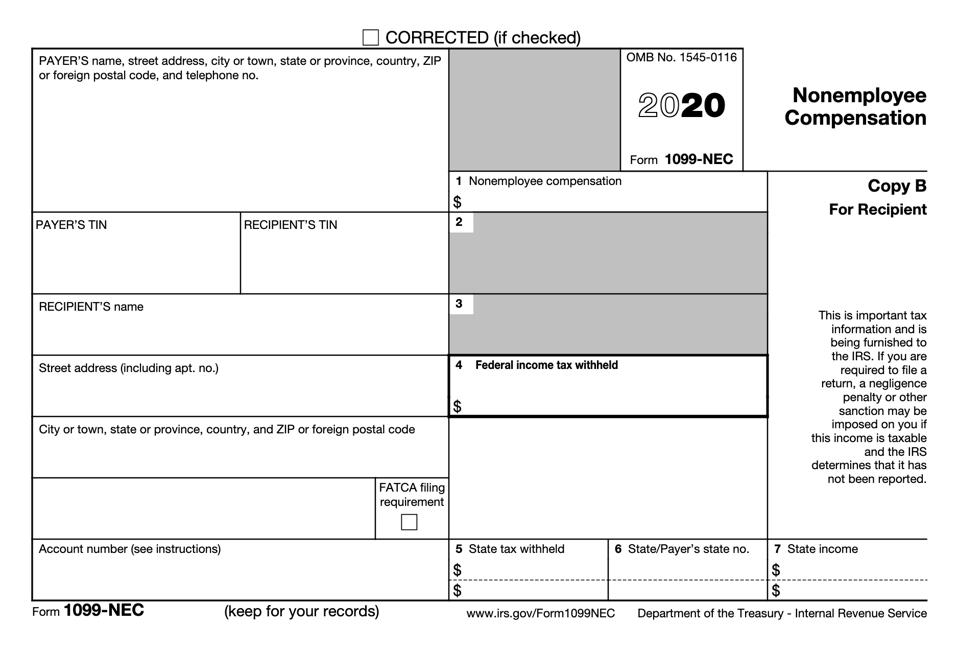

2020 Form 1099 Nec

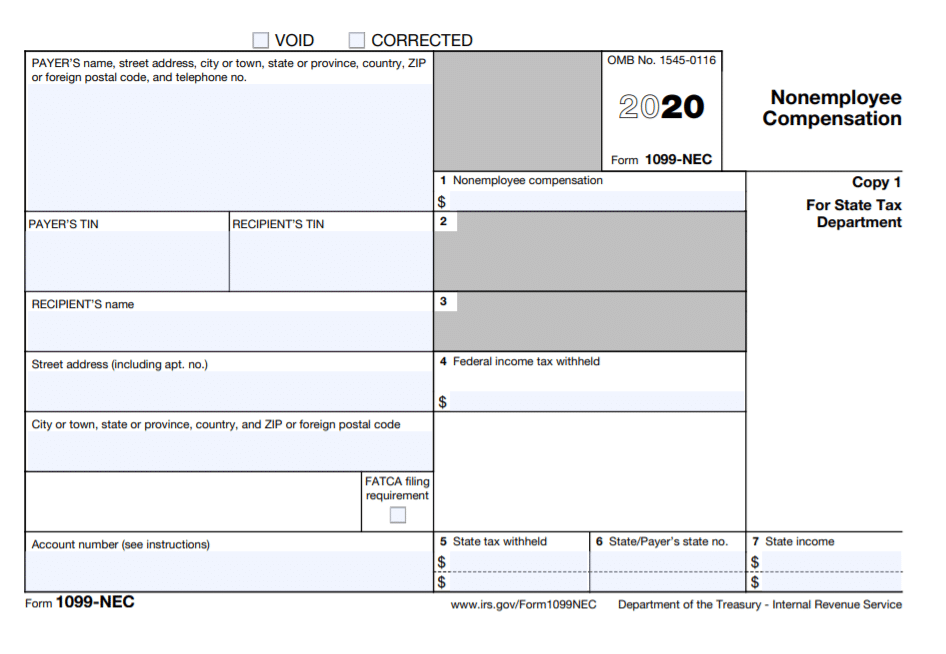

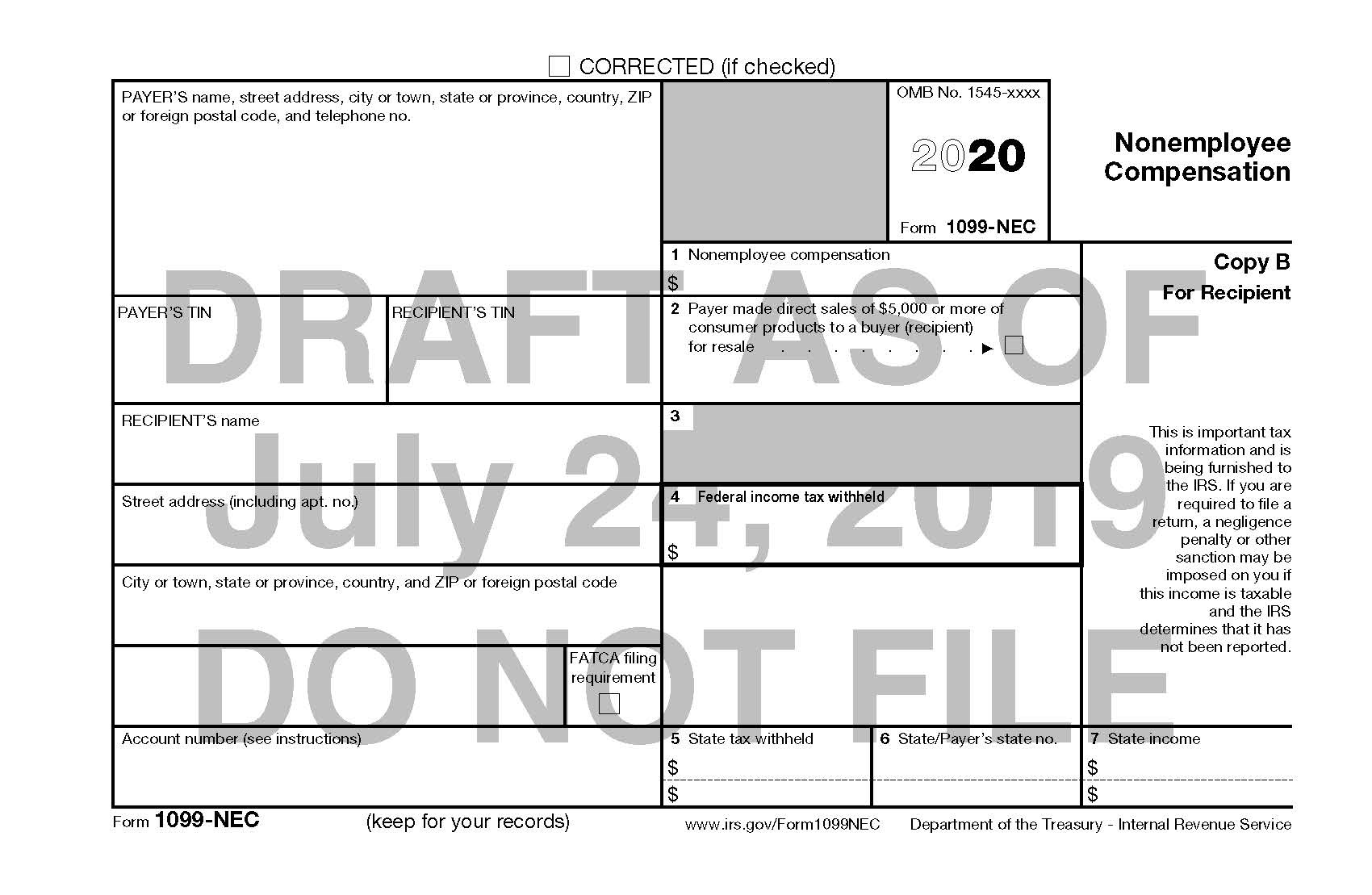

2020 Form 1099 Nec - Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Copy a for internal revenue service center. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. 2020 general instructions for certain information returns. For internal revenue service center. For privacy act and paperwork reduction act notice, see the. Current general instructions for certain information returns.

2020 general instructions for certain information returns. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Copy a for internal revenue service center. For internal revenue service center. Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. For privacy act and paperwork reduction act notice, see the. Current general instructions for certain information returns.

For privacy act and paperwork reduction act notice, see the. 2020 general instructions for certain information returns. Copy a for internal revenue service center. For internal revenue service center. Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Current general instructions for certain information returns. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor.

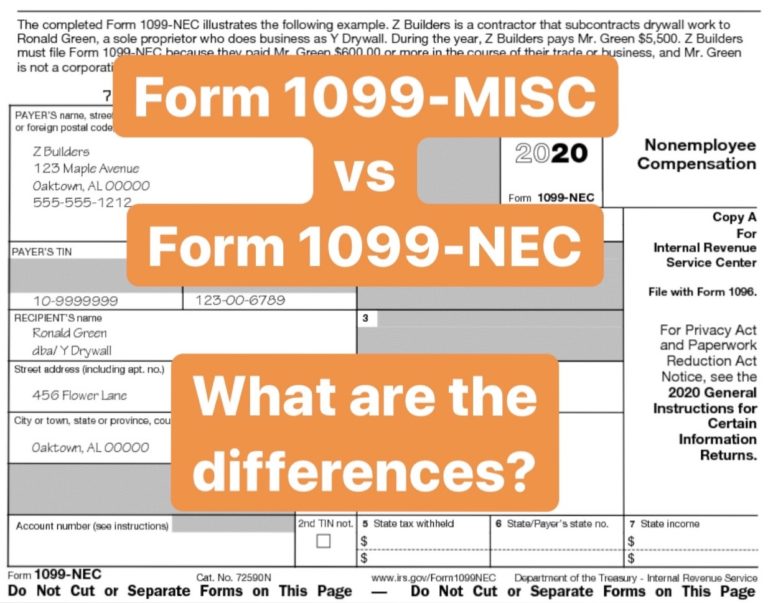

Form 1099MISC vs Form 1099NEC How are they Different?

