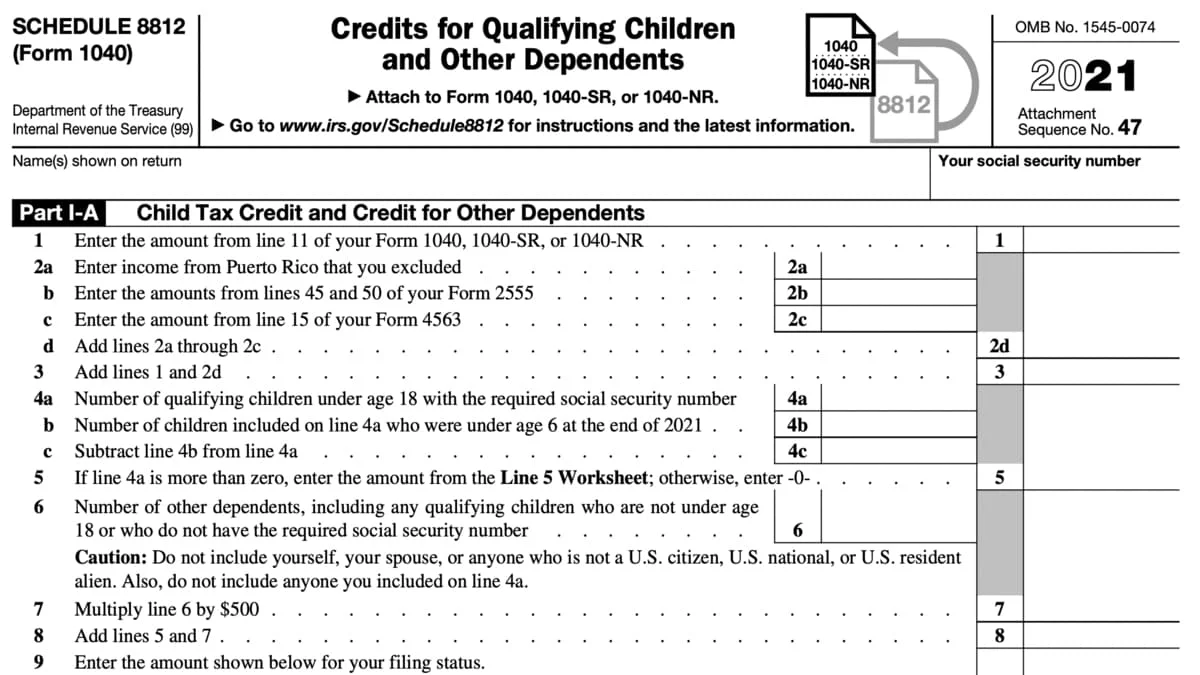

2021 Form 8812

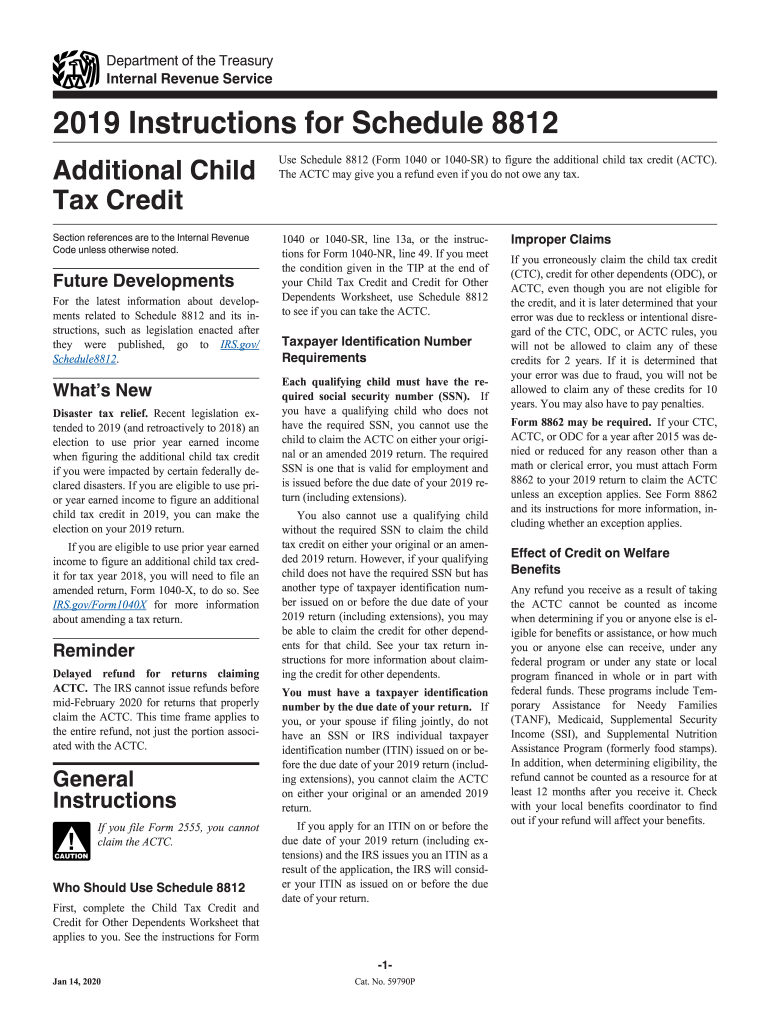

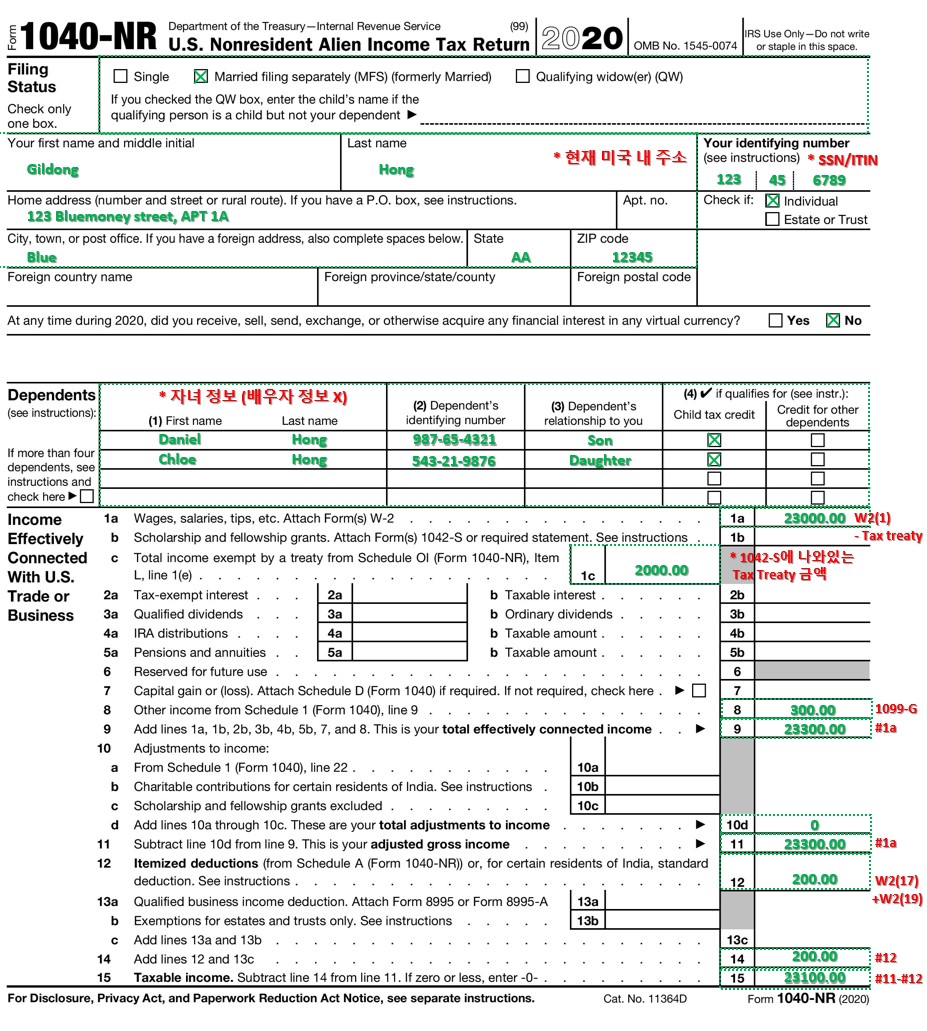

2021 Form 8812 - Signnow allows users to edit, sign, fill & share all type of documents online. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. The ctc and odc are nonrefundable credits. Ad upload, modify or create forms. Look like irs is expecting the highlighted cell to be $1,000, but i'm not sure why, The 2022 schedule 8812 instructions are published as a separate booklet which you. Go to www.irs.gov/schedule8812 for instructions and the latest information. See the instructions for form 1040, line 19, or form 1040nr, line 19. Web form 1040 schedule 8812, credits for qualifying children and other dependents, asks that you first complete the child tax credit and credit for other dependents worksheet. Try it for free now!

Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. The ctc and odc are nonrefundable credits. See the instructions for form 1040, line 19, or form 1040nr, line 19. Ad upload, modify or create forms. Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Web updated for tax year 2022 • february 9, 2023 01:46 pm. Go to www.irs.gov/schedule8812 for instructions and the latest information.

The 2022 schedule 8812 instructions are published as a separate booklet which you. Go to www.irs.gov/schedule8812 for instructions and the latest information. Get ready for tax season deadlines by completing any required tax forms today. See the instructions for form 1040, line 19, or form 1040nr, line 19. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. The actc is a refundable credit. Web updated for tax year 2022 • february 9, 2023 01:46 pm. The ctc and odc are nonrefundable credits. Web form 1040 schedule 8812, credits for qualifying children and other dependents, asks that you first complete the child tax credit and credit for other dependents worksheet. Signnow allows users to edit, sign, fill & share all type of documents online.

Irs Child Tax Credit Fill Out and Sign Printable PDF Template signNow

The 2022 schedule 8812 instructions are published as a separate booklet which you. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. Signnow allows users to edit, sign,.

Schedule 8812 2022 for Child Tax Credit File Online Schedules TaxUni

Look like irs is expecting the highlighted cell to be $1,000, but i'm not sure why, The ctc and odc are nonrefundable credits. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Get ready for tax season deadlines by completing any required tax forms today. Web form 1040 schedule 8812, credits for qualifying children and other dependents,.

Form 8812 Line 5 Worksheet

Get ready for tax season deadlines by completing any required tax forms today. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. Web updated for tax year 2022.

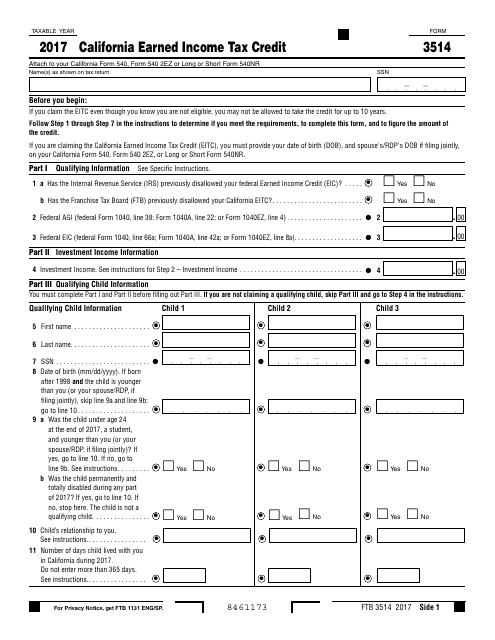

Form FTB 3514 Download Fillable PDF 2017, California Earned Tax

The 2022 schedule 8812 instructions are published as a separate booklet which you. Try it for free now! Ad upload, modify or create forms. Web form 1040 schedule 8812, credits for qualifying children and other dependents, asks that you first complete the child tax credit and credit for other dependents worksheet. Web use schedule 8812 (form 1040) to figure your.

