2022 Form 8915-F Instructions

2022 Form 8915-F Instructions - You can choose to use worksheet 1b even if you are not required to do so. If married, file a separate form for each. See worksheet 1b, later, to determine whether you must use worksheet 1b. (january 2022) qualified disaster retirement plan distributions and repayments. Web body of these instructions. The withdrawal must come from an eligible retirement. Web go to www.irs.gov/form8915f for instructions and the latest information. Department of the treasury internal.

You can choose to use worksheet 1b even if you are not required to do so. Web body of these instructions. If married, file a separate form for each. Department of the treasury internal. The withdrawal must come from an eligible retirement. (january 2022) qualified disaster retirement plan distributions and repayments. Web go to www.irs.gov/form8915f for instructions and the latest information. See worksheet 1b, later, to determine whether you must use worksheet 1b.

If married, file a separate form for each. Web body of these instructions. (january 2022) qualified disaster retirement plan distributions and repayments. Web go to www.irs.gov/form8915f for instructions and the latest information. You can choose to use worksheet 1b even if you are not required to do so. The withdrawal must come from an eligible retirement. Department of the treasury internal. See worksheet 1b, later, to determine whether you must use worksheet 1b.

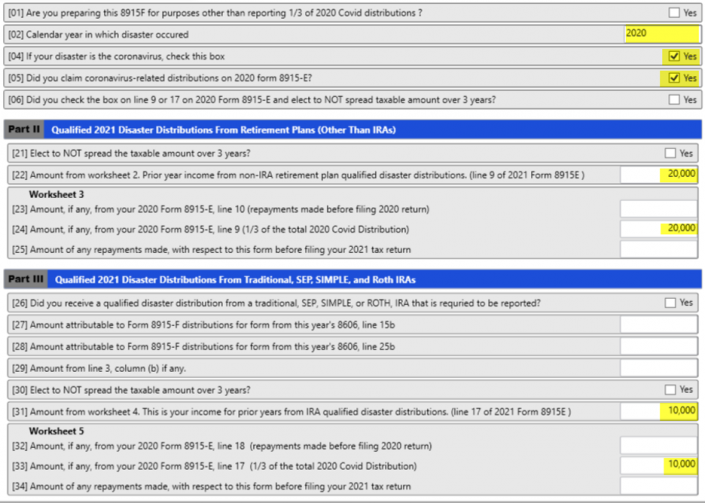

Basic 8915F Instructions for 2021 Taxware Systems

The withdrawal must come from an eligible retirement. Web body of these instructions. You can choose to use worksheet 1b even if you are not required to do so. See worksheet 1b, later, to determine whether you must use worksheet 1b. If married, file a separate form for each.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

If married, file a separate form for each. You can choose to use worksheet 1b even if you are not required to do so. The withdrawal must come from an eligible retirement. (january 2022) qualified disaster retirement plan distributions and repayments. See worksheet 1b, later, to determine whether you must use worksheet 1b.

IRS Issues 'Forever' Form 8915F For Retirement Distributions The

Web body of these instructions. See worksheet 1b, later, to determine whether you must use worksheet 1b. (january 2022) qualified disaster retirement plan distributions and repayments. Department of the treasury internal. If married, file a separate form for each.

