Aetna 1095 Form

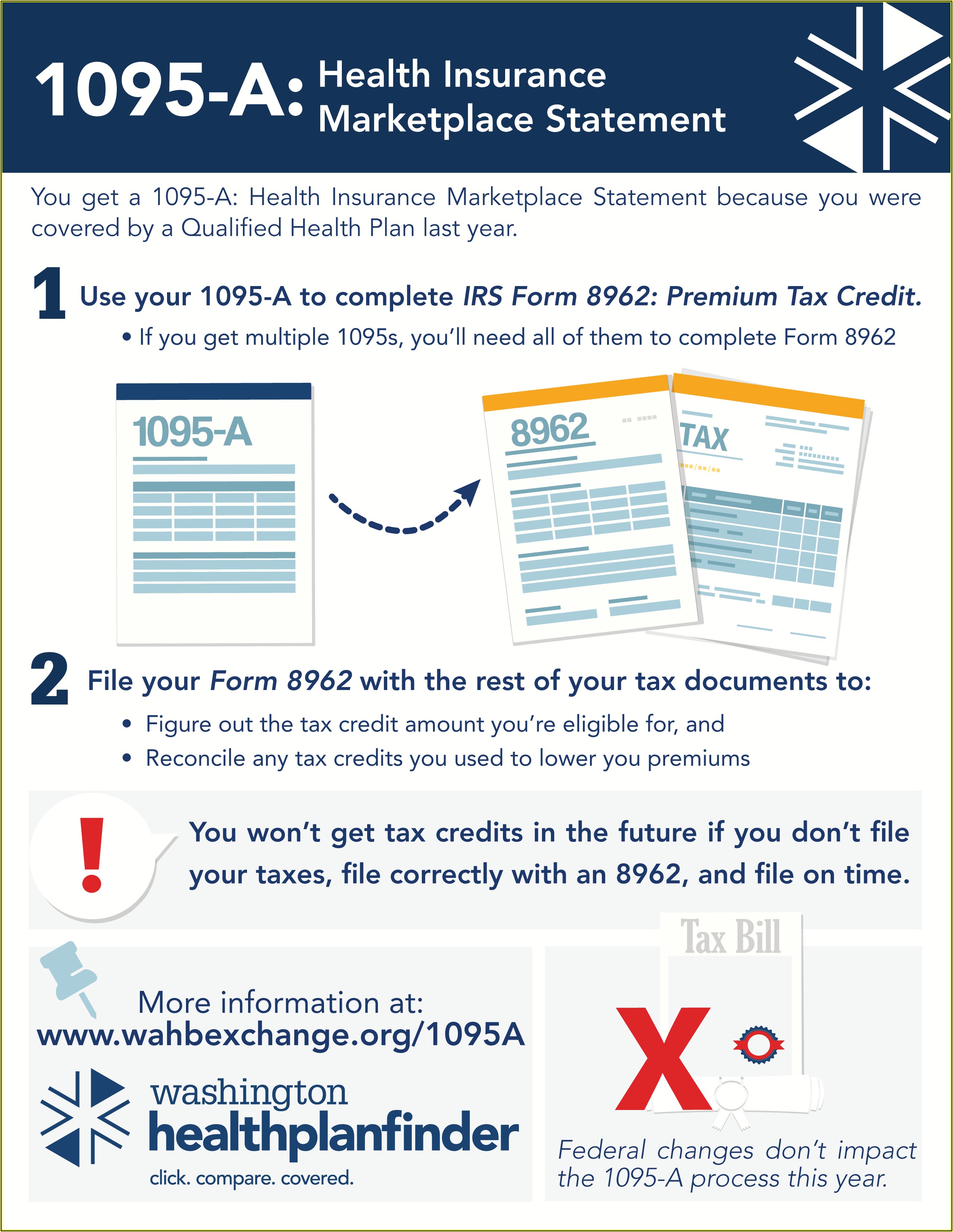

Aetna 1095 Form - Easily fill out pdf blank, edit, and sign them. Web log in to your healthcare.gov account. The 1095 form is a health insurance tax form which reports the type of coverage you had and the period of coverage for the prior year. Under your existing applications, select your 2022not your 2023 application. Web follow this straightforward instruction to edit aetna 1095 form in pdf format online at no cost: Web you’ll need it to complete form 8962, premium tax credit. Web complete aetna medical benefits request form online with us legal forms. Log into member website at www.aetna.com using your secure member login name and. Sign up and sign in. You should get it on or before january 31.

Web find the forms and documents you need. Under your existing applications, select your 2022not your 2023 application. Log into member website at www.aetna.com using your secure member login name and. Easily fill out pdf blank, edit, and sign them. Web complete aetna medical benefits request form online with us legal forms. Web faster, easier submission of claims, the provider may contact the aetna claim processing center for information regarding. Spending/savings account reimbursement (fsa, hra & hsa). Select “tax forms” from the menu on the left. Web you’ll need it to complete form 8962, premium tax credit. The 1095 form is a health insurance tax form which reports the type of coverage you had and the period of coverage for the prior year.

Under your existing applications, select your 2022not your 2023 application. Web you’ll need it to complete form 8962, premium tax credit. Did you receive a tax form 1095b in the mail from aetna, your health insurance carrier, and are wondering what to do with it? Web follow this straightforward instruction to edit aetna 1095 form in pdf format online at no cost: Save or instantly send your ready documents. This form is absolutely required for taxpayers who. Medical, dental & vision claim forms. Web log in to your healthcare.gov account. Web find the forms and documents you need. Web instructions for tax form 1095b.

Affordable Care Act (ACA) forms mailed News Illinois State

Web you’ll need it to complete form 8962, premium tax credit. This form is absolutely required for taxpayers who. Did you receive a tax form 1095b in the mail from aetna, your health insurance carrier, and are wondering what to do with it? Please be prepared to submit authorization to. Web instructions for tax form 1095b.

Aetna 1095 Form Fill Online, Printable, Fillable, Blank pdfFiller

Page last reviewed or updated: Save or instantly send your ready documents. Web find the forms and documents you need. Under your existing applications, select your 2022not your 2023 application. Web instructions for tax form 1095b.

78 MEDICAL FORM 1095A MedicalForm

Web follow this straightforward instruction to edit aetna 1095 form in pdf format online at no cost: This form is absolutely required for taxpayers who. Irs to report certain information about. Log into member website at www.aetna.com using your secure member login name and. Web you’ll need it to complete form 8962, premium tax credit.

Benefits Longmeadow, MA

Sign up and sign in. Please be prepared to submit authorization to. You should wait to file your income tax. Page last reviewed or updated: Web complete aetna medical benefits request form online with us legal forms.

What is Form 1095? Infographic Health insurance cost, Health

Please be prepared to submit authorization to. Web complete aetna medical benefits request form online with us legal forms. Save or instantly send your ready documents. Web instructions for tax form 1095b. Web find the forms and documents you need.

Form 1095C

Web complete aetna medical benefits request form online with us legal forms. The 1095 form is a health insurance tax form which reports the type of coverage you had and the period of coverage for the prior year. Log into member website at www.aetna.com using your secure member login name and. Select “tax forms” from the menu on the left..

Aetna 1095 B amulette

Web find the forms and documents you need. Page last reviewed or updated: Save or instantly send your ready documents. Log into member website at www.aetna.com using your secure member login name and. Web faster, easier submission of claims, the provider may contact the aetna claim processing center for information regarding.

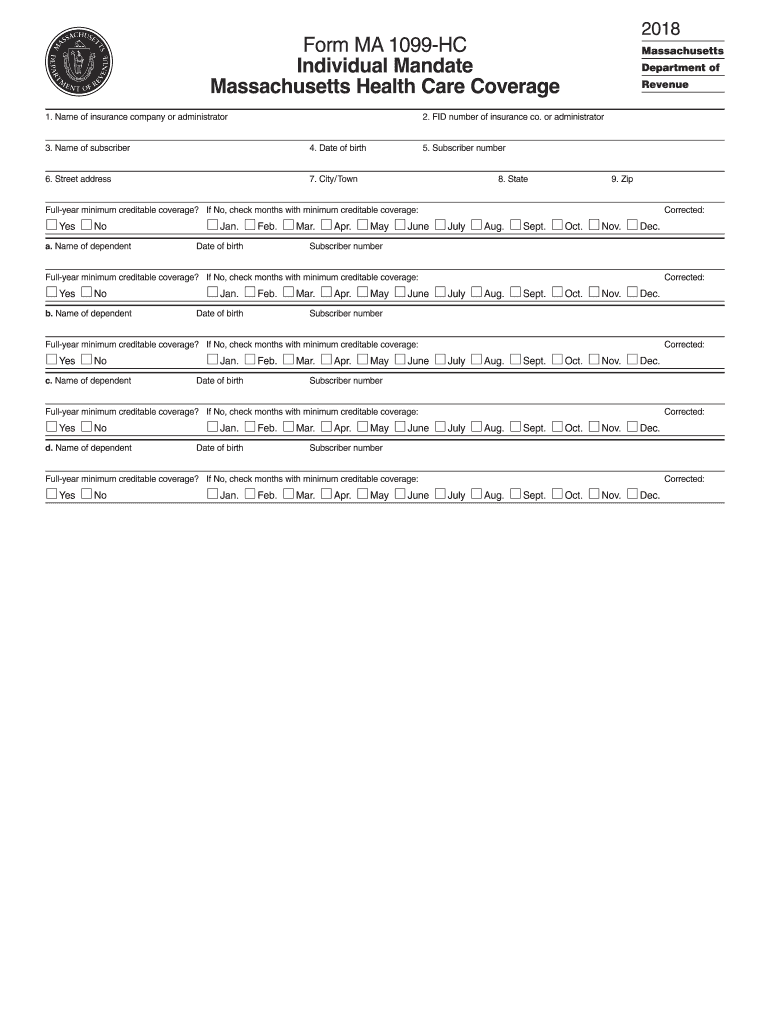

Aetna 1099 Hc Form Fill Out and Sign Printable PDF Template signNow

Web log in to your healthcare.gov account. Sign up and sign in. Web find the forms and documents you need. Web faster, easier submission of claims, the provider may contact the aetna claim processing center for information regarding. Did you receive a tax form 1095b in the mail from aetna, your health insurance carrier, and are wondering what to do.

Www.healthcare.gov Form 1095 A Form Resume Examples BpV5WAba91

Web instructions for tax form 1095b. Irs to report certain information about. Register for a free account, set a strong password, and. Under your existing applications, select your 2022not your 2023 application. Web complete aetna medical benefits request form online with us legal forms.

Log Into Member Website At Www.aetna.com Using Your Secure Member Login Name And.

Medical, dental & vision claim forms. Web follow this straightforward instruction to edit aetna 1095 form in pdf format online at no cost: This form is absolutely required for taxpayers who. Web instructions for tax form 1095b.

You Should Wait To File Your Income Tax.

Under your existing applications, select your 2022not your 2023 application. Web find the forms and documents you need. Select “tax forms” from the menu on the left. You should get it on or before january 31.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web complete aetna medical benefits request form online with us legal forms. Page last reviewed or updated: Register for a free account, set a strong password, and. Web log in to your healthcare.gov account.

Sign Up And Sign In.

Please be prepared to submit authorization to. Save or instantly send your ready documents. The 1095 form is a health insurance tax form which reports the type of coverage you had and the period of coverage for the prior year. Spending/savings account reimbursement (fsa, hra & hsa).