2021 Form 990 Due Date

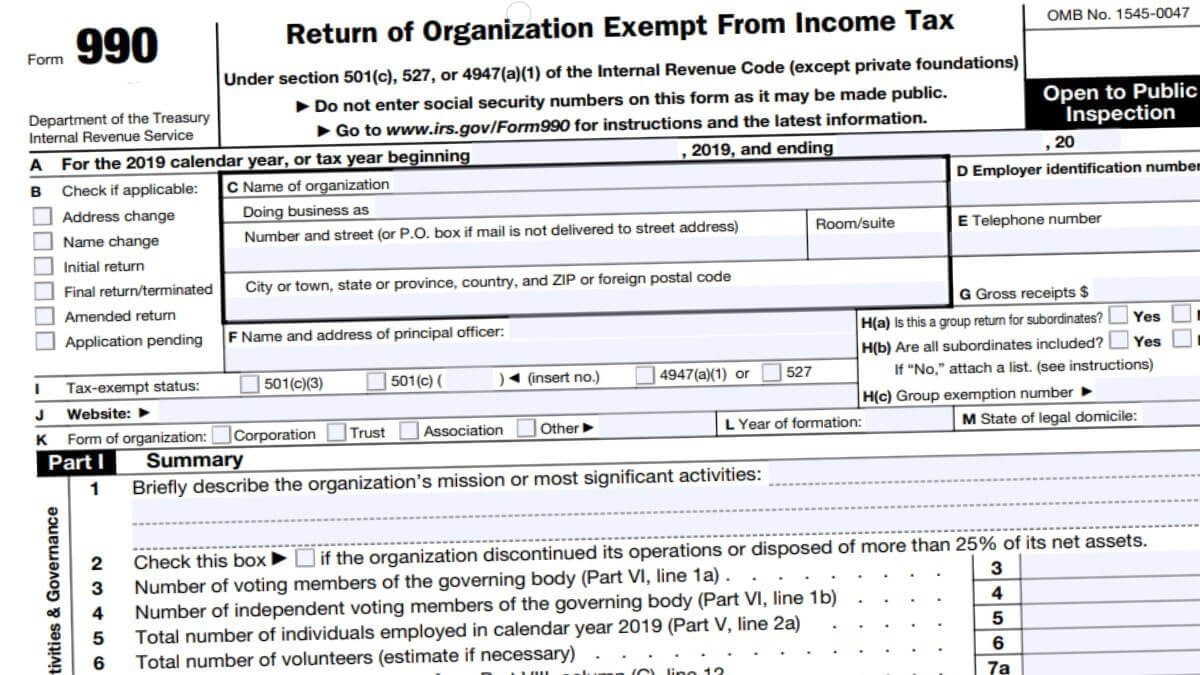

2021 Form 990 Due Date - The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. For organizations on a calendar year, the form 990 is due. For organizations on a calendar year, form 990 is. Web this week marks the august 16, 2021 form 990 deadline for nonprofits whose tax year ended on march 31, 2021. Web form 990 is due on the 15th day of the 5th month following the end of the organization’s taxable year. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. If the organization follows a fiscal tax period (with an ending date other than december 31), the due date is the 15th day of the 5th month following the end of your. Web support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due. For organizations on a calendar. Web may 17, 2021 was a big deadline for the nonprofit sector but your form 990 deadline is always the 15th day of the fifth month following the end of your tax year.

Web upcoming form 990 deadline: Web nonprofit tax returns due date finder. Web irs form 990 and similar forms. To use the table, you must know. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. Web this week marks the august 16, 2021 form 990 deadline for nonprofits whose tax year ended on march 31, 2021. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web form 990 is due on the 15th day of the 5th month following the end of the organization’s taxable year. Web support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due. Six month extension due date:

If the due date falls on a saturday, sunday, or. Web when is form 990 due? Web nonprofit tax returns due date finder. Six month extension due date: Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Form 990 protects transparency in the. Web this week marks the august 16, 2021 form 990 deadline for nonprofits whose tax year ended on march 31, 2021. Ad get ready for tax season deadlines by completing any required tax forms today. Download or email 990 pf & more fillable forms, register and subscribe now! The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal.

what is the extended due date for form 990 Fill Online, Printable

Web form 990 return due date: Web this week marks the august 16, 2021 form 990 deadline for nonprofits whose tax year ended on march 31, 2021. For organizations on a calendar. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021.

What Nonprofits Need to Know About the July 15, 2021 Form 990 Deadline

Web irs form 990 and similar forms. Web when is form 990 due? For organizations on a calendar year, form 990 is. Web support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due. Web may 17, 2021 was a big deadline for the nonprofit sector but your form.