For privacy act and paperwork reduction act notice, see the. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. 2020 general instructions for certain information returns. For internal revenue service center. Starting in tax year 2020, payers must complete this form to report any payment of $600 or.

What the 1099NEC Coming Back Means for your Business Chortek

Current general instructions for certain information returns. 2020 general instructions for certain information returns. Copy a for internal revenue service center. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. For internal revenue service center.

1099NEC or 1099MISC? What has changed and why it matters! IssueWire

For privacy act and paperwork reduction act notice, see the. Current general instructions for certain information returns. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Copy.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Current general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the. Copy a for internal revenue service center. Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Businesses will use this form if they made payments totaling $600 or more to certain.

IRS to Bring Back Form 1099NEC, Last Used in 1982 — Current Federal

For privacy act and paperwork reduction act notice, see the. 2020 general instructions for certain information returns. For internal revenue service center. Copy a for internal revenue service center. Current general instructions for certain information returns.

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

Current general instructions for certain information returns. 2020 general instructions for certain information returns. Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Copy a for internal revenue service center. For privacy act and paperwork reduction act notice, see the.

1099NEC or 1099MISC? What has changed and why it matters! Pro News

For internal revenue service center. Copy a for internal revenue service center. Current general instructions for certain information returns. 2020 general instructions for certain information returns. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor.

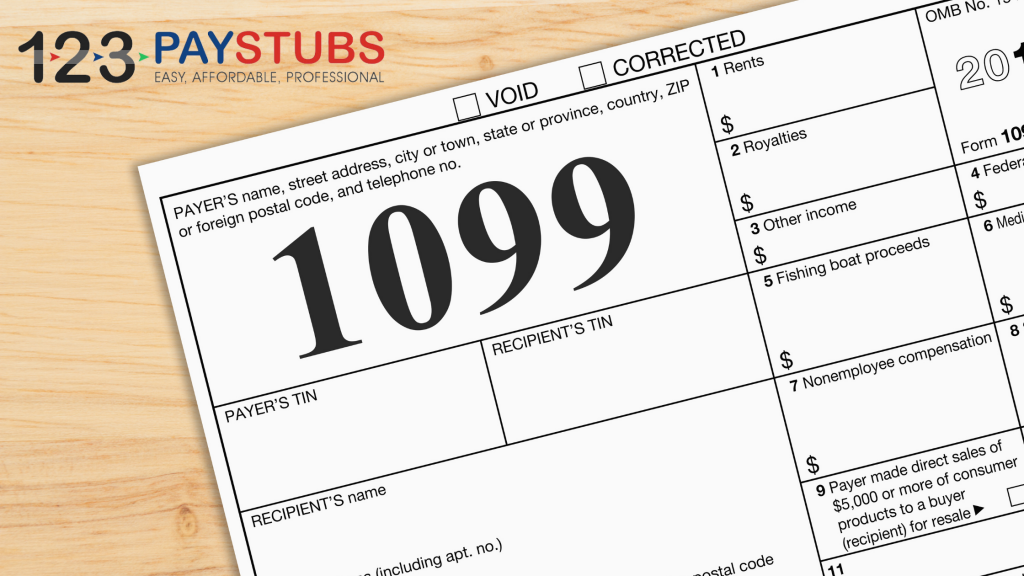

What is Form 1099NEC and Who Needs to File? 123PayStubs Blog

Current general instructions for certain information returns. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Copy a for internal revenue service center. For privacy act and paperwork reduction act notice, see the. For internal revenue service center.

Addsum Business Software, Inc. Adv 8 r3 will support IRS form 1099NEC

Current general instructions for certain information returns. For internal revenue service center. For privacy act and paperwork reduction act notice, see the. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Copy a for internal revenue service center.

There’s A New Tax Form With Some Changes For Freelancers & Gig

Current general instructions for certain information returns. Copy a for internal revenue service center. 2020 general instructions for certain information returns. For privacy act and paperwork reduction act notice, see the. Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee.

Current General Instructions For Certain Information Returns.

For privacy act and paperwork reduction act notice, see the. For internal revenue service center. Businesses will use this form if they made payments totaling $600 or more to certain nonemployees, such as an independent contractor. Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee.

2020 General Instructions For Certain Information Returns.

Copy a for internal revenue service center.