8995 Form 2020

8995 Form 2020 - Form 8995 and form 8995a. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Form 8995 is a simplified. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web use form 8995 if: Web irs has released two draft forms which are to be used to compute the qualified business income deduction under code sec. The draft forms are form. Web use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a patron of an agricultural or.

You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2020 taxable income before the qualified business. Web form 8995 is the simplified form and is used if all of the following are true: Web irs has released two draft forms which are to be used to compute the qualified business income deduction under code sec. Register and subscribe now to work on your irs instructions 8995 & more fillable forms. Web use form 8995 if: The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web dec 15, 2020 — information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. Complete, edit or print tax forms instantly. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Include the following schedules (their specific instructions are.

Form 8995 is a simplified. Complete, edit or print tax forms instantly. Web there are two ways to calculate the qbi deduction: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. Web to enter the qualified business loss carryover on form 8995, line 16, do the following: Web dec 15, 2020 — information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. Web form 8995 is the simplified form and is used if all of the following are true: Complete, edit or print tax forms instantly. Form 8995 and form 8995a.

Complete Janice's Form 8995 for 2019. Qualified Business

Web irs has released two draft forms which are to be used to compute the qualified business income deduction under code sec. Form 8995 and form 8995a. Web use form 8995 if: Web form 8995 is the simplified form and is used if all of the following are true: The individual has qualified business income (qbi), qualified reit dividends, or.

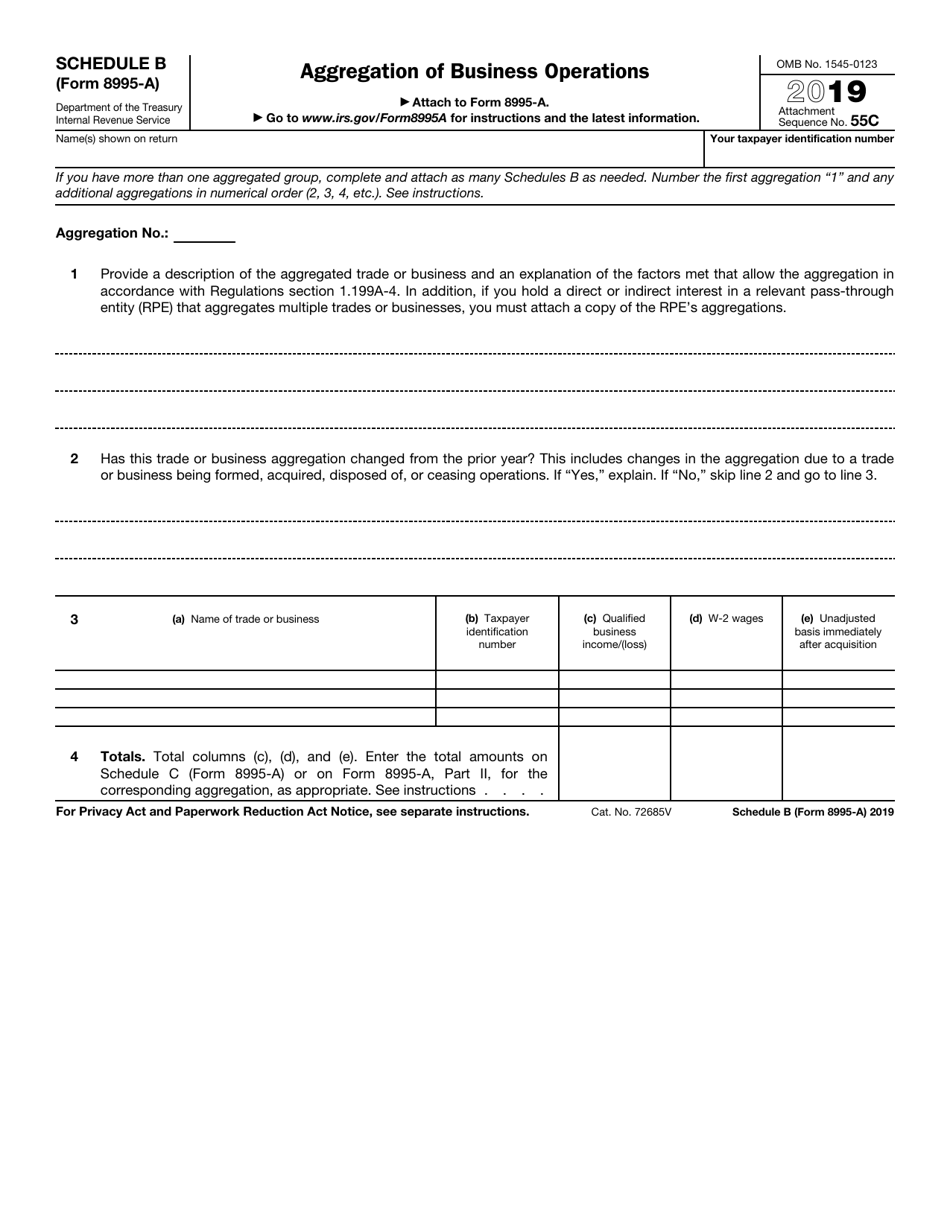

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Include the following schedules (their specific instructions are. Form 8995 is a simplified. Don’t worry about which form your return needs to use. Web there are two ways to calculate the qbi deduction:

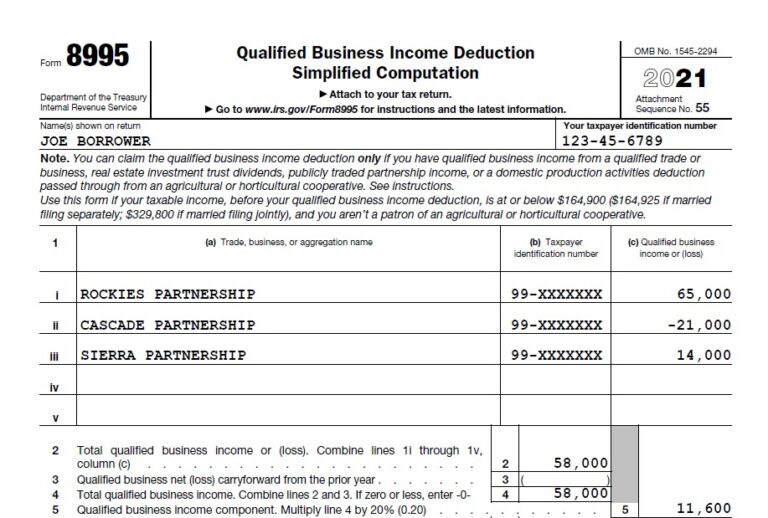

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Ad register and subscribe now to work on your irs instructions 8995 & more fillable forms. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. Form 8995 and form 8995a. Web use this form if your taxable income, before your qualified business income deduction, is above $163,300.

Using Form 8995 to Identify Your Borrower's K1s? Think Again! Bukers

You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2020 taxable income before the qualified business. Web there are two ways to calculate the qbi deduction: Web use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a patron of an agricultural.

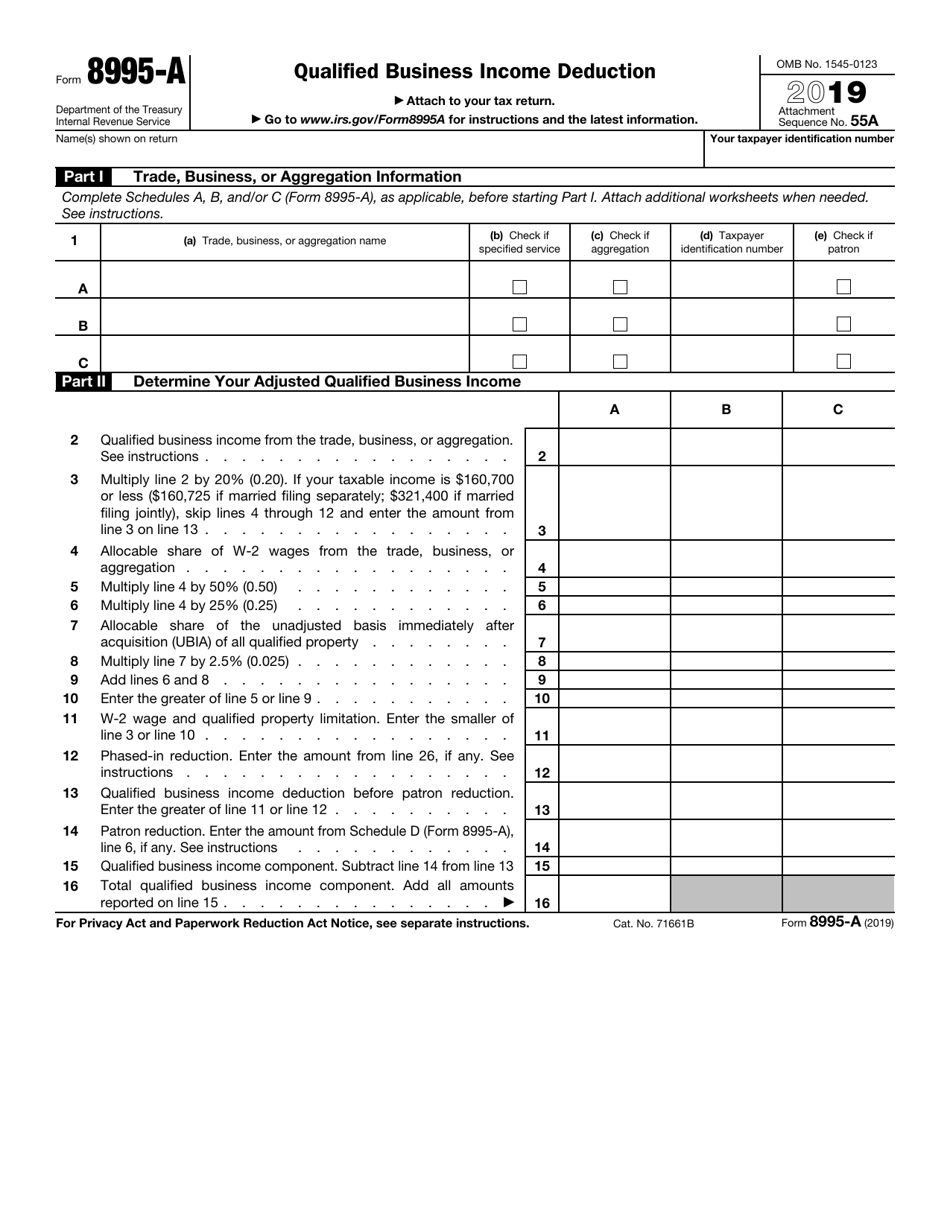

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Ad register and subscribe now to work on your irs instructions 8995 & more fillable forms. Don’t worry about which form your return needs to use. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. You have qualified business income, qualified reit dividends, or qualified ptp.

Fill Free fillable Form 2020 8995A Qualified Business

Web use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a patron of an agricultural or. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. Web dec 15, 2020 — information about.

I need help with Form 8995. I have highlighted the boxes in... Course

Web form 8995 is the simplified form and is used if all of the following are true: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Don’t worry about which form your return needs to use. Web to enter the qualified business loss carryover on form 8995, line.

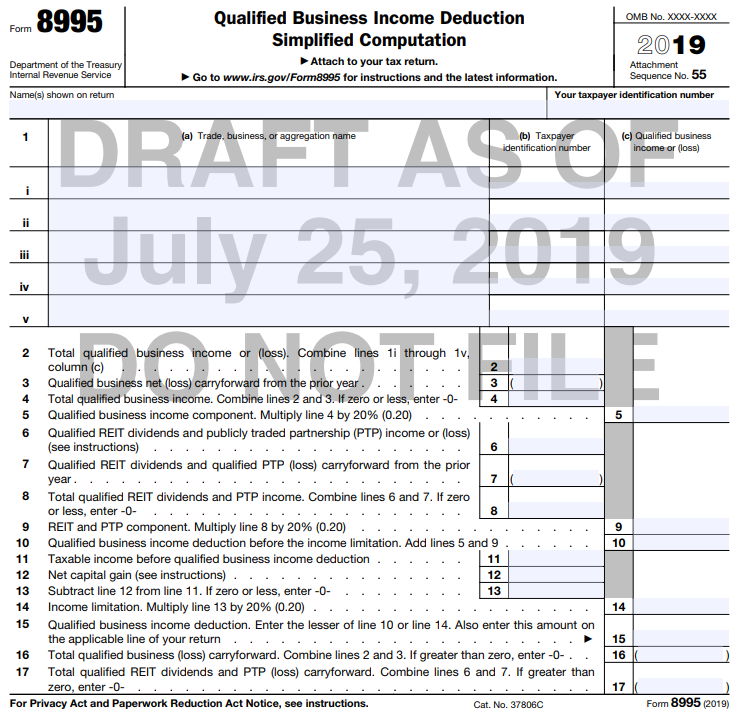

QBI gets 'formified'

Form 8995 is a simplified. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. Web information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. You have qualified business income, qualified reit dividends, or qualified.

Mason + Rich Blog NH’s CPA Blog

Web dec 15, 2020 — information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and. Include the following schedules (their specific instructions are. Web use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a patron of an agricultural or. Web.

Staying on Top of Changes to the 20 QBI Deduction (199A) One Year

Ad register and subscribe now to work on your irs instructions 8995 & more fillable forms. Web to enter the qualified business loss carryover on form 8995, line 16, do the following: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. The individual has qualified business income (qbi),.

Include The Following Schedules (Their Specific Instructions Are.

The draft forms are form. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Register and subscribe now to work on your irs instructions 8995 & more fillable forms.

Web Use Form 8995 If:

Ad register and subscribe now to work on your irs instructions 8995 & more fillable forms. Web to enter the qualified business loss carryover on form 8995, line 16, do the following: Web use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a patron of an agricultural or. Form 8995 and form 8995a.

Form 8995 Is A Simplified.

Web there are two ways to calculate the qbi deduction: Web irs has released two draft forms which are to be used to compute the qualified business income deduction under code sec. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web dec 15, 2020 — information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and.

Web Form 8995 Department Of The Treasury Internal Revenue Service Qualified Business Income Deduction Simplified Computation Attach To Your Tax Return.

You have qualified business income, qualified reit dividends, or qualified ptp income (loss), your 2020 taxable income before the qualified business. Web the draft instructions for 2020 form 8995, qualified business income deduction simplified computation, contain a change that indicates that irs no longer. Don’t worry about which form your return needs to use. Web form 8995 is the simplified form and is used if all of the following are true: