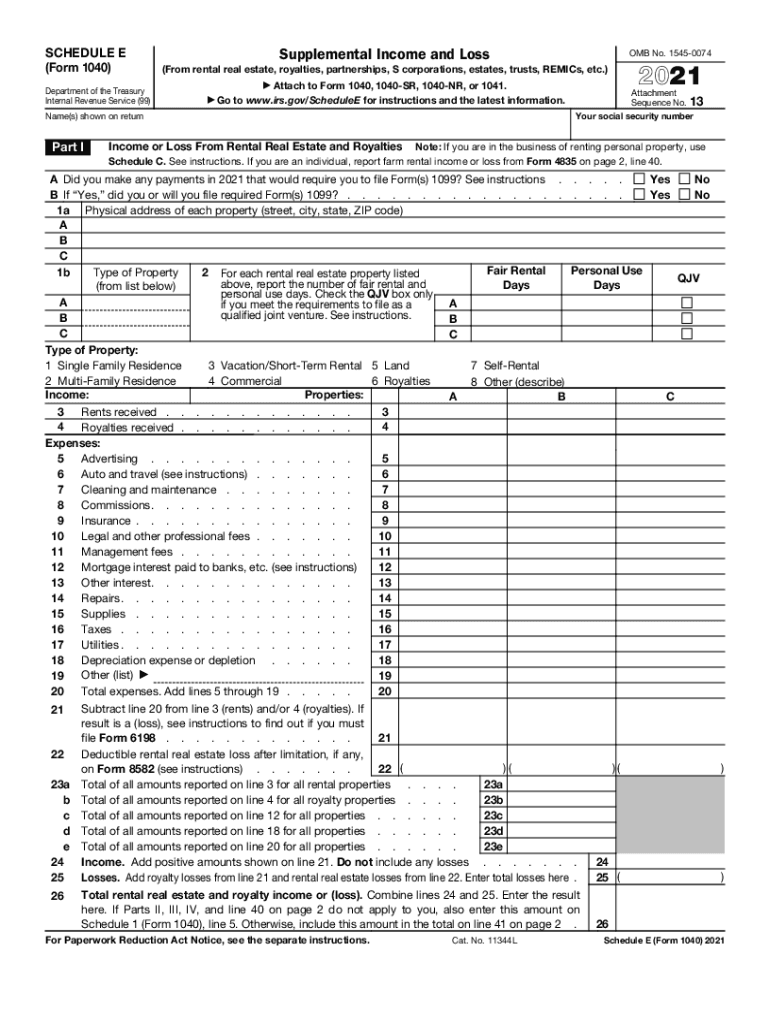

2021 Schedule E Form

2021 Schedule E Form - Interests in partnerships and s. July 29, 2023 5:00 a.m. Upload, modify or create forms. Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. 71397a schedule e (form 5471) (rev. This form is for income earned in tax year 2022, with tax returns. Include photos, crosses, check and text boxes, if it is supposed. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Do not enter name and social security number if shown on other side. Web schedule e is a tax form that you will complete and attach to form 1040.

Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if you earn rental income on a home or building you own, receive royalties or have income reported. If you are a real estate investor or. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Do not enter name and social security number if shown on other side. Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Interests in partnerships and s. 71397a schedule e (form 5471) (rev. Upload, modify or create forms. Upload, modify or create forms.

Find tax calculators and tax forms for all. July 29, 2023 5:00 a.m. Web federal supplemental income and loss 1040 (schedule e) pdf form content report error it appears you don't have a pdf plugin for this browser. Please use the link below. Web schedule e (form 1040) 2022: Web we last updated federal 1040 (schedule e) in december 2022 from the federal internal revenue service. Try it for free now! Web march 02, 2023 what is the irs schedule e: This form is for income earned in tax year 2022, with tax returns. Upload, modify or create forms.

941 schedule b 2021 Fill Online, Printable, Fillable Blank form941

Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Web schedule e(form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. This form is for income earned in tax year 2022, with tax returns. Try it.

