1310 Tax Form

1310 Tax Form - Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. However, you must attach to his return a copy of the court certificate showing your appointment. Download, print or email irs 1310 tax form on pdffiller for free. Save or instantly send your ready documents. Ad access irs tax forms. Web what is irs form 1310? Get ready for tax season deadlines by completing any required tax forms today. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310.

Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web file form 1310 to claim the refund on mr. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. Download, print or email irs 1310 tax form on pdffiller for free. Web we are sending you letter 12c because we need more information to process your individual income tax return.

Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. You are a surviving spouse filing an original or. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Probate is opened in the. However, you must attach to his return a copy of the court certificate showing your appointment. Web what is irs form 1310? Ad access irs tax forms. According to the irs website, form 1310 is known as a statement of person claiming refund due a deceased taxpayer. Web file form 1310 to claim the refund on mr. Ad get ready for tax season deadlines by completing any required tax forms today.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

This form is for income earned in tax year 2022, with tax returns due in april. You are a surviving spouse filing an original or. Easily fill out pdf blank, edit, and sign them. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order.

Louisiana She Revenue Fill Online, Printable, Fillable, Blank pdfFiller

Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web form 1310 can be used by a.

Irs Form 1310 Printable 2020 2021 Blank Sample to Fill out Online

Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Web we are sending you letter 12c because we need more information to process your individual income tax return. Web file form 1310 to claim the refund on mr. This form.

1999 Form MI MI1310 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax.

Fill Free fillable Form 1310 Claiming Refund Due a Deceased Taxpayer

Web find federal form 1310 instructions at esmart tax today. Web file form 1310 to claim the refund on mr. Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. This form is for income earned in tax year 2022, with tax returns due in april. Web.