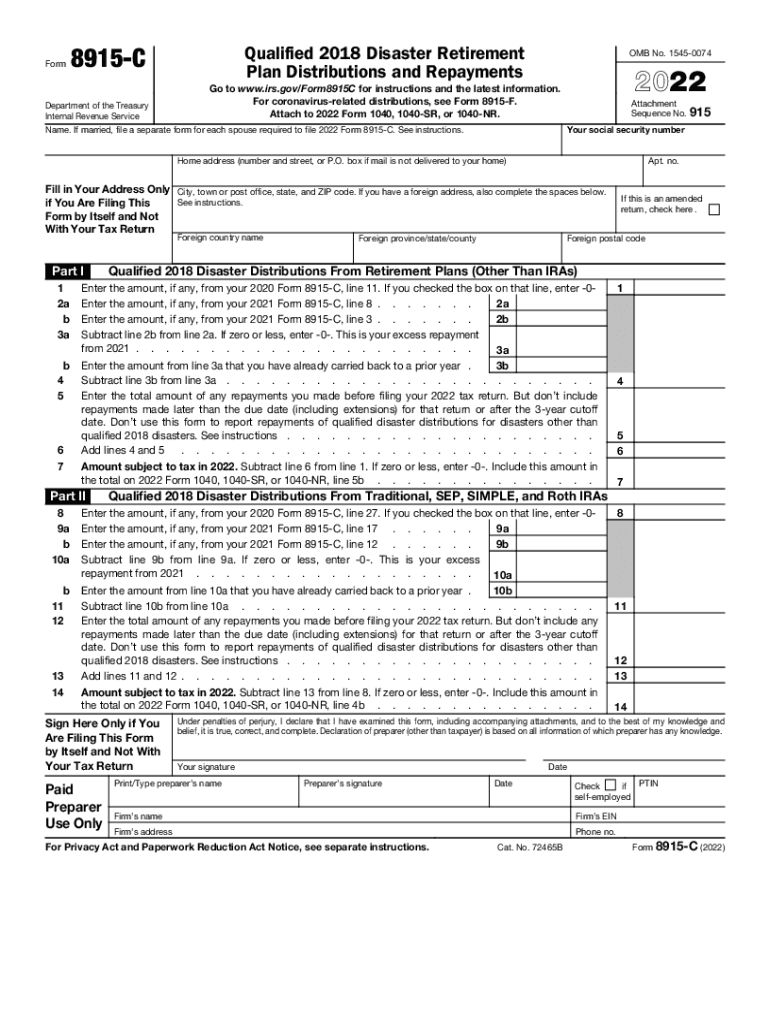

2022 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

Department of the treasury internal. Web go to www.irs.gov/form8915f for instructions and the latest information. If married, file a separate form for each. The withdrawal must come from an eligible retirement. (january 2022) qualified disaster retirement plan distributions and repayments.

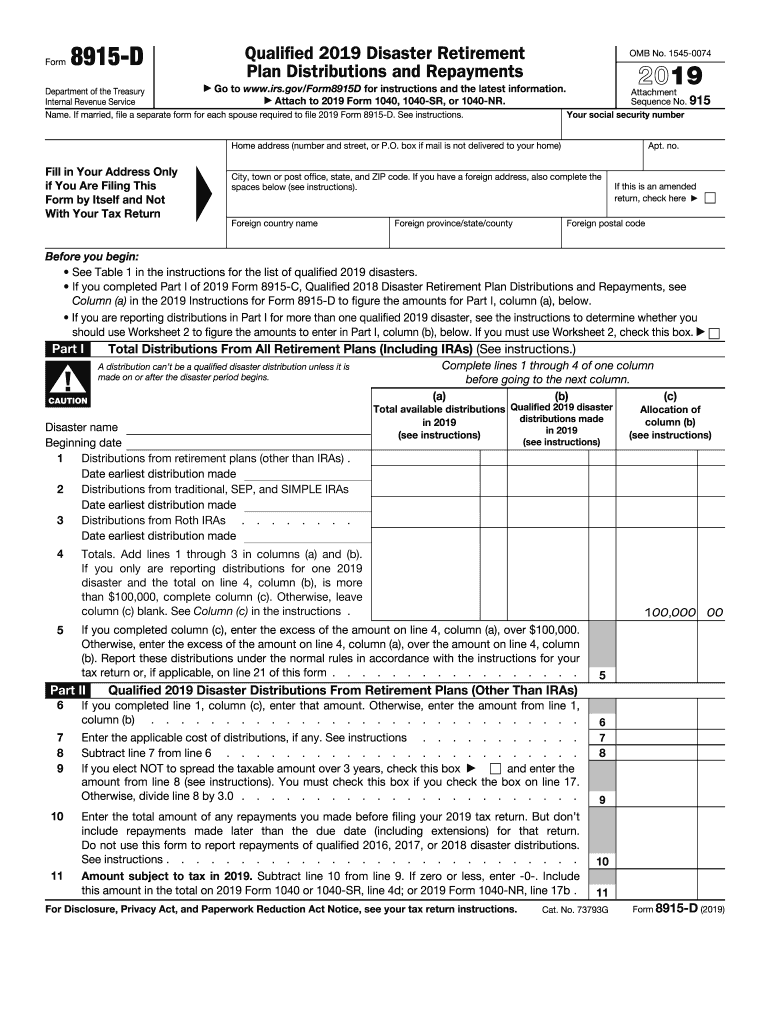

8915 D Form Fill Out and Sign Printable PDF Template signNow

If married, file a separate form for each. You can choose to use worksheet 1b even if you are not required to do so. Web body of these instructions. The withdrawal must come from an eligible retirement. See worksheet 1b, later, to determine whether you must use worksheet 1b.

Where can I find the 8915 F form on the TurboTax app?

You can choose to use worksheet 1b even if you are not required to do so. Department of the treasury internal. The withdrawal must come from an eligible retirement. If married, file a separate form for each. (january 2022) qualified disaster retirement plan distributions and repayments.

2022 Form IRS Instructions 8915D Fill Online, Printable, Fillable

Web body of these instructions. If married, file a separate form for each. You can choose to use worksheet 1b even if you are not required to do so. Department of the treasury internal. The withdrawal must come from an eligible retirement.

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

(january 2022) qualified disaster retirement plan distributions and repayments. Department of the treasury internal. The withdrawal must come from an eligible retirement. Web go to www.irs.gov/form8915f for instructions and the latest information. Web body of these instructions.

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

You can choose to use worksheet 1b even if you are not required to do so. If married, file a separate form for each. Web body of these instructions. Web go to www.irs.gov/form8915f for instructions and the latest information. Department of the treasury internal.

form 8915 e instructions turbotax Renita Wimberly

The withdrawal must come from an eligible retirement. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web go to www.irs.gov/form8915f for instructions and the latest information. (january 2022) qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to do so.

The Withdrawal Must Come From An Eligible Retirement.

See worksheet 1b, later, to determine whether you must use worksheet 1b. If married, file a separate form for each. Department of the treasury internal. Web body of these instructions.

(January 2022) Qualified Disaster Retirement Plan Distributions And Repayments.

Web go to www.irs.gov/form8915f for instructions and the latest information. You can choose to use worksheet 1b even if you are not required to do so.