CA FTB Schedule CA (540) 20202022 Fill out Tax Template Online US

Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Web schedule e (form 1040) department of the treasury internal revenue service.

2020 2021 Schedule B Interest And Ordinary Dividends 1040 Form

Upload, modify or create forms. Web schedule e(form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. August social security checks are getting disbursed this week for recipients who've. You will use part i of schedule e to report rental and royalty income and part ii of. Try it.

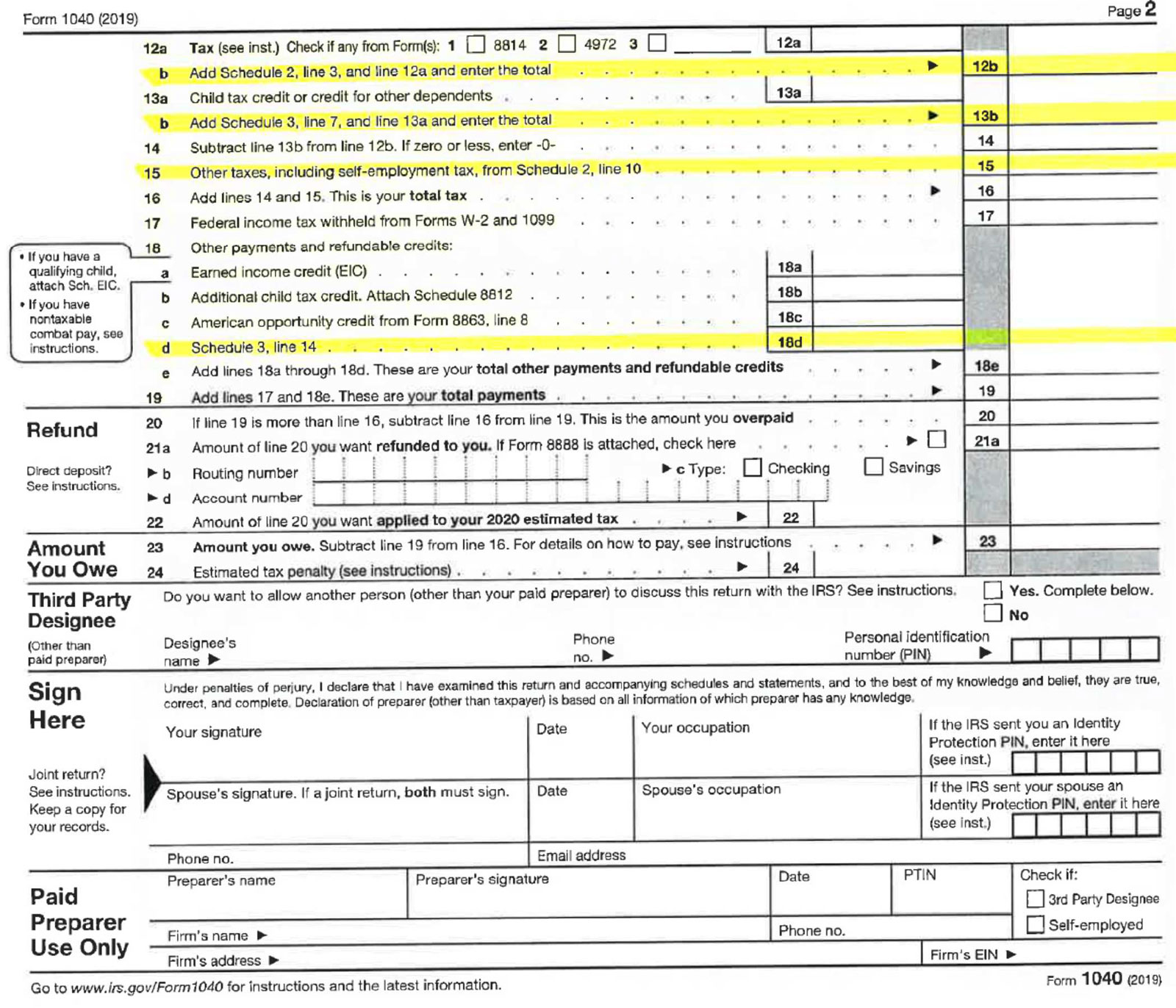

2020 2021 Form 1040 Individual Tax Return 1040 Form

Web open the file in our advanced pdf editor. Complete, edit or print tax forms instantly. Schedule e is used to. 71397a schedule e (form 5471) (rev. Please use the link below.

2021 schedule for website CAGS

This form is for income earned in tax year 2022, with tax returns. Please use the link below. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Try it for free now! Upload, modify or create forms.

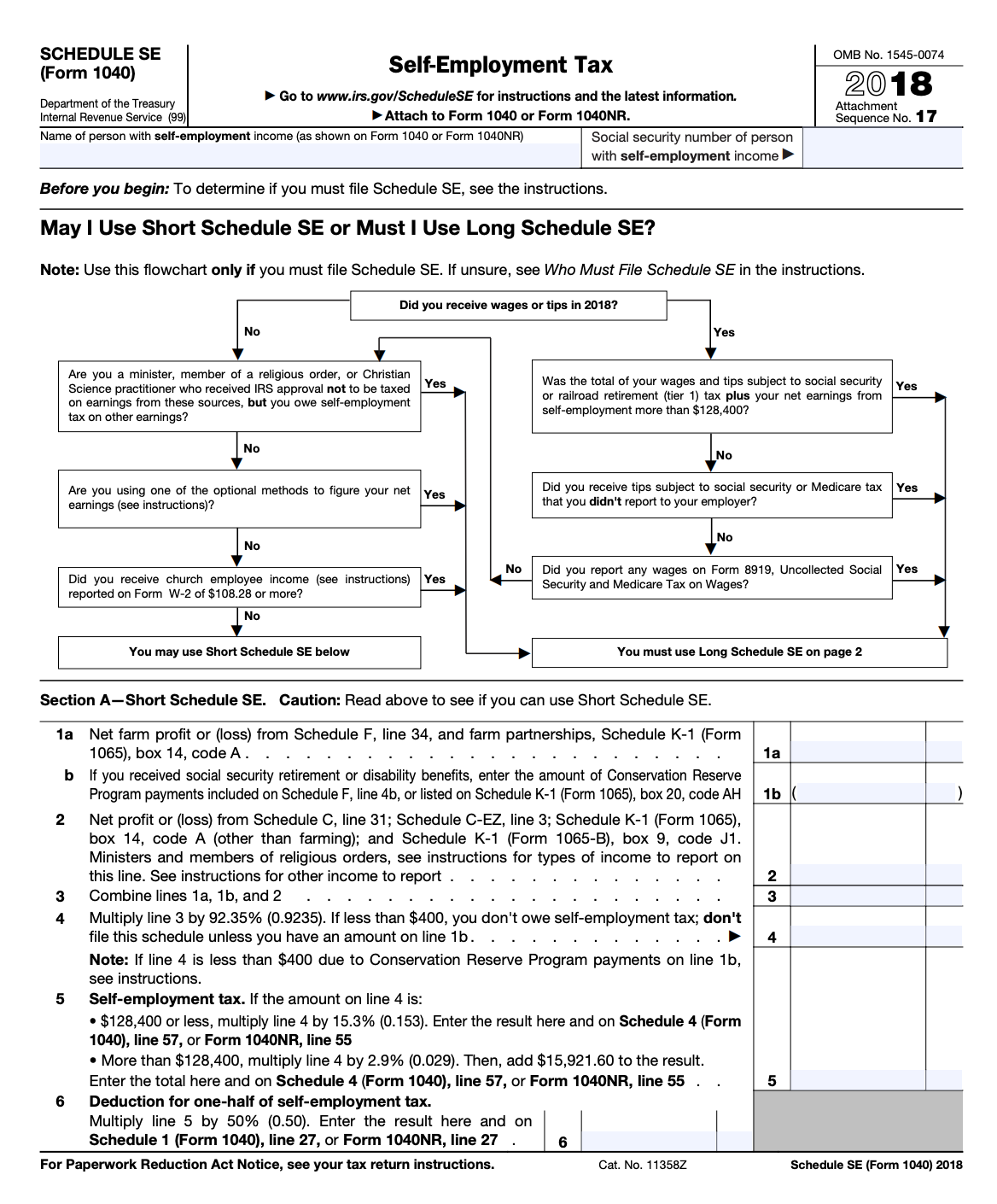

Schedule SE A Simple Guide to Filing the SelfEmployment Tax Form

Web schools schedule e (form 990) schools omb no. Find tax calculators and tax forms for all. Web schedule e (form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. Do not enter name and social security number if shown on other side. Web use schedule e (form 1040).

