2023 Form 941B

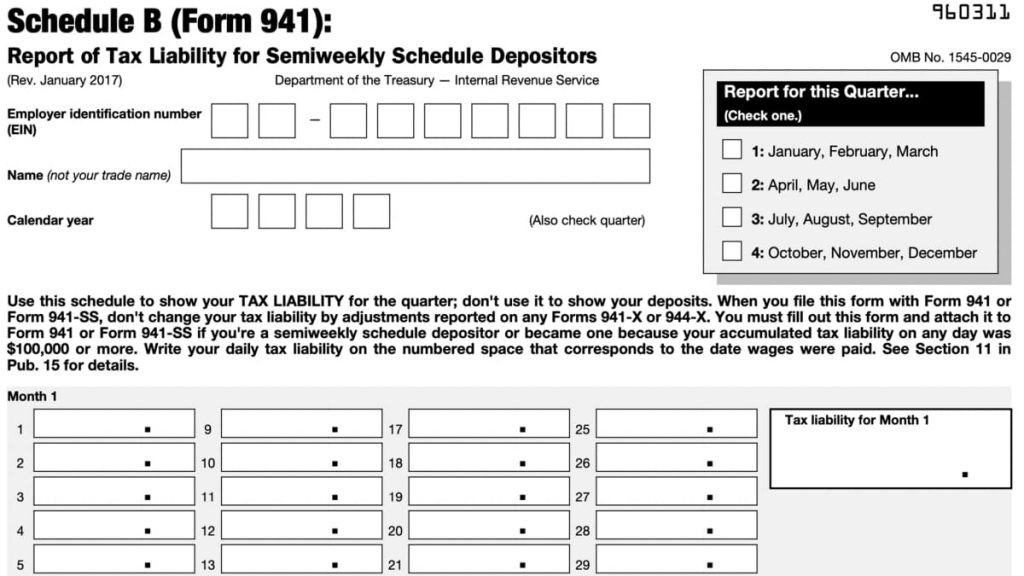

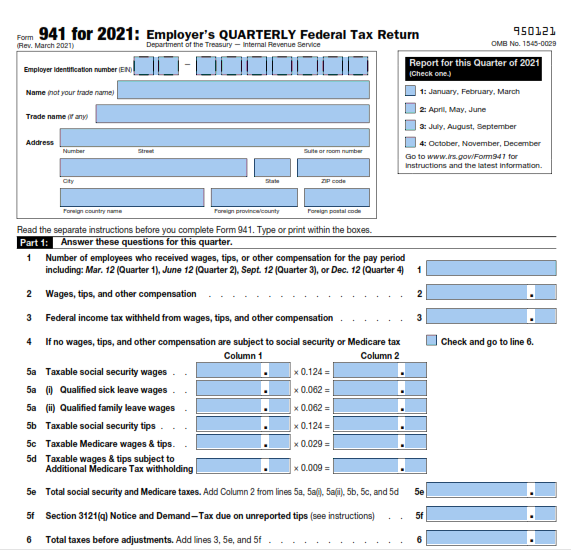

2023 Form 941B - Form 941 schedule b must be filed by employers, if they are reporting more than $50,000 in employment taxes for the previous. The irs has released draft versions of the march 2023 form 941 (employer’s quarterly. Treasury international capital (tic) forms and instructions. Web irs releases the final forms and instructions for form 941. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. A lcohol and tobacco tax and trade. The instructions for line 1 have changed. December 8, 2022 · 5 minute read. Web 941 tax form for 2023 i'm trying to launch the 2qtr 2023 941 form and it says, you are about to create a tax form for the 2023 tax year, but the form currently. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

December 8, 2022 · 5 minute read. Form 941 is used by employers. The instructions for line 1 have changed. There are a few minor changes to q1 form 941 for 2023. The 2023 form 941, employer’s quarterly federal tax return, and its instructions. Web thomson reuters tax & accounting. Web savings bonds and treasury securities forms. Web report for this quarter of 2023 (check one.) 1: Web november 28, 2022. This webinar will give you the tools to better be able to understand line by line of the form 941.

Web savings bonds and treasury securities forms. December 8, 2022 · 5 minute read. The instructions now refer to the quarter of “2023” instead. The instructions for line 1 have changed. Completes schedule b by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social. The irs has released draft versions of the march 2023 form 941 (employer’s quarterly. Web 941 tax form for 2023 i'm trying to launch the 2qtr 2023 941 form and it says, you are about to create a tax form for the 2023 tax year, but the form currently. Web november 28, 2022. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service american samoa, guam, the. Form 941 schedule b must be filed by employers, if they are reporting more than $50,000 in employment taxes for the previous.

