401K Distribution Form

401K Distribution Form - Use the cross or check marks in the top toolbar to select your answers in the list boxes. You’ll simply need to contact your plan administrator or log into your account online and request a. But you must pay taxes on the amount of the withdrawal. Unlike a 401(k) loan, the funds need not be repaid. Web how you can fill out the distribution form 401k on the web: Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. They may provide a physical copy or allow you to download it online. When requesting a claim of inheritance, review the ira inheritance facts and the t. Sep, simple, trad, rollover, roth, i401k, individual, joint, trust, org). Rowe price traditional and roth ira disclosure statement and custodial agreement before completing the distribution form.

Web use this process to sell full or partial shares of your retirement or nonretirement account. Please submit the invesco solo 401(k) beneficiary transfer/distribution form. Rowe price traditional and roth ira disclosure statement and custodial agreement before completing the distribution form. Web do not use this form to: Web how to report 401k distribution on tax return? Withdrawals from a 401 (k) go on line 16a. Start completing the fillable fields and carefully type in required information. Use get form or simply click on the template preview to open it in the editor. Do not use this form to request required minimum distributions (rmds). This tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution.

Sep, simple, trad, rollover, roth, i401k, individual, joint, trust, org). You’ll simply need to contact your plan administrator or log into your account online and request a. Employers can contribute to employees’ accounts. Any individual retirement arrangements (iras). Use the cross or check marks in the top toolbar to select your answers in the list boxes. To report the 401 (k) distribution in your taxact return: Web if you've saved for retirement with a 401 (k), understand when you can start taking distributions, your withdrawal options, and what you should know about early distributions. • a distribution from an alternate payee account awarded pursuant to a qualified domestic relations order (qdro). They may provide a physical copy or allow you to download it online. A copy of that form is also sent to the irs.

7+ Sample 401k Calculators Sample Templates

From the payer of your 401 (k) distribution. (the starting year is the year in which you reach age 72 (70 ½ if you reach age 70 ½ before january 1, 2020) or retire, whichever applies, to. Annuities, pensions, insurance contracts, survivor income benefit plans. Elective salary deferrals are excluded from the employee’s taxable income (except for designated roth deferrals)..

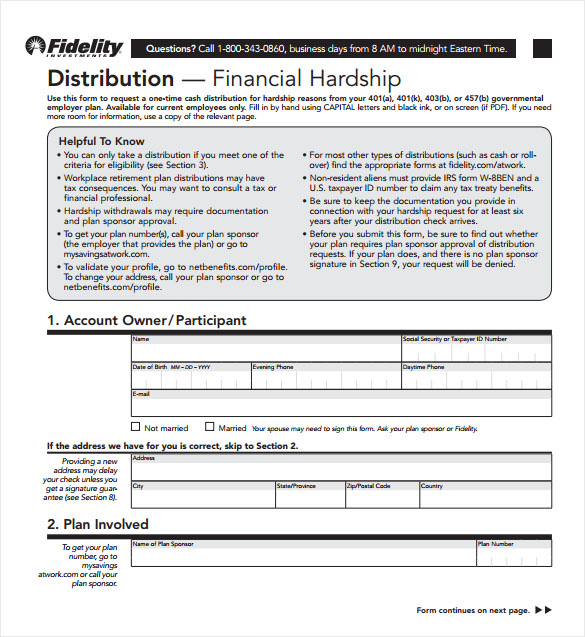

Fidelity 401k Distribution Form Universal Network

You can also complete many of these transactions online. Plan participants 401 (k) plan overview for participants general information on 401 (k) plans contribution limits Start completing the fillable fields and carefully type in required information. (the starting year is the year in which you reach age 72 (70 ½ if you reach age 70 ½ before january 1, 2020).

Massmutual 401 K

Withdrawals from a 401 (k) go on line 16a. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Unlike a 401(k) loan, the funds need not be repaid. Web use this form to request a distribution from a retirement plan or individual retirement annuity (ira). Ira inherit an ira.

401k Distribution Form 1040 Universal Network

Web 401 (k) distribution tax form. Web if you've saved for retirement with a 401 (k), understand when you can start taking distributions, your withdrawal options, and what you should know about early distributions. See section 5.01(c)(1) of the basic plan document. Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account.