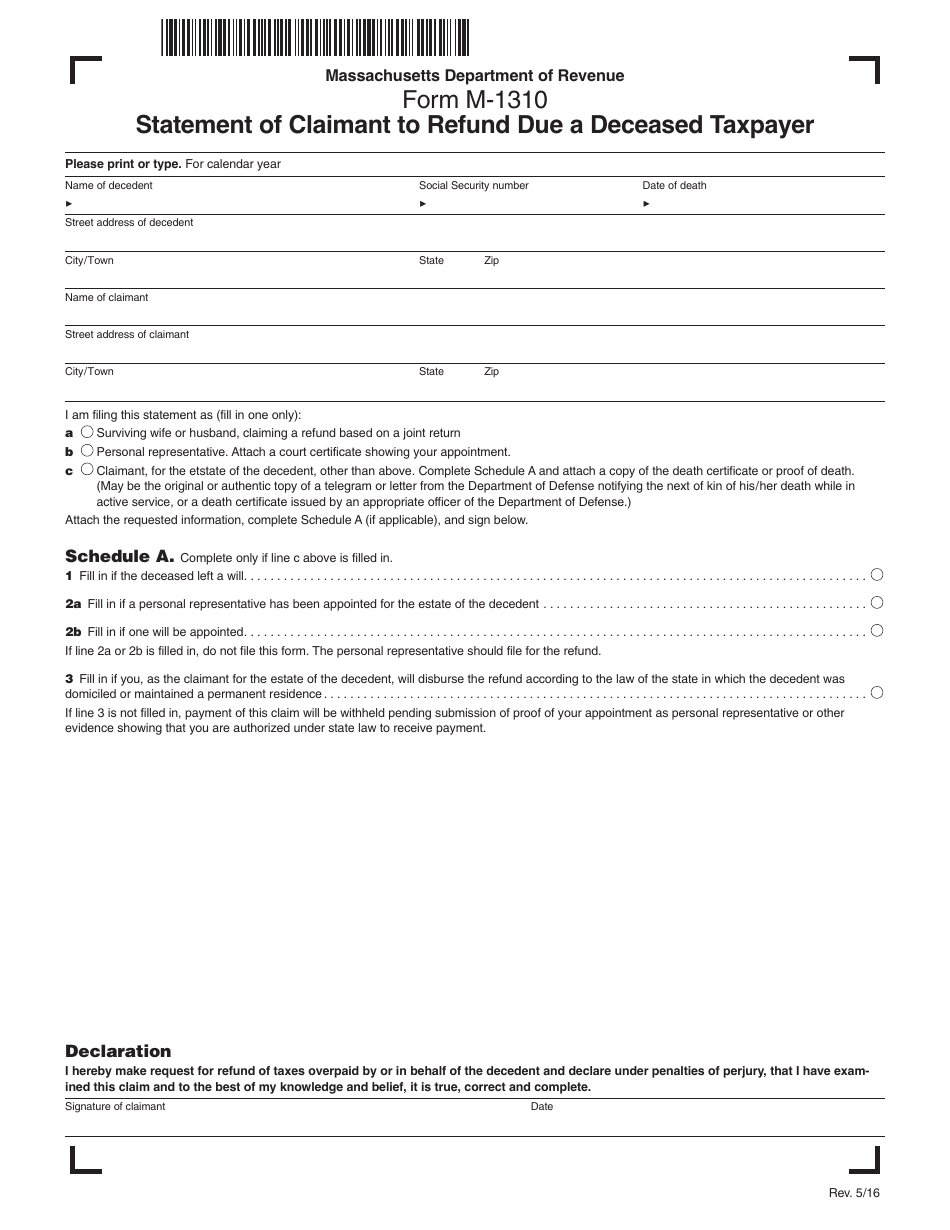

Form M1310 Download Printable PDF or Fill Online Statement of Claimant

Web file form 1310 to claim the refund on mr. Probate is opened in the. This form is for income earned in tax year 2022, with tax returns due in april. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due.

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

Web what is irs form 1310? Ad get ready for tax season deadlines by completing any required tax forms today. Web we are sending you letter 12c because we need more information to process your individual income tax return. Web statement of person claiming refund due a deceased taxpayer (irs form 1310) probate the legal process that takes place after.

Fill Free fillable Statement of Person Claiming Refund Due a Deceased

According to the irs website, form 1310 is known as a statement of person claiming refund due a deceased taxpayer. Save or instantly send your ready documents. In today’s post, i’ll answer some common questions about requesting a tax refund. Probate is opened in the. Web we last updated federal form 1310 in january 2023 from the federal internal revenue.

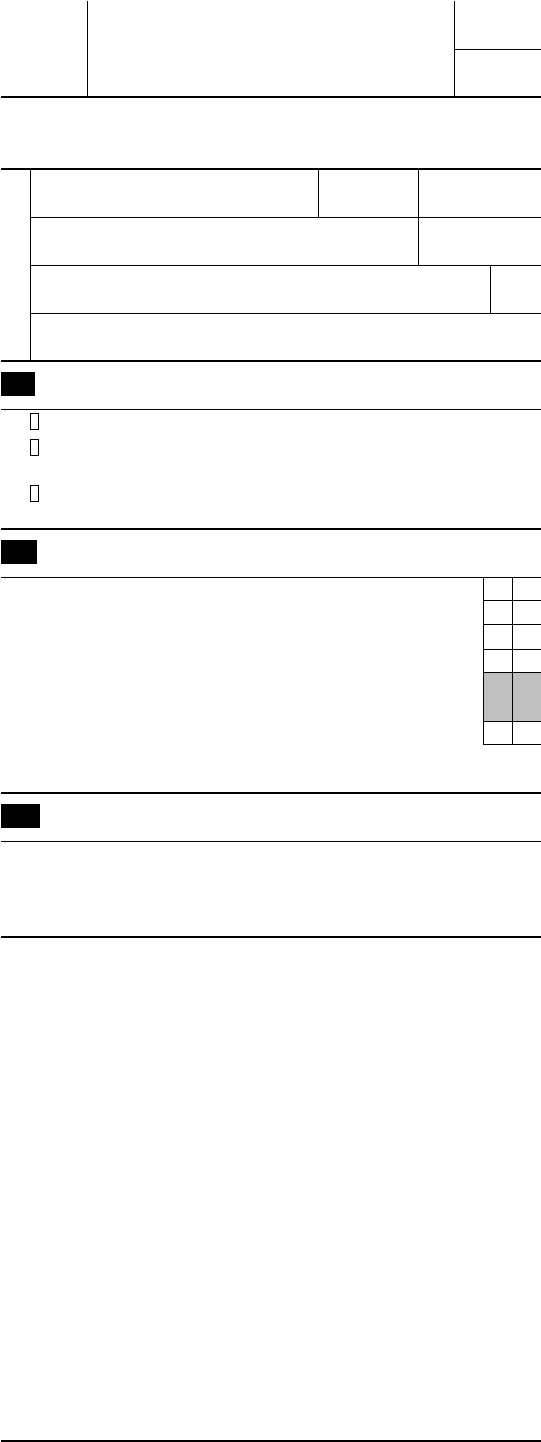

Form IL1310 Download Fillable PDF or Fill Online Statement of Person

Complete, edit or print tax forms instantly. Web file form 1310 to claim the refund on mr. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web what is irs form 1310? Save or instantly send your ready documents.

