500Ez Form Georgia

500Ez Form Georgia - We last updated the individual income tax return (short. Complete, edit or print tax forms instantly. Persons with very simple taxes may file this form. Short individual income tax return georgia department of revenue. Print blank form > georgia department of revenue. 05/24/22) short individual income tax return georgia department of revenue 2022 (approved web version) page1state issued your. You are not 65 or over, or blind. If your filing status is single, enter $7,300.00, married filing joint, enter $13,400.00. 06/20/19) short individual income tax return georgia department of revenue your ssn# 2019 (approved web2 version) version). 05/29/18) short individual income tax return georgia department of revenue.

Web you may use form 500ez if: 05/24/22) short individual income tax return georgia department of revenue 2022 (approved web version) page1state issued your. You are not 65 or over, or blind. Web you may use form 500ez if: Complete, edit or print tax forms instantly. Short individual income tax return georgia department of revenue. Show details we are not affiliated with any brand or entity on this form. Print blank form > georgia department of revenue. Web signatures are required on page 2 of this form georgia form 500ez (rev. Your filing status is single or married filing joint and you do not claim any exemptions other than yourself or yourself.

05/24/22) short individual income tax return georgia department of revenue 2022 (approved web version) page1state issued your. You are not 65 or over, or blind. Your filing status is single or married filing joint and you do not claim any exemptions other than yourself or yourself. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due in april. Web georgia form 500ez (rev. You are not 65 or over, or blind. Web you may use form 500ez if: Persons with very simple taxes may file this form.

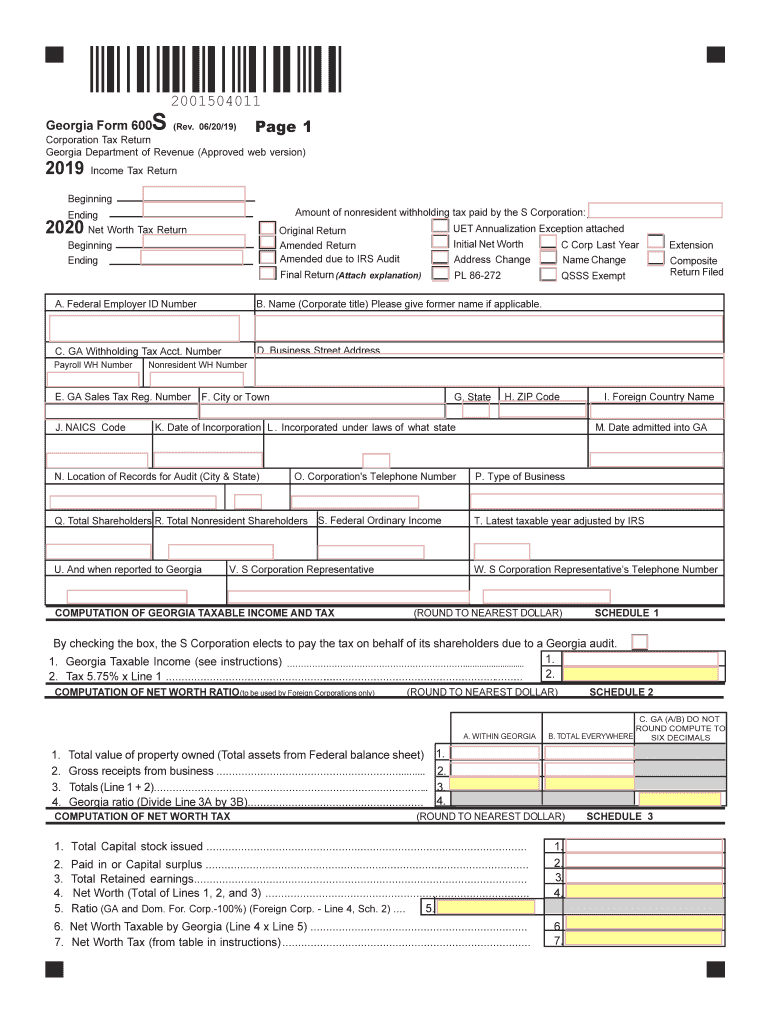

GA DoR 600S 20192022 Fill out Tax Template Online US Legal Forms

Web ga form 500ez instructions rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 28 votes how to fill out and sign georgia 500ez tax form online? Complete, edit or print tax forms instantly. Short individual income tax return georgia department of revenue. You are not 65 or over, or blind..