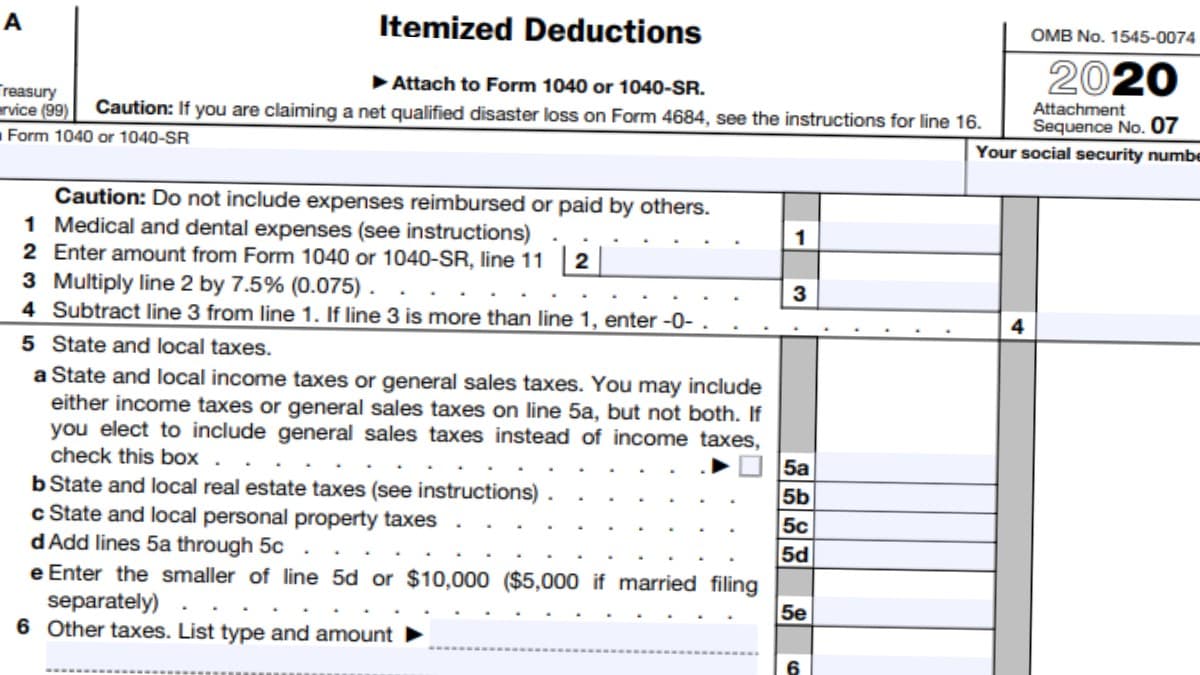

Do you need to submit a schedule 1, 2, and 3 along with your 1040 Tax

Web schedule e(form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. Web information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on how to file. Web march 02, 2023 what is the irs schedule e: Try it for free now!.

2020 2021 form 1040 schedule e Fill Online, Printable, Fillable

Web open the file in our advanced pdf editor. Schedule e is used to. 71397a schedule e (form 5471) (rev. Web schedule e (form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. Please use the link below.

