1099 Form Ohio

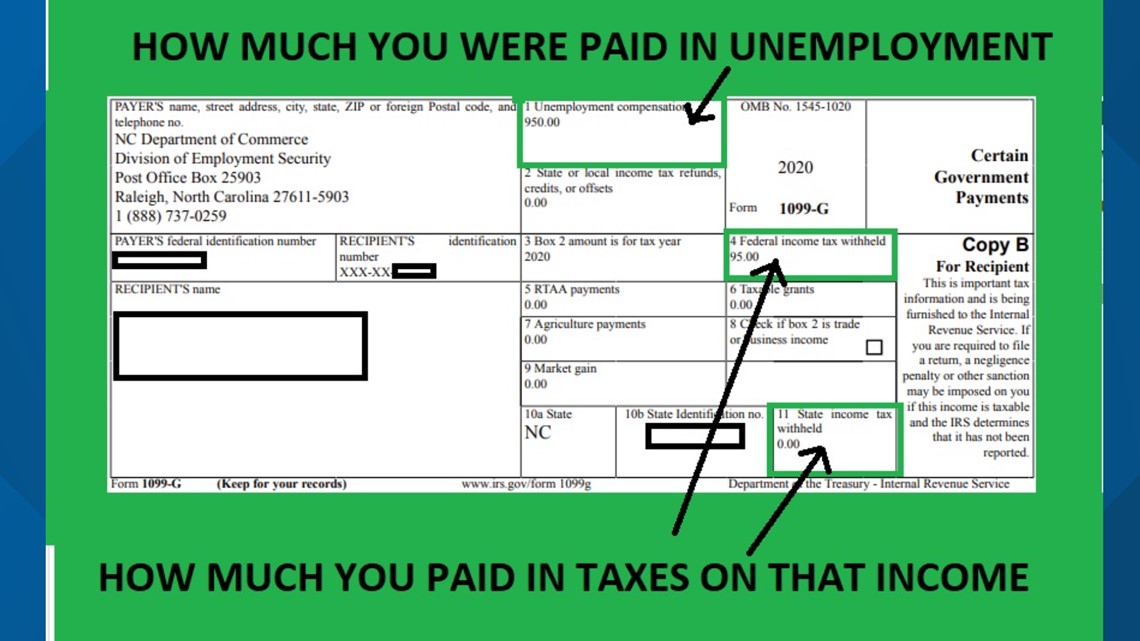

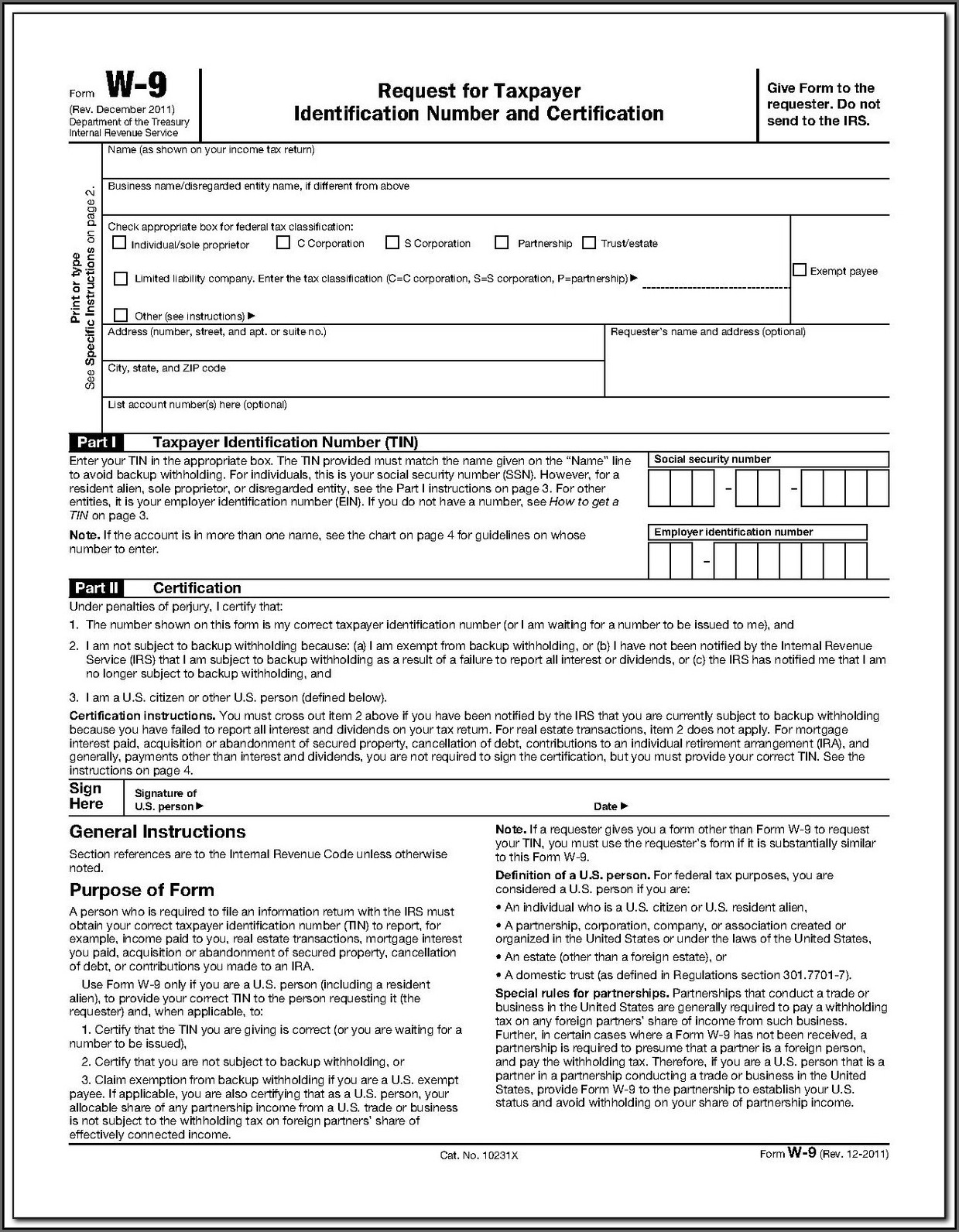

1099 Form Ohio - (this information is provided to benefit recipients for tax. Web ohio department of taxation. These where to file addresses are. Ad electronically file 1099 forms. Web our w2 mate® software makes it easy to report your 1099 forms with the irs and ohio department of revenue, both electronically and on paper.our 1099. Web popular forms & instructions; Do not miss the deadline. Individual tax return form 1040 instructions; Access the forms you need to file taxes or do business in ohio. For your protection, this form may show only the last four digits of your social security number.

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in ohio. The irs compares reported income. This is just a separator between the navigation and the help and search icons. Web if you were paid more than $10.00 in interest but did not receive a 1099 form or if you are uncertain about the amount of interest you received as part of your claim payment, then. Access the forms you need to file taxes or do business in ohio. Ad success starts with the right supplies. Tax payments are based on the amount listed on the. Web instructions for recipient recipient’s taxpayer identification number (tin). Web popular forms & instructions; These where to file addresses are.

Find them all in one convenient place. (this information is provided to benefit recipients for tax. They usually receive a 1099 instead. Those who issue 10 or more must remit the information electronically on the ohio. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in ohio. This is just a separator between the navigation and the help and search icons. Web independent providers who made more than $600 in 2018 and who are certified under their social security number will be issued an irs form 1099 (report of miscellaneous. Web if you were paid more than $10.00 in interest but did not receive a 1099 form or if you are uncertain about the amount of interest you received as part of your claim payment, then. The irs compares reported income. Web popular forms & instructions;

Ohio Form 1099 G Form Resume Examples 6V3R5AQK7b

Web ohio department of taxation. For your protection, this form may show only the last four digits of your social security number. (this information is provided to benefit recipients for tax. From the latest tech to workspace faves, find just what you need at office depot®! Web our w2 mate® software makes it easy to report your 1099 forms with.

Ohio 1099 Form Form Resume Examples XE8jEa63Oo

Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in ohio. Web odjfs online archived messages lost wages assistance: Web independent providers who made more than $600 in 2018 and who are certified under their social security number will be issued an irs form 1099 (report of miscellaneous. Ad success starts.

Grandparent Guardianship Form Ohio Form Resume Examples EZVgJlOYJk

Web odjfs online archived messages lost wages assistance: Individual tax return form 1040 instructions; Web our w2 mate® software makes it easy to report your 1099 forms with the irs and ohio department of revenue, both electronically and on paper.our 1099. For your protection, this form may show only the last four digits of your social security number. Web contract.

How To Get 1099 G Form Online Iowa Nicolette Mill's Template

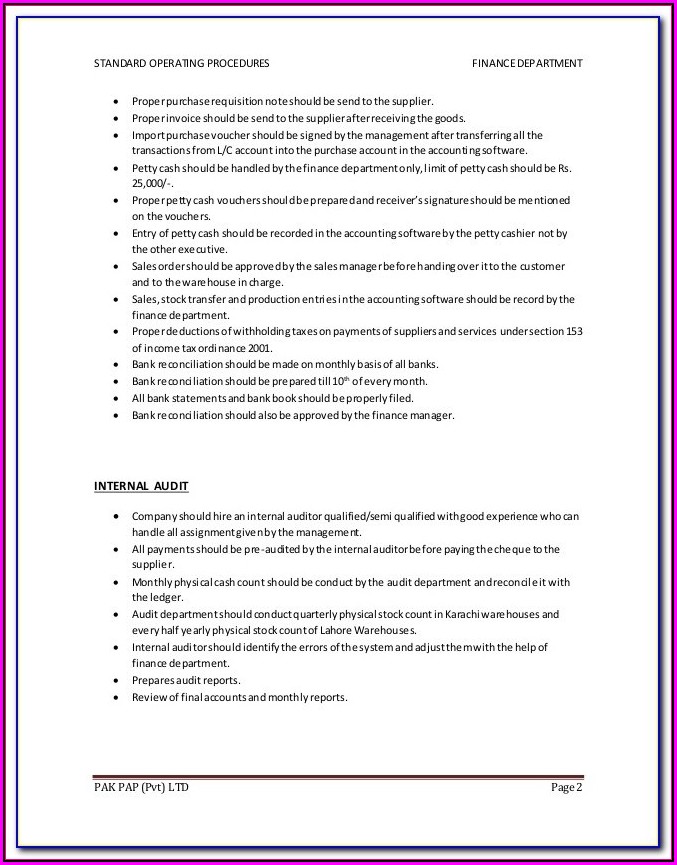

Web contract labor/1099s independent contractor use of independent contractors is common in the construction industry and some other industries. Web the ohio department of medicaid is required to supply a copy of the irs form 1099 to the internal revenue service (irs). Web popular forms & instructions; Web independent providers who made more than $600 in 2018 and who are.

Printable Ny State Tax Form It 201 Form Resume Examples 4x2vyLPV5l

For your protection, this form may show only the last four digits of your social security number. Those who issue 10 or more must remit the information electronically on the ohio. Web our w2 mate® software makes it easy to report your 1099 forms with the irs and ohio department of revenue, both electronically and on paper.our 1099. Tax payments.

Irs Printable 1099 Form Printable Form 2022

The irs compares reported income. Web instructions for recipient recipient’s taxpayer identification number (tin). Web popular forms & instructions; Web ohio department of taxation. Individual tax return form 1040 instructions;

State Of Ohio Form 1099 G Form Resume Examples Or85VMx1Wz

The irs compares reported income. Web the ohio department of medicaid is required to supply a copy of the irs form 1099 to the internal revenue service (irs). Web ohio department of taxation. From the latest tech to workspace faves, find just what you need at office depot®! Those who issue 10 or more must remit the information electronically on.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Access the forms you need to file taxes or do business in ohio. (this information is provided to benefit recipients for tax. These where to file addresses are. This is just a separator between the navigation and the help and search icons. Ad electronically file 1099 forms.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Web our w2 mate® software makes it easy to report your 1099 forms with the irs and ohio department of revenue, both electronically and on paper.our 1099. Web the ohio department of medicaid is required to supply a copy of the irs form 1099 to the internal revenue service (irs). These where to file addresses are. For your protection, this.

Free Printable 1099 Misc Forms Free Printable

Web instructions for recipient recipient’s taxpayer identification number (tin). Web popular forms & instructions; These where to file addresses are. Those who issue 10 or more must remit the information electronically on the ohio. From the latest tech to workspace faves, find just what you need at office depot®!

Do Not Miss The Deadline.

From the latest tech to workspace faves, find just what you need at office depot®! Access the forms you need to file taxes or do business in ohio. Web ohio department of taxation. Ad electronically file 1099 forms.

Find Them All In One Convenient Place.

This is just a separator between the navigation and the help and search icons. Web the ohio department of medicaid is required to supply a copy of the irs form 1099 to the internal revenue service (irs). Web odjfs online archived messages lost wages assistance: Individual tax return form 1040 instructions;

These Where To File Addresses Are.

Web independent providers who made more than $600 in 2018 and who are certified under their social security number will be issued an irs form 1099 (report of miscellaneous. Web popular forms & instructions; Web instructions for recipient recipient’s taxpayer identification number (tin). The irs compares reported income.

For Your Protection, This Form May Show Only The Last Four Digits Of Your Social Security Number.

Web our w2 mate® software makes it easy to report your 1099 forms with the irs and ohio department of revenue, both electronically and on paper.our 1099. Web contract labor/1099s independent contractor use of independent contractors is common in the construction industry and some other industries. They usually receive a 1099 instead. (this information is provided to benefit recipients for tax.