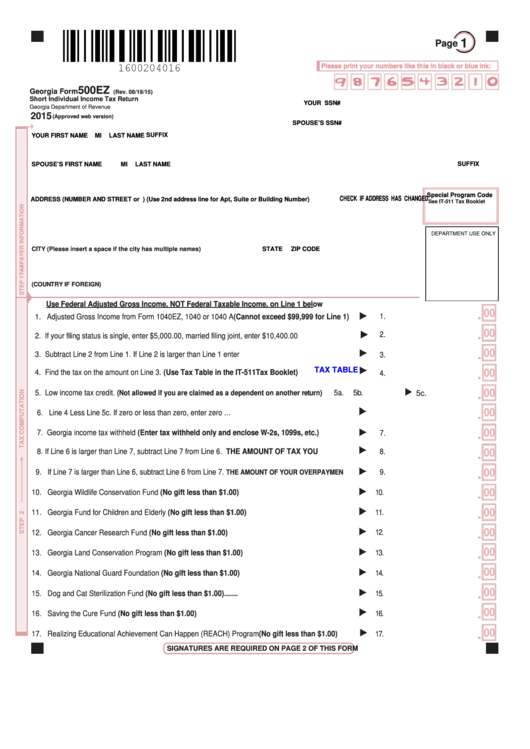

Fillable Form 500ez Short Individual Tax Return 2015

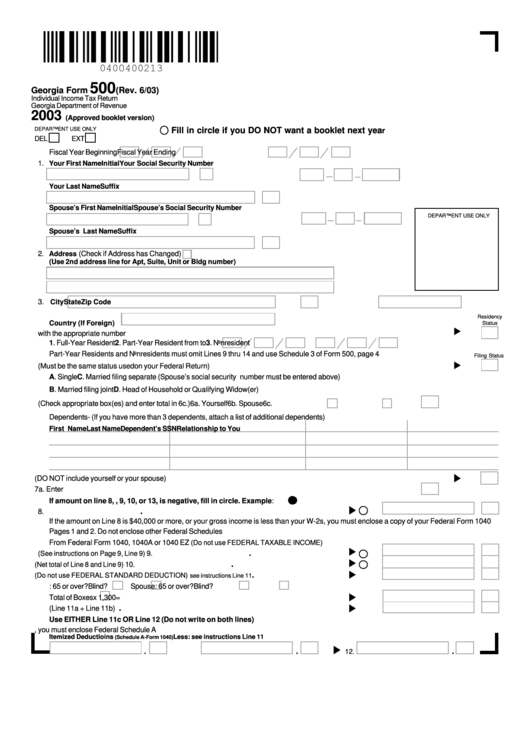

We last updated the individual income tax return (short. Short individual income tax return georgia department of revenue. Show details we are not affiliated with any brand or entity on this form. Web georgia form 500ez (rev. Web form 500ez and form 500 are the individual income tax return forms in georgia.

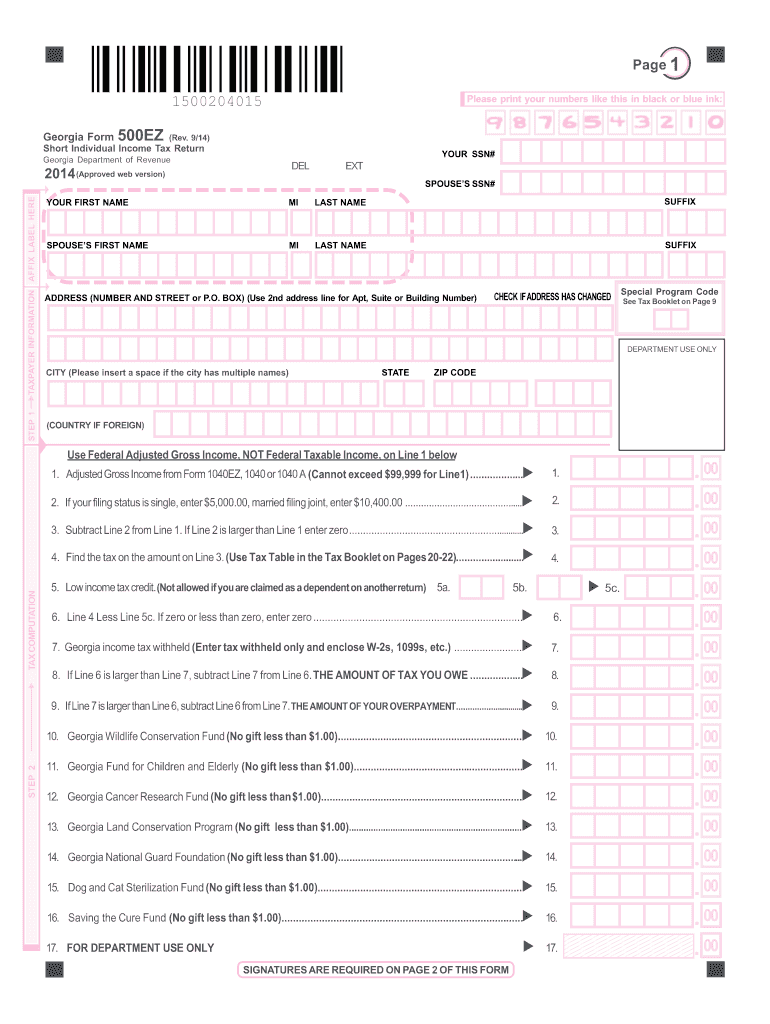

2014 Form GA 500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Print blank form > georgia department of revenue. 06/20/19) short individual income tax return georgia department of revenue your ssn# 2019 (approved web2 version) version). You are not 65 or over, or blind. Get ready for tax season deadlines by completing any required tax forms today. Web you may use form 500ez if:

