2022 Form 3804

2022 Form 3804 - Web once all conditions are met, the owner’s pro rata or distributive share (plus guaranteed payments) of qualified net income is reported on form 3804. Click forms in the turbotax header. Web form 100, california corporation franchise or income tax return; Go to sch e, p. Web you can trigger the creation of form 3804 (and related worksheet) in turbotax business using forms mode. By june 15 of the tax year of the election, at least 50% of the elective tax paid in. Automatically include all shareholders go to california > other information worksheet. To suppress or override the 3893 follow these steps to make the election: For the 2022 rates), on ecti allocable to all foreign partners for 2022, without any reductions for state and local taxes under regulations section. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income.

Web once all conditions are met, the owner’s pro rata or distributive share (plus guaranteed payments) of qualified net income is reported on form 3804. I have two shareholders and need to get them the form 3804. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web form 100, california corporation franchise or income tax return; Form 3554, new employment credit; For the 2022 rates), on ecti allocable to all foreign partners for 2022, without any reductions for state and local taxes under regulations section. By june 15 of the tax year of the election, at least 50% of the elective tax paid in. Attach to your california tax return. Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments:

Attach to your california tax return. Web form 100, california corporation franchise or income tax return; I have two shareholders and need to get them the form 3804. Web home how do i prepare california form 3804 and 3893 with an 1120s return using interview forms in cch® prosystem fx® tax? Form ftb 3804 also includes a schedule of qualified taxpayers that requires. By june 15 of the tax year of the election, at least 50% of the elective tax paid in. Web once all conditions are met, the owner’s pro rata or distributive share (plus guaranteed payments) of qualified net income is reported on form 3804. Form 3554, new employment credit; Go to sch e, p. For the 2022 rates), on ecti allocable to all foreign partners for 2022, without any reductions for state and local taxes under regulations section.

Come and Try Horsemanship Tickets, Archery Ascension, Narre Warren

By june 15 of the tax year of the election, at least 50% of the elective tax paid in. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web how do i make the election for next year? Attach to your california tax return. Form 3554, new employment credit;

