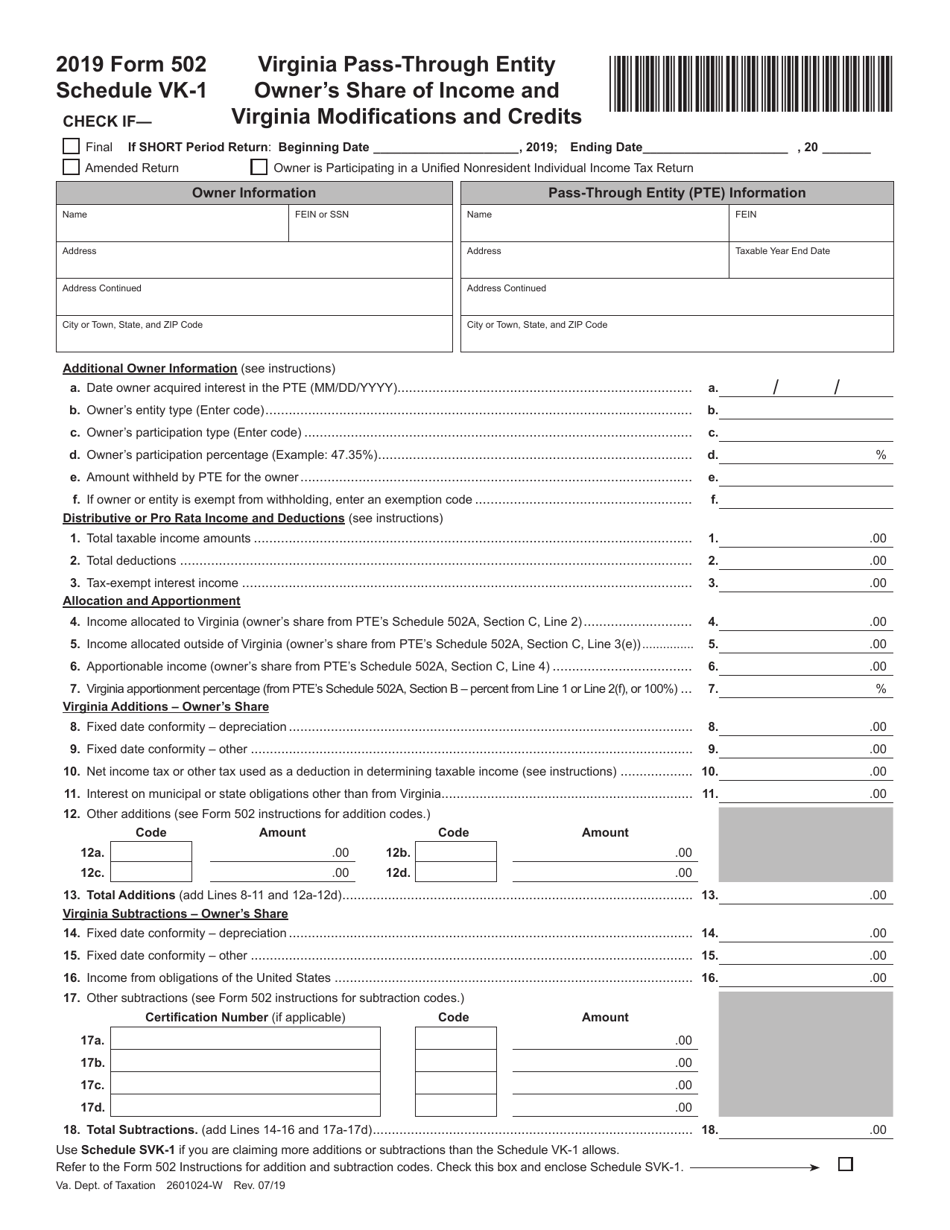

2021 Form 502 Schedule Vk-1

2021 Form 502 Schedule Vk-1 - Under additional owner information it says on line f: A copy should be given to each owner, and a copy included with the entity’s virginia return of income. This form is for income earned in tax year 2022, with tax returns due in april. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Ending / / partner’s share of. Web 2021 $ md dates of maryland residence (mm dd yyyy) from to other state of residence: Virginia modifications and credits *va0vk1122888* check if— final if short. Edit your 2021 virginia form 502 online. Department of the treasury internal revenue service. If you began or ended legal residence in maryland in 2021 place a p in the.

