941 Form B

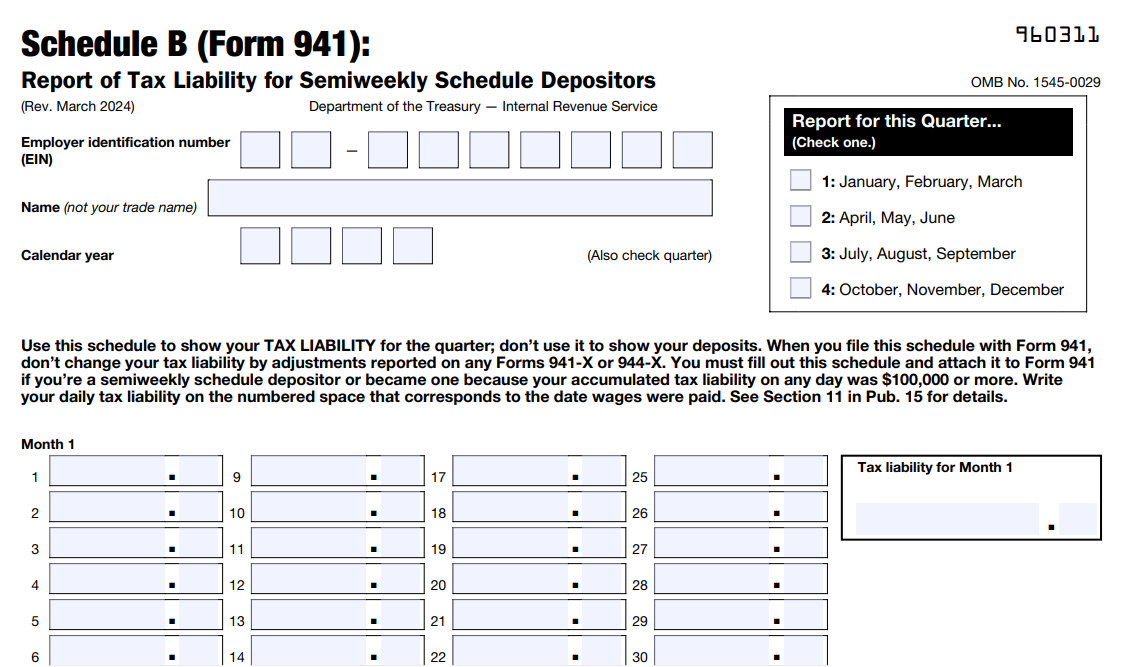

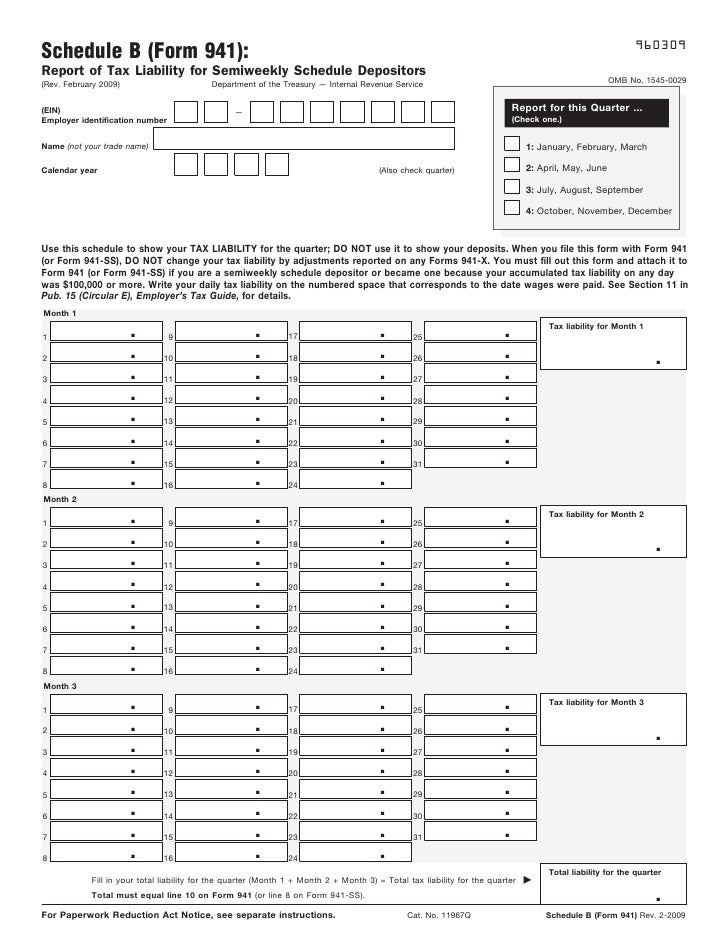

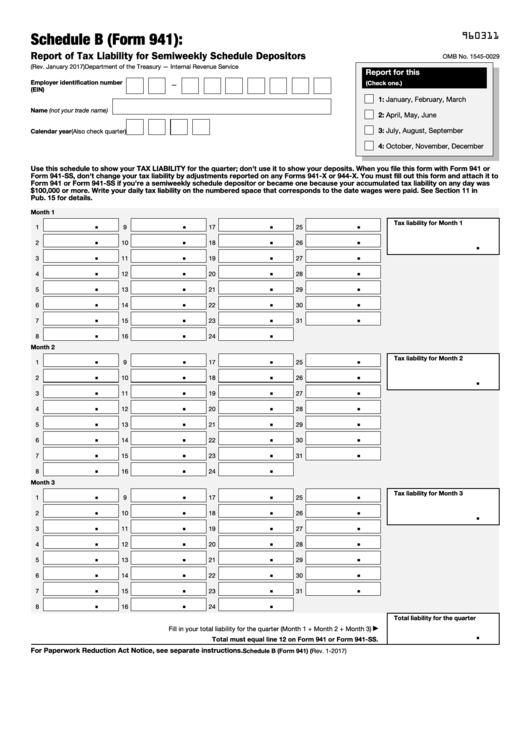

941 Form B - Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll tax credit. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Reported more than $50,000 of employment taxes in the lookback period. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Installment agreement request popular for tax pros; Schedule b specifically deals with reporting federal income tax, social security tax, and medicare tax withheld from the employee’s pay. Employers engaged in a trade or business who pay compensation form 9465; Web schedule b (form 941): The instructions are 19 pages long.

Your tax liability is based on the dates wages were paid. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. The federal income tax you withheld from your employees' pay, and both employee and employer social security and medicare taxes. See deposit penalties in section 11 of pub. Web what is schedule b (form 941)? Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. January 2017) department of the treasury — internal revenue service. Report of tax liability for semiweekly schedule depositors (rev. The instructions are 19 pages long. Don’t use schedule b to show federal tax deposits.

Employer identification number (ein) — name (not your trade name) calendar year (also check quarter) report for this quarter. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. The irs released two drafts of the 941 instructions and released the final instructions on june 26. You are a semiweekly depositor if you: Installment agreement request popular for tax pros; If you don’t have an ein, you may apply for one online by Web on schedule b, list your tax liability for each day. Don’t use schedule b to show federal tax deposits. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well. Web file schedule b (form 941) if you are a semiweekly schedule depositor.

Form 941 Schedule B YouTube

Web schedule b (form 941): Your tax liability is based on the dates wages were paid. Reported more than $50,000 of employment taxes in the lookback period. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well..

File 941 Online How to File 2023 Form 941 electronically

Form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. If you don’t have an ein, you may apply for one online by Your tax liability is based on the dates wages were paid. Completes schedule b (form 941) by reducing the amount of liability entered.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

The prior version was 12 pages. See deposit penalties in section 11 of pub. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. Employers engaged in a trade or business who pay compensation form 9465; The irs released two drafts of the 941 instructions and released the final instructions on.

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

This will help taxpayers feel more prepared when it. You are a semiweekly depositor if you: The instructions are 19 pages long. The updated form 941 (employer’s quarterly federal tax return) was released on june 19, 2020. The irs released two drafts of the 941 instructions and released the final instructions on june 26.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Web instructions for form 941. The updated form 941 (employer’s quarterly federal tax return) was released on june 19, 2020. Reported more than $50,000 of employment taxes in the lookback period. Web schedule b (form 941): Schedule b specifically deals with reporting federal income tax, social security tax, and medicare tax withheld from the employee’s pay.

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Web what is schedule b (form 941)? Specific instructions box 1—employer identification number (ein). Schedule b (form 941) pdf instructions for schedule b. If you don’t have an ein, you may apply for one online by The irs released two drafts of the 941 instructions and released the final instructions on june 26.

How to File Schedule B for Form 941

Specific instructions box 1—employer identification number (ein). Completes schedule b (form 941) by reducing the amount of liability entered for the first payroll payment in the third quarter of 2023 that includes wages subject to social security tax by the lesser of (1) its share of social security tax (up to $250,000) on the wages, or (2) the available payroll.

What is Form 941 Schedule B, Who Should Complete It? Blog TaxBandits

Web file schedule b (form 941) if you are a semiweekly schedule depositor. Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. This will help taxpayers feel more prepared when it. The updated form 941 (employer’s quarterly federal tax return) was released on june 19, 2020. Web on schedule b,.

Schedule B 941 Create A Digital Sample in PDF

Web what is schedule b (form 941)? The irs released two drafts of the 941 instructions and released the final instructions on june 26. You are a semiweekly depositor if you: The prior version was 12 pages. The federal income tax you withheld from your employees' pay, and both employee and employer social security and medicare taxes.

Fillable Schedule B (Form 941) Report Of Tax Liability For Semiweekly

Schedule b specifically deals with reporting federal income tax, social security tax, and medicare tax withheld from the employee’s pay. If you don’t have an ein, you may apply for one online by However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Installment agreement request popular for tax pros;.

Employer Identification Number (Ein) — Name (Not Your Trade Name) Calendar Year (Also Check Quarter) Report For This Quarter.

However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. See deposit penalties in section 11 of pub. Web instructions for form 941. Web on schedule b, list your tax liability for each day.

Web What Is Schedule B (Form 941)?

Don’t use schedule b to show federal tax deposits. Schedule b specifically deals with reporting federal income tax, social security tax, and medicare tax withheld from the employee’s pay. Employers engaged in a trade or business who pay compensation form 9465; The prior version was 12 pages.

Web File Schedule B (Form 941) If You Are A Semiweekly Schedule Depositor.

The irs released two drafts of the 941 instructions and released the final instructions on june 26. If you don’t have an ein, you may apply for one online by Web schedule b (form 941): Accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year.

Web Irs Form 941, Also Known As The Employer’s Quarterly Federal Tax Return, Is Where Businesses Report The Income Taxes And Payroll Taxes That They Withheld From Their Employees’ Wages — As Well.

Report of tax liability for semiweekly schedule depositors (rev. The updated form 941 (employer’s quarterly federal tax return) was released on june 19, 2020. Reported more than $50,000 of employment taxes in the lookback period. Form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes.