2022 Form 3522

2022 Form 3522 - However, you are not required to provide information requested unless a valid omb control number is. Web form 3522 california — limited liability company tax voucher download this form print this form it appears you don't have a pdf plugin for this browser. Web what is form 3522? An llc should use this. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Web we last updated the limited liability company tax voucher in january 2023, so this is the latest version of form 3522, fully updated for tax year 2022. Pdffiller allows users to edit, sign, fill & share all type of documents online. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 34 votes how to fill out and sign 2023 ftb 3522 online? Use get form or simply click on the template preview to open it in the editor.

Web i filled out the california form 3522 and requested electronic payment of the $800 annual fee on april 15, 2022/ the client letter indicates that this is an estimated. Web you need to submit form 3522 with the california ftb yearly, but you can also do it any time before the june 30 due date. However, you are not required to provide information requested unless a valid omb control number is. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. The 15th day of 3rd month after end of their tax year if the due date. An llc should use this. An llc should use this. Use get form or simply click on the template preview to open it in the editor. The form can be suppressed when printing extensions by. March 15, 2023 fiscal tax year:

An llc should use this voucher if any of the following. Web we last updated the limited liability company tax voucher in january 2023, so this is the latest version of form 3522, fully updated for tax year 2022. The form can be suppressed when printing extensions by. However, you are not required to provide information requested unless a valid omb control number is. An llc should use this. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Ad download or email 3522 & more fillable forms, register and subscribe now! Finding a authorized specialist, creating a scheduled visit and coming to the workplace for a personal conference makes finishing a ca ftb. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800.

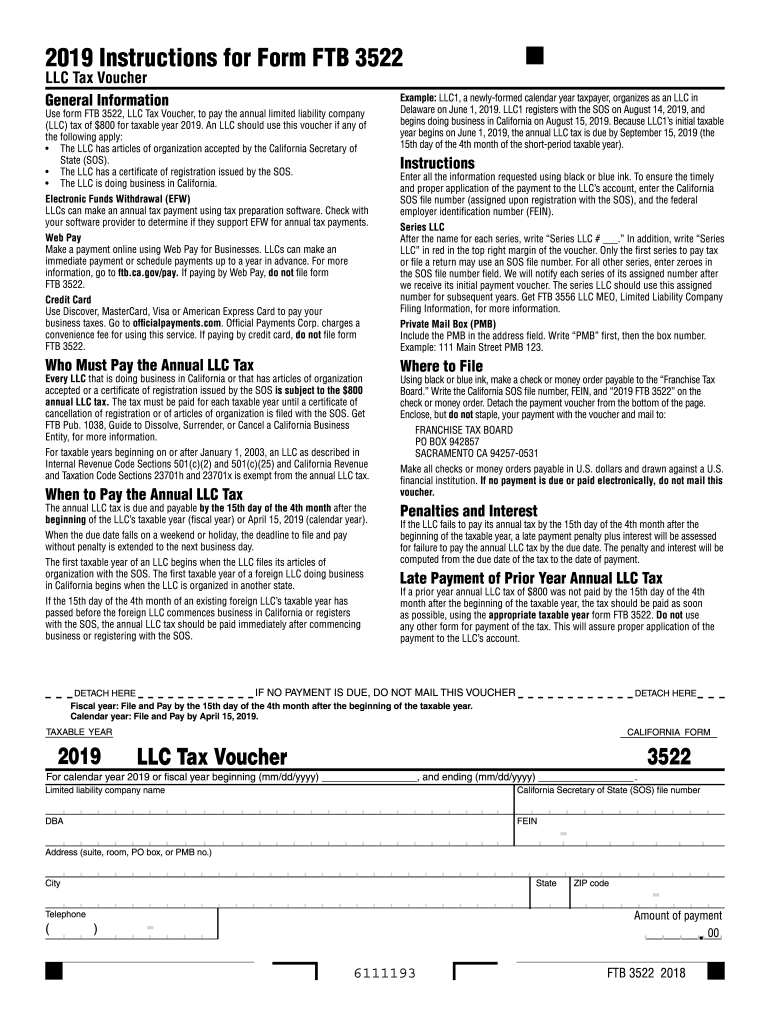

Printable form 3522 2019 voucher form Fill out & sign online DocHub

Web follow the simple instructions below: Web form 3522 california — limited liability company tax voucher download this form print this form it appears you don't have a pdf plugin for this browser. Web we estimate it will take you about 55 minutes to complete this form. Web general information use form ftb 3522, llc tax voucher, to pay the.

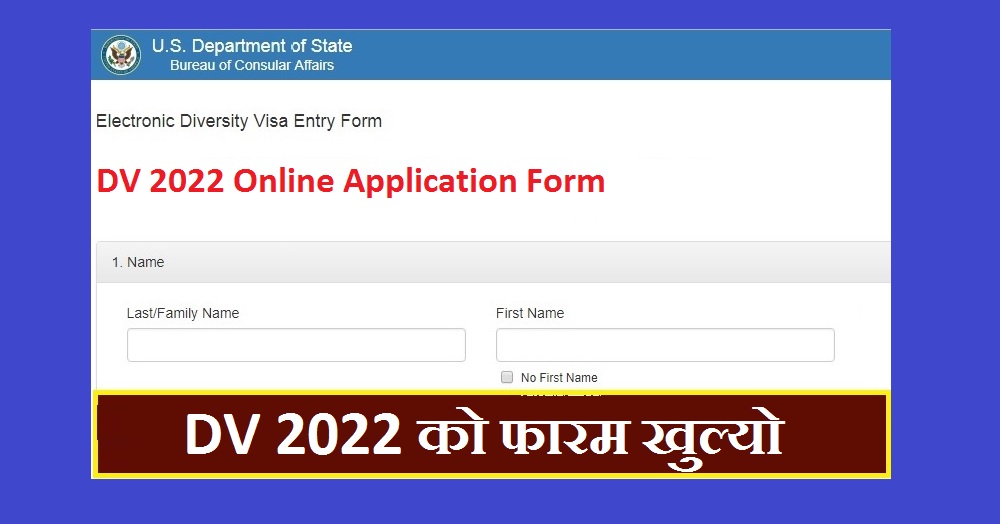

DV 2022 Online Application Form; EDV 2022 Form gbsnote

Use get form or simply click on the template preview to open it in the editor. Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 34 votes how to fill out and sign 2023 ftb 3522 online? Web what is form 3522? Web general information use.

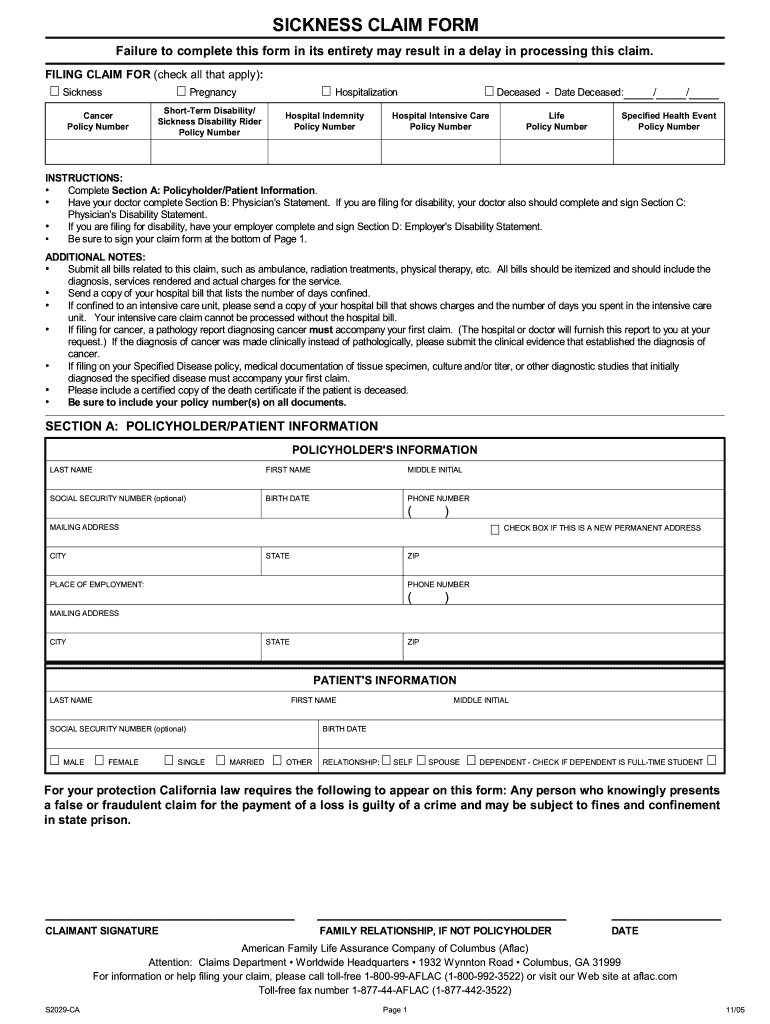

Aflac form s2029 ca 2005 Fill out & sign online DocHub

Pdffiller allows users to edit, sign, fill & share all type of documents online. Web i filled out the california form 3522 and requested electronic payment of the $800 annual fee on april 15, 2022/ the client letter indicates that this is an estimated. However, you are not required to provide information requested unless a valid omb control number is..

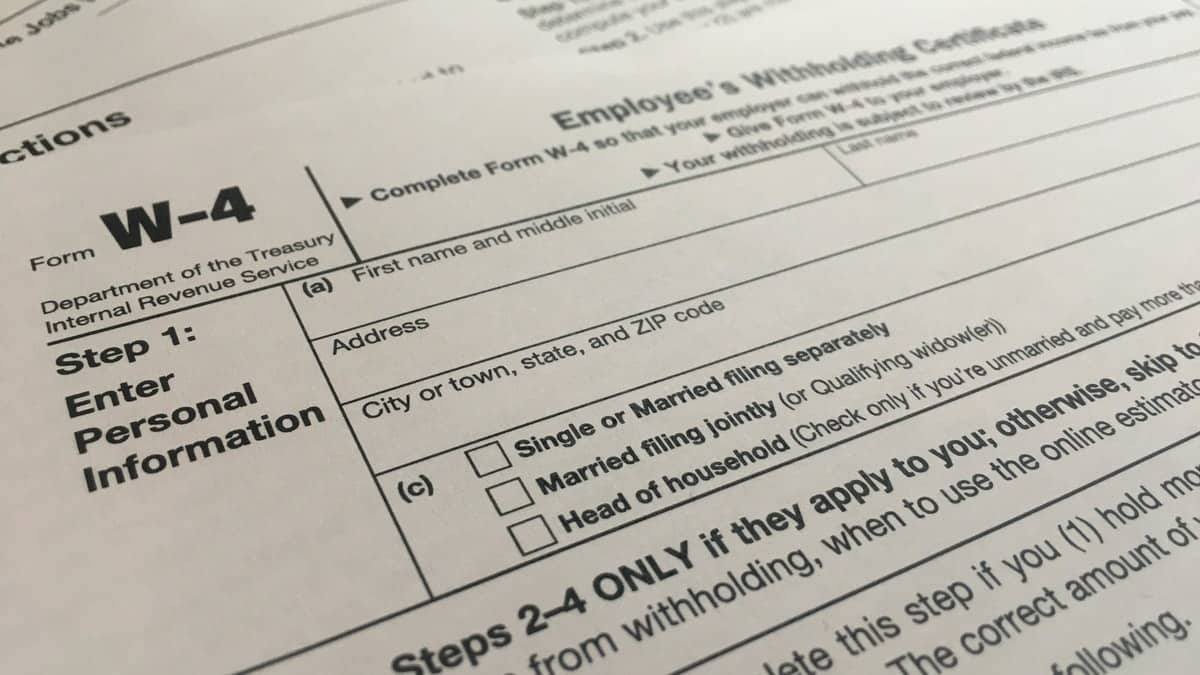

W4 Form 2023 Instructions

The 15th day of 3rd month after end of their tax year if the due date. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. For calendar year 2022, or tax year beginning , 2022, ending , 20. Web form 3522 can be printed with the.