This form is for income earned in tax year 2022, with tax returns due in april. 2021 schedule 1 (form 1040) author: A copy should be given to each owner, and a copy included with the entity’s virginia return of income. Owner’s share of income and. Virginia modifications and credits *va0vk1122888* check if— final if short. Under additional owner information it says on line f: Web schedule vk 1 instructions 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 48 votes how to fill out and sign form 502 schedule vk 1 instructions online?. Department of the treasury internal revenue service. For calendar year 2021, or tax year beginning / / 2021. Sign it in a few clicks.

Edit your 2021 virginia form 502 online. Web schedule vk 1 instructions 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 48 votes how to fill out and sign form 502 schedule vk 1 instructions online?. Type text, add images, blackout confidential details, add comments, highlights and more. This form is for income earned in tax year 2022, with tax returns due in april. If owner or entity is. 2021 schedule 1 (form 1040) author: If you began or ended legal residence in maryland in 2021 place a p in the. He is a non resident of virginia. A copy should be given to each owner, and a copy included with the entity’s virginia return of income. Sign it in a few clicks.

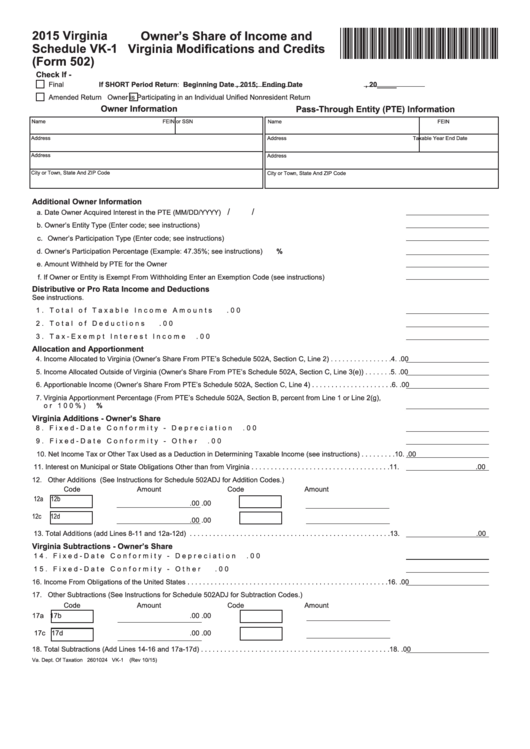

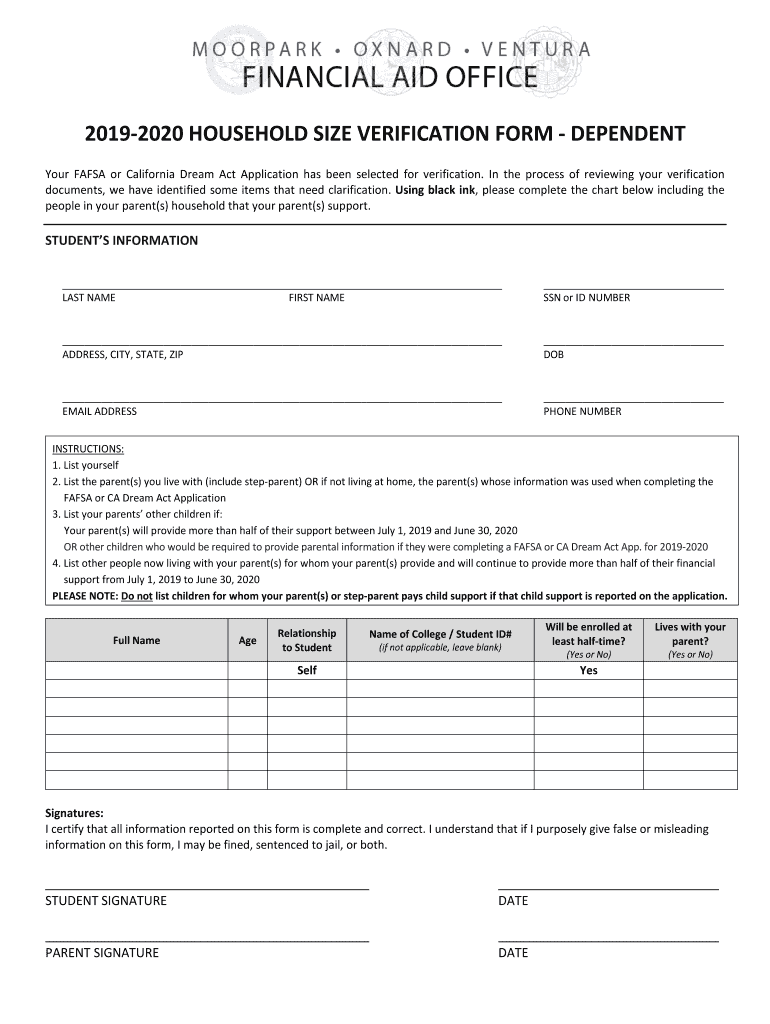

Fillable Schedule Vk1 (Form 502) Virginia Owner'S Share Of

If you began or ended legal residence in maryland in 2021 place a p in the. Type text, add images, blackout confidential details, add comments, highlights and more. Web schedule vk 1 instructions 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 48 votes how to fill out and sign.

Revised IRS Form 941 Schedule R 2nd quarter 2021

He is a non resident of virginia. A copy should be given to each owner, and a copy included with the entity’s virginia return of income. If owner or entity is. Type text, add images, blackout confidential details, add comments, highlights and more. Owner’s share of income and.

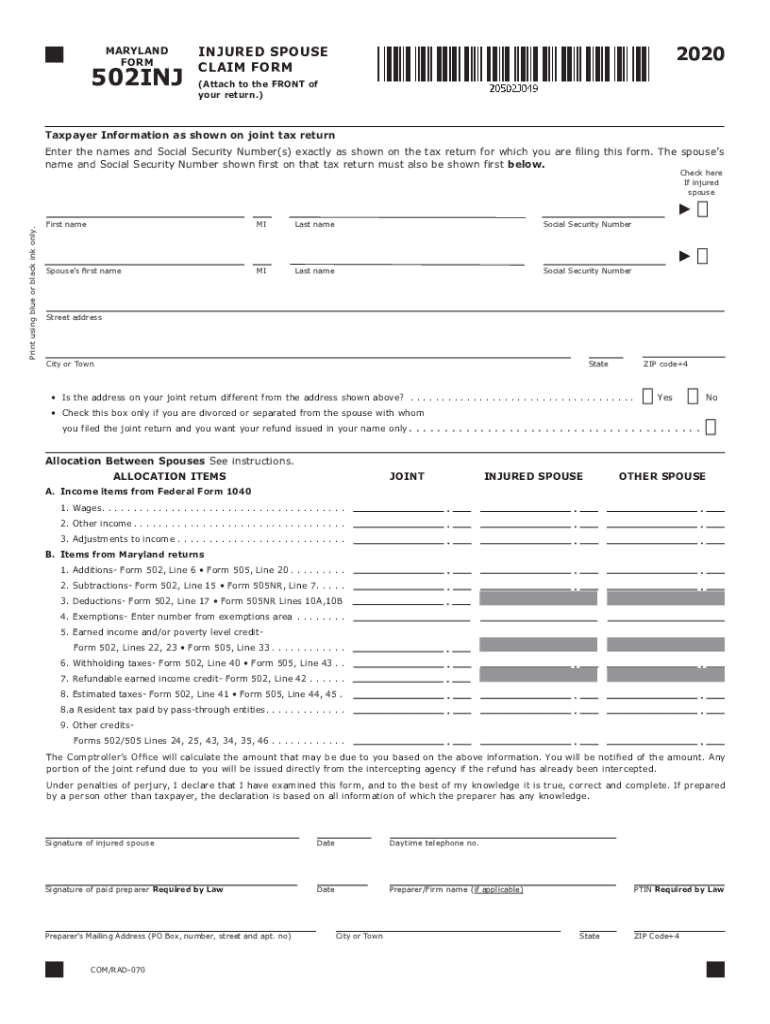

2020 Form MD 502INJ Fill Online, Printable, Fillable, Blank pdfFiller

Type text, add images, blackout confidential details, add comments, highlights and more. If owner or entity is. 2021 schedule 1 (form 1040) author: Web 2021 $ md dates of maryland residence (mm dd yyyy) from to other state of residence: If you began or ended legal residence in maryland in 2021 place a p in the.

2021 Form Irs 1099Int Fill Online, Printable, Fillable with Irs Forms

He is a non resident of virginia. This form is for income earned in tax year 2022, with tax returns due in april. Additional income and adjustments to income keywords: 2021 schedule 1 (form 1040) author: You can download or print.