401k Rollover Form Voya Universal Network

Use the cross or check marks in the top toolbar to select your answers in the list boxes. Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401(k) plan. Web use this form to request: Please submit the invesco solo 401(k) and 403(b)(7) loan application and.

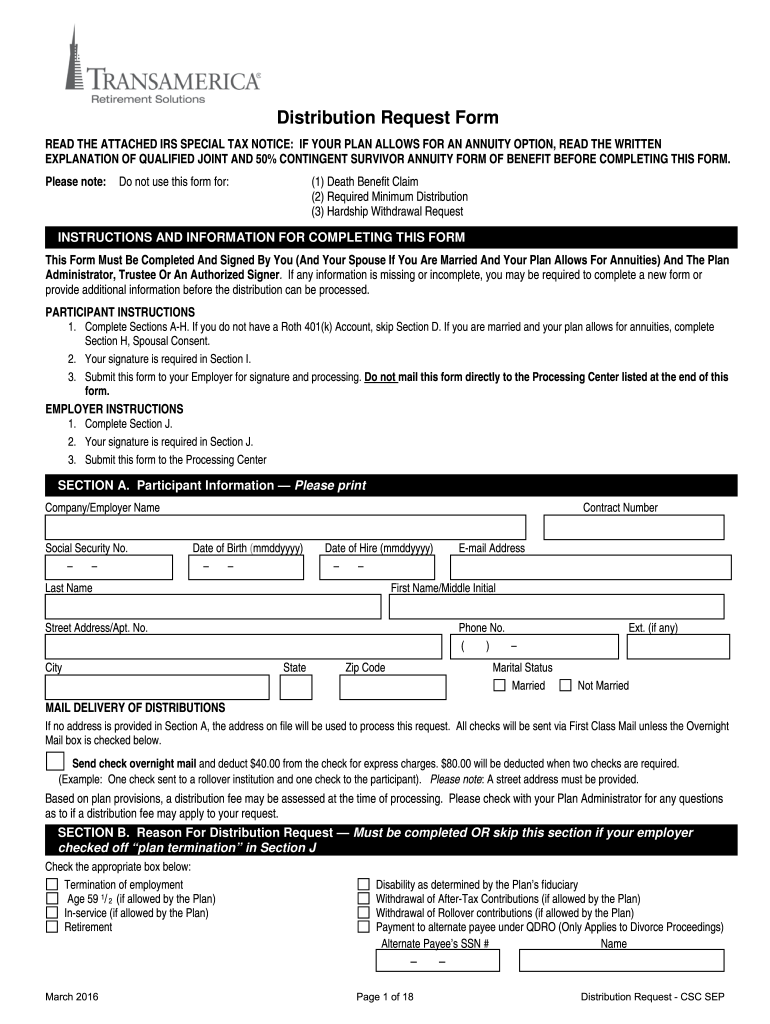

Fillable Online transamerica 401k withdrawal form Fax Email Print

Web do not use this form to: Please submit the invesco solo 401(k) and 403(b)(7) loan application and agreement request a transfer due to death or a distribution from a beneficiary status account. But you must pay taxes on the amount of the withdrawal. Web use this form to request: Web 401 (k) distribution tax form.

Distribution From 401K Fill Out and Sign Printable PDF Template signNow

Any individual retirement arrangements (iras). Web use this process to sell full or partial shares of your retirement or nonretirement account. A copy of that form is also sent to the irs. Unlike a 401(k) loan, the funds need not be repaid. Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account.

Paychex 401k Rollover Form Universal Network

See section 5.01(c)(1) of the basic plan document. Web a hardship withdrawal from a 401(k) retirement account is for large, unexpected expenses. Web individual 401(k) distribution request form this notice contains important information about the payment of your vested account balance in your employer's individual 401(k) plan. Web how you can fill out the distribution form 401k on the web:.