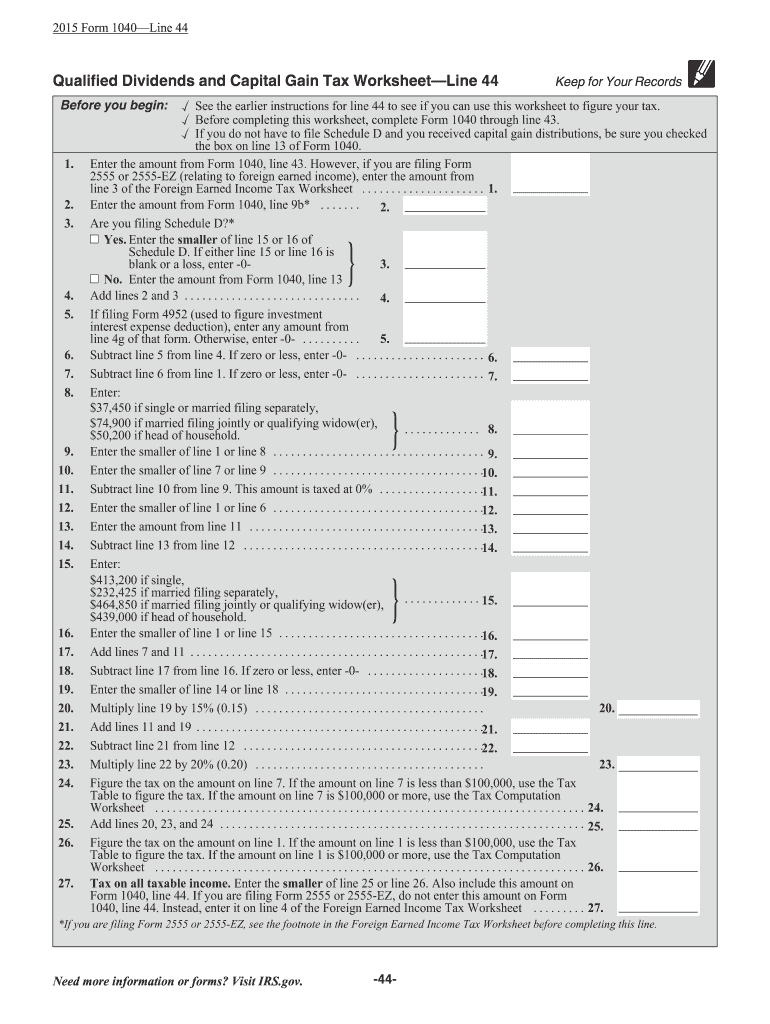

2015 2020 Form IRS Instruction 1040 Line 44 Fill Online 1040 Form

Look like irs is expecting the highlighted cell to be $1,000, but i'm not sure why, Signnow allows users to edit, sign, fill & share all type of documents online. The ctc and odc are nonrefundable credits. Web irs notification of error related to refundable child tax credit, it's about schedule 8812 sheet 5 i received a notification from irs.

8812 Worksheet

The actc is a refundable credit. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. The ctc and odc are nonrefundable credits. Web form 1040 schedule 8812, credits.

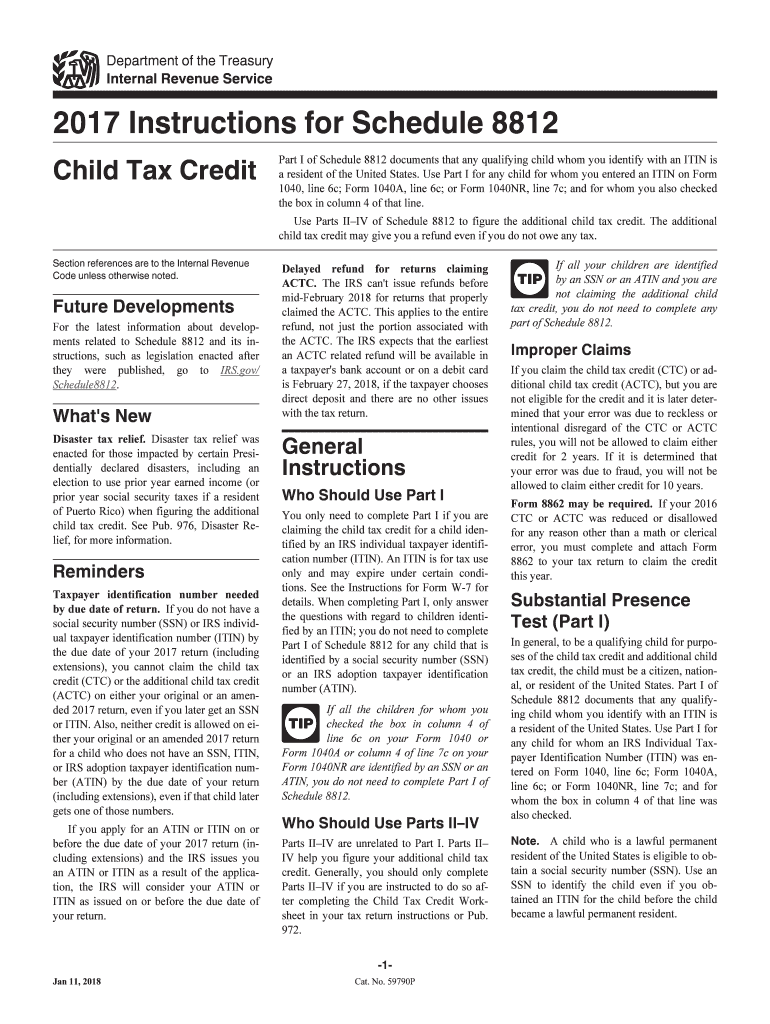

Irs Instructions Form 8812 Fill Out and Sign Printable PDF Template

The ctc and odc are nonrefundable credits. The 2022 schedule 8812 instructions are published as a separate booklet which you. Signnow allows users to edit, sign, fill & share all type of documents online. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents.

Schedule 8812 Instructions Fill Out and Sign Printable PDF Template

Go to www.irs.gov/schedule8812 for instructions and the latest information. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. Many changes to the ctc for 2021 implemented by the.

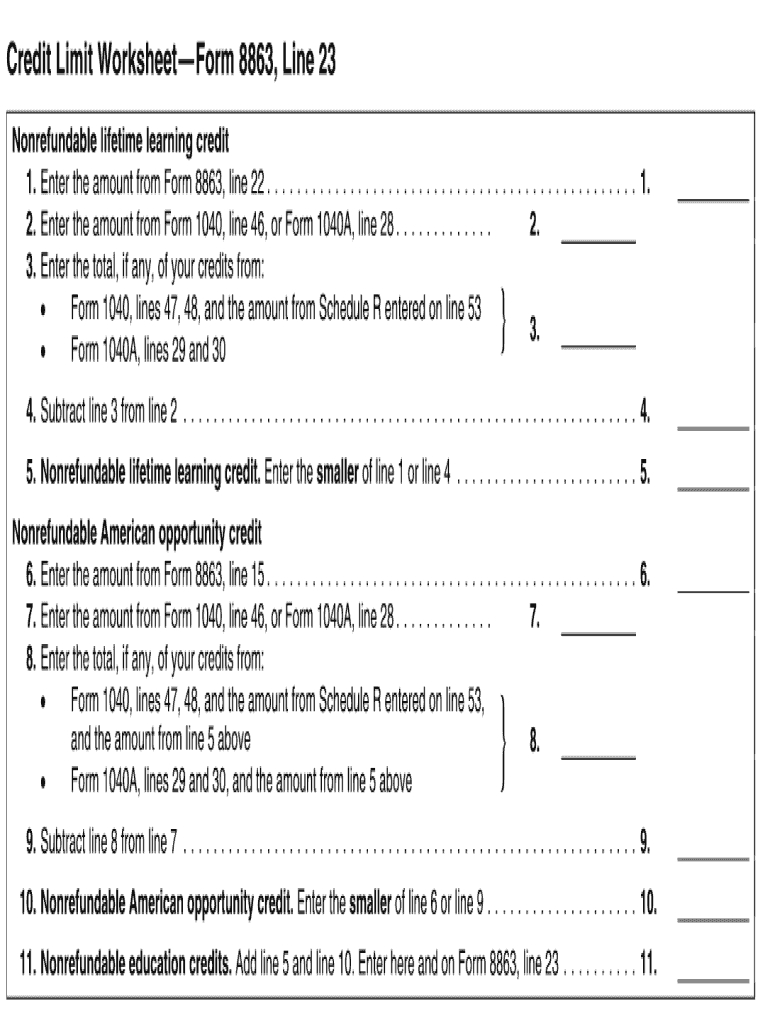

What Is The Credit Limit Worksheet A For Form 8812

Go to www.irs.gov/schedule8812 for instructions and the latest information. Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. The ctc and odc are nonrefundable credits. Web form 1040 schedule 8812, credits for qualifying children and other dependents, asks that you first complete the child tax credit and credit for other dependents worksheet. Try it for free now!

Credit Limit Worksheet 2016 —

Web updated for tax year 2022 • february 9, 2023 01:46 pm. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. The ctc and odc are nonrefundable credits..

Try It For Free Now!

Web 2021 instructions for schedule 8812credits for qualifying children and other dependents. Many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web irs notification of error related to refundable child tax credit, it's about schedule 8812 sheet 5 i received a notification from irs today, to say i owe $1,000 which is due to an error in my form 1040 about refundable child tax credit. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc).

Ad Upload, Modify Or Create Forms.

Signnow allows users to edit, sign, fill & share all type of documents online. See the instructions for form 1040, line 19, or form 1040nr, line 19. The actc is a refundable credit. Get ready for tax season deadlines by completing any required tax forms today.

The Ctc And Odc Are Nonrefundable Credits.

Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional tax owed if you received excess advance child tax credit payments during 2021. Go to www.irs.gov/schedule8812 for instructions and the latest information. Web form 1040 schedule 8812, credits for qualifying children and other dependents, asks that you first complete the child tax credit and credit for other dependents worksheet. The 2022 schedule 8812 instructions are published as a separate booklet which you.

The Ctc And Odc Are Nonrefundable Credits.

Go to www.irs.gov/schedule8812 for instructions and the latest information. If you have children and a low tax bill, you may need irs form 8812 to claim all of your child tax credit. Web updated for tax year 2022 • february 9, 2023 01:46 pm. Look like irs is expecting the highlighted cell to be $1,000, but i'm not sure why,