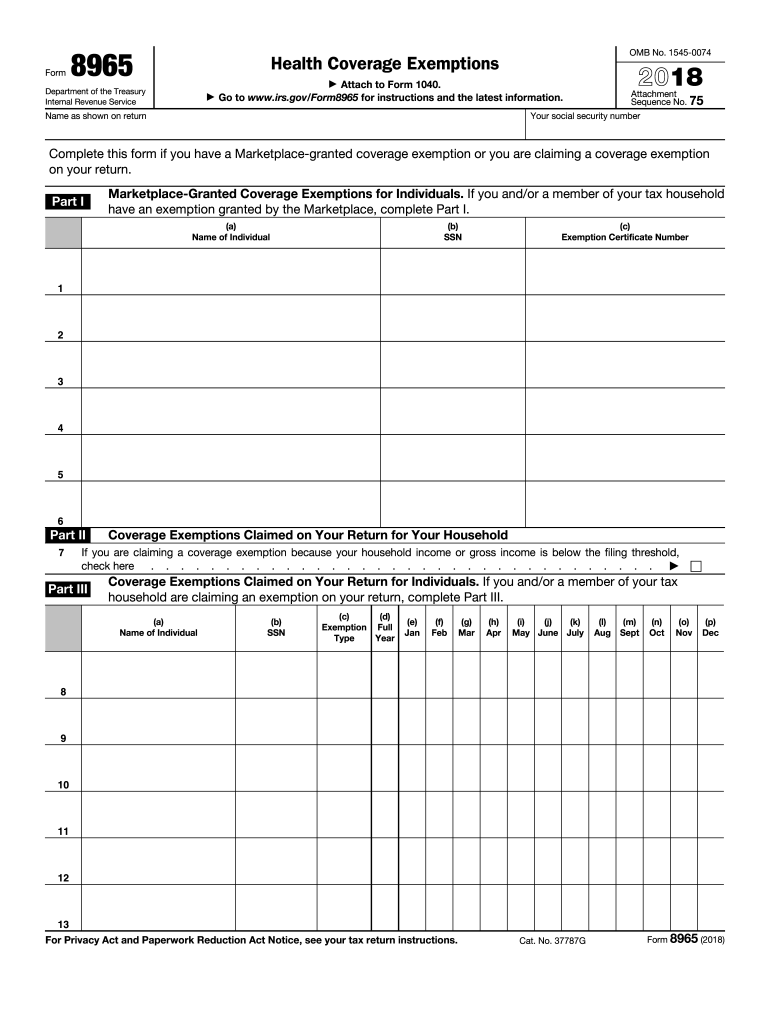

8995 Tax Form

8995 Tax Form - Web one such document is the federal tax form 8995, which is required for taxpayers who want to claim the qualified business income deduction. Income tax return for estates and trusts. The computation of the federal qualified business income. Web when mailing your federal amended return, you will need to send the following: The document pertains to calculating and documenting the. Web see the instructions for form 1041, u.s. Web the irs form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. Web 8995 federal — qualified business income deduction simplified computation download this form print this form it appears you don't have a pdf plugin for this browser. Web form 8995 is the simplified form and is used if all of the following are true: Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return.

Web what is the purpose of the irs form 8995, and when do you need to use it? Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Income tax return for estates and trusts. Web the irs form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. The document pertains to calculating and documenting the. Web get the 8995 tax form and fill out qbid for the 2022 year. Deduction as if the affected business entity was. This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass. In this article, we will walk you through. Web we are sending you letter 12c because we need more information to process your individual income tax return.

It has four parts and four additional schedules designed to help. Web see the instructions for form 1041, u.s. Web what is form 8995? Web what is the purpose of the irs form 8995, and when do you need to use it? Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Complete, edit or print tax forms instantly. Web get the 8995 tax form and fill out qbid for the 2022 year. Web we are sending you letter 12c because we need more information to process your individual income tax return. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). In this article, we will walk you through.

Form 8995 Fill Out and Sign Printable PDF Template signNow

The document pertains to calculating and documenting the. Complete, edit or print tax forms instantly. Ad register and subscribe now to work on your irs qualified business income deduction form. Web what is the purpose of the irs form 8995, and when do you need to use it? Web one such document is the federal tax form 8995, which is.

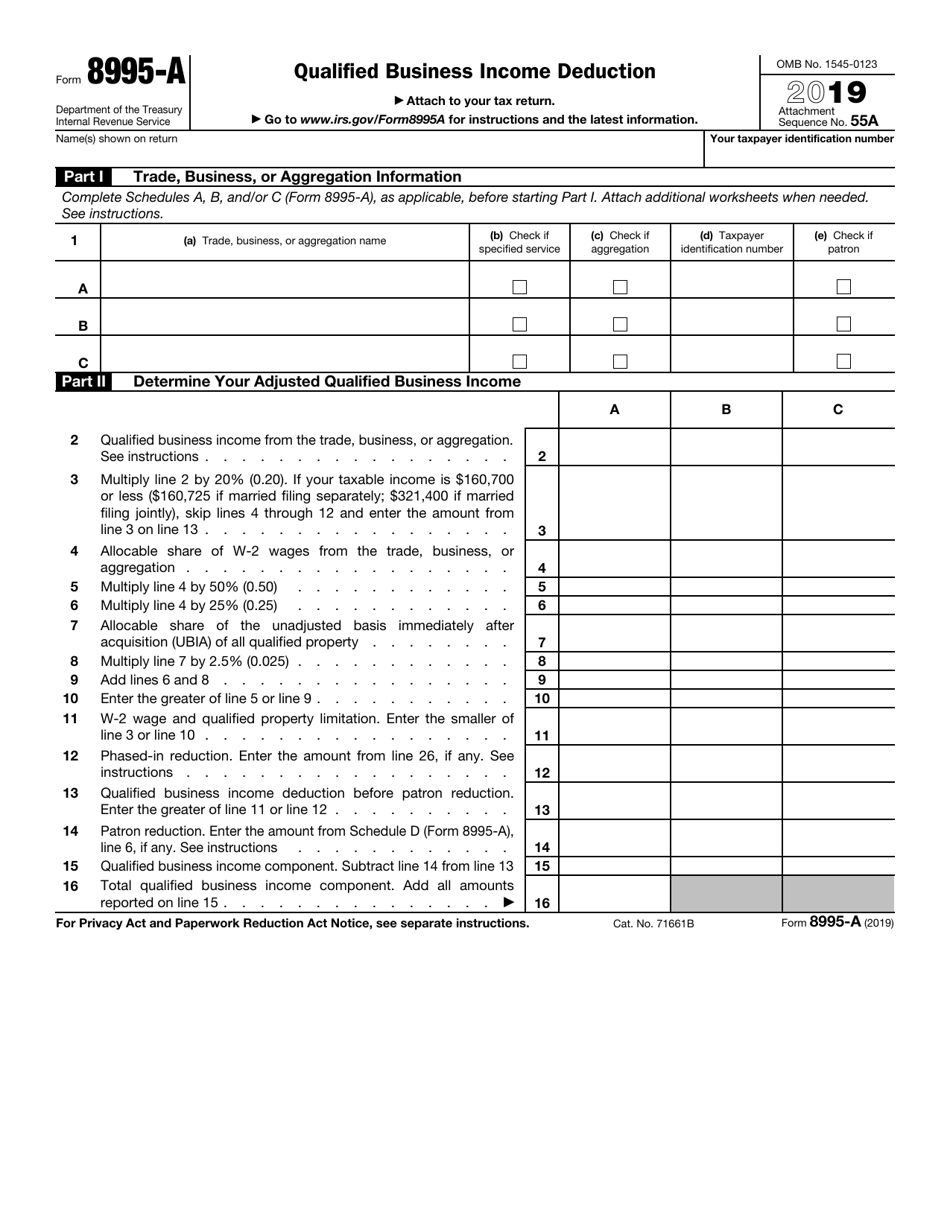

What is Form 8995A? TurboTax Tax Tips & Videos

Web get the 8995 tax form and fill out qbid for the 2022 year. Web the irs form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. Complete, edit or print tax forms instantly. Ad register and subscribe now to work on your irs qualified business income deduction form. Web see the instructions for.

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Web the irs form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. Ad register and subscribe now to work on your irs 8995 & more fillable forms. The computation of the federal qualified business income. Web form 8995 is the simplified form and is used if all of the following are true: Web.

QBI gets 'formified'

This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass. It has four parts and four additional schedules designed to help. Income tax return for estates and trusts. Complete, edit or print tax forms instantly. Web what is the purpose of the irs form 8995, and when do you need to use it?