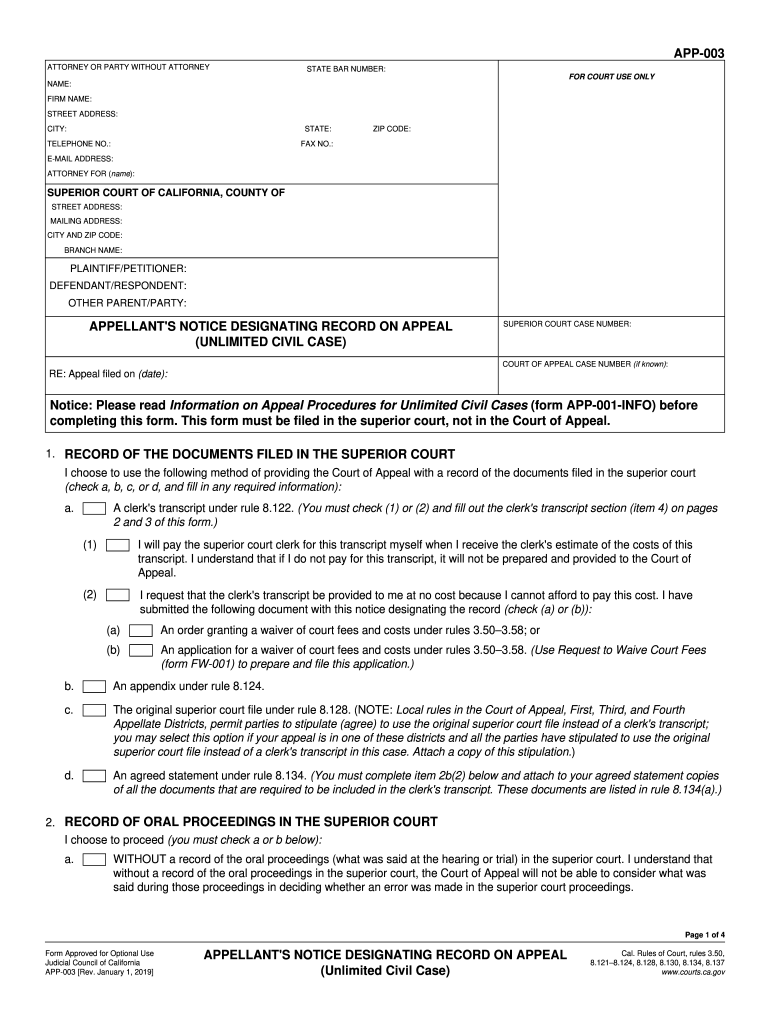

App 003 Fill Out and Sign Printable PDF Template signNow

An llc should use this voucher if any of the following. An llc should use this. Get your online template and fill it in using. The 15th day of 3rd month after end of their tax year if the due date. All llcs in the state are required to pay this annual tax to stay compliant and in.

W4 Form 2022 Fillable PDF

Ad download or email 3522 & more fillable forms, register and subscribe now! Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021. However, you are not required to provide information requested unless a valid omb control number is. March 15, 2023 fiscal tax year:.

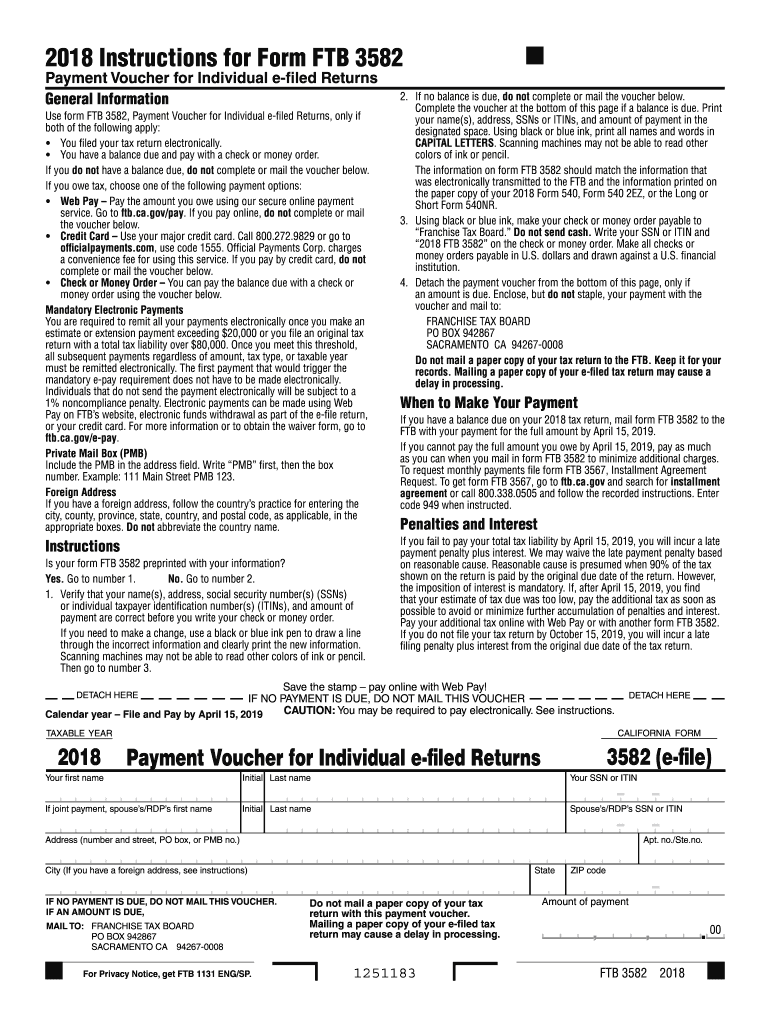

Form 3582 Fill Out and Sign Printable PDF Template signNow

Get your online template and fill it in using. An llc should use this voucher if any of the following. Web i filled out the california form 3522 and requested electronic payment of the $800 annual fee on april 15, 2022/ the client letter indicates that this is an estimated. Web form 3522 california — limited liability company tax voucher.

Ftb 3522 Fill Out and Sign Printable PDF Template signNow

Web we estimate it will take you about 55 minutes to complete this form. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. The 15th day of 3rd month after end of their tax year if the due date. Web follow the simple instructions below: Web.

Form 3522 Fill out & sign online DocHub

Finding a authorized specialist, creating a scheduled visit and coming to the workplace for a personal conference makes finishing a ca ftb. An llc should use this voucher if any of the following. Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021. Web what.

W2 Form 2022 Instructions W2 Forms TaxUni

Web what is form 3522? An llc should use this. Web for example, an s corporation's 2022 tax return due date is: Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. An llc should use this.

Web Use Form Ftb 3522, Llc Tax Voucher, To Pay The Annual Limited Liability Company (Llc) Tax Of $800 For Taxable Year 2022.

Use get form or simply click on the template preview to open it in the editor. Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 34 votes how to fill out and sign 2023 ftb 3522 online? Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Web what is form 3522?

An Llc Should Use This Voucher If Any Of The Following.

The form can be suppressed when printing extensions by. The 15th day of 3rd month after end of their tax year if the due date. You can download or print. Web i filled out the california form 3522 and requested electronic payment of the $800 annual fee on april 15, 2022/ the client letter indicates that this is an estimated.

All Llcs In The State Are Required To Pay This Annual Tax To Stay Compliant And In.

An llc should use this. Web form 3522 california — limited liability company tax voucher download this form print this form it appears you don't have a pdf plugin for this browser. For calendar year 2022, or tax year beginning , 2022, ending , 20. Finding a authorized specialist, creating a scheduled visit and coming to the workplace for a personal conference makes finishing a ca ftb.

March 15, 2023 Fiscal Tax Year:

Pdffiller allows users to edit, sign, fill & share all type of documents online. An llc should use this. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Web follow the simple instructions below: