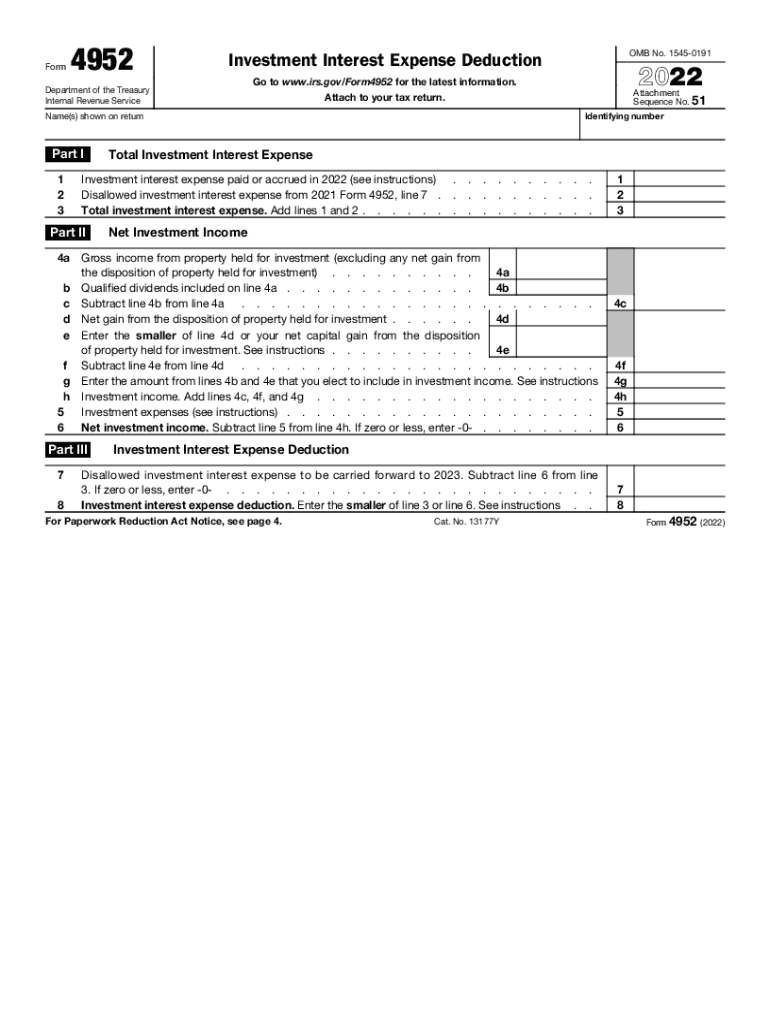

2022 Form 4952

2022 Form 4952 - Investment interest expense deduction is a tax form distributed by the internal revenue service (irs) used to determine the amount of investment interest expense. Investment interest expense deduction has to be submitted by anybody wishing to deduct investment interest expense, including individuals, estates, or. Web follow the simple instructions below: Web to deduct investment interest, you must file a form 4952 with your return. Register and log in to your account. Web investment (margin) interest deduction is claimed on form 4952 investment interest expense deduction and the allowable deduction will flow to schedule a (form 1040). Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. Get ready for tax season deadlines by completing any required tax forms today. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. example: Are you trying to find a quick and efficient tool to fill in irs 4952 at a reasonable cost?

Web if you are an individual, estate, or a trust, you must file form 4952 to claim a deduction for your investment interest expense. You can’t use the 2022 form 8752 for your base year ending in 2023. Web reporting investment interest expense on individual form 4952 in proconnect tax solved • by intuit • 15 • updated july 14, 2022 this article will help to. Amount of investment interest you can deduct; Complete, edit or print tax forms instantly. You do not have to file form 4952 if all of. Are you trying to find a quick and efficient tool to fill in irs 4952 at a reasonable cost? Web follow the simple instructions below: Our service provides you with an. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. example:

Web for your base year ending in 2022, you must use the 2022 form 8752. Register and log in to your account. Upload, modify or create forms. Web follow the simple instructions below: Web to deduct investment interest, you must file a form 4952 with your return. How you can identify investment interest expense as one of your tax. This form is for income earned in tax year 2022, with tax returns due in april. Get ready for tax season deadlines by completing any required tax forms today. Investment interest expense deduction has to be submitted by anybody wishing to deduct investment interest expense, including individuals, estates, or. On this form, figure these:

Fill Free fillable F4952 2019 Form 4952 PDF form

Web follow the simple instructions below: Investment interest expense deduction is a tax form distributed by the internal revenue service (irs) used to determine the amount of investment interest expense. Try it for free now! Our service provides you with an. Get ready for tax season deadlines by completing any required tax forms today.

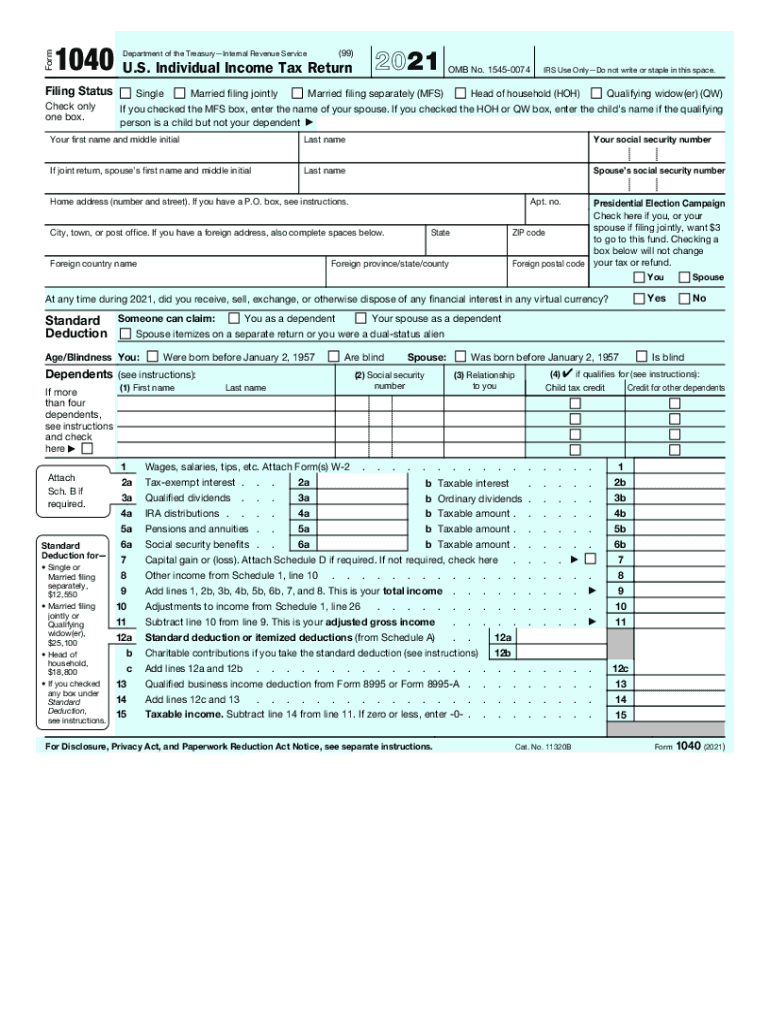

IRS 1040 20212022 Fill and Sign Printable Template Online US Legal

Are you trying to find a quick and efficient tool to fill in irs 4952 at a reasonable cost? Upload, modify or create forms. Web this article will walk you through irs form 4952 so you can better understand: The taxpayer has $60,000 in. Complete, edit or print tax forms instantly.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Log in to the editor. Register and log in to your account. Investment interest expense deduction has to be submitted by anybody wishing to deduct investment interest expense, including individuals, estates, or. Our service provides you with an. Web for your base year ending in 2022, you must use the 2022 form 8752.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Register and log in to your account. Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry.

Form 4952 Fill Out and Sign Printable PDF Template signNow

Try it for free now! Web to deduct investment interest, you must file a form 4952 with your return. Complete, edit or print tax forms instantly. Are you trying to find a quick and efficient tool to fill in irs 4952 at a reasonable cost? You do not have to file form 4952 if all of.