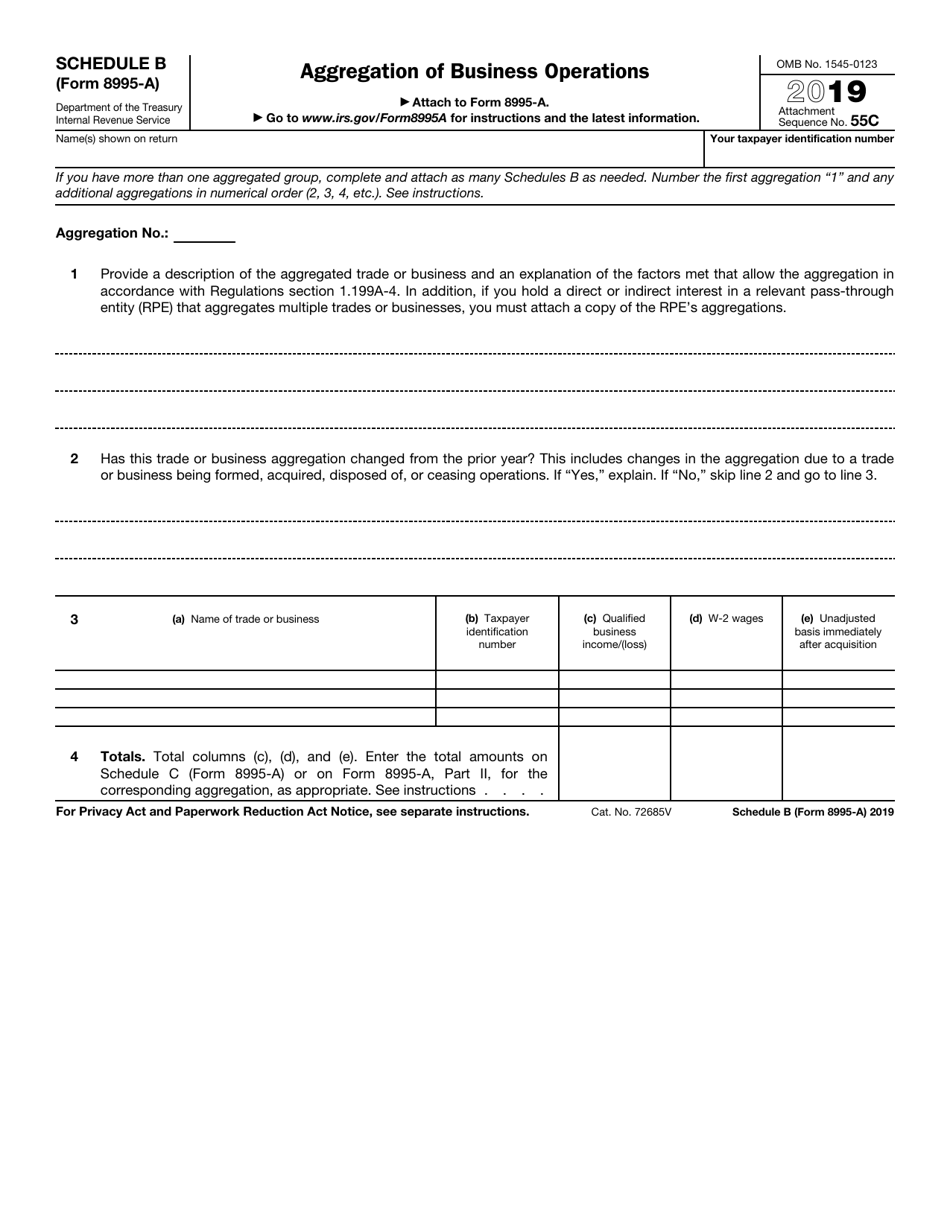

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Web see the instructions for form 1041, u.s. Complete, edit or print tax forms instantly. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web what is form 8995? This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass.

IRS Form 8995 Instructions Your Simplified QBI Deduction

It has four parts and four additional schedules designed to help. Ad register and subscribe now to work on your irs qualified business income deduction form. In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Deduction as if the affected business entity was. Income tax return for estates and trusts.

Staying on Top of Changes to the 20 QBI Deduction (199A) One Year

The newest instructions for business owners & examples. Web the irs form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web what is form 8995? Web form 8995 is the simplified form and is used if all of.

Other Version Form 8995A 8995 Form Product Blog

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web when mailing your federal amended return, you will need to send the following: Electing small business trusts (esbt). In this article, we will walk you through. The document pertains to calculating and documenting the.

Form 8995 Basics & Beyond

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). The computation of the federal qualified business income. In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Electing small business trusts (esbt). Web when mailing your federal amended return, you will need to.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

The newest instructions for business owners & examples. Web form 8995 is the simplified form and is used if all of the following are true: The computation of the federal qualified business income. An esbt must compute the qbi deduction separately for. Web see the instructions for form 1041, u.s.

Web See The Instructions For Form 1041, U.s.

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp income or. Web what is the purpose of the irs form 8995, and when do you need to use it? In order to understand form 8995, business owners should first understand the qualified business income tax (qbit) deduction. Web we are sending you letter 12c because we need more information to process your individual income tax return.

Web What Is Form 8995?

Complete, edit or print tax forms instantly. The document pertains to calculating and documenting the. Web the missouri department of revenue administers missouri's business tax laws, and collects sales and use tax, employer withholding, motor fuel tax, cigarette tax, financial. Ad register and subscribe now to work on your irs 8995 & more fillable forms.

Ad Register And Subscribe Now To Work On Your Irs Qualified Business Income Deduction Form.

Web get the 8995 tax form and fill out qbid for the 2022 year. Web the irs form 8995 is a crucial income tax document that taxpayers need to understand and complete accurately. Web 8995 federal — qualified business income deduction simplified computation download this form print this form it appears you don't have a pdf plugin for this browser. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid).

Web Form 8995 Department Of The Treasury Internal Revenue Service Qualified Business Income Deduction Simplified Computation Attach To Your Tax Return.

Web when mailing your federal amended return, you will need to send the following: This form calculates the qualified business income (qbi) deduction for eligible taxpayers with pass. The computation of the federal qualified business income. In this article, we will walk you through.