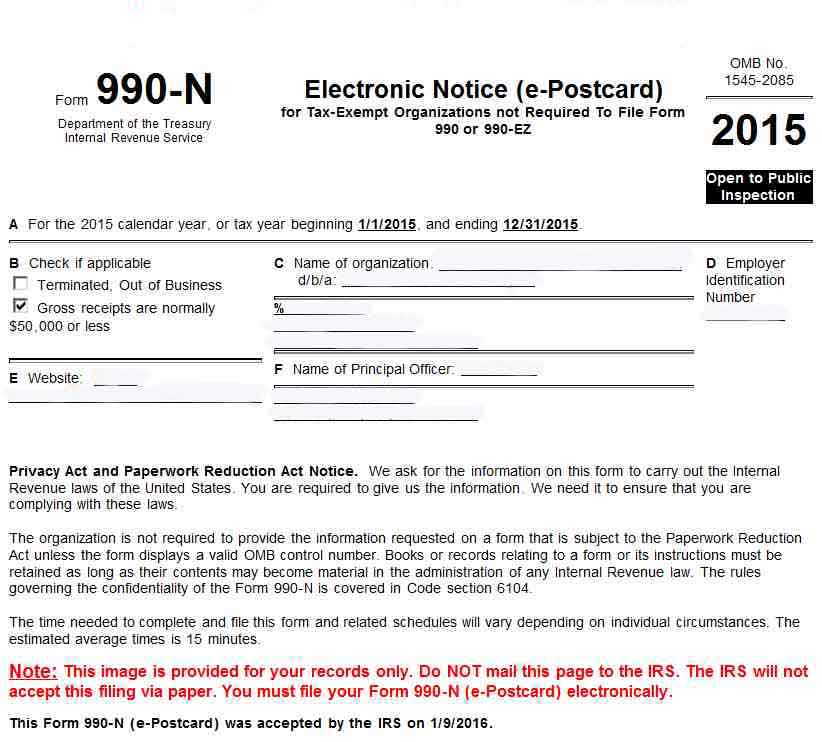

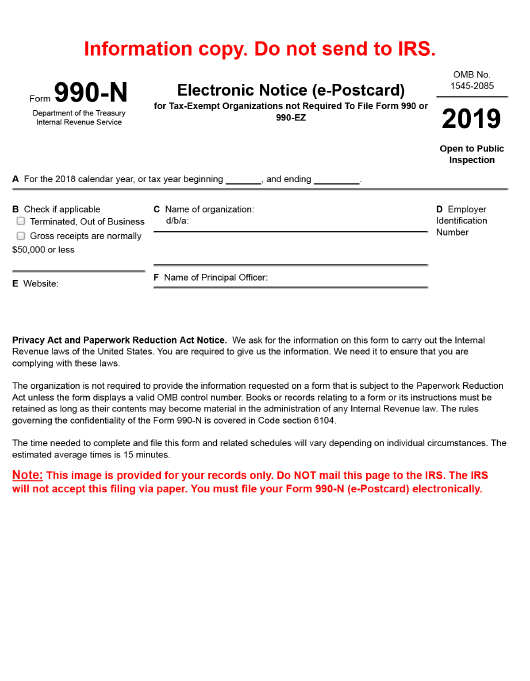

Printable 990 N Form Printable Form 2022

Web the deadline for irs form 990 filing is the 15th day of the fifth month following the end of your fiscal year. Web form 990 is due on the 15th day of the 5th month following the end of the organization’s taxable year. Download or email 990 pf & more fillable forms, register and subscribe now! Web this week.

Printable 990 N Form Printable Form 2022

Six month extension due date: Web upcoming form 990 deadline: Form 990 protects transparency in the. To use the table, you must know. Download or email 990 pf & more fillable forms, register and subscribe now!

990 pf due date 2021 ergaret

Web irs form 990 and similar forms. For organizations on a calendar. If the due date falls on a saturday, sunday, or. To use the tables, you must know. Web may 17, 2021 was a big deadline for the nonprofit sector but your form 990 deadline is always the 15th day of the fifth month following the end of your.

IRS 990EZ 2022 Form Printable Blank PDF Online

This year, may 15 falls on a sunday, giving. Web upcoming form 990 deadline: Web form 990 is due on the 15th day of the 5th month following the end of the organization’s taxable year. Download or email 990 pf & more fillable forms, register and subscribe now! To use the tables, you must know.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

To use the tables, you must know. Web the deadline for irs form 990 filing is the 15th day of the fifth month following the end of your fiscal year. Download or email 990 pf & more fillable forms, register and subscribe now! For organizations on a calendar. Web form 990 return due date:

Form 990 Due Date for Exempt Organizations YouTube

Ad get ready for tax season deadlines by completing any required tax forms today. For organizations on a calendar. If the organization follows a fiscal tax period (with an ending date other than december 31), the due date is the 15th day of the 5th month following the end of your. Web if an organization is unable to complete its.

File Form 990 by June 15, 2021 and Keep Your Organization IRS Compliant!

Web upcoming form 990 deadline: Web when is form 990 due? If the due date falls on a saturday, sunday, or. Web form 990 is due on the 15th day of the 5th month following the end of the organization’s taxable year. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form.

Irs 1040 Form 2021 / What Is IRS Form 8821? IRS Tax Attorney You

For organizations on a calendar year, form 990 is. Web form 990 return due date: Web support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due. Download or email 990 pf & more fillable forms, register and subscribe now! Web nonprofit tax returns due date finder.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web upcoming form 990 deadline: Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to. Web the deadline for irs form 990 filing is the 15th day of the fifth month following the end of your fiscal year. Six month extension due date:

For Organizations On A Calendar.

Web form 990 is due on the 15th day of the 5th month following the end of the organization’s taxable year. For organizations on a calendar year, form 990 is. If the due date falls on a saturday, sunday, or. To use the tables, you must know.

Web Irs Form 990 And Similar Forms.

Web support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due. This year, may 15 falls on a sunday, giving. The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. For organizations on a calendar year, the form 990 is due.

Form 990 Is Due On The 15Th Day Of The 5Th Month Following The End Of The Organization's Taxable Year.

To use the table, you must know. Form 990 protects transparency in the. If the organization follows a fiscal tax period (with an ending date other than december 31), the due date is the 15th day of the 5th month following the end of your. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023.