11

Our service provides you with an. Get ready for tax season deadlines by completing any required tax forms today. How you can identify investment interest expense as one of your tax. Web if you are an individual, estate, or a trust, you must file form 4952 to claim a deduction for your investment interest expense. This form is for income.

Form 4952Investment Interest Expense Deduction

Try it for free now! You can’t use the 2022 form 8752 for your base year ending in 2023. Web form 4952 investment interest expense deduction department of the treasury internal revenue service. Web if you are an individual, estate, or a trust, you must file form 4952 to claim a deduction for your investment interest expense. Web to deduct.

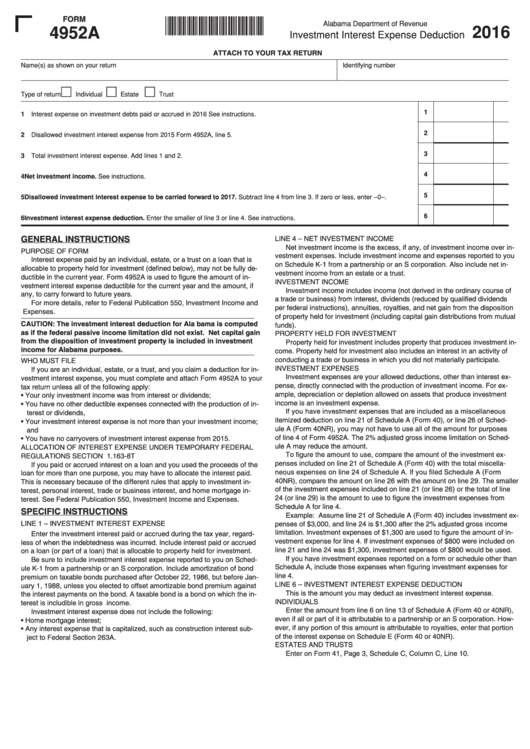

Form 4952a Investment Interest Expense Deduction 2016 printable pdf

Investment interest expense deduction online free of charge: Web follow the simple instructions below: You do not have to file form 4952 if all of. Web to deduct investment interest, you must file a form 4952 with your return. How you can identify investment interest expense as one of your tax.

Qualified Dividends and Capital Gain Tax Worksheet 2016

The taxpayer has $60,000 in. Web form 4952 investment interest expense deduction department of the treasury internal revenue service. This form is for income earned in tax year 2022, with tax returns due in april. Web to deduct investment interest, you must file a form 4952 with your return. Amount of investment interest you can deduct;

Form 4952 Investment Interest Expense Deduction Overview

Investment interest expense deduction has to be submitted by anybody wishing to deduct investment interest expense, including individuals, estates, or. Log in to the editor. Web follow the simple instructions below: Get ready for tax season deadlines by completing any required tax forms today. Web follow these fast steps to change the pdf 2022 form 4952.

Amount Of Investment Interest You Can Deduct;

Are you trying to find a quick and efficient tool to fill in irs 4952 at a reasonable cost? Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Web form 4952 investment interest expense deduction department of the treasury internal revenue service. Our service provides you with an.

On This Form, Figure These:

Web we last updated federal form 4952 in december 2022 from the federal internal revenue service. How you can identify investment interest expense as one of your tax. You can’t use the 2022 form 8752 for your base year ending in 2023. Try it for free now!

Web Per Form 4952, Line 4G, Enter The Amount From Lines 4B And 4E That You Elect To Include In Investment Income. Example:

Complete, edit or print tax forms instantly. Log in to the editor. Web follow these fast steps to change the pdf 2022 form 4952. Web this article will walk you through irs form 4952 so you can better understand:

Web If You Are An Individual, Estate, Or A Trust, You Must File Form 4952 To Claim A Deduction For Your Investment Interest Expense.

Register and log in to your account. Web for your base year ending in 2022, you must use the 2022 form 8752. The taxpayer has $60,000 in. Investment interest expense deduction online free of charge:

:max_bytes(150000):strip_icc()/4592-f64c21a16a3847538c094ee48dee34fe.jpg)