5500 Form Due Date

5500 Form Due Date - The general rule is that form 5500s must be filed by the last day of the seventh. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Web by the 30th day after the due date. Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. The form 5500 due date for filing depends on the plan year. Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Get ready for tax season deadlines by completing any required tax forms today. Web form 5500 due date.

Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. Web by the 30th day after the due date. Get ready for tax season deadlines by completing any required tax forms today. Notes there is no limit for the grace period on a rejected. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. Complete, edit or print tax forms instantly. Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans? The general rule is that form 5500s must be filed by the last day of the seventh. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Web form 5500 due date.

Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Web form 5500 due date. If your plan has a short plan year. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for. The form 5500 due date for filing depends on the plan year. Get ready for tax season deadlines by completing any required tax forms today. Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. Complete, edit or print tax forms instantly. Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

The general rule is that form 5500s must be filed by the last day of the seventh. The form 5500 due date for filing depends on the plan year. Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. Complete, edit or print tax forms instantly. Web the extension automatically applies to.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Who should i contact with questions about a. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october,.

Retirement plan 5500 due date Early Retirement

Get ready for tax season deadlines by completing any required tax forms today. If your plan has a short plan year. Web form 5500 due date. Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans? Web this topic provides electronic filing opening day information and information.

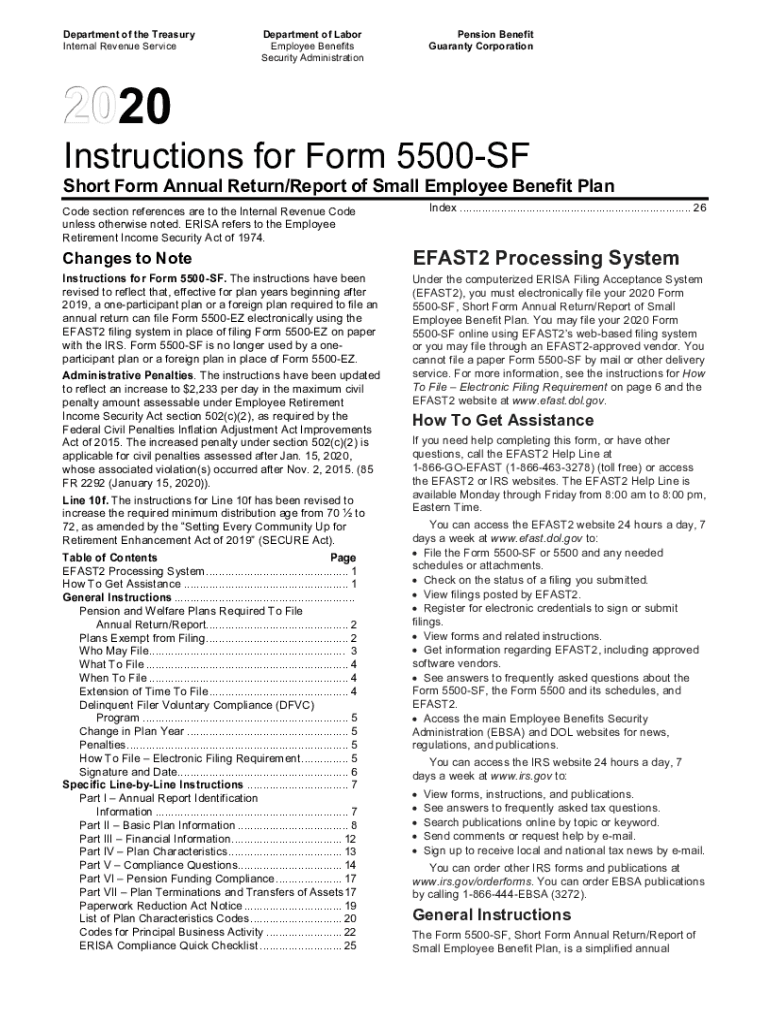

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

The general rule is that form 5500s must be filed by the last day of the seventh. Web form 5500 due date. If your plan has a short plan year. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the.

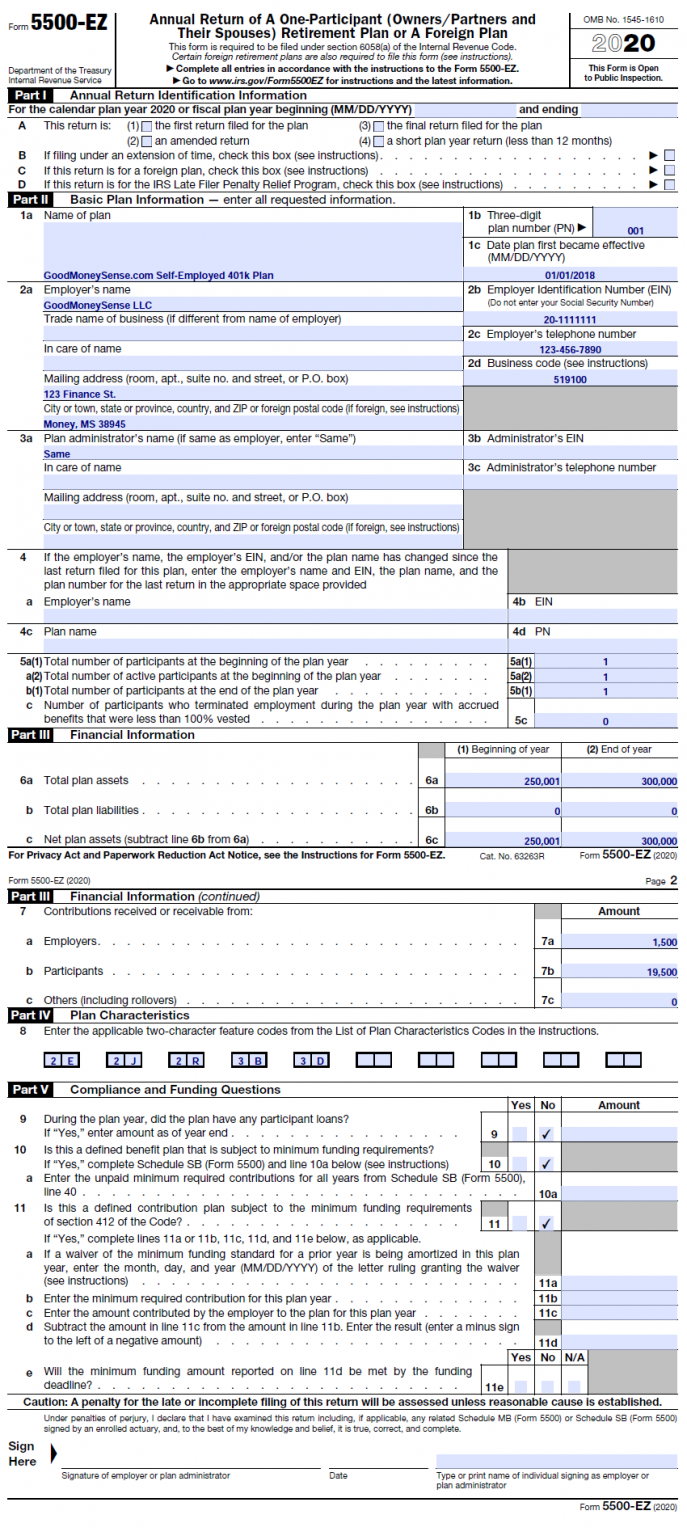

form 5500 instructions 2022 Fill Online, Printable, Fillable Blank

The form 5500 due date for filing depends on the plan year. Web form 5500 due date. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Complete, edit or print tax forms instantly. Notes.

Form 5500 Pdf Fillable and Editable PDF Template

Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Complete, edit or print tax forms instantly. The general rule is that form 5500s must be filed by the last day of the seventh. Who.