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

December 8, 2022 · 5 minute read. Web 941 tax form for 2023 i'm trying to launch the 2qtr 2023 941 form and it says, you are about to create a tax form for the 2023 tax year, but the form currently. Web 20 apr form 941 for 2023: Form 941 schedule b must be filed by employers, if they.

W4 Form 2023

Taxpayers have been receiving cp136 notices from the irs to update their 2023 deposit requirements for form 941, employer's quarterly. The instructions for line 1 have changed. This webinar will give you the tools to better be able to understand line by line of the form 941. Treasury international capital (tic) forms and instructions. Web report for this quarter of.

Top 10 Us Tax Forms In 2022 Explained Pdf Co Gambaran

Web 20 apr form 941 for 2023: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web report for this quarter of 2023 (check one.) 1: The irs has released draft versions of the march 2023 form 941 (employer’s quarterly. Web department of the treasury internal revenue service.

FLTWPNVSQVe2PCJ6ZxnUQ_thumb_941b Roberts Corvettes and Classics

There are a few minor changes to q1 form 941 for 2023. Web the irs has introduced a second worksheet for form 941. This webinar will give you the tools to better be able to understand line by line of the form 941. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service american samoa,.

[51+] Toyota Harrier Book, Toyota Harrier 2003 On Owners Manual (Two

Form 941 schedule b must be filed by employers, if they are reporting more than $50,000 in employment taxes for the previous. June 2022) use with the january 2017 revision of schedule b (form 941) report of tax liability for. Web 941 tax form for 2023 i'm trying to launch the 2qtr 2023 941 form and it says, you are.

IRS Fillable Form 941 2023

There are a few minor changes to q1 form 941 for 2023. Treasury international capital (tic) forms and instructions. There is also a small update to the instruction box for line 5. Web march 21, 2023 at 11:10 am · 4 min read rock hill, sc / accesswire / march 21, 2023 / march 31, 2023, marks the end of.

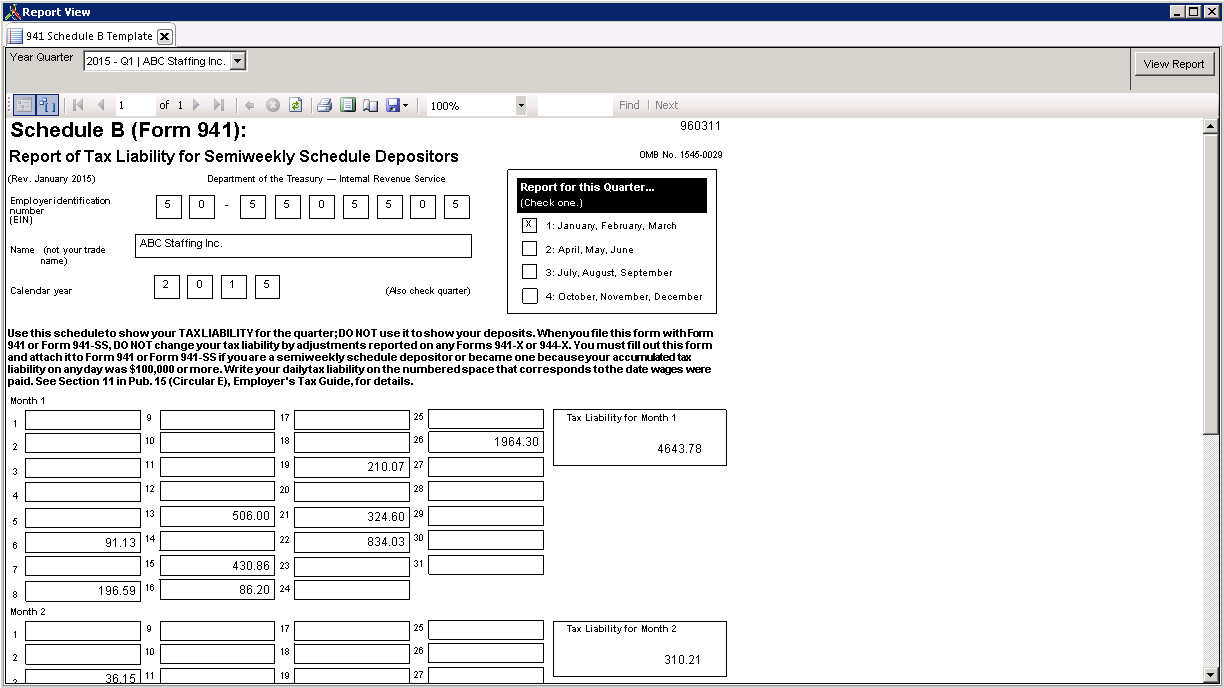

Standard Report 941 Schedule B Template Avionte Classic

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Form 941 schedule b must be filed by employers, if they are reporting more than $50,000 in employment taxes for the previous. Details around 2023 updates to the form 941 and review of common. Web the irs form 941 schedule.

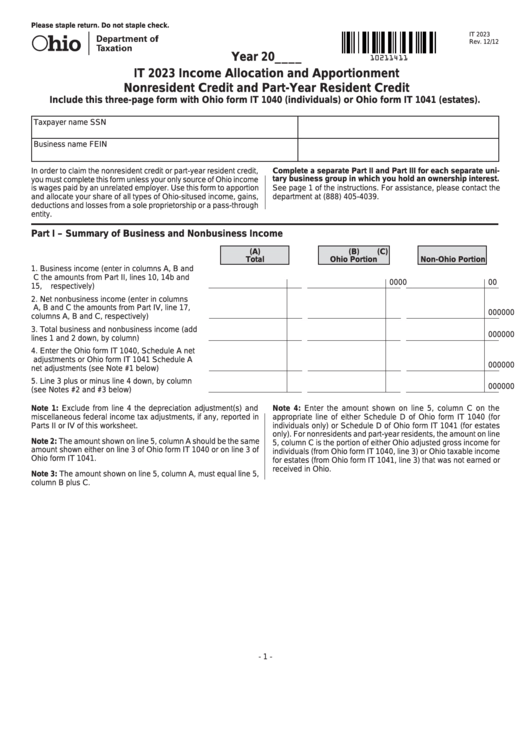

Fillable Form It 2023 Allocation And Apportionment Nonresident

Web 20 apr form 941 for 2023: The instructions for line 1 have changed. Treasury international capital (tic) forms and instructions. Web irs releases the final forms and instructions for form 941. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service american samoa, guam, the.

39394e8b6cdc4b87941beb70b4fe2448 Phenome Networks Knowledge Base

Web report for this quarter of 2023 (check one.) 1: Web form 941 schedule b filing requirements. Treasury international capital (tic) forms and instructions. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Form 941 is used by employers.

Calendar2023 form horizontal and vertical

Web department of the treasury internal revenue service (form 941) (rev. Web march 21, 2023 at 11:10 am · 4 min read rock hill, sc / accesswire / march 21, 2023 / march 31, 2023, marks the end of the first quarter of the 2023 tax year. Web november 28, 2022. Taxpayers have been receiving cp136 notices from the irs.

Completes Schedule B By Reducing The Amount Of Liability Entered For The First Payroll Payment In The Third Quarter Of 2023 That Includes Wages Subject To Social.

Details around 2023 updates to the form 941 and review of common. Web department of the treasury internal revenue service (form 941) (rev. There is also a small update to the instruction box for line 5. The 2023 form 941, employer’s quarterly federal tax return, and its instructions.

Web The Irs Has Introduced A Second Worksheet For Form 941.

Web report for this quarter of 2023 (check one.) 1: December 8, 2022 · 5 minute read. You must complete all three. Form 941 is used by employers.

Thursday, April 20, 2023 (12:00 Am) To Monday, May 1, 2023 (11:59 Pm) 1.5 Pdcs Provider:

The irs has released draft versions of the march 2023 form 941 (employer’s quarterly. Web irs releases the final forms and instructions for form 941. A lcohol and tobacco tax and trade. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service american samoa, guam, the.

Form 941 Schedule B Must Be Filed By Employers, If They Are Reporting More Than $50,000 In Employment Taxes For The Previous.

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. The instructions now refer to the quarter of “2023” instead. Taxpayers have been receiving cp136 notices from the irs to update their 2023 deposit requirements for form 941, employer's quarterly. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with.

![[51+] Toyota Harrier Book, Toyota Harrier 2003 On Owners Manual (Two](https://build.toyota.com.my/wp-content/uploads/2020/06/harrier-pearl-white-2048x1144.png)