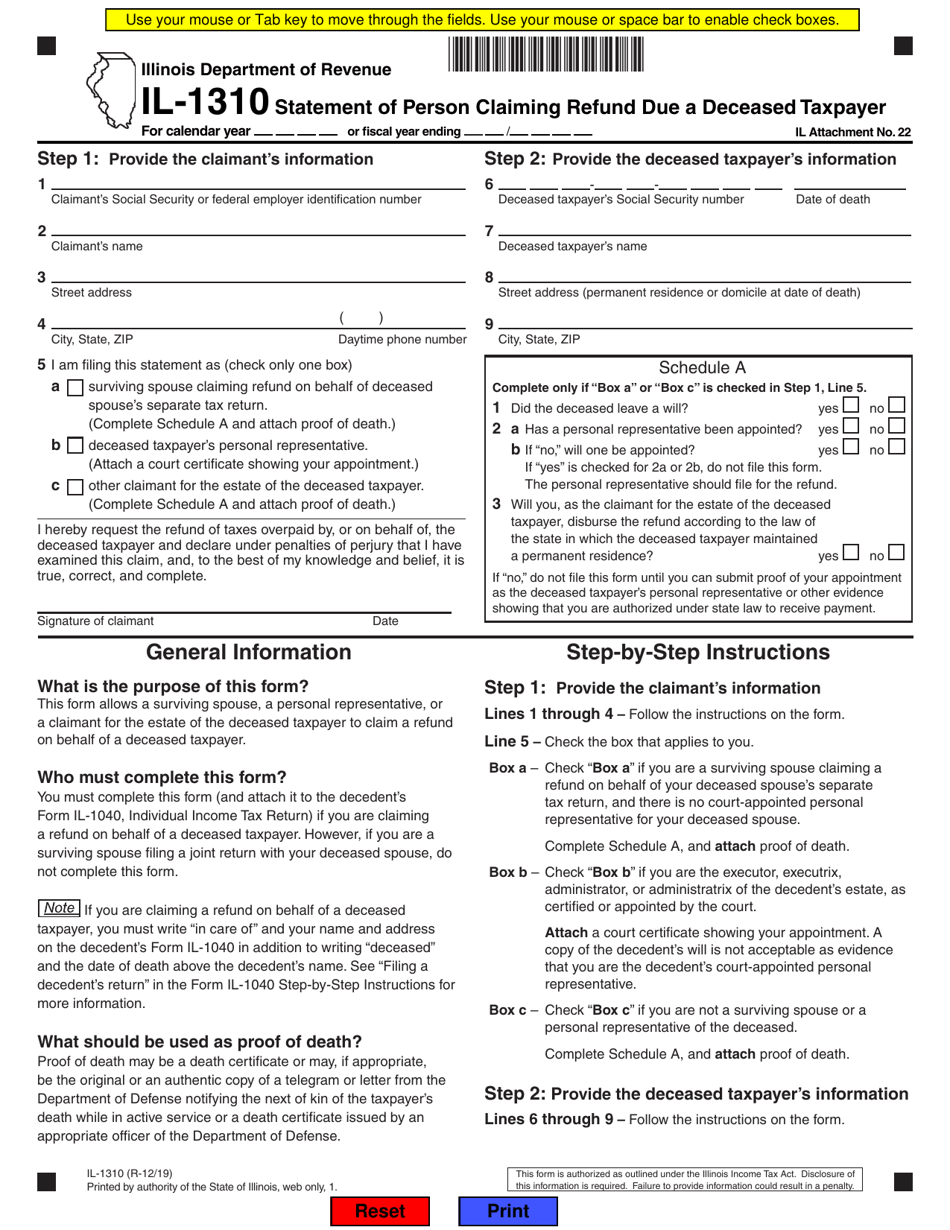

Form NH1310 Download Fillable PDF or Fill Online Request for Refund

Generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming. According to the irs website, form 1310 is known as a statement of person claiming refund due a deceased taxpayer. Web file form 1310 to claim the refund on mr. Web we last updated the statement of.

Web File Form 1310 To Claim The Refund On Mr.

Ad access irs tax forms. Web yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Probate is opened in the. This form is for income earned in tax year 2022, with tax returns due in april.

Web We Are Sending You Letter 12C Because We Need More Information To Process Your Individual Income Tax Return.

Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Download, print or email irs 1310 tax form on pdffiller for free.

Web Statement Of Person Claiming Refund Due A Deceased Taxpayer (Irs Form 1310) Probate The Legal Process That Takes Place After Someone Passes Away.

Web file form 1310 to claim the refund on mr. In today’s post, i’ll answer some common questions about requesting a tax refund. Complete, edit or print tax forms instantly. Web what is irs form 1310?

Web We Last Updated The Statement Of Person Claiming Refund Due A Deceased Taxpayer In January 2023, So This Is The Latest Version Of Form 1310, Fully Updated For Tax Year 2022.

According to the irs website, form 1310 is known as a statement of person claiming refund due a deceased taxpayer. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. However, you must attach to his return a copy of the court certificate showing your appointment. Get ready for tax season deadlines by completing any required tax forms today.