2022 Form 2106

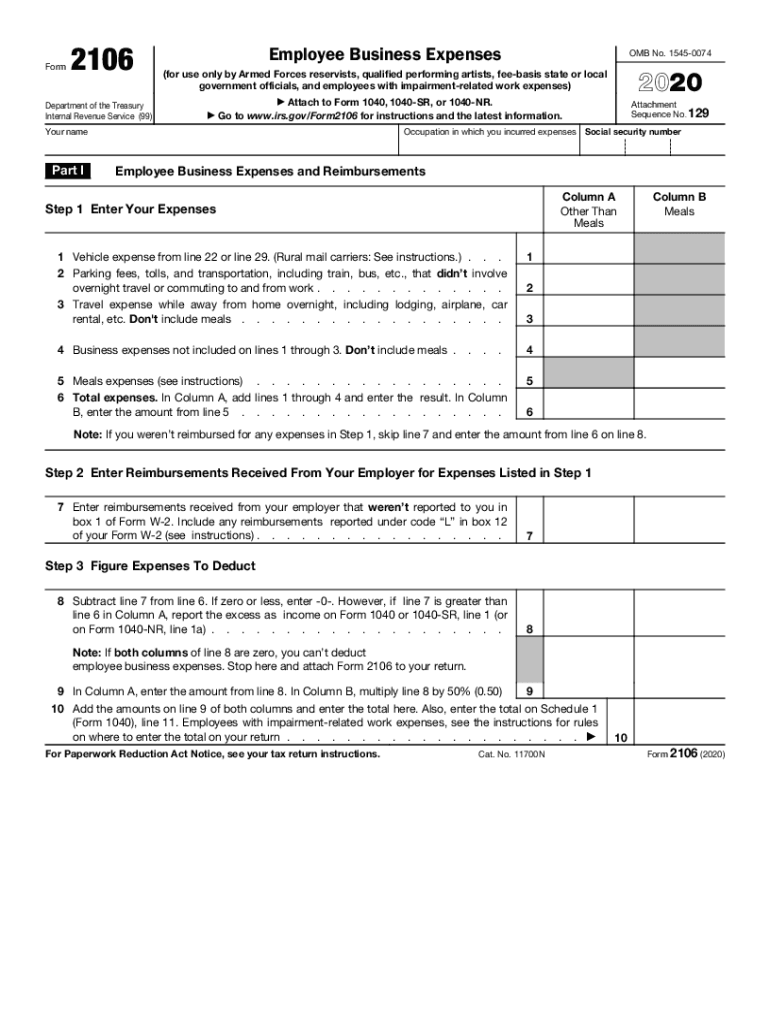

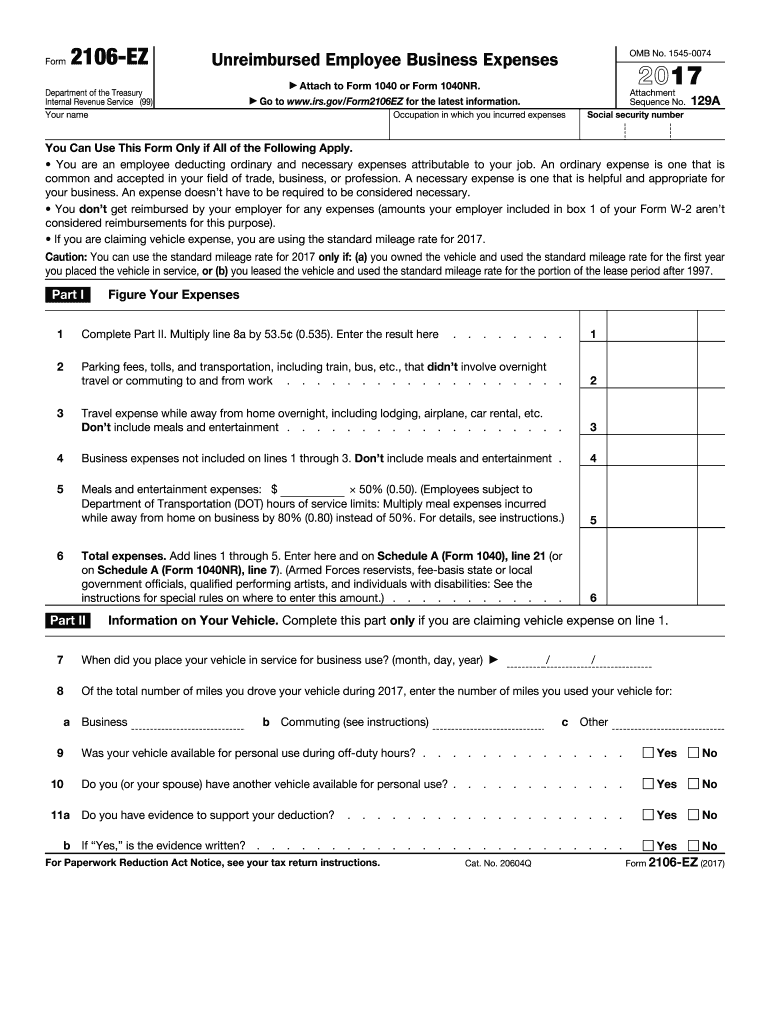

2022 Form 2106 - Web form 2106 is the form used to claim allowed business expenses such as miles, meals, and other allowed expenses. Employees file this form to deduct. Web federal — unreimbursed employee business expenses download this form print this form it appears you don't have a pdf plugin for this browser. Please use the link below. Ad complete irs tax forms online or print government tax documents. Web complete form 2106 ez 2023 in minutes, not hours. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • december 1, 2022 09:45 am overview. Web updated for tax year 2017 • december 1, 2022 09:21 am. What's new standard mileage rate. Web to report more than two vehicles on form 2106 (you can enter up to four vehicles per form;

Web complete form 2106 ez 2023 in minutes, not hours. Web form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Get ready for tax season deadlines by completing any required tax forms today. Web what is the irs form 2106? You can deduct the cost of meals if it is necessary for you to stop for substantial sleep or rest to properly perform your duties while traveling away from home on. What's new standard mileage rate. To enter the per diem. Web updated for tax year 2017 • december 1, 2022 09:21 am. Per diem rates would be entered on schedule c (form 1040), lines 24a and 24b, for travel and meal expenses. Only certain taxpayers are currently allowed.

You can deduct the cost of meals if it is necessary for you to stop for substantial sleep or rest to properly perform your duties while traveling away from home on. Web form 2106 is an irs document that is used to itemize and tally “ordinary and necessary” business expenses that aren’t reimbursed by your employer. From within your form 2106, continue with. Per diem rates would be entered on schedule c (form 1040), lines 24a and 24b, for travel and meal expenses. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. Employees file this form to deduct. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • december 1, 2022 09:45 am overview. What's new standard mileage rate. Web what is the irs form 2106? Taxact will use the higher.

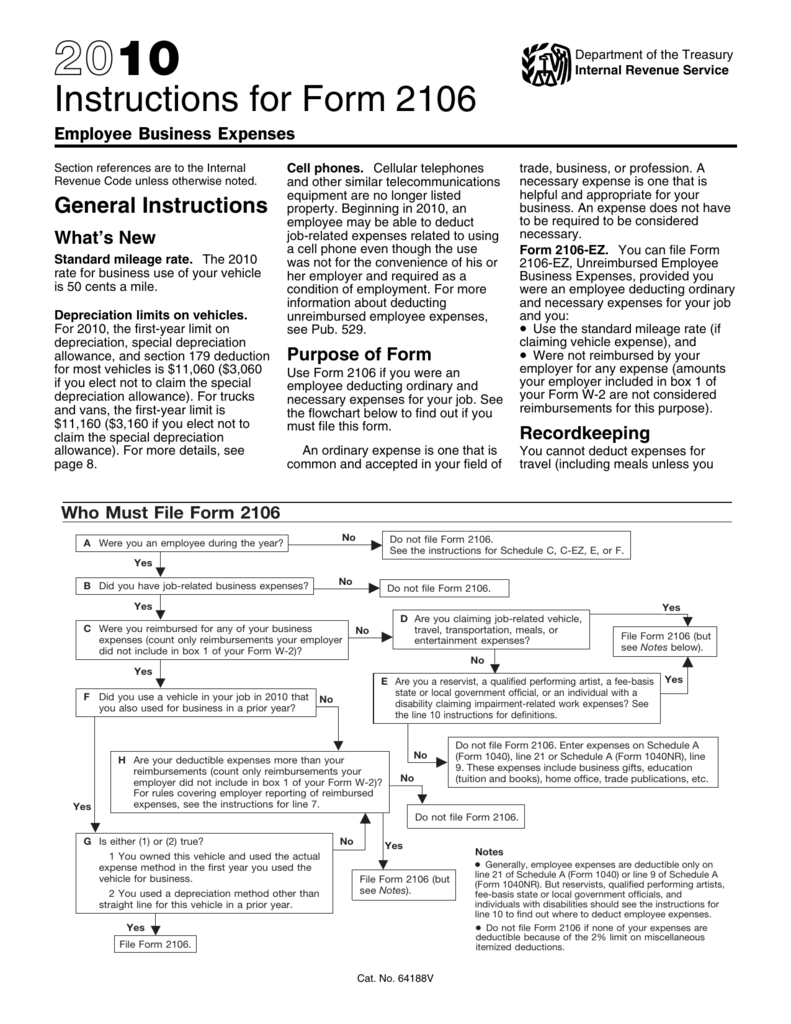

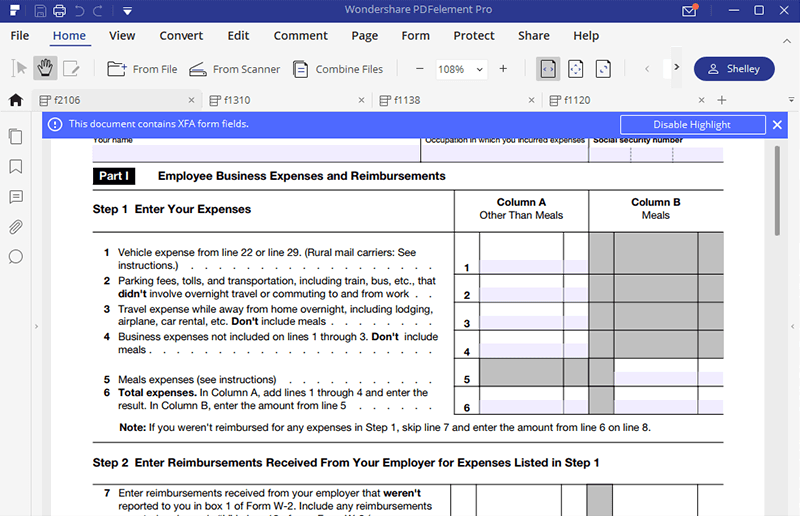

Ssurvivor Form 2106 Instructions Line 6

Web form 2106 is an irs document that is used to itemize and tally “ordinary and necessary” business expenses that aren’t reimbursed by your employer. Ad complete irs tax forms online or print government tax documents. Web form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Per diem rates would be entered on.

Form 2106 Employee Business Expenses Fill Out and Sign Printable PDF

Ad complete irs tax forms online or print government tax documents. You can deduct the cost of meals if it is necessary for you to stop for substantial sleep or rest to properly perform your duties while traveling away from home on. Save your time needed to printing, signing, and scanning a paper copy of form 2106 ez 2023. Employees.

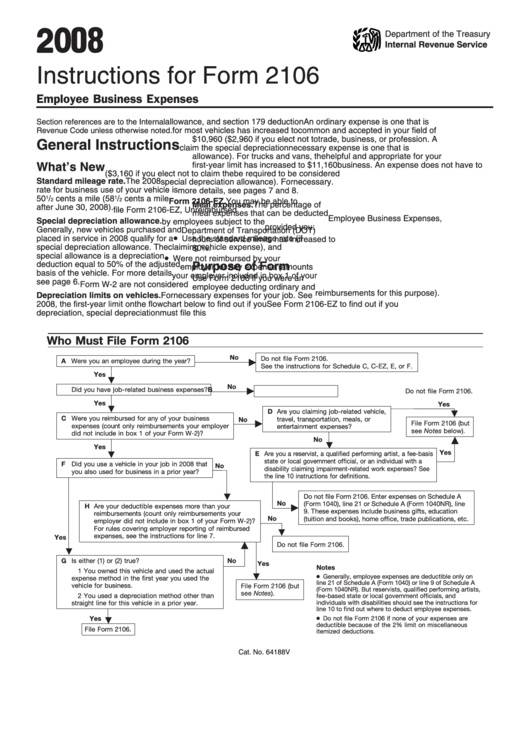

Instructions For Form 2106 Employee Business Expenses 2008

Web form 2106 is an irs document that is used to itemize and tally “ordinary and necessary” business expenses that aren’t reimbursed by your employer. What's new standard mileage rate. From within your form 2106, continue with. Web prior to 2018, an employee could deduct unreimbursed job expenses to the extent these expenses, along with certain other miscellaneous expenses, were.

Irs Form 2106 Tax Year 2021 essentially.cyou 2022

Ad complete irs tax forms online or print government tax documents. Web prior to 2018, an employee could deduct unreimbursed job expenses to the extent these expenses, along with certain other miscellaneous expenses, were more than 2% of their. Web form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Web information about form.

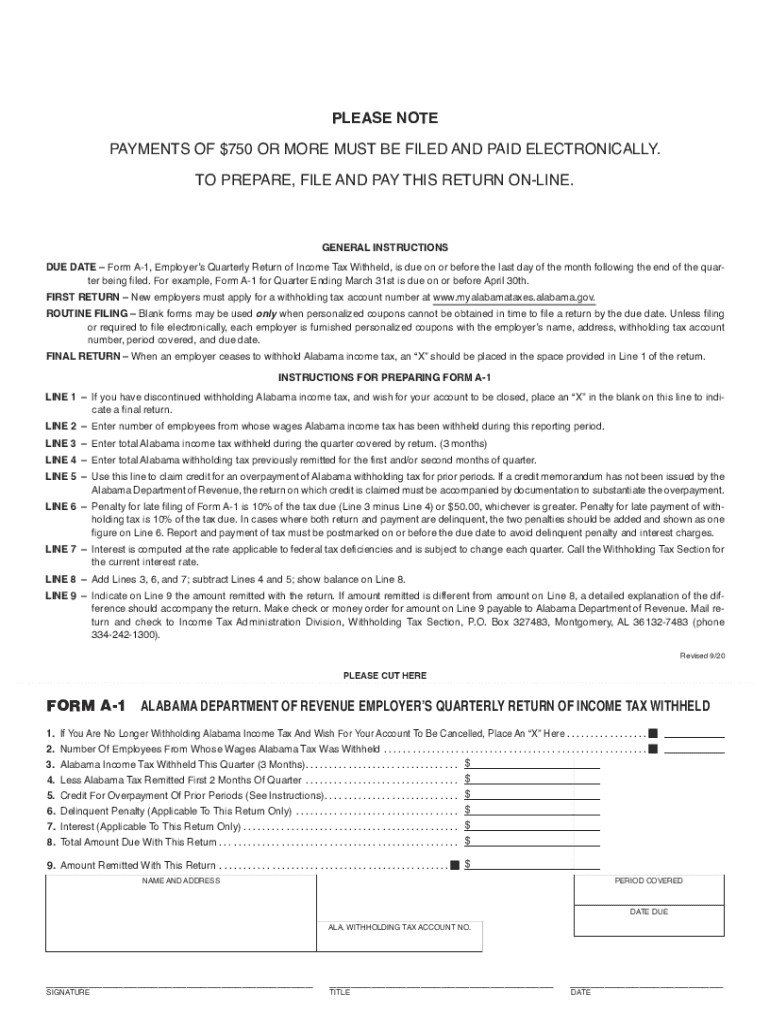

20202023 Form AL A1 Fill Online, Printable, Fillable, Blank pdfFiller

Each spouse can file a separate form 2106). Web complete form 2106 ez 2023 in minutes, not hours. Web federal — unreimbursed employee business expenses download this form print this form it appears you don't have a pdf plugin for this browser. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to.

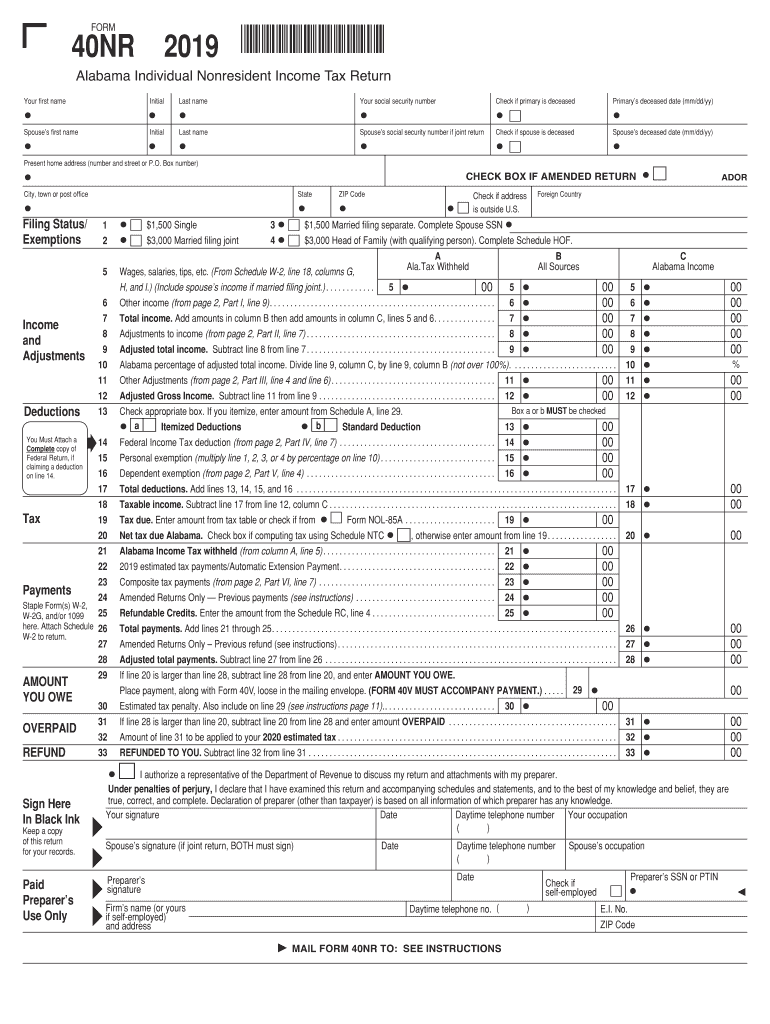

AL DoR 40NR 2019 Fill out Tax Template Online US Legal Forms

Web complete form 2106 ez 2023 in minutes, not hours. Web form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Per diem rates would be entered on schedule c (form 1040), lines 24a and 24b, for travel and meal expenses. Please use the link below. Web updated for tax year 2017 • december.

Form 2106 Instructions & Information on IRS Form 2106

Employees file this form to deduct. Taxact will use the higher. Web complete form 2106 ez 2023 in minutes, not hours. Per diem rates would be entered on schedule c (form 1040), lines 24a and 24b, for travel and meal expenses. Web form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106.

Breanna Form 2106 Employee Business Expenses

Ad complete irs tax forms online or print government tax documents. To enter the per diem. Web form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Web updated for tax year 2017 • december 1, 2022 09:21 am. Per diem rates would be entered on schedule c (form 1040), lines 24a and 24b,.

IRS Form 2106 Employee Business Expenses Instructions & How to File

You can deduct the cost of meals if it is necessary for you to stop for substantial sleep or rest to properly perform your duties while traveling away from home on. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • december 1, 2022 09:45 am overview. To enter the per diem. Ad.

Irs Form 2106 Fill Out and Sign Printable PDF Template signNow

Web form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Web complete form 2106 ez 2023 in minutes, not hours. You can deduct the cost of meals if it is necessary for you to stop for substantial sleep or rest to properly perform your duties while traveling away from home on. To enter.

From Within Your Form 2106, Continue With.

Each spouse can file a separate form 2106). Web form 2106 is an irs document that is used to itemize and tally “ordinary and necessary” business expenses that aren’t reimbursed by your employer. Web publication 463 explains what expenses are deductible, how to report them on your return, what records you need to prove your expenses, and how to treat any. Web complete form 2106 ez 2023 in minutes, not hours.

Employees File This Form To Deduct.

Web prior to 2018, an employee could deduct unreimbursed job expenses to the extent these expenses, along with certain other miscellaneous expenses, were more than 2% of their. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • december 1, 2022 09:45 am overview. Please use the link below. Get ready for tax season deadlines by completing any required tax forms today.

Web Federal — Unreimbursed Employee Business Expenses Download This Form Print This Form It Appears You Don't Have A Pdf Plugin For This Browser.

Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. Only certain taxpayers are currently allowed. Save your time needed to printing, signing, and scanning a paper copy of form 2106 ez 2023. Taxact will use the higher.

Web Updated For Tax Year 2017 • December 1, 2022 09:21 Am.

Ad complete irs tax forms online or print government tax documents. Web form 2106 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2106. Per diem rates would be entered on schedule c (form 1040), lines 24a and 24b, for travel and meal expenses. Web form 2106 is the form used to claim allowed business expenses such as miles, meals, and other allowed expenses.