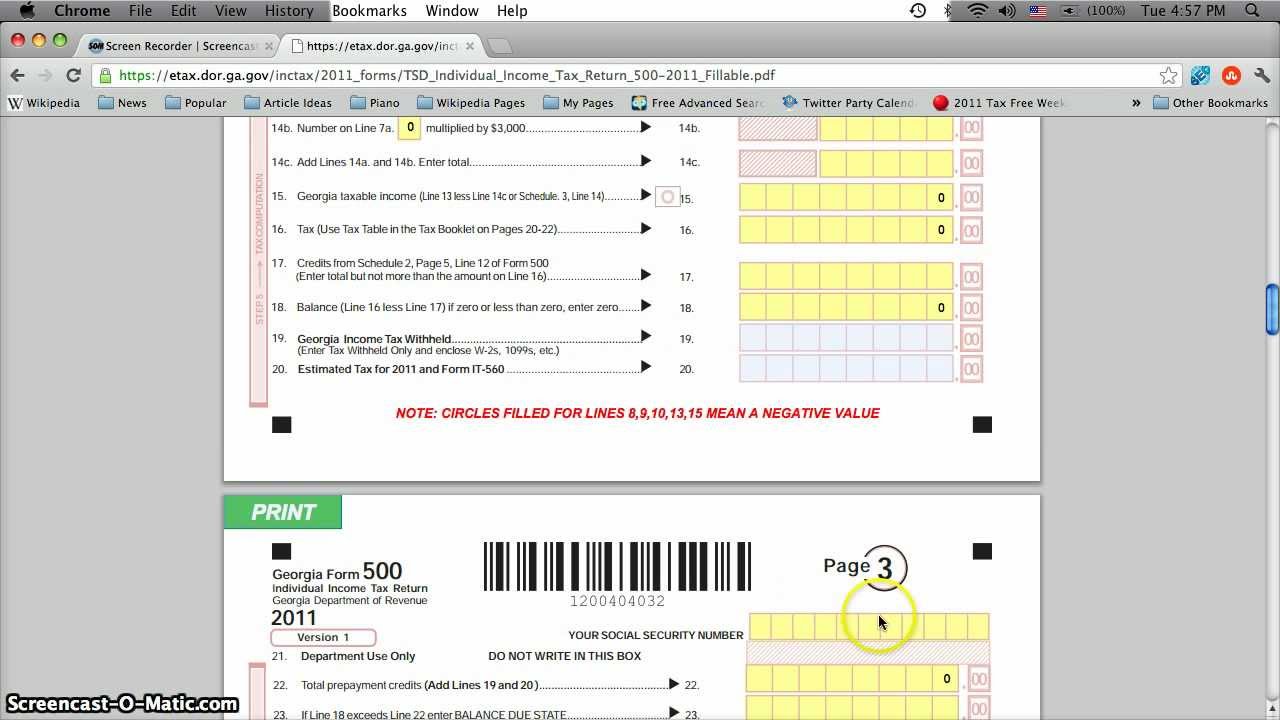

Printable Tax Forms 2012 State 500 and 500 EZ Online Options

Get ready for tax season deadlines by completing any required tax forms today. 05/29/18) short individual income tax return georgia department of revenue. Your filing status is single or married. Print blank form > georgia department of revenue. When completing your return please remember to:

Nillohit Samagra 6 Pdf fasrnuts

Web you may use form 500ez if: This form is for income earned in tax year 2022, with tax returns due in april. Web georgia form 500ez (rev. Web 2021 georgia form 500ez, short individual income tax return (short form) form link: Short individual income tax return georgia department of revenue.

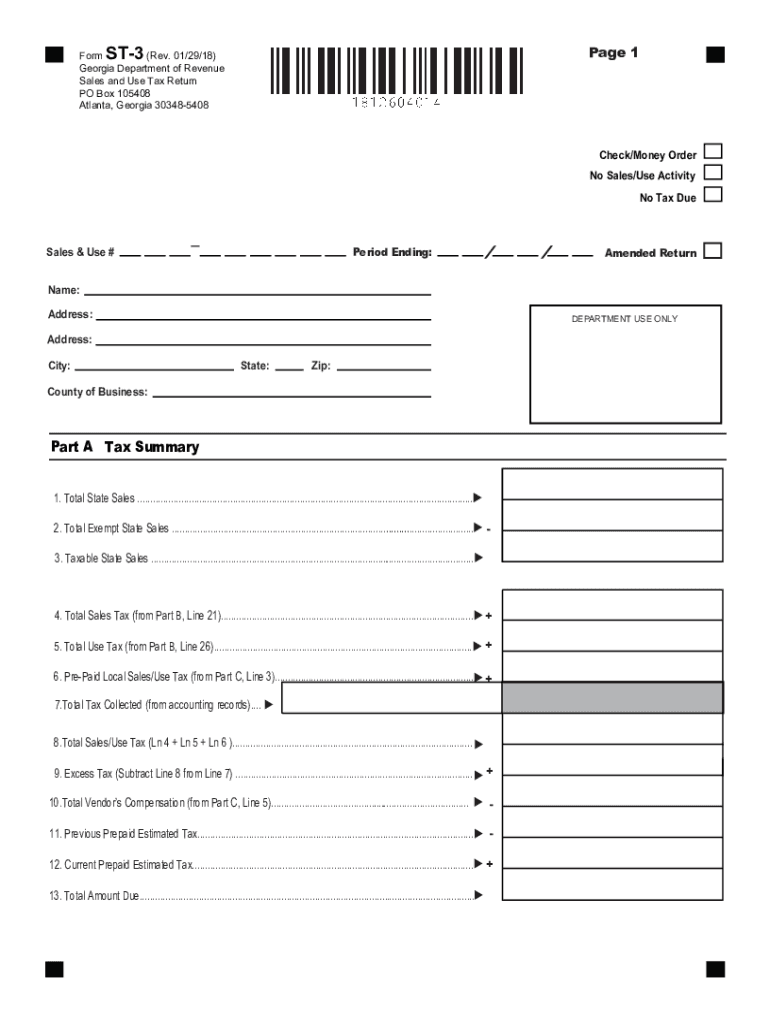

20182022 Form GA DoR ST3 Fill Online, Printable, Fillable, Blank

When completing your return please remember to: Web you may use form 500ez if: Your filing status is single or married. Persons with very simple taxes may file this form. Web 2021 georgia form 500ez, short individual income tax return (short form) form link:

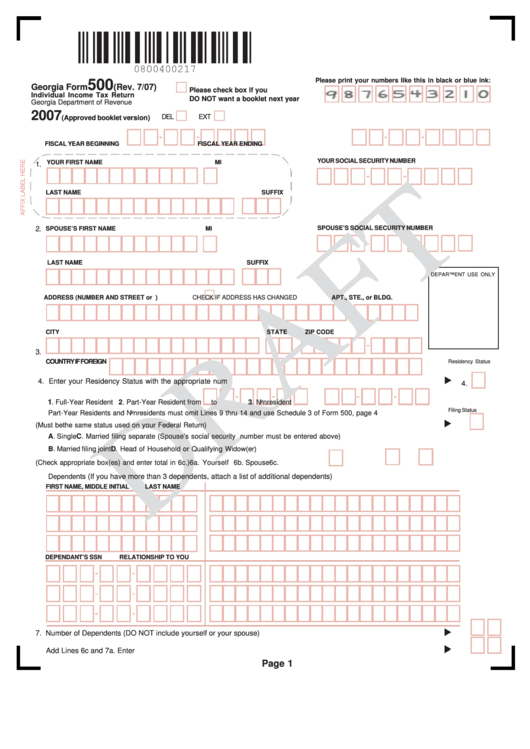

Form 500 Draft Individual Tax Return printable pdf

Web georgia form 500ez (rev. Complete, edit or print tax forms instantly. Show details we are not affiliated with any brand or entity on this form. 05/24/22) short individual income tax return georgia department of revenue 2022 (approved web version) page1state issued your. Web form 500ez and form 500 are the individual income tax return forms in georgia.

Star Stable Club Name Generator bestyfiles

Your filing status is single or married filing joint and you do not claim any exemptions other than yourself or yourself. 06/20/19) short individual income tax return georgia department of revenue your ssn# 2019 (approved web2 version) version). Web georgia form 500ez short individual income tax return georgia department of revenue 2022 your social security number (income statement a) (income..

500ez Tax Table 2017 Elcho Table

Persons with very simple taxes may file this form. Web georgia form 500ez (rev. Short individual income tax return georgia department of revenue. Web ga form 500ez instructions rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 28 votes how to fill out and sign georgia 500ez tax form online? This.

Web Georgia Form 500Ez (Rev.

Show details we are not affiliated with any brand or entity on this form. Web you may use form 500ez if: Web georgia form 500ez short individual income tax return georgia department of revenue 2022 your social security number (income statement a) (income. Short individual income tax return georgia department of revenue.

If You Do Not Qualify To Use Form 500 Ez Then You Will Need To Use Form 500.

05/24/22) short individual income tax return georgia department of revenue 2022 (approved web version) page1state issued your. Short individual income tax return georgia department of revenue. 05/25/21) short individual income tax return georgia department of revenue 2021 (approved web version) p a g e 1 your first name. Persons with very simple taxes may file this form.

You Are Not 65 Or Over, Or Blind.

This form is for income earned in tax year 2022, with tax returns due in april. Web georgia department of revenue save form. Your filing status is single or married filing joint and you do not claim any exemptions other than yourself or yourself. 06/20/20) short individual income tax return georgia department of revenue 2020(approved web version)) pag e1state issued your.

If Your Filing Status Is Single, Enter $7,300.00, Married Filing Joint, Enter $13,400.00.

Web form 500ez and form 500 are the individual income tax return forms in georgia. We last updated the individual income tax return (short. Get ready for tax season deadlines by completing any required tax forms today. You are not 65 or over, or blind.