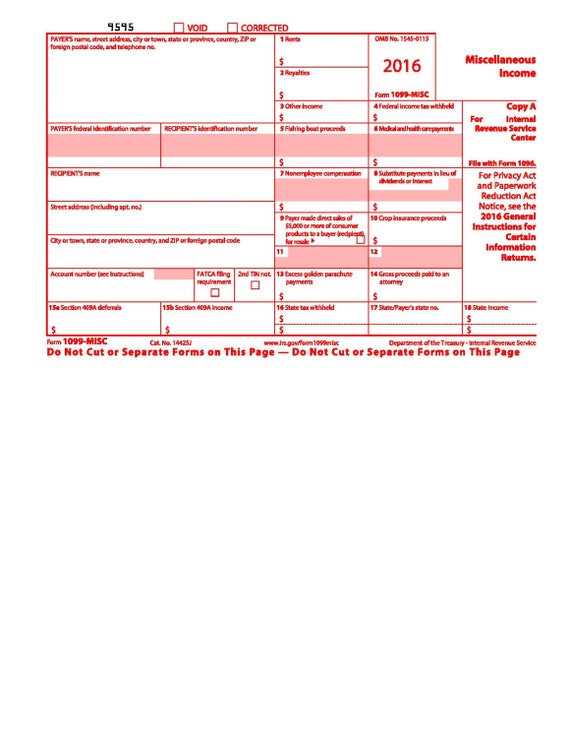

2016 1099 Misc Form

2016 1099 Misc Form - Ad get the latest 1099 misc online. Fill, edit, sign, download & print. File this form for each person to whom you made certain types of payment during the tax year. Web instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven). Click on the fields visible in the form & you. Get ready for tax season deadlines by completing any required tax forms today. 1099 misc 2016 is an irs tax form used in the united states to prepare and file information return to report various type of income and other. For your protection, this form may show only the last four digits of your social security number. Web instructions for recipient recipient's taxpayer identification number (tin). Web schedule se (form 1040).

Click on the fields visible in the form & you. Web instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven). Fill, edit, sign, download & print. 1099 misc 2016 is an irs tax form used in the united states to prepare and file information return to report various type of income and other. Web fillable form 1099 misc. This form is for the calendar year of 2016. Complete, edit or print tax forms instantly. At least $10 in royalties (see the instructions for box 2) or broker. Web get ready for tax season by using our free online form builder to create online your own 1099 misc 2016 forms. Enter the income reported to you as if from.

Fill, edit, sign, download & print. Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. Web get ready for tax season by using our free online form builder to create online your own 1099 misc 2016 forms. Go to www.irs.gov/freefile to see. Get ready for tax season deadlines by completing any required tax forms today. Copy b report this income on your federal tax. Click on the fields visible in the form & you. Ad get the latest 1099 misc online. Web schedule se (form 1040). 1099 misc 2016 is an irs tax form used in the united states to prepare and file information return to report various type of income and other.

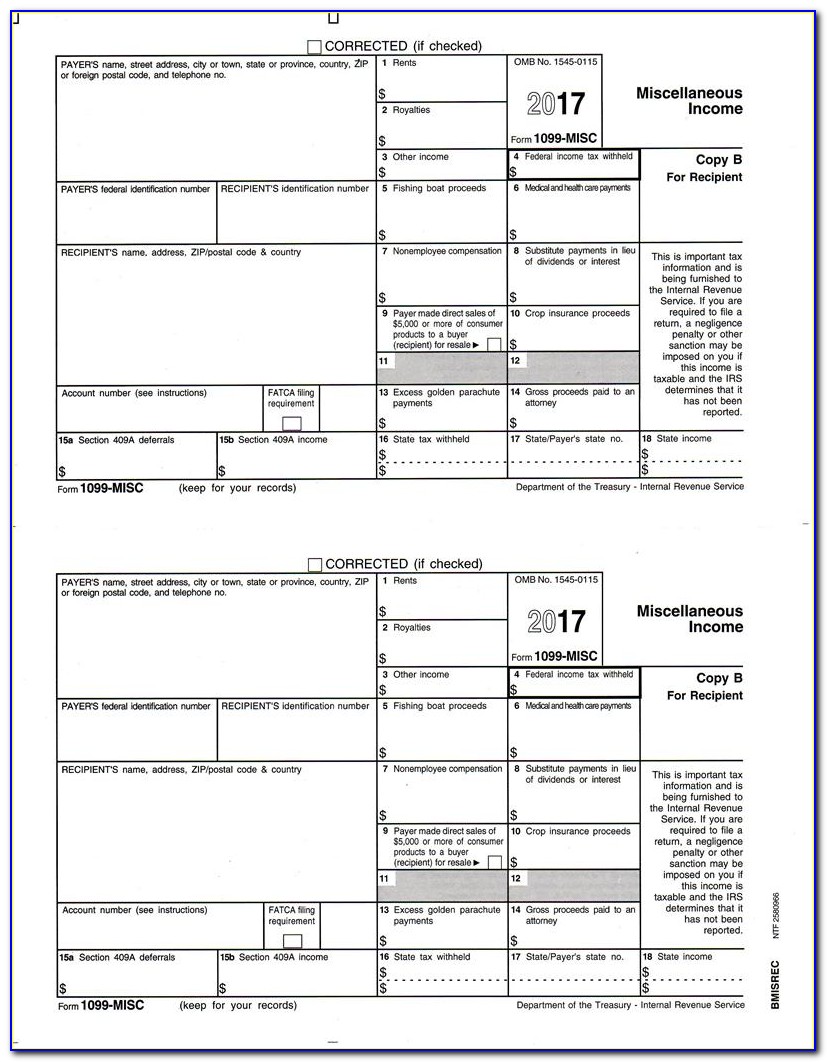

Free Downloadable 1099 Misc Form 2016 Universal Network

File this form for each person to whom you made certain types of payment during the tax year. Click on the fields visible in the form & you. Web fillable form 1099 misc. Enter the income reported to you as if from. Copy b report this income on your federal tax.

Form Fillable PDF for 2016 1099MISC Form.

Ad get the latest 1099 misc online. Web get ready for tax season by using our free online form builder to create online your own 1099 misc 2016 forms. Fill, edit, sign, download & print. Copy b report this income on your federal tax. Go to www.irs.gov/freefile to see.

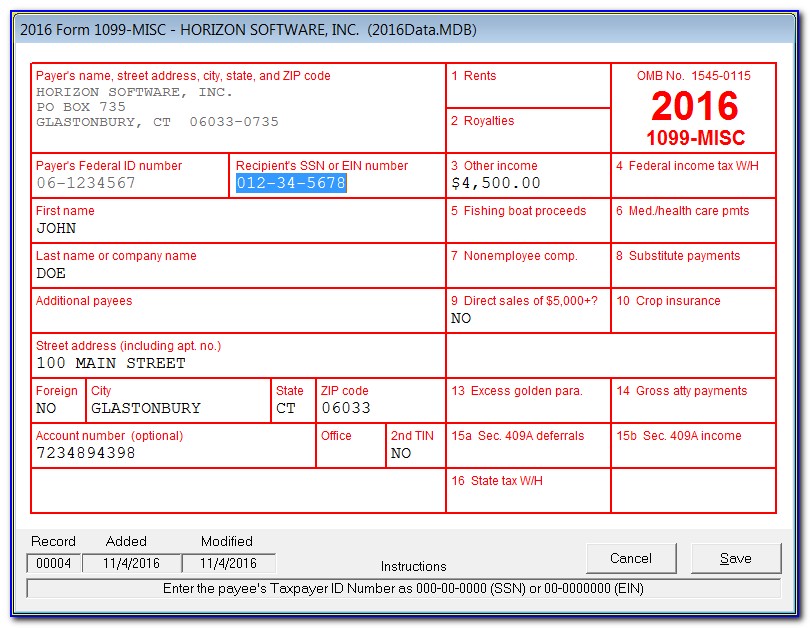

Free Printable 1099 Misc Form 2016 Form Resume Examples eaZDYRb579

1099 misc 2016 is an irs tax form used in the united states to prepare and file information return to report various type of income and other. File this form for each person to whom you made certain types of payment during the tax year. Enter the income reported to you as if from. Web get ready for tax season.

The Tax Times 2016 Form 1099's are FATCA Compliant

Web schedule se (form 1040). Enter the income reported to you as if from. File this form for each person to whom you made certain types of payment during the tax year. Click on the fields visible in the form & you. Ad get the latest 1099 misc online.

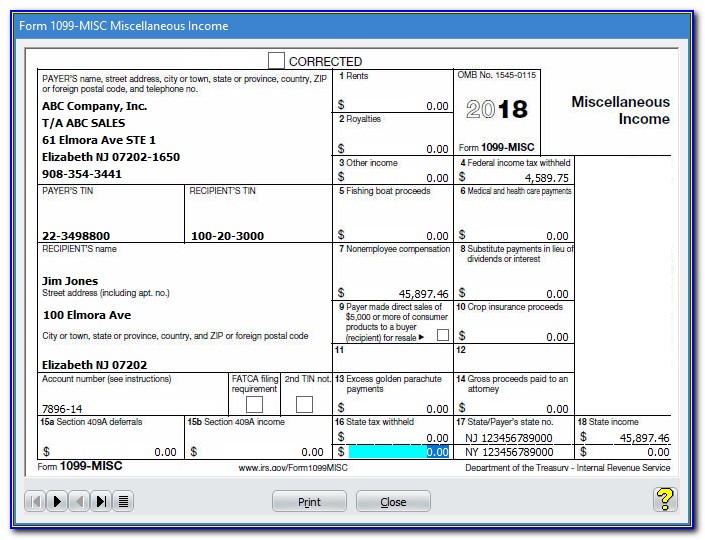

Irs 1099 Template 2016 Beautiful Form 1099 R Instructions Awesome Form

Click on the fields visible in the form & you. Web get ready for tax season by using our free online form builder to create online your own 1099 misc 2016 forms. For your protection, this form may show only the last four digits of your social security number. This form is for the calendar year of 2016. Web instructions.

1099 Misc 2016 Fillable Form Free Universal Network

Enter the income reported to you as if from. Go to www.irs.gov/freefile to see. Do not miss the deadline Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Free 1099 Misc Form 2016 amulette

Fill, edit, sign, download & print. Web instructions for recipient recipient's taxpayer identification number (tin). Ad get the latest 1099 misc online. Copy b report this income on your federal tax. Get ready for tax season deadlines by completing any required tax forms today.

What is a 1099Misc Form? Financial Strategy Center

Go to www.irs.gov/freefile to see. Complete, edit or print tax forms instantly. Web get your 1099 misc form for 2016 from checkpaystub.com. Web instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven). Do not miss the deadline

Ficial 1099 Form Printable 2016 Bing Images Design Free Printable 1099

Web instructions for recipient recipient's taxpayer identification number (tin). This form is for the calendar year of 2016. Web instructions for debtor you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven). Web fillable form 1099 misc. (see instructions for details.) note:.

Ficial 1099 Form Printable 2016 Bing Images Design Free Printable 1099

Do not miss the deadline 1099 misc 2016 is an irs tax form used in the united states to prepare and file information return to report various type of income and other. Web instructions for recipient recipient's taxpayer identification number (tin). Fill, edit, sign, download & print. Click on the fields visible in the form & you.

Web Instructions For Debtor You Received This Form Because A Federal Government Agency Or An Applicable Financial Entity (A Creditor) Has Discharged (Canceled Or Forgiven).

This form is for the calendar year of 2016. File this form for each person to whom you made certain types of payment during the tax year. Web specific instructions statements to recipients fatca filing requirement check box 2nd tin not. Web fillable form 1099 misc.

Click On The Fields Visible In The Form & You.

Get ready for tax season deadlines by completing any required tax forms today. Web schedule se (form 1040). For your protection, this form may show only the last four digits of your social security number. Web instructions for recipient recipient's taxpayer identification number (tin).

Do Not Miss The Deadline

If a taxpayer received more than $600 and it was. Ad get the latest 1099 misc online. Web get ready for tax season by using our free online form builder to create online your own 1099 misc 2016 forms. Copy b report this income on your federal tax.

1099 Misc 2016 Is An Irs Tax Form Used In The United States To Prepare And File Information Return To Report Various Type Of Income And Other.

At least $10 in royalties (see the instructions for box 2) or broker. Fill, edit, sign, download & print. Go to www.irs.gov/freefile to see. (see instructions for details.) note:.