What Happens If I Don't File Form 8958

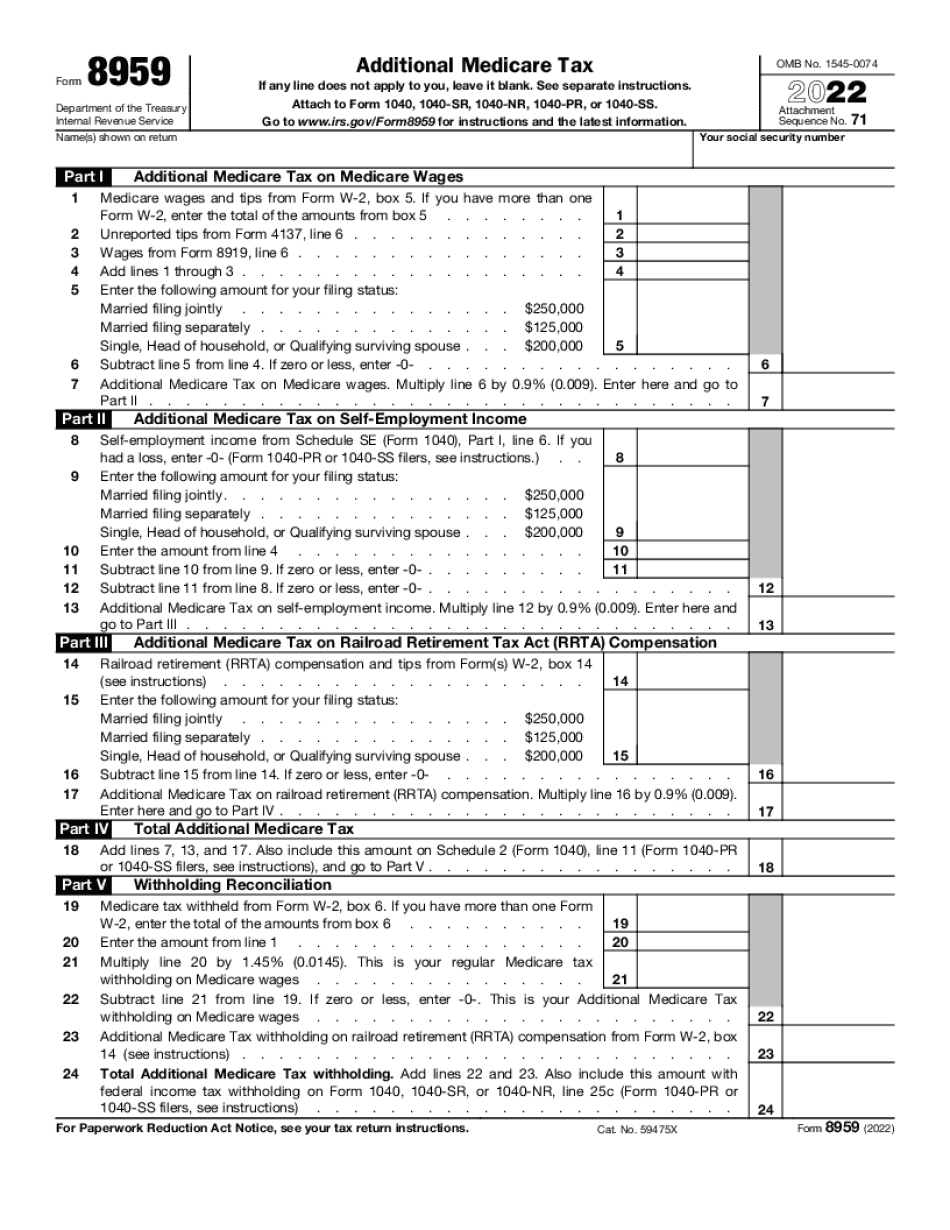

What Happens If I Don't File Form 8958 - Is spouse's separate income required on this form? Your marital status isn't reflected as. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web 1.you and your spouse lived apart all year. You did not include the item of community income in gross income. Web form is already filled out. You did not file a joint return for the tax year. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. The irs will reject electronically filed tax returns for 2021 that are missing a required form 8962, premium tax. Web yes technically you should complete it, no i have never heard of it being a problem if not.

The irs will reject electronically filed tax returns for 2021 that are missing a required form 8962, premium tax. You did not file a joint return for the tax year. Web suppress form 8958 allocation of tax amounts between individuals in community property states. 2.you and your spouse didn't file a joint return for a tax year beginning or ending in the calendar year. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. We file separately because my wife is doing a student loan forgiveness program. Type text, complete fillable fields, insert images, highlight or blackout data. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web if however, you have requirement to file form 8958, you will need to mail in your tax return as it cannot be electronically filed. Web send out signed what happens if i don't file form 8958 or print it rate the form 8958 instructions 4.7 satisfied 283 votes what makes the example of completed form 8958.

You only need to complete form 8958 allocation of tax amounts between certain individuals in. Web once you have completed the steps above, please complete the married filing separately allocations form 8958. Edit your form 8958 form online. Splitting a married filing jointly return. 2.you and your spouse didn't file a joint return for a tax year beginning or ending in the calendar year. Web yes technically you should complete it, no i have never heard of it being a problem if not. Web suppress form 8958 allocation of tax amounts between individuals in community property states. The irs will reject electronically filed tax returns for 2021 that are missing a required form 8962, premium tax. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. This form will explain to the irs why the taxable income and.

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

Web how to properly fill out form 8958 your community property income will be your normal income for the year plus or minus an adjustment for your community. This form will explain to the irs why the taxable income and. Web if however, you have requirement to file form 8958, you will need to mail in your tax return as.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web taxes get your taxes done bfwp33 level 2 form 8958: Web how to properly fill out form 8958 your community property income will be your normal income for the year plus or minus an adjustment for your community. Edit your form 8958 form online. The irs will reject electronically filed tax returns for 2021 that are missing a required.

What Happens If You Don't File Taxes? Filing taxes, Irs taxes,

F6 does not attach it to the filing return. Web if however, you have requirement to file form 8958, you will need to mail in your tax return as it cannot be electronically filed. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web suppress.

수질배출부과금징수유예 및 분납신청 샘플, 양식 다운로드

Web if you are truly legally separated then you may be able to file as single and don't need his docs. Web 1.you and your spouse lived apart all year. Web if however, you have requirement to file form 8958, you will need to mail in your tax return as it cannot be electronically filed. 2.you and your spouse didn't.

Quick Tips Filling Out IRS Form 8821 Tax Information Authorization

Is spouse's separate income required on this form? Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Type text, complete fillable fields, insert images, highlight or blackout data. Web taxes get your taxes done bfwp33 level 2 form 8958: Web up to 10% cash back.

Form 8958 Fillable ≡ Fill Out Printable PDF Forms Online

We file separately because my wife is doing a student loan forgiveness program. You did not file a joint return for the tax year. Web send out signed what happens if i don't file form 8958 or print it rate the form 8958 instructions 4.7 satisfied 283 votes what makes the example of completed form 8958. Web if your resident.

Community property / Form 8958 penalty for r/tax

You did not include the item of community income in gross income. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Type text, complete fillable fields, insert images, highlight or blackout data. Web taxes get your taxes done bfwp33 level 2 form 8958: Splitting a married filing jointly return.

How to File Form 15 in Sri Lanka Step by Step Guide

F6 does not attach it to the filing return. You did not include the item of community income in gross income. Is spouse's separate income required on this form? Your marital status isn't reflected as. Web up to 10% cash back by:

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Splitting a married filing jointly return. 2.you and your spouse didn't file a joint return for a tax year beginning or ending in the calendar year. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Your marital status isn't reflected as. F6 does not attach it to the filing return.

수질배출부과금징수유예 및 분납신청 샘플, 양식 다운로드

Web taxes get your taxes done bfwp33 level 2 form 8958: Is spouse's separate income required on this form? Web if however, you have requirement to file form 8958, you will need to mail in your tax return as it cannot be electronically filed. 2.you and your spouse didn't file a joint return for a tax year beginning or ending.

Web If You Are Truly Legally Separated Then You May Be Able To File As Single And Don't Need His Docs.

We file separately because my wife is doing a student loan forgiveness program. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Splitting a married filing jointly return. Is spouse's separate income required on this form?

Web Up To 10% Cash Back By:

2.you and your spouse didn't file a joint return for a tax year beginning or ending in the calendar year. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Your marital status isn't reflected as. Web form 8938 penalties under 6038d (fatca) form 8938 is one of the newest additions to the internal revenue service’s international information reporting requirements for us.

Web Form Is Already Filled Out.

Web suppress form 8958 allocation of tax amounts between individuals in community property states. You did not file a joint return for the tax year. Web taxes get your taxes done bfwp33 level 2 form 8958: This form will explain to the irs why the taxable income and.

Type Text, Complete Fillable Fields, Insert Images, Highlight Or Blackout Data.

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. You did not include the item of community income in gross income. You only need to complete form 8958 allocation of tax amounts between certain individuals in. Web send out signed what happens if i don't file form 8958 or print it rate the form 8958 instructions 4.7 satisfied 283 votes what makes the example of completed form 8958.