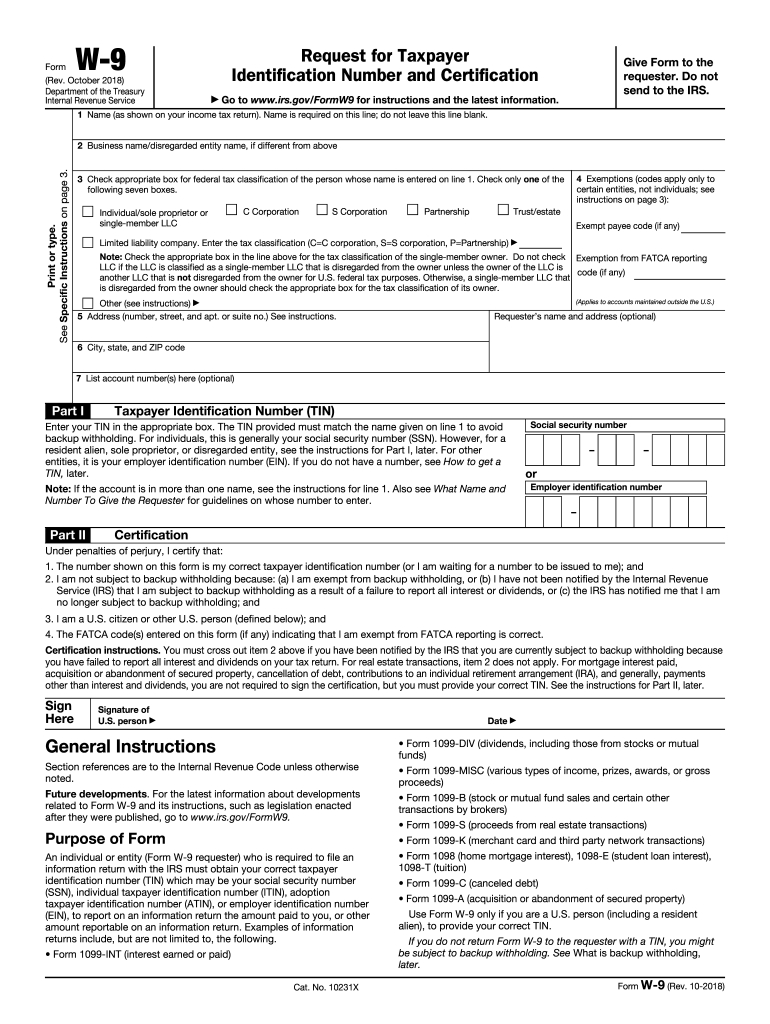

2021 W9 Form Printable Example Calendar Printable

If owner or entity is. A copy should be given to each owner, and a copy included with the entity’s virginia return of income. Web 2021 $ md dates of maryland residence (mm dd yyyy) from to other state of residence: Owner’s share of income and. Virginia modifications and credits *va0vk1122888* check if— final if short.

W 9 2021 Form Pdf Irs Calendar Printable Free

He is a non resident of virginia. You can download or print. 2021 schedule 1 (form 1040) author: Sign it in a few clicks. This form is for income earned in tax year 2022, with tax returns due in april.

Form 502 Schedule VK1 Download Fillable PDF or Fill Online Virginia

2021 schedule 1 (form 1040) author: Department of the treasury internal revenue service. Ending / / partner’s share of. For calendar year 2021, or tax year beginning / / 2021. Virginia modifications and credits *va0vk1122888* check if— final if short.

Ckht 502 Form 2019 / CA Olympic Archery In Schools New School

If owner or entity is. He is a non resident of virginia. A copy should be given to each owner, and a copy included with the entity’s virginia return of income. Type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks.

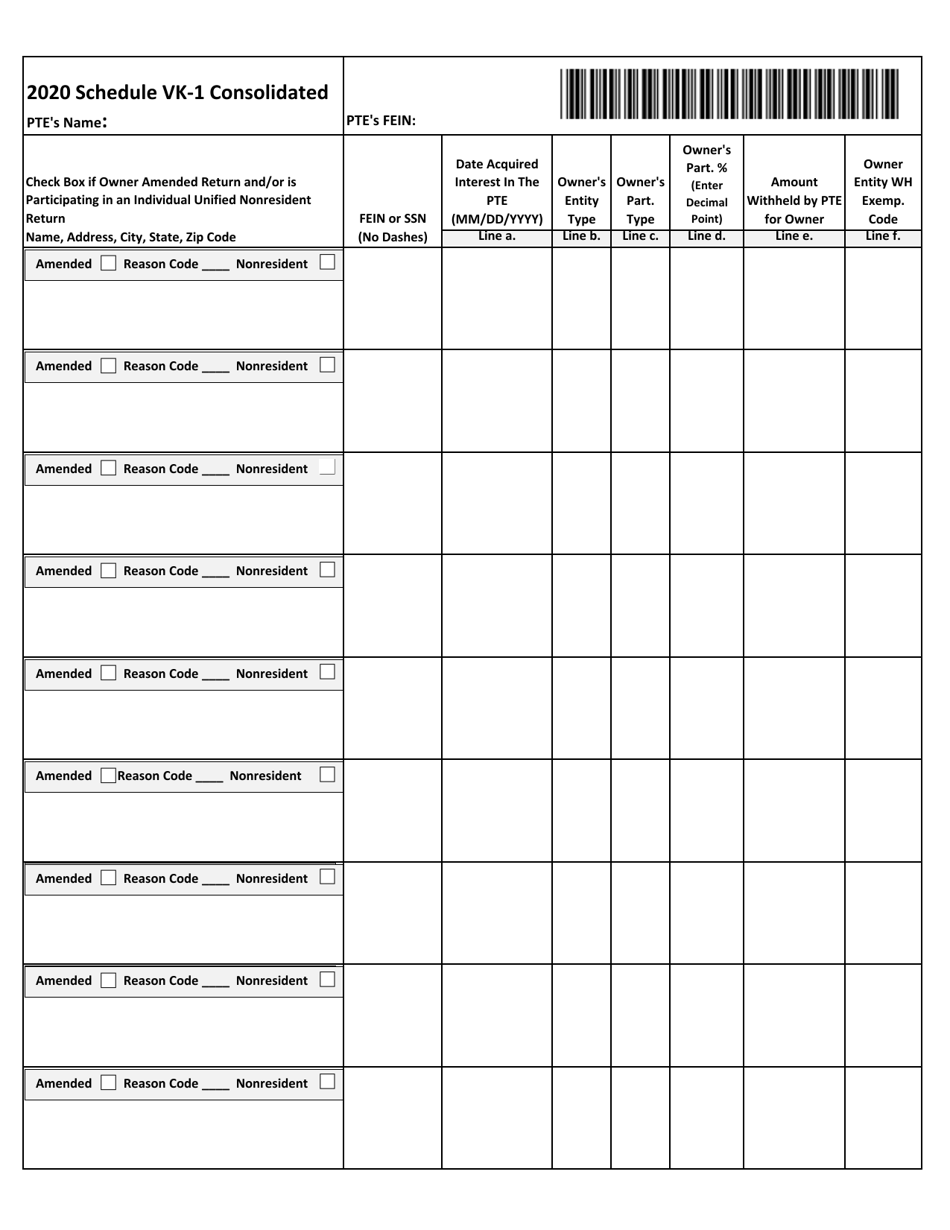

Schedule VK1 CONSOLIDATED Download Fillable PDF or Fill Online Allows

If you began or ended legal residence in maryland in 2021 place a p in the. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Virginia modifications and credits *va0vk1122888* check if— final if short. Department of the treasury internal revenue service. A copy.

2012 Form MD 502D Fill Online, Printable, Fillable, Blank pdfFiller

Web 2021 $ md dates of maryland residence (mm dd yyyy) from to other state of residence: Type text, add images, blackout confidential details, add comments, highlights and more. Under additional owner information it says on line f: Ending / / partner’s share of. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners.

If You Began Or Ended Legal Residence In Maryland In 2021 Place A P In The.

Additional income and adjustments to income keywords: Web schedule vk 1 instructions 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 48 votes how to fill out and sign form 502 schedule vk 1 instructions online?. Edit your 2021 virginia form 502 online. He is a non resident of virginia.

A Copy Should Be Given To Each Owner, And A Copy Included With The Entity’s Virginia Return Of Income.

Type text, add images, blackout confidential details, add comments, highlights and more. Owner’s share of income and. Department of the treasury internal revenue service. Ending / / partner’s share of.

You Can Download Or Print.

This form is for income earned in tax year 2022, with tax returns due in april. 2021 schedule 1 (form 1040) author: Web 2021 $ md dates of maryland residence (mm dd yyyy) from to other state of residence: Sign it in a few clicks.

Virginia Modifications And Credits *Va0Vk1122888* Check If— Final If Short.

Under additional owner information it says on line f: For calendar year 2021, or tax year beginning / / 2021. If owner or entity is. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding.