15H Form For Senior Citizens

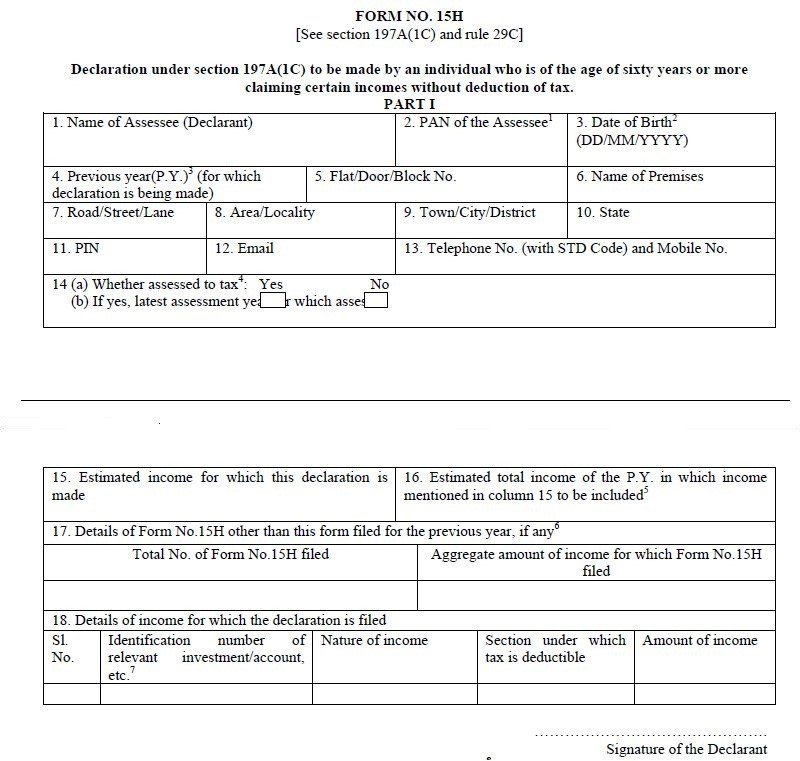

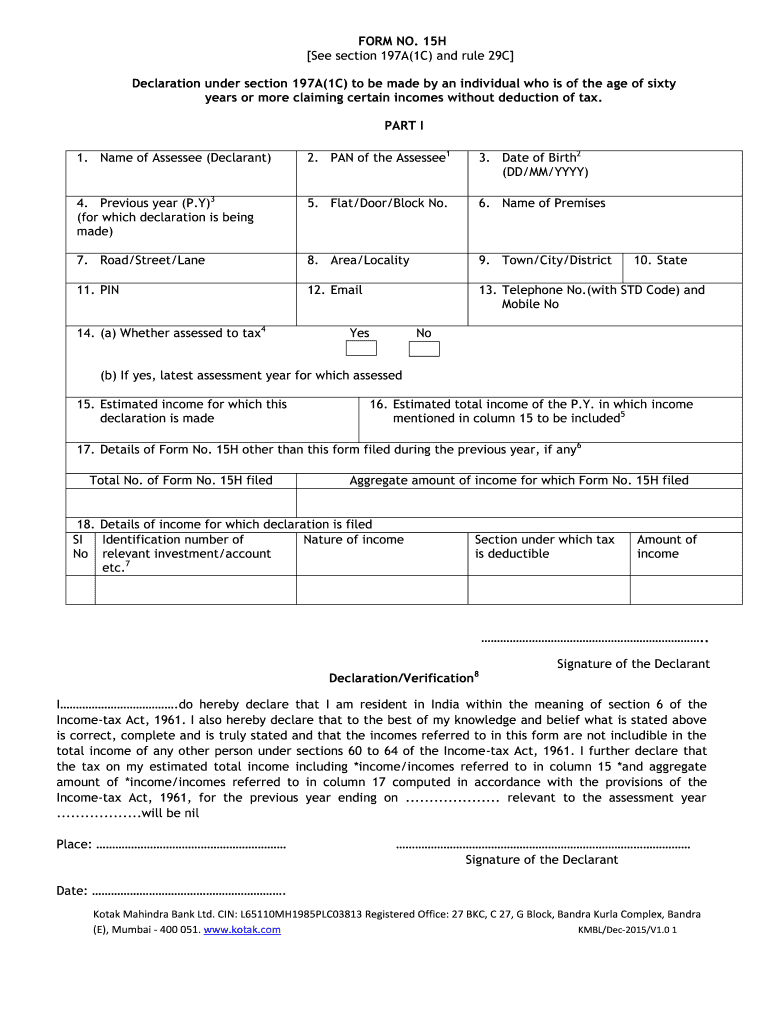

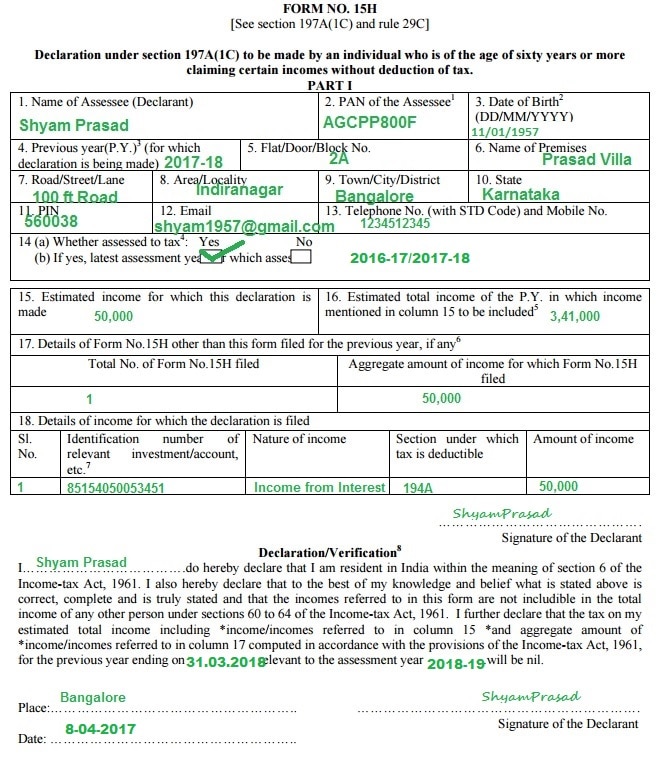

15H Form For Senior Citizens - Web the bipartisan budget act of 2018 required the irs to create a tax form for seniors. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. Web some of the banks provide the facility to upload forms online through their website as well. Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. You can submit the forms online as well via the bank’s. Web form 15h for senior citizen fy 2020 21 | how to save tds | senior citizen form 15h fill up form 15h helps to avoid tds deduction from income. Form no 15h for senior citizens who needs to receive interest without deduction of tax #pdf submitted. The total income tax liability of the taxpayer must be nil for the financial. Web he/ she is a senior citizen who is more than 60 years of age at the time of filing form 15h. He should be a senior.

Web the bipartisan budget act of 2018 required the irs to create a tax form for seniors. Web if you are a senior citizen, you should file form 15h; Web some of the banks provide the facility to upload forms online through their website as well. Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. Topic covered in this video: However, you need to meet certain eligibility conditions. Form 15h is for senior citizens who are 60 years or elder and form 15g. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a.

Form 15h is for senior citizens who are 60 years or elder and form 15g. Since these forms are valid for only one financial year, eligible individuals wanting to. Web form 15h is solely for senior citizens, that is, individuals who are at least 60 years of age. This is a request to reduce the tds burden on interest earned on recurring. Web if you are a senior citizen, you should file form 15h; Web the bipartisan budget act of 2018 required the irs to create a tax form for seniors. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. Web some of the banks provide the facility to upload forms online through their website as well. You can submit the forms online as well via the bank’s. Tax return for seniors 2022 department of the treasury—internal revenue service.

Tax declaration form download pdf Australian guidelines Cognitive Guide

Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. Web form 15h for senior citizen fy 2020 21 | how to save tds | senior citizen form 15h fill up form 15h helps to avoid tds deduction from income. 15h [see section 197a(1c).

Form 15H for senior citizen FY 2020 21 How to Save TDS Senior

He should be a senior. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. Form no 15h for senior citizens who needs to receive interest without deduction of tax #pdf submitted. Web form 15h for senior citizen fy 2020 21 | how to save tds | senior citizen form 15h.

Form 15h Download Form 20152022 Fill Out and Sign Printable PDF

Web he/ she is a senior citizen who is more than 60 years of age at the time of filing form 15h. Web if you are a senior citizen, you should file form 15h; The total income tax liability of the taxpayer must be nil for the financial. He should be a senior. Web form 15g is a declaration filed.

Form 15g In Word Format professionalslasopa

Web he/ she is a senior citizen who is more than 60 years of age at the time of filing form 15h. Form no 15h for senior citizens who needs to receive interest without deduction of tax #pdf submitted. Form 15h is for senior citizens who are 60 years or elder and form 15g. Tax return for seniors 2022 department.

[PDF] Form 15 H For Senior Citizen PDF Download in English InstaPDF

Tax return for seniors 2022 department of the treasury—internal revenue service. You can submit the forms online as well via the bank’s. Web if you are a senior citizen, you should file form 15h; Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60..

How to fill Form 15H (English) Save TDS on FDs Senior Citizens

Household employee cash wages of $1,900. Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. Topic covered in this video: He should be a senior. Web some of the banks provide the facility to upload forms online through their website as well.

[PDF] Form 15H For PF Withdrawal PDF Download PDFfile

Since these forms are valid for only one financial year, eligible individuals wanting to. Web form no 15h for senior citizens download preview description: Topic covered in this video: Tax return for seniors rather than the standard form 1040 when you file your taxes. The total income tax liability of the taxpayer must be nil for the financial.

New FORM 15H Applicable PY 201617 Government Finances Public Law

You can submit the forms online as well via the bank’s. He should be a senior. Irs use only—do not write or staple in this. Topic covered in this video: Since these forms are valid for only one financial year, eligible individuals wanting to.

Form 15H (Save TDS on Interest How to Fill & Download

Topic covered in this video: Web form 15h for senior citizen fy 2020 21 | how to save tds | senior citizen form 15h fill up form 15h helps to avoid tds deduction from income. Form 15h is for senior citizens who are 60 years or elder and form 15g. 15h [see section 197a(1c) and rule 29c] declaration under section.

How To Fill New Form 15G / Form 15H roy's Finance

Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. Since these forms are valid for only one financial year, eligible individuals wanting to. Form no 15h for senior citizens who needs to receive interest without deduction of tax #pdf submitted. Web form 15h.

Form 15H Is For Senior Citizens Who Are 60 Years Or Elder And Form 15G.

Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. Web the bipartisan budget act of 2018 required the irs to create a tax form for seniors. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. The total income tax liability of the taxpayer must be nil for the financial.

Web Form 15G Is A Declaration Filed By Individuals Below The Age Of 60 Years, While Form 15H Is For Senior Citizens, I.e., Individuals Above 60.

However, you need to meet certain eligibility conditions. Web form 15h for senior citizen fy 2020 21 | how to save tds | senior citizen form 15h fill up form 15h helps to avoid tds deduction from income. Web some of the banks provide the facility to upload forms online through their website as well. Form no 15h for senior citizens who needs to receive interest without deduction of tax #pdf submitted.

Irs Use Only—Do Not Write Or Staple In This.

Web form 15h is solely for senior citizens, that is, individuals who are at least 60 years of age. Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. This is a request to reduce the tds burden on interest earned on recurring. Web if you are a senior citizen, you should file form 15h;

He Should Be A Senior.

Household employee cash wages of $1,900. Topic covered in this video: Tax return for seniors 2022 department of the treasury—internal revenue service. Web he/ she is a senior citizen who is more than 60 years of age at the time of filing form 15h.

![[PDF] Form 15 H For Senior Citizen PDF Download in English InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/form-15h-pdf-179.jpg)

![[PDF] Form 15H For PF Withdrawal PDF Download PDFfile](https://pdffile.co.in/wp-content/uploads/pdf-thumbnails/2021/07/small/form-15h-for-pf-withdrawal-847.jpg)