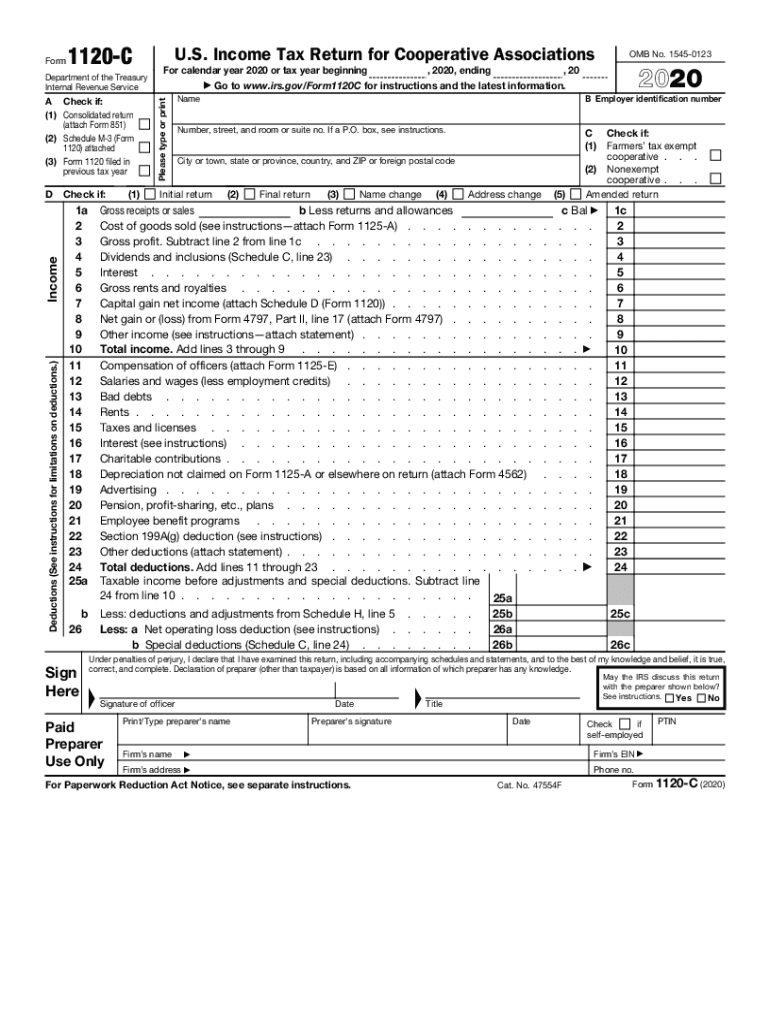

2020 Form IRS 1120C Fill Online, Printable, Fillable, Blank pdfFiller

July 29, 2023 5:00 a.m. Web federal supplemental income and loss 1040 (schedule e) pdf form content report error it appears you don't have a pdf plugin for this browser. Schedule e is used to. August social security checks are getting disbursed this week for recipients who've. Web use schedule e (form 1040) to report income or loss from rental.

2021 Form IRS 1040 Schedule E Fill Online, Printable, Fillable, Blank

Upload, modify or create forms. 71397a schedule e (form 5471) (rev. July 29, 2023 5:00 a.m. Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Interests in partnerships and s.

Upload, Modify Or Create Forms.

Complete, edit or print tax forms instantly. July 29, 2023 5:00 a.m. Web updated for tax year 2022 • june 2, 2023 08:40 am overview if you earn rental income on a home or building you own, receive royalties or have income reported. You will use part i of schedule e to report rental and royalty income and part ii of.

Try It For Free Now!

71397a schedule e (form 5471) (rev. Web schedule e(form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s. This form is for income earned in tax year 2022, with tax returns. Web schedule e (form 1040) department of the treasury internal revenue service (99) supplemental income and loss (from rental real estate, royalties, partnerships, s.

Upload, Modify Or Create Forms.

Include photos, crosses, check and text boxes, if it is supposed. Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Schedule e is used to. August social security checks are getting disbursed this week for recipients who've.

Try It For Free Now!

Web use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Complete, edit or print tax forms instantly. If you are a real estate investor or. Irs form 1040 schedule e (2021) is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual.