What's The Difference Between Chapter 7 11 And 13

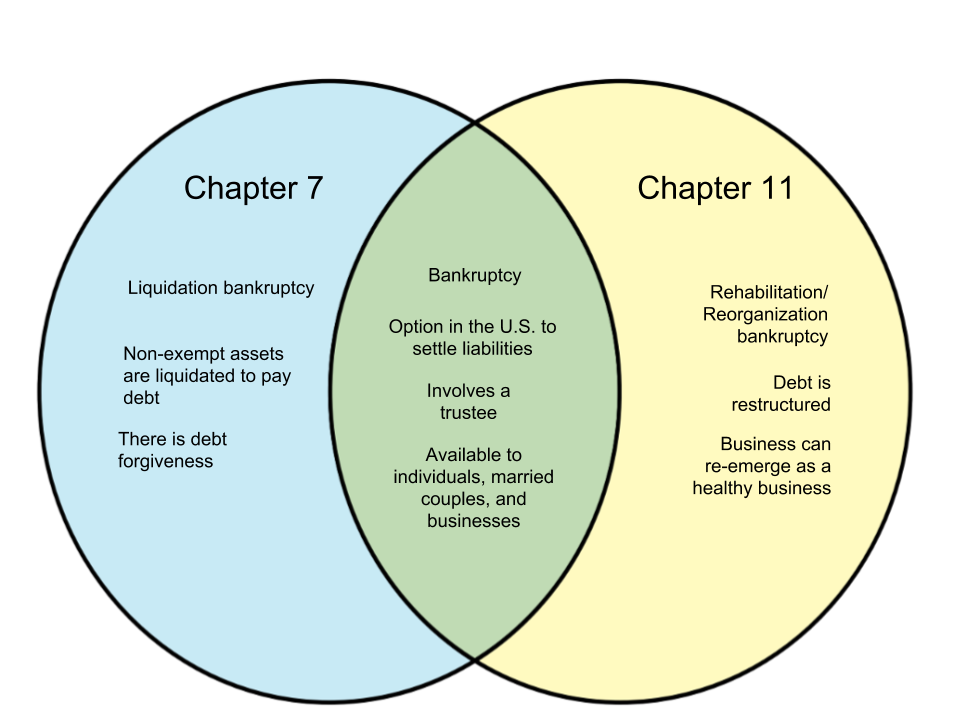

What's The Difference Between Chapter 7 11 And 13 - Web chapter 7 vs. Chapter 13 bankruptcy the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies financially. Web rescuing your business chapter 11 is generally the best way to alleviate your liabilities without going out of business. Web emily norris updated june 21, 2022 reviewed by pamela rodriguez companies that find themselves in a dire financial situation where bankruptcy is their best—or only—option have two basic. Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable to repair their financial situation. Web chapter 7 provides liquidation of an individual’s property and then distributes it to creditors. Web chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an extended period of time according to a plan. In contrast, chapter 13 is a debt. Rarely businesses — sell their. Web chapter 7 and chapter 13 are very different types of bankruptcy.

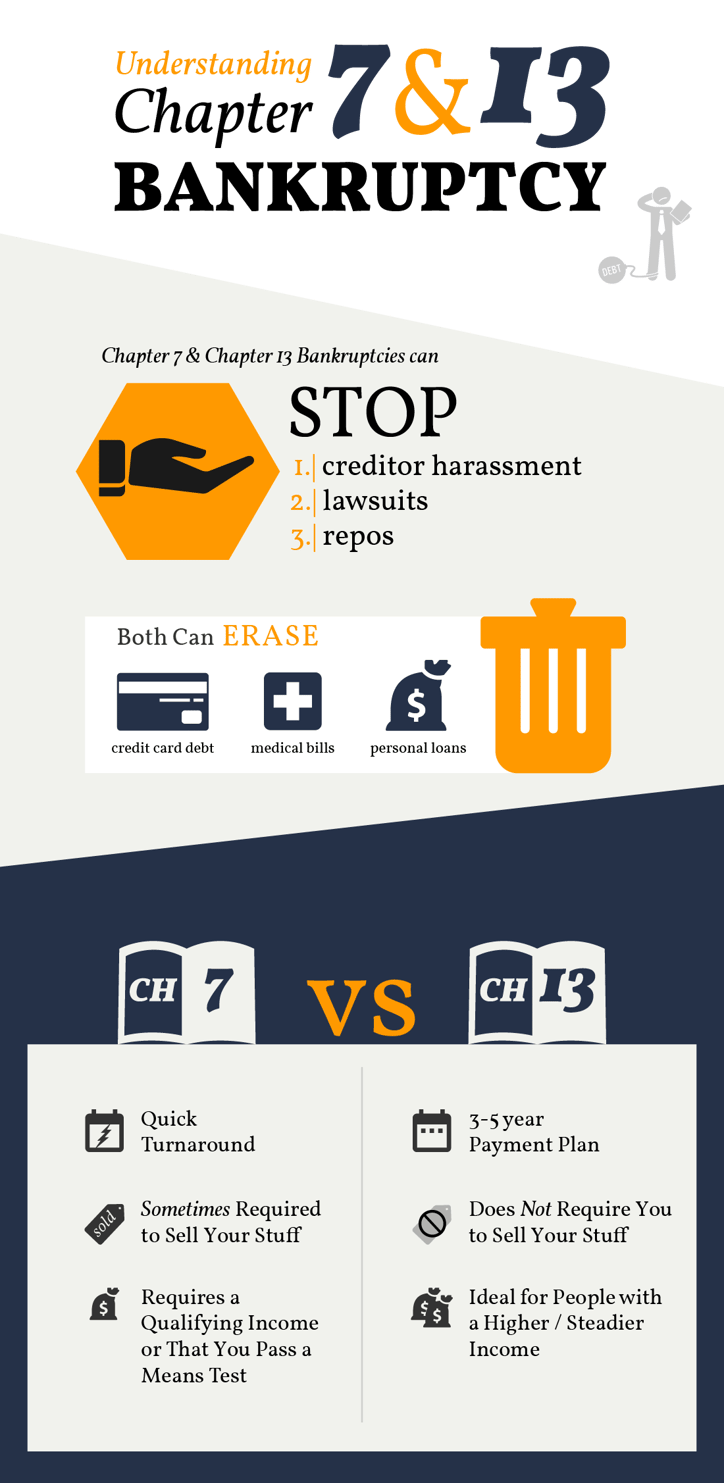

Web some of the differences between chapter 7 and 13 bankruptcy include: Web child support or alimony student loans auto loans chapter 7 bankruptcy vs. Chapter 13 bankruptcy the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies financially. Web rescuing your business chapter 11 is generally the best way to alleviate your liabilities without going out of business. Web perhaps it was unsecured creditors like credit card companies. Web emily norris updated june 21, 2022 reviewed by pamela rodriguez companies that find themselves in a dire financial situation where bankruptcy is their best—or only—option have two basic. There is no limit to the amount of money owed by debtors filing for chapter 11. Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable to repair their financial situation. Corporations cannot file under chapter 13. Web chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an extended period of time according to a plan.

Web perhaps it was unsecured creditors like credit card companies. When filing for chapter 13, a debtor needs. In a chapter 13 proceeding, the debtor must pay all or part of his debts from the future income over a period of three to five years through his chapter 13 plan. Chapter 7 is designed to eliminate debt by liquidating assets. Web chapter 7 vs. In chapter 7 asset cases, the debtor's. Either way, filing for bankruptcy can help waive those away. Individuals are allowed to keep “exempt property.” the courts may provide businesses that file chapter 7. This is because chapter 7 typically results in the liquidation of the entire company, and chapter 13 is not available for business entities. The plan may call for full or partial repayment.

The Difference Between Chapter 7 & Chapter 13 Bankruptcies

When filing for chapter 13, a debtor needs. Individuals are allowed to keep “exempt property.” the courts may provide businesses that file chapter 7. Web the main difference between the two is the amount of money the debtor owes. Rarely businesses — sell their. Web perhaps it was unsecured creditors like credit card companies.

What's the Difference Between Chapter 13 and Chapter 7 Bankruptcy?

Web chapter 7 vs. There is no limit to the amount of money owed by debtors filing for chapter 11. Web the main difference between the two is the amount of money the debtor owes. Chapter 7 is designed to eliminate debt by liquidating assets. In contrast, chapter 13 is a debt.

37+ Can I File Chapter 7 Before 8 Years KhamShunji

The plan may call for full or partial repayment. Chapter 13 bankruptcy the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies financially. In a chapter 13 proceeding, the debtor must pay all or part of his debts from the future income over a period of three to five years through.

What's the Difference Between Chapter 7 and Chapter 13 Bankruptcy?

[track latest developments in bankruptcy with bloomberg law.] chapter 7 bankruptcy and chapter 11 bankruptcy are both common options for businesses in declaring bankruptcy. But there are different types of bankruptcies, and the most common ones are chapter 7, 11, and 13… This chapter of the u.s. Web chapter 7 is the type of bankruptcy that most people imagine when.

Difference Between Chapter and Lesson Compare the Difference Between

But there are different types of bankruptcies, and the most common ones are chapter 7, 11, and 13… Web some of the differences between chapter 7 and 13 bankruptcy include: Chapter 13 bankruptcy the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies financially. If the court approves the plan of.

Tampa Bankruptcy Chapter 7 vs Chapter 13 Galewski Law Group

In chapter 7 asset cases, the debtor's. Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable to repair their financial situation. The critical difference is that chapter 7 revolves around the liquidation of assets to repay debts. Individuals are allowed to keep “exempt property.” the courts may provide businesses that file chapter.

What's the Difference Between a Chapter 7 and 13 Bankruptcy?

This chapter of the u.s. Web chapter 7 is the type of bankruptcy that most people imagine when they think of bankruptcy: For some people, the time period must be five years. The plan may call for full or partial repayment. In contrast, chapter 13 is a debt.

45+ Difference Between Chapter 7 And Chapter 11

This chapter of the u.s. If the court approves the plan of payment, the debts will be paid in full or partially by the chapter 13. Web perhaps it was unsecured creditors like credit card companies. Rarely businesses — sell their. In a chapter 13 proceeding, the debtor must pay all or part of his debts from the future income.

The Difference Between Chapter 11 and Chapter 7 Bankruptcy Ritter Spencer

Web chapter 7 is the type of bankruptcy that most people imagine when they think of bankruptcy: Either way, filing for bankruptcy can help waive those away. Chapter 13 focuses on restructuring debt to be fully or partially paid off over. But there are different types of bankruptcies, and the most common ones are chapter 7, 11, and 13… Often.

Bankruptcy Chapter 7 vs 13 What is The Difference

Web chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an extended period of time according to a plan. Corporations cannot file under chapter 13. Web what is the difference between chapter 7, 11, 12 & 13 cases? Chapter 13 focuses on restructuring debt to be fully or partially paid off over..

Rarely Businesses — Sell Their.

There is no limit to the amount of money owed by debtors filing for chapter 11. Web child support or alimony student loans auto loans chapter 7 bankruptcy vs. If the court approves the plan of payment, the debts will be paid in full or partially by the chapter 13. The plan may call for full or partial repayment.

In A Chapter 13 Proceeding, The Debtor Must Pay All Or Part Of His Debts From The Future Income Over A Period Of Three To Five Years Through His Chapter 13 Plan.

Web chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an extended period of time according to a plan. The critical difference is that chapter 7 revolves around the liquidation of assets to repay debts. This chapter of the u.s. In chapter 7 asset cases, the debtor's.

In Contrast, Chapter 13 Is A Debt.

Web emily norris updated june 21, 2022 reviewed by pamela rodriguez companies that find themselves in a dire financial situation where bankruptcy is their best—or only—option have two basic. Web chapter 7 provides liquidation of an individual’s property and then distributes it to creditors. Chapter 13 focuses on restructuring debt to be fully or partially paid off over. Web chapter 7 and chapter 13 are very different types of bankruptcy.

But There Are Different Types Of Bankruptcies, And The Most Common Ones Are Chapter 7, 11, And 13…

Web rescuing your business chapter 11 is generally the best way to alleviate your liabilities without going out of business. If you are running a sole proprietorship, however, chapter 13. Chapter 13 bankruptcy the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies financially. This is because chapter 7 typically results in the liquidation of the entire company, and chapter 13 is not available for business entities.