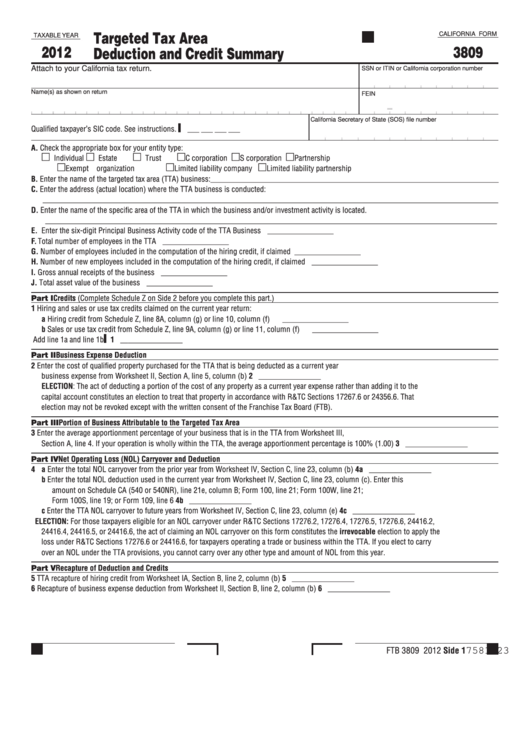

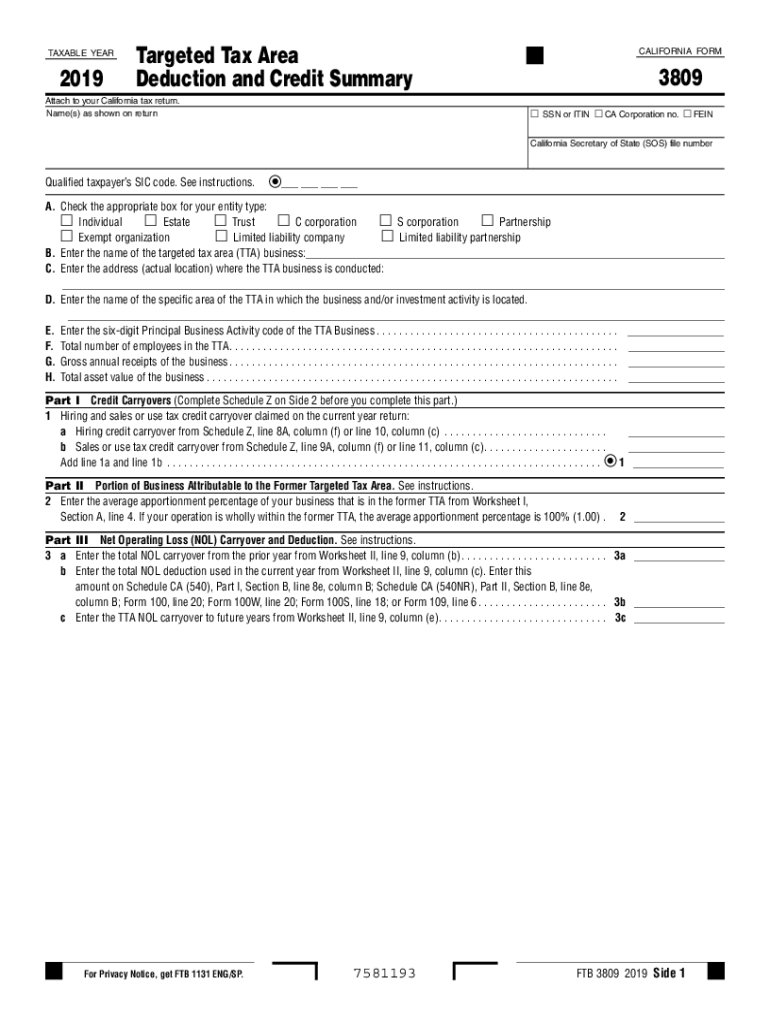

Fillable California Form 3809 Targeted Tax Area Deduction And Credit

Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web once all conditions are met, the owner’s pro rata or distributive share (plus guaranteed payments) of qualified net income is reported on form 3804. Automatically include all shareholders go to california > other information worksheet. Web form 100, california corporation franchise.

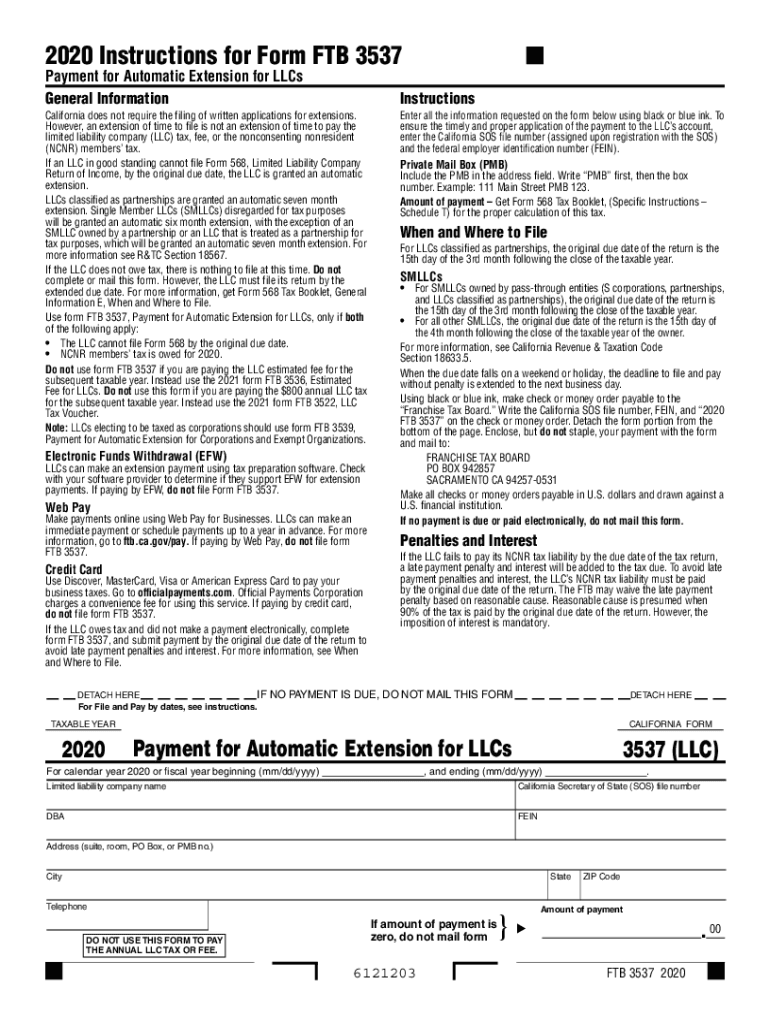

Form 3537 California Fill Out and Sign Printable PDF Template signNow

Web once all conditions are met, the owner’s pro rata or distributive share (plus guaranteed payments) of qualified net income is reported on form 3804. Click forms in the turbotax header. Web home how do i prepare california form 3804 and 3893 with an 1120s return using interview forms in cch® prosystem fx® tax? I have two shareholders and need.

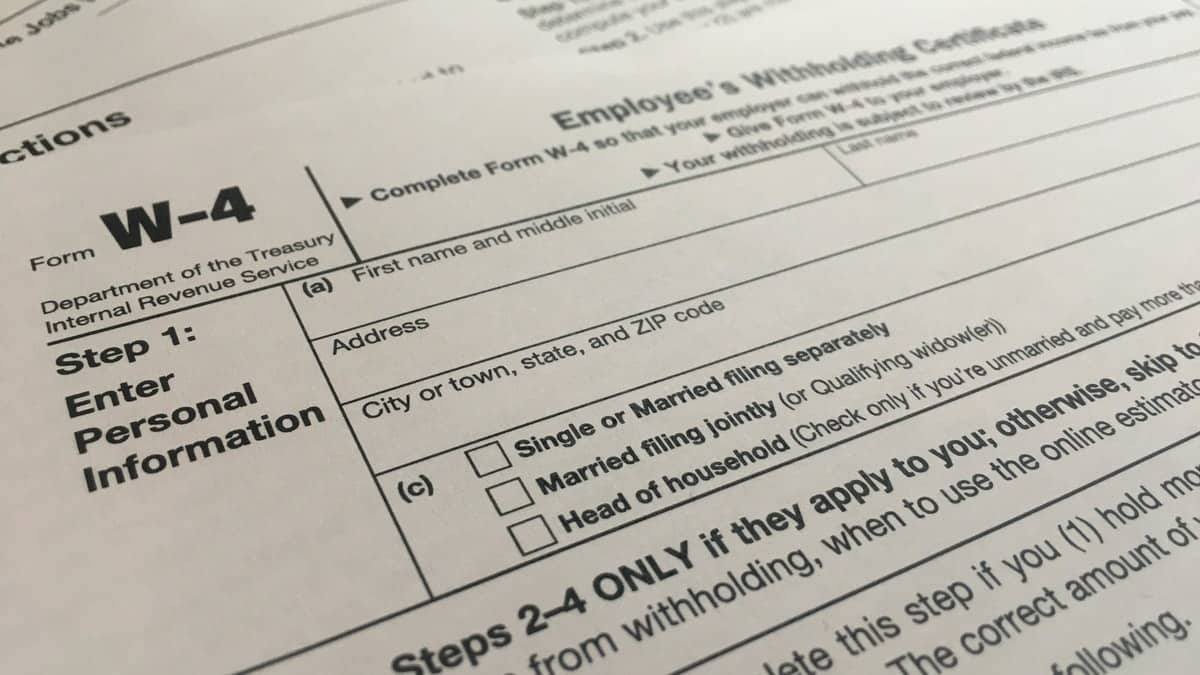

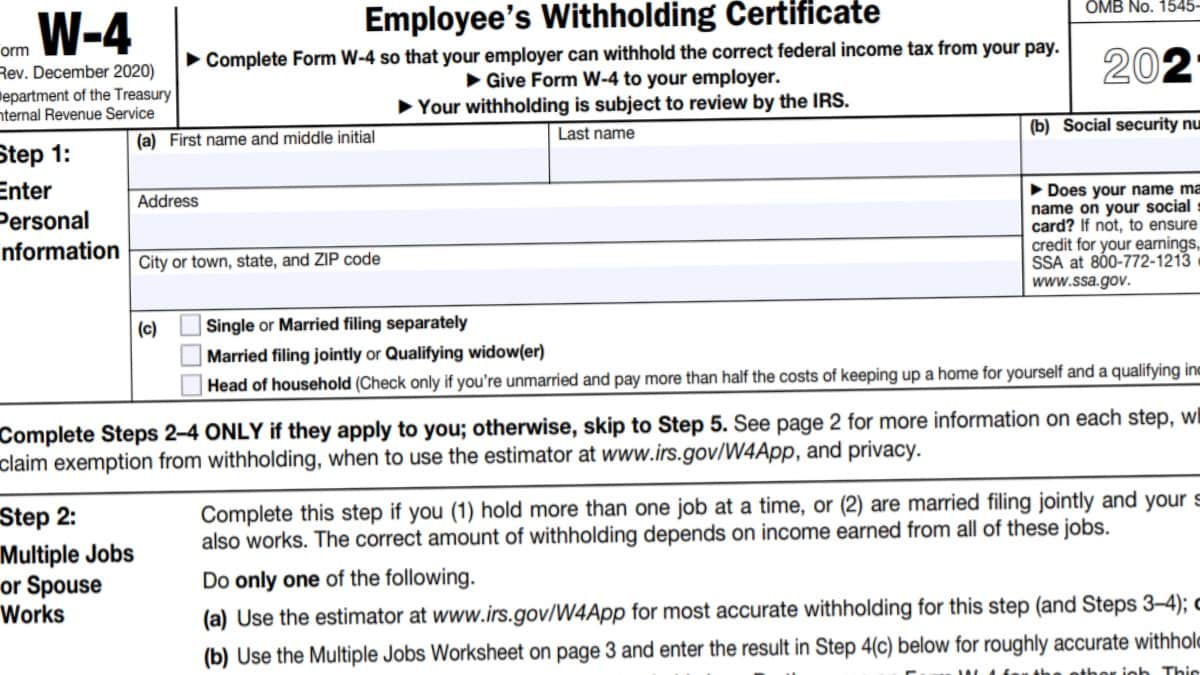

W4 Form 2023 Instructions

Web home how do i prepare california form 3804 and 3893 with an 1120s return using interview forms in cch® prosystem fx® tax? By june 15 of the tax year of the election, at least 50% of the elective tax paid in. Web the total from form 3804 flows to form 565, line 25, or form 568, line 4. To.

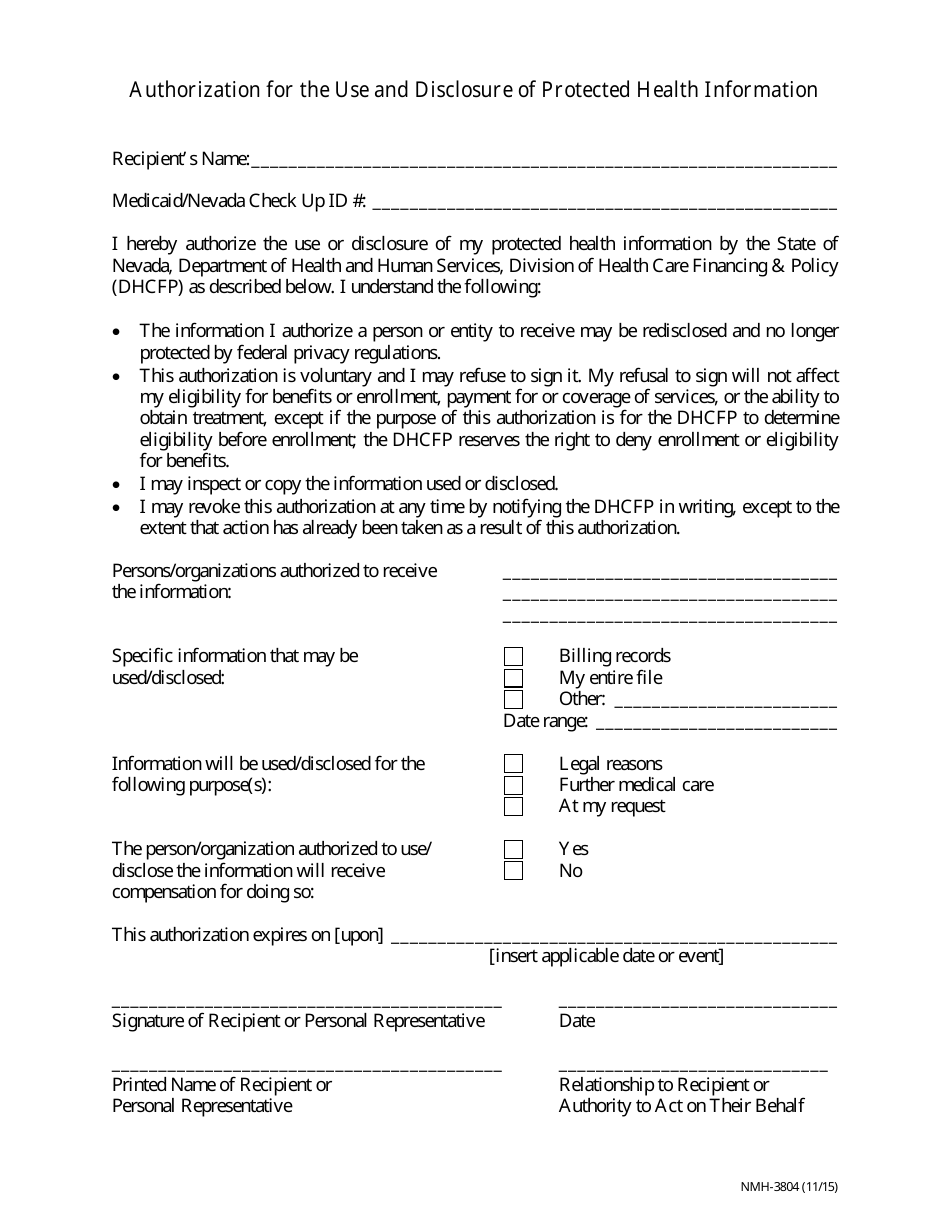

Form NMH3804 Download Fillable PDF or Fill Online Authorization for

Form 3554, new employment credit; Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. For the 2022 rates), on ecti allocable to all foreign partners for 2022, without any reductions for state and local taxes under regulations section. Web the total from form 3804 flows to form 565, line 25, or.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: I have two shareholders and need to get them the form 3804. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web once all conditions are met, the owner’s pro rata or.

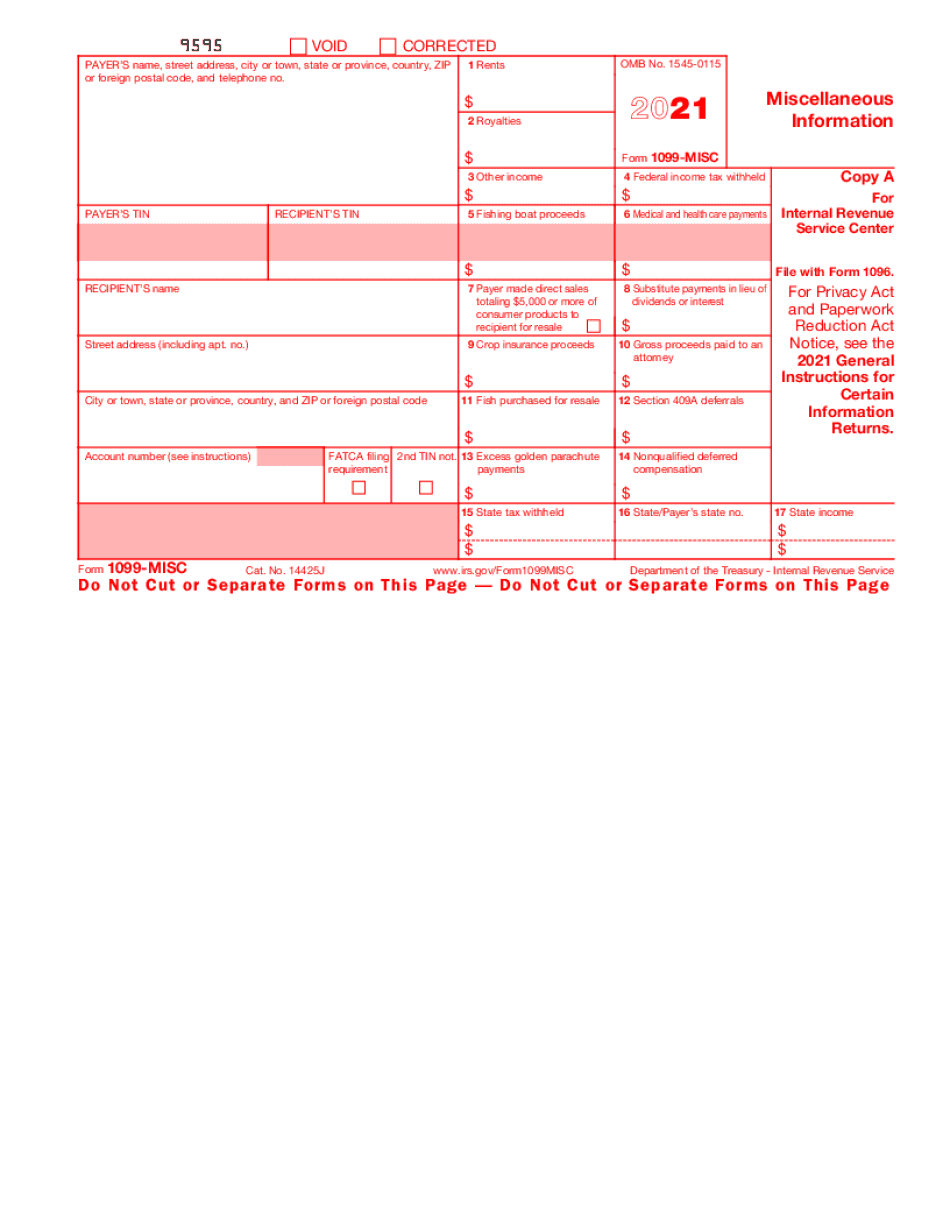

1099MISC Form 2022 Fillable Template

I have two shareholders and need to get them the form 3804. Web the total from form 3804 flows to form 565, line 25, or form 568, line 4. Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: Form ftb 3804 also includes a schedule of qualified taxpayers that requires..

CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

Web august 31, 2022 draft as of. Web the total from form 3804 flows to form 565, line 25, or form 568, line 4. For the 2022 rates), on ecti allocable to all foreign partners for 2022, without any reductions for state and local taxes under regulations section. Go to sch e, p. Web up to 10% cash back for.

Form 590 Withholding Exemption Certificate City Of Fill Out and Sign

Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: Name(s) as shown on your california tax return. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web home how do i prepare california form 3804 and 3893 with an 1120s return using interview forms in cch® prosystem.

W4 Form 2022 Instructions W4 Forms TaxUni

Click forms in the turbotax header. For the 2022 rates), on ecti allocable to all foreign partners for 2022, without any reductions for state and local taxes under regulations section. Web once all conditions are met, the owner’s pro rata or distributive share (plus guaranteed payments) of qualified net income is reported on form 3804. Name(s) as shown on your.

Web Form 100, California Corporation Franchise Or Income Tax Return;

Web the total from form 3804 flows to form 565, line 25, or form 568, line 4. Automatically include all shareholders go to california > other information worksheet. Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: Go to sch e, p.

Web You Can Trigger The Creation Of Form 3804 (And Related Worksheet) In Turbotax Business Using Forms Mode.

By june 15 of the tax year of the election, at least 50% of the elective tax paid in. To suppress or override the 3893 follow these steps to make the election: Web once all conditions are met, the owner’s pro rata or distributive share (plus guaranteed payments) of qualified net income is reported on form 3804. For the 2022 rates), on ecti allocable to all foreign partners for 2022, without any reductions for state and local taxes under regulations section.

Web How Do I Make The Election For Next Year?

Click forms in the turbotax header. Web august 31, 2022 draft as of. Form 3554, new employment credit; Form ftb 3804 also includes a schedule of qualified taxpayers that requires.

Attach To Your California Tax Return.

Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Name(s) as shown on your california tax return. Web home how do i prepare california form 3804 and 3893 with an 1120s return using interview forms in cch® prosystem fx® tax? I have two shareholders and need to get them the form 3804.