2021 Form 944

2021 Form 944 - Web q4 2021 form 941 filer eligibility annual 2021 form 944 filer eligibility; Web what information is required to file form 944 online? Web irs released revised draft instructions for employer’s annual federal tax return. Upload, modify or create forms. Web form 944 for 2022: Web we last updated the employer's annual federal tax return in february 2023, so this is the latest version of form 944, fully updated for tax year 2022. Web the following tips can help you complete irs 944 quickly and easily: You can download or print. The form was introduced by the irs to give smaller employers a break in filing and paying federal. Fill in the required fields that are.

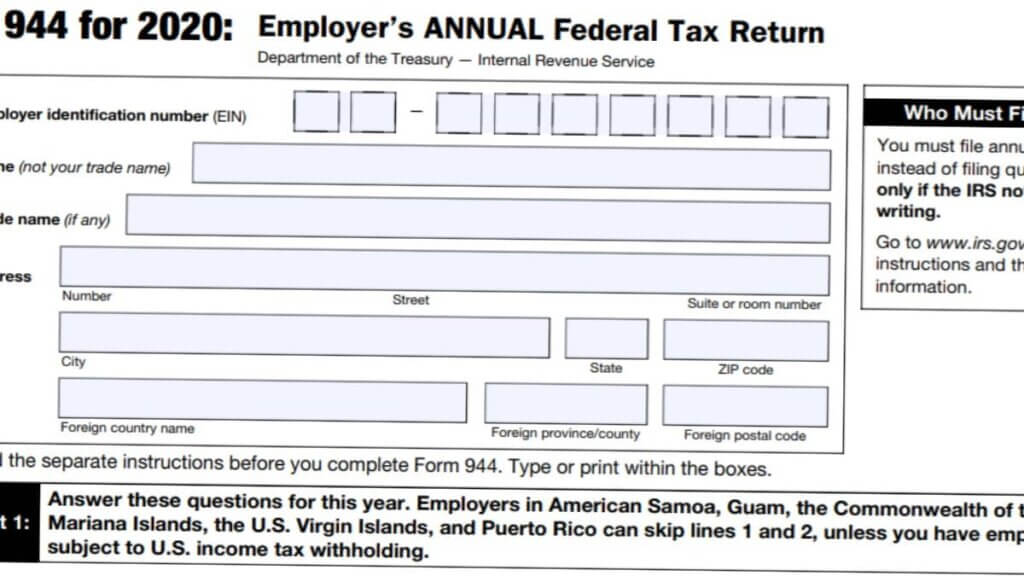

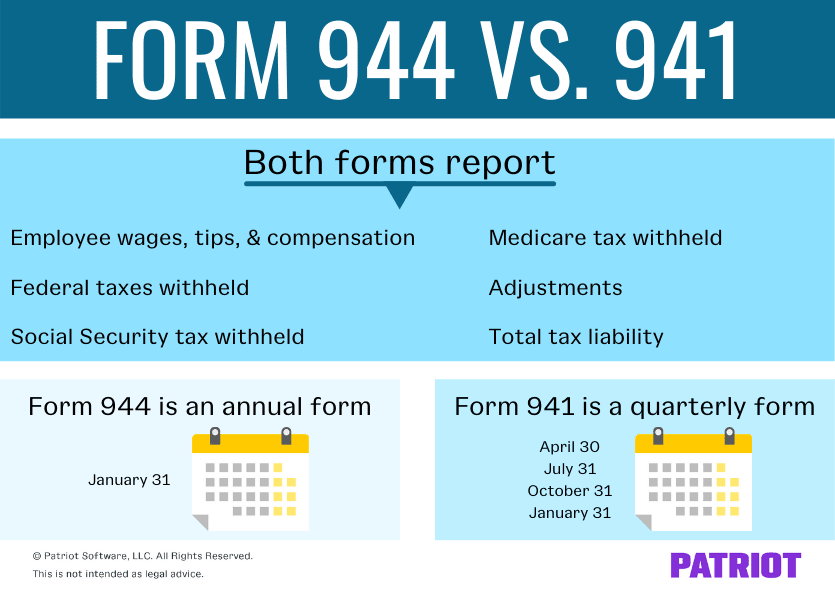

Fill in the required fields that are. Web for 2022, file form 944 by january 31, 2023. Your net taxes for the. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. Web the following tips can help you complete irs 944 quickly and easily: Complete, edit or print tax forms instantly. Upload, modify or create forms. Section 9501 of the nov 02, 2022 cat. Web what information is required to file form 944 online? Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing).

Web the following tips can help you complete irs 944 quickly and easily: Web irs form 944 becomes the mechanism to pay these taxes, taking the place of the irs form 941. However, if you made deposits on time in full payment of the. Web form 944 for 2021: The form was introduced by the irs to give smaller employers a break in filing and paying federal. Register and subscribe now to work on your irs 944 & more fillable forms. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Revised instructions for form 941 and form 944 with revisions pertaining to the rescinded. Section 9501 of the nov 02, 2022 cat. Upload, modify or create forms.

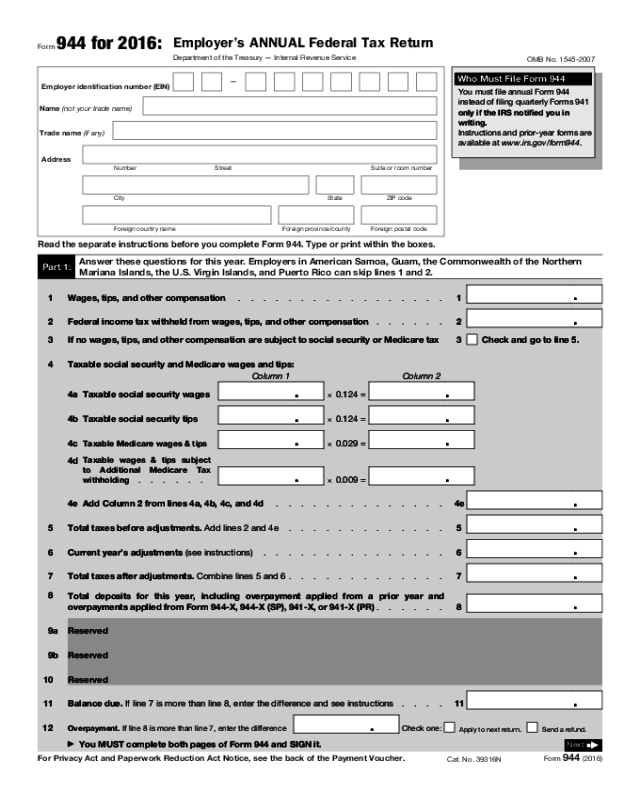

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

You can download or print. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Complete, edit or print tax forms instantly. Section 9501 of the nov 02, 2022 cat. Revised instructions for form 941 and form 944 with revisions pertaining to the rescinded.

Form 944 Demonstration

Register and subscribe now to work on your irs 944 & more fillable forms. Who must file form 944. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. You can download or print. Employer’s annual federal tax return department of the treasury — internal revenue service.

File Form 944 Online EFile 944 Form 944 for 2021

Web we last updated the employer's annual federal tax return in february 2023, so this is the latest version of form 944, fully updated for tax year 2022. However, if you made deposits on time in full payment of the. Web form 944 for 2022: Web form 944 is due by january 31st every year, regardless of the filing method.