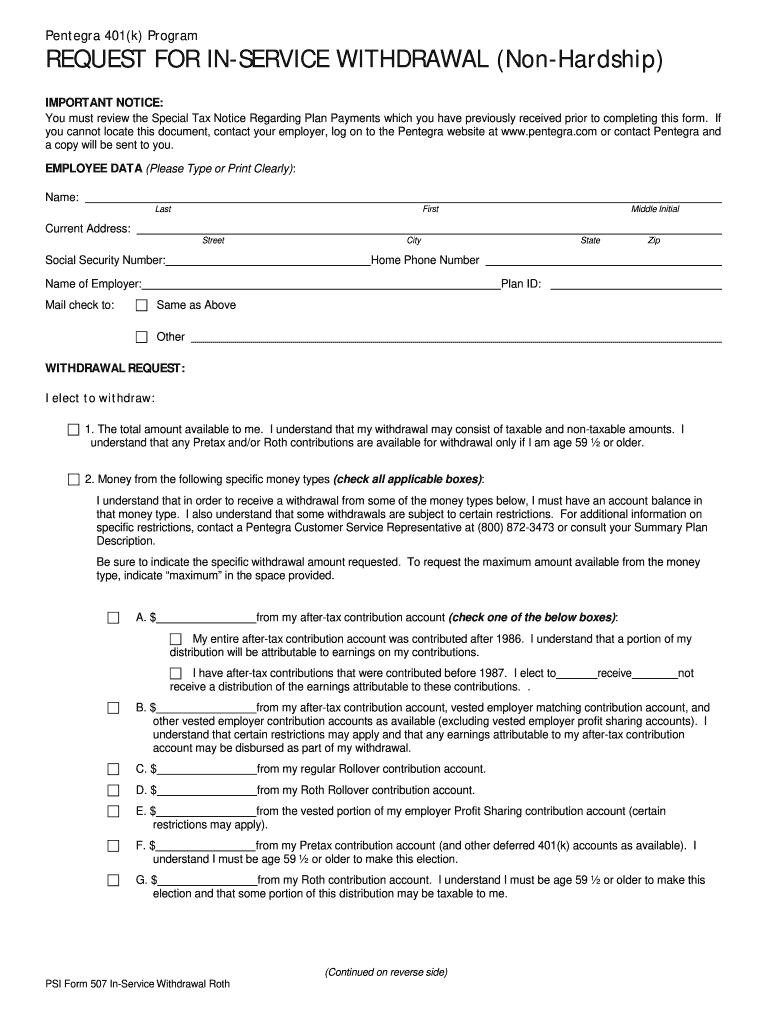

Pentegra 401k Withdrawal Form Fill Out and Sign Printable PDF

Web if you've saved for retirement with a 401 (k), understand when you can start taking distributions, your withdrawal options, and what you should know about early distributions. But you must pay taxes on the amount of the withdrawal. Checkwriting add checkwriting to an existing nonretirement, health savings account (hsa), the fidelity ® cash management account, or ira account. Please.

401k Rollover Tax Form Universal Network

Contact your employer's hr department or the administrator of your 401 (k) plan to request the distribution request form. Please submit the invesco solo 401(k) and 403(b)(7) loan application and agreement request a transfer due to death or a distribution from a beneficiary status account. See section 5.01(c)(1) of the basic plan document. They may provide a physical copy or.

Unlike A 401(K) Loan, The Funds Need Not Be Repaid.

They may provide a physical copy or allow you to download it online. Any individual retirement arrangements (iras). When requesting a claim of inheritance, review the ira inheritance facts and the t. Annuities, pensions, insurance contracts, survivor income benefit plans.

Contact Your Employer's Hr Department Or The Administrator Of Your 401 (K) Plan To Request The Distribution Request Form.

Web a hardship withdrawal from a 401(k) retirement account is for large, unexpected expenses. Web use this form to request: Ira inherit an ira from a spouse or non. Web the distribution required to be made by april 1 is treated as a distribution for the starting year.

Withdrawals From A 401 (K) Go On Line 16A.

But you must pay taxes on the amount of the withdrawal. Elective salary deferrals are excluded from the employee’s taxable income (except for designated roth deferrals). Web how to report 401k distribution on tax return? Fill in by hand using capital letters and black ink, or on screen (if pdf).

Web Use This Form To Request A Distribution From A Retirement Plan Or Individual Retirement Annuity (Ira).

Sep, simple, trad, rollover, roth, i401k, individual, joint, trust, org). Please submit the invesco solo 401(k) and 403(b)(7) loan application and agreement request a transfer due to death or a distribution from a beneficiary status account. Web by age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401 (k) without having to pay a penalty tax. Plan participants 401 (k) plan overview for participants general information on 401 (k) plans contribution limits