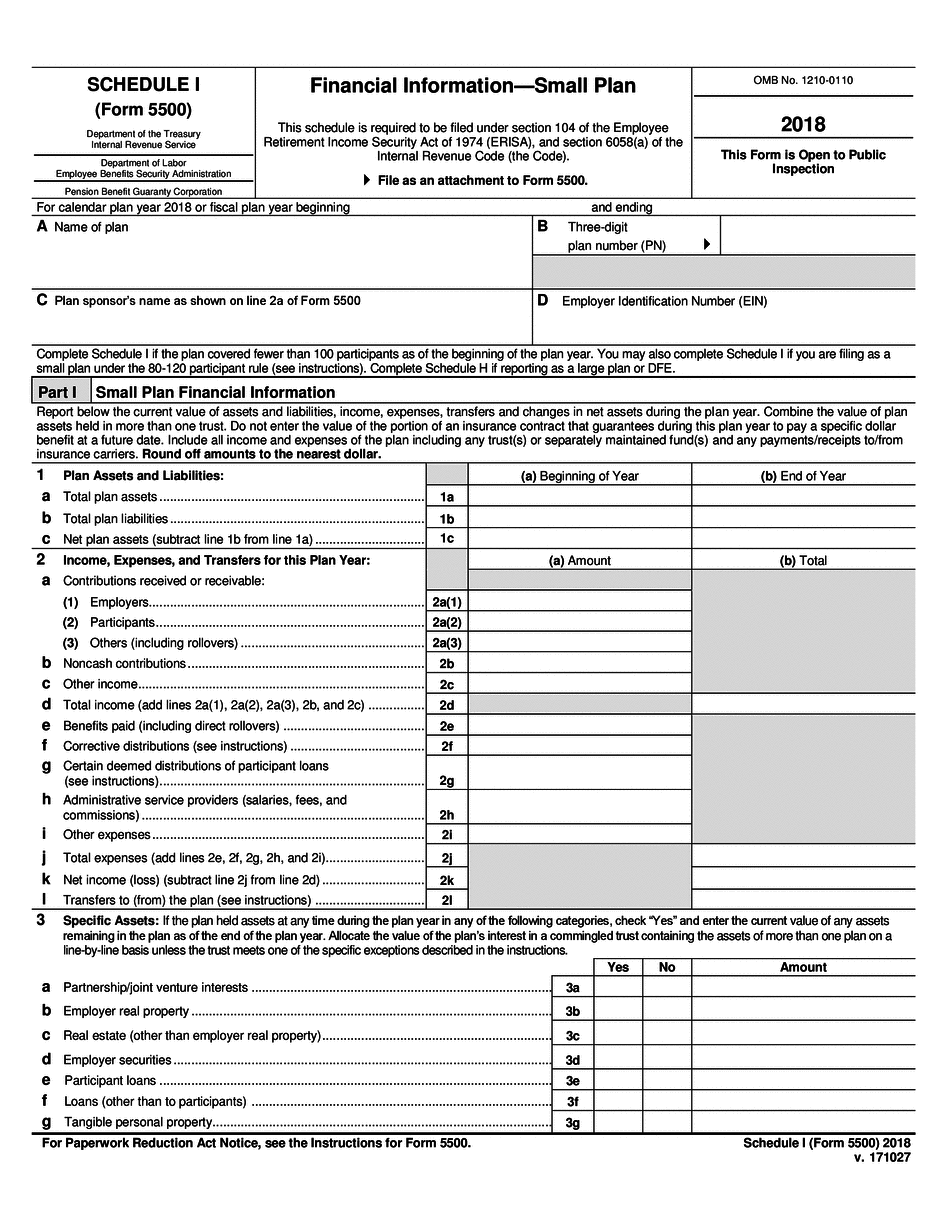

How to File Form 5500EZ Solo 401k

Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. The form 5500 due date for filing depends on the plan year. The general rule is that form 5500s must be filed by the last day of the seventh. Web form 5500 due date. Department of labor’s employee benefits security administration, the.