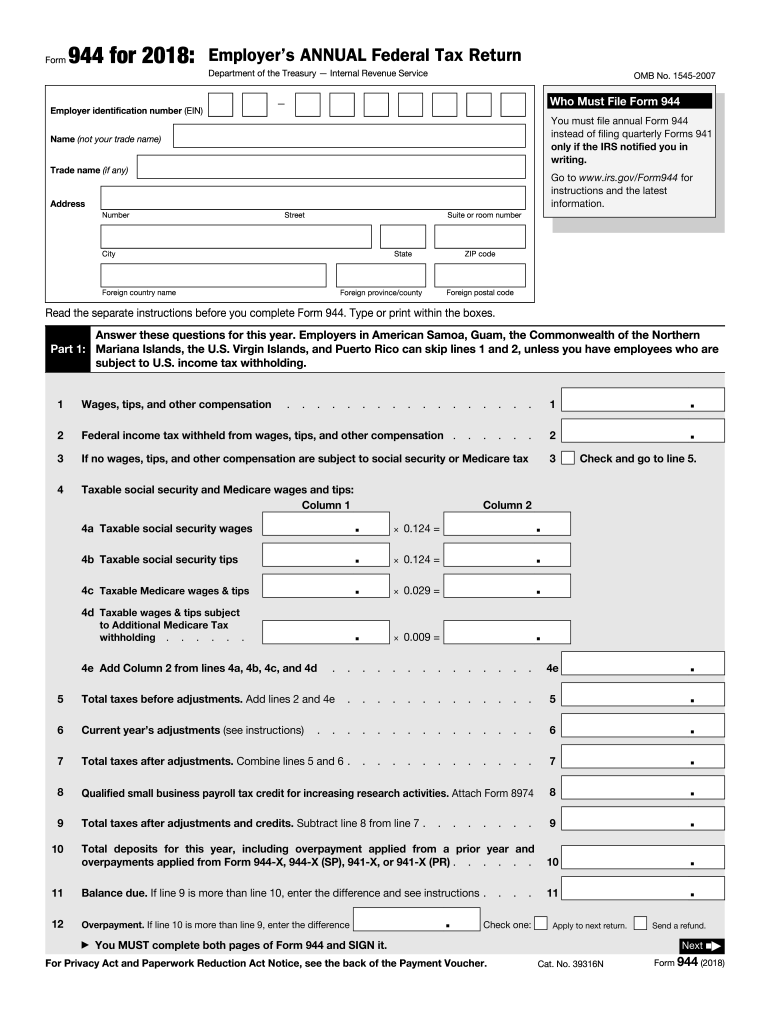

2018 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Complete, edit or print tax forms instantly. Web form 944 for 2022: Web your net taxes for the year (form 944, line 9) are $2,500 or more and you already deposited the taxes you owed for the first, second, and third.

944 d5

Web irs form 944 is the employer's annual federal tax return. Who must file form 944. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. However, if you made deposits on time in full payment of the. The form was introduced by the irs to give smaller employers.

944 Form 2020 2021 IRS Forms Zrivo

Web form 944 (sp) is the spanish version of the form 944. Web irs released revised draft instructions for employer’s annual federal tax return. Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Complete, edit or print tax forms instantly. Web irs form 944 becomes the mechanism to pay these.

Form 944 Edit, Fill, Sign Online Handypdf

Web form 944 for 2022: Try it for free now! Section 9501 of the nov 02, 2022 cat. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Web irs released revised draft instructions for employer’s annual federal tax return.

How To Fill Out Form I944 StepByStep Instructions [2021]

Complete, edit or print tax forms instantly. The new lines are for. Web form 944 for 2022: However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Web irs released revised draft instructions for employer’s annual federal tax return.

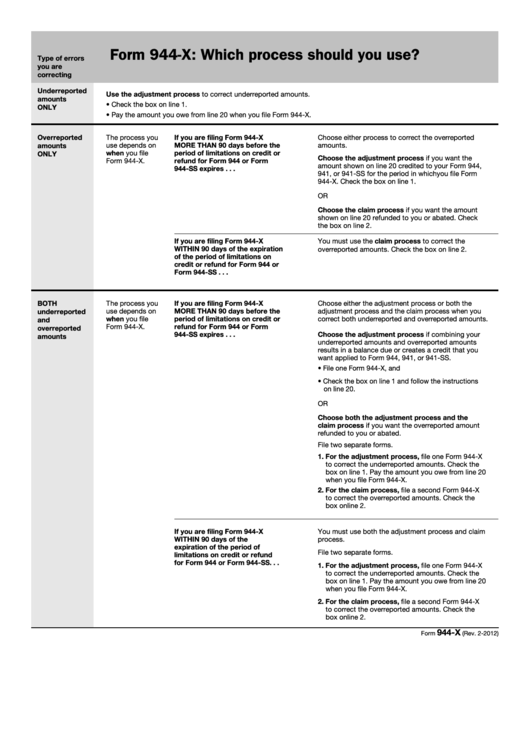

Instructions For Form 944X Adjusted Employer'S Annual Federal Tax

The form was introduced by the irs to give smaller employers a break in filing and paying federal. Who must file form 944. However, if you made deposits on time in full payment of the. Complete, edit or print tax forms instantly. Section 9501 of the nov 02, 2022 cat.

944 Form 2021 2022 IRS Forms Zrivo

However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Web your net taxes for the year (form 944, line 9) are $2,500 or more and you already deposited the taxes you owed for the first, second, and third quarters of 2021; Web a.

31 For The Previous Tax Year — The Return Covering The 2021 Year, Therefore, Would Be Due Jan.

Web april 1, 2021, through periods of coverage beginning on or before september 30, 2021. Web irs form 944 is the employer's annual federal tax return. Try it for free now! Web form 944 (sp) is the spanish version of the form 944.

Section 9501 Of The Nov 02, 2022 Cat.

Complete, edit or print tax forms instantly. Web irs released revised draft instructions for employer’s annual federal tax return. The form was introduced by the irs to give smaller employers a break in filing and paying federal. Web this being said, the deadline to file form 944 is jan.

The New Lines Are For.

Employer’s annual federal tax return department of the treasury — internal revenue service omb no. Upload, modify or create forms. Form 944 additionally includes information on medicare tax that is withheld from. Web the following tips can help you complete irs 944 quickly and easily:

Employer’s Annual Federal Tax Return Department Of The Treasury — Internal Revenue Service.

Who must file form 944. Web we last updated the employer's annual federal tax return in february 2023, so this is the latest version of form 944, fully updated for tax year 2022. However, if you made deposits on time in full payment of the taxes due for the year, you may file the return by february 10, 2023. Web q4 2021 form 941 filer eligibility annual 2021 form 944 filer eligibility;

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)