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to.

What you Should know about Crypto Tax Evasion CTR

Import your cash app trades automatically, generate your tax forms, and file your taxes. The platform is entirely free of charge and can be used by. Select the tax settings you’d like to generate your tax reports. You may refer to this section on how to set up your tax. Ago mi_census_nrfu • 1 yr.

Don't make checks out to 'IRS' for federal taxes, or your payment could

Web this is done in just seconds and at no cost. Web here’s how to report crypto purchases on your tax form. This online tax tool helps you to import your transactions from a wide. The platform is entirely free of charge and can be used by. Web jan 26, 2022.

When You Pay Your Taxes, You Love Your Neighbor Good Faith Media

Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021. The platform is entirely free of charge and can be used by. Type “ csv ” in the search bar and click csv file import in the search results. Web you can also chose among common cost basis methods.

Registration Process Student Self Enroll via Online Pay

Web crypto.com tax can provide users with an estimation of taxable gains and losses on crypto transactions. Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021. Web in this video, we show how you can create crypto tax reports using crypto.com tax. Crypto.com provides american customers with a.

How To Get Tax Forms 🔴 YouTube

Web jan 26, 2022. Web you can also chose among common cost basis methods used for tax calculation: Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. You may refer to this section on how to set up your tax. Web here’s how.

Where Can I Get IRS Tax Forms and Options to File Free

Web complete free solution for every cryptocurrency owner crypto.com tax is entirely free for anyone who needs to prepare their crypto taxes. Web jan 26, 2022. Import your cash app trades automatically, generate your tax forms, and file your taxes. No matter how many transactions you. And canada users can now generate their 2021 crypto tax reports on crypto.com tax,.

Crypto.com Provides American Customers With A Form.

Login to taxact and click help center in the top right corner. Web you should expect to receive the following irs tax forms from cryptocurrency exchanges and similar platforms before january 31, 2021. You can then download those transactions for tax filing. The platform is entirely free of charge and can be used by.

Register Your Account In Crypto.com Tax Step 2:

Ago mi_census_nrfu • 1 yr. Web download the taxact csv file under your tax reports page in crypto.com tax. Web crypto.com tax can provide users with an estimation of taxable gains and losses on crypto transactions. Import your cash app trades automatically, generate your tax forms, and file your taxes.

Web This Is Done In Just Seconds And At No Cost.

You may refer to this section on how to set up your tax. Web here’s how to report crypto purchases on your tax form. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the. Web examples include selling your cryptocurrency or trading it for another cryptocurrency.

Web 2 [Deleted] • 1 Yr.

Web jan 26, 2022. Type “ csv ” in the search bar and click csv file import in the search results. No matter how many transactions you. What’s more, this detailed crypto tax report includes the user’s transaction history and full record of capital gains and.