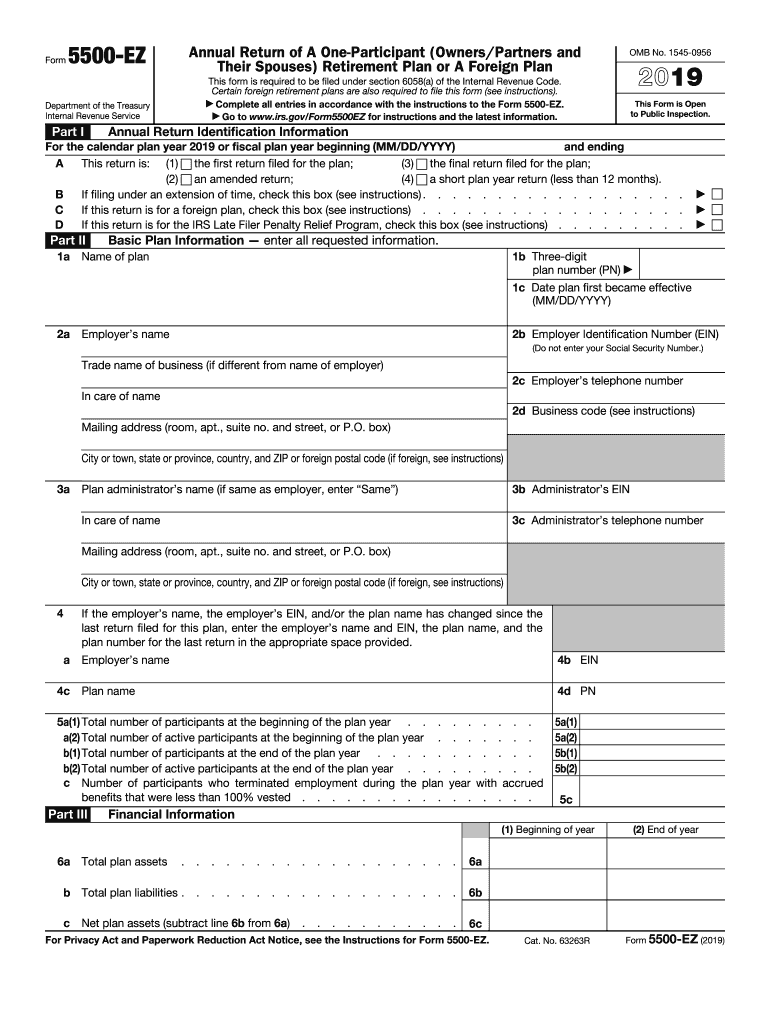

Form 5500 Instructions 5 Steps to Filing Correctly

Who should i contact with questions about a. The general rule is that form 5500s must be filed by the last day of the seventh. Complete, edit or print tax forms instantly. Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans? Web this topic provides electronic.

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Web form 5500 due date. The form 5500 due date for filing depends on the plan year. Notes there is no limit for the grace period on a rejected. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Who should i contact with questions about a.

Retirement plan 5500 due date Early Retirement

Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans? Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Get ready for tax.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Who should i contact with questions about a. Web form 5500 due date.

Department Of Labor’s Employee Benefits Security Administration, The Irs And The Pension Benefit Guaranty Corp.

Complete, edit or print tax forms instantly. The general rule is that form 5500s must be filed by the last day of the seventh. If your plan has a short plan year. Web the extension automatically applies to form 5500 filings for plan years that ended in september, october, or november 2019 because the regular due dates for.

Web Official Use Only 4 If The Name And/Or Ein Of The Plan Sponsor Has Changed Since The Last Return/Report Filed For This Plan, Enter The Name, Ein And The Plan Number From The Last.

Notes there is no limit for the grace period on a rejected. The form 5500 due date for filing depends on the plan year. Web by the 30th day after the due date. Web what you need to do you may want to frequently asked questions where can i get more information about employee benefit plans?