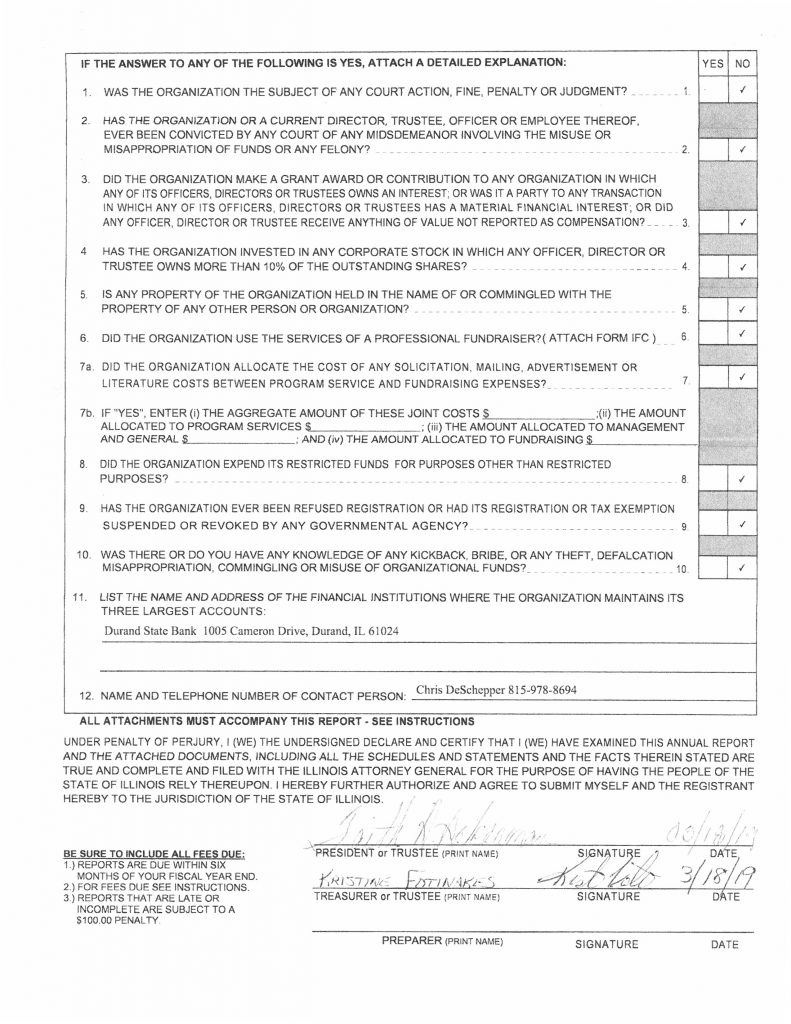

Ag990-Il Form

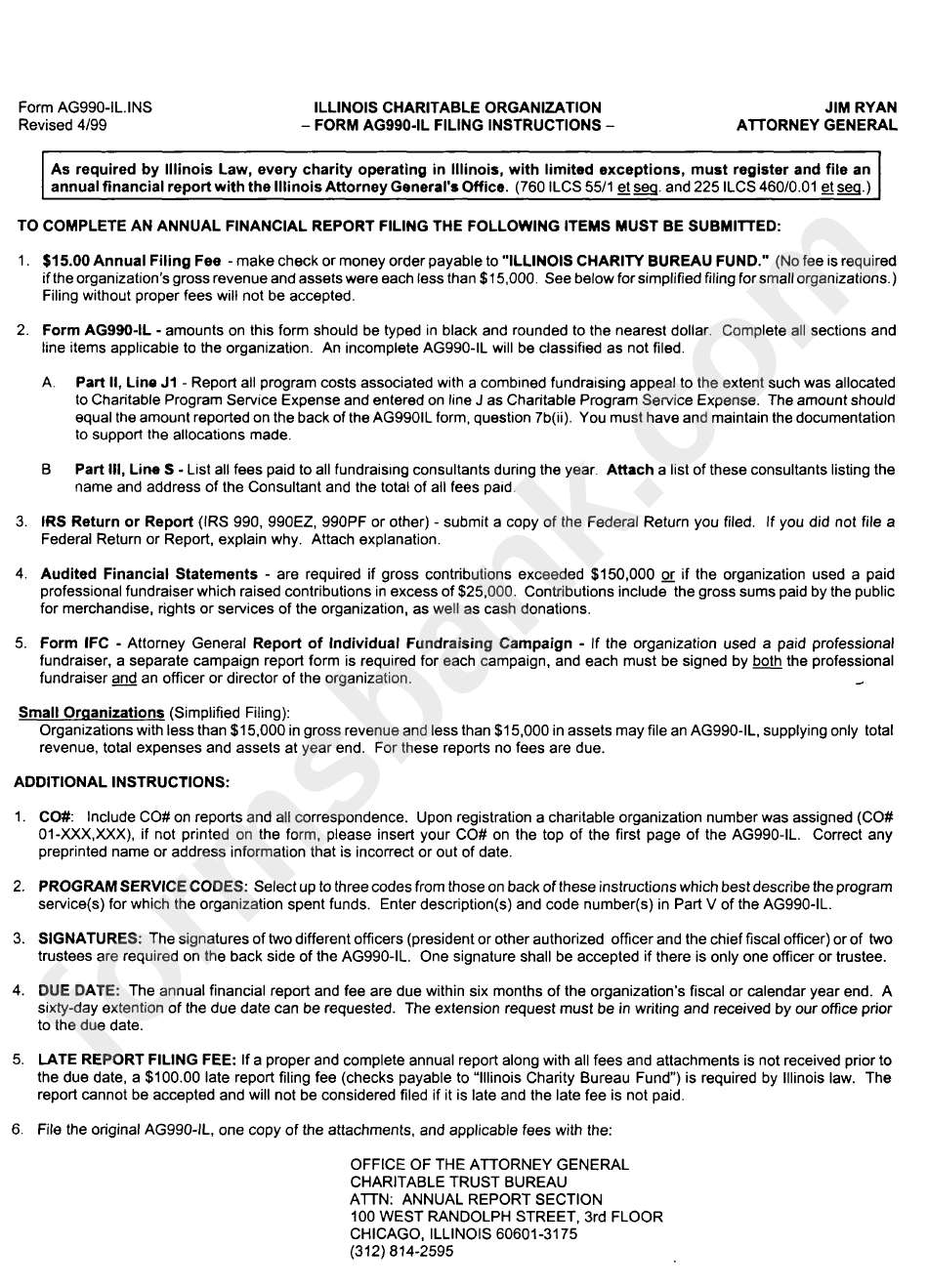

Ag990-Il Form - Illinois charitable organization annual report form. Reports should also include audited financial statements if the charity’s annual gross contributions exceed $300,000 or it used a paid professional fundraiser that raised contributions in excess of $25,000. Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses r) net received by the charity (p. Charity annual report extensions these are the instructions for requesting and receiving. Summary of all revenue items during the year: Once completed you can sign your fillable form or send for signing. Web we would like to show you a description here but the site won’t allow us. And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Illinois charitable organization annual report (lake land college) form is 2 pages long and contains:

Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: See 6 below for simplified filing option for small organizations. Illinois charitable organization annual report form. And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Charity annual report extensions these are the instructions for requesting and receiving. Web summary of all paid fundraiser and consultant activities: Once completed you can sign your fillable form or send for signing. Reports should also include audited financial statements if the charity’s annual gross contributions exceed $300,000 or it used a paid professional fundraiser that raised contributions in excess of $25,000. Web we would like to show you a description here but the site won’t allow us.

All forms are printable and downloadable. Illinois charitable organization annual report form. Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: Charity annual report extensions these are the instructions for requesting and receiving. See 6 below for simplified filing option for small organizations. Forms for lake land college browse lake land college forms Reports should also include audited financial statements if the charity’s annual gross contributions exceed $300,000 or it used a paid professional fundraiser that raised contributions in excess of $25,000. Web summary of all paid fundraiser and consultant activities: Web we would like to show you a description here but the site won’t allow us. Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed.

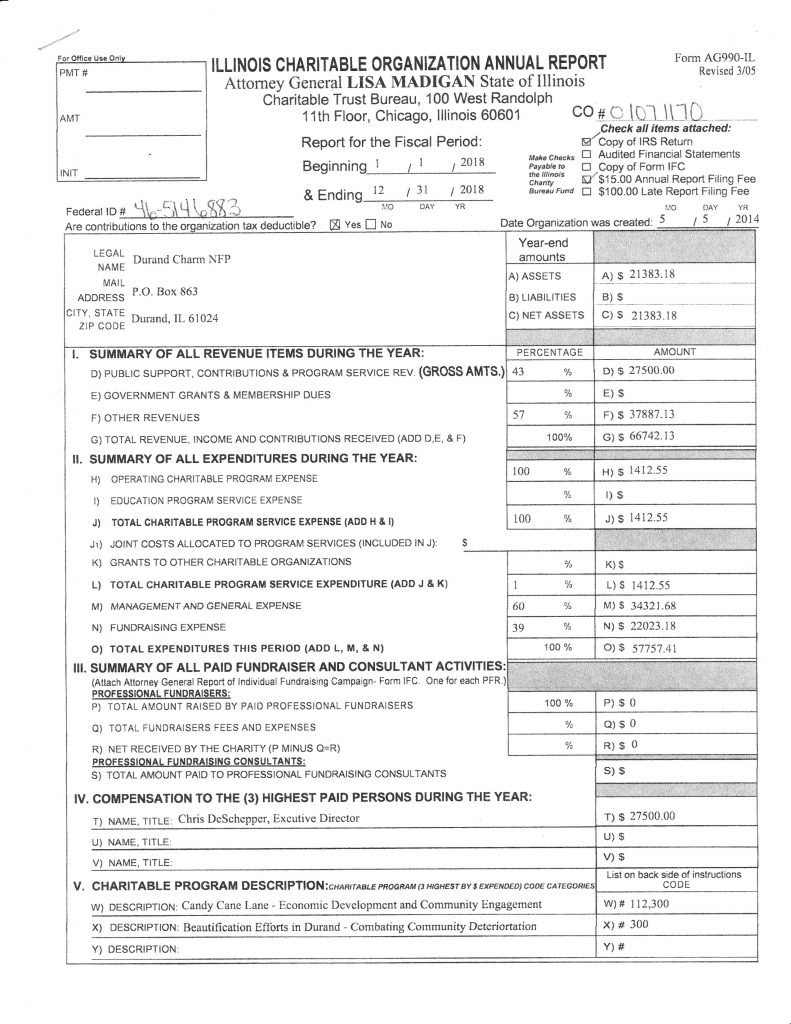

FY 2018 AG990IL Form Durand Charm

Forms for lake land college browse lake land college forms Once completed you can sign your fillable form or send for signing. Web we would like to show you a description here but the site won’t allow us. Charity annual report extensions these are the instructions for requesting and receiving. Reports should also include audited financial statements if the charity’s.

Form Ag990 Il 2017 Awesome What is Sel

Summary of all revenue items during the year: Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. See 6 below for simplified filing option for small organizations. One.

Form Ag990 Il 2017 Inspirational Home

Use fill to complete blank online others pdf forms for free. Summary of all revenue items during the year: Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: Forms for lake land college browse lake land college forms And copy of the federal returns for the last three years (irs form 990 and irs.

Form Ag990 Il 2017 Lovely Iaa Cv 2018 â £ Iaa 2018

Web we would like to show you a description here but the site won’t allow us. One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses r) net received by the charity (p. Forms for lake land college browse lake land college forms Copy of the federal returns for the last three.

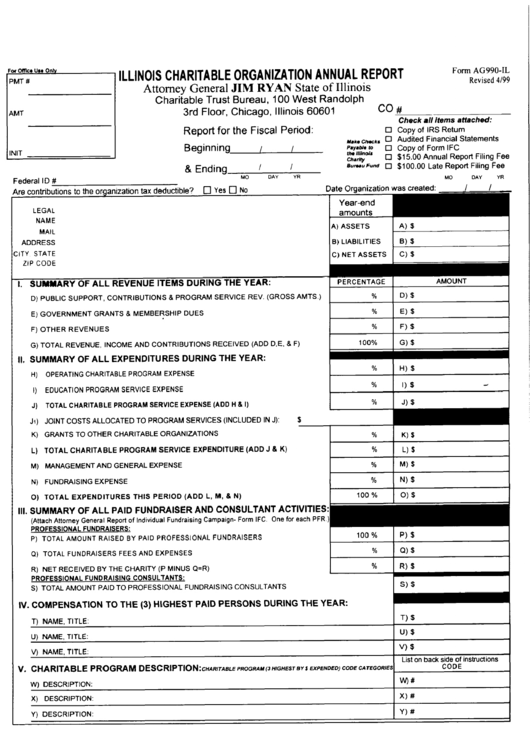

Form Ag990Il Annucal Financial Report For Illinois Charitable

Illinois charitable organization annual report form. Forms for lake land college browse lake land college forms All forms are printable and downloadable. Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. One for each pfr.) p) total amount raised by paid professional fundraisers.

FY 2018 AG990IL Form Durand Charm

Web summary of all paid fundraiser and consultant activities: Illinois charitable organization annual report form. One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses r) net received by the charity (p. Reports should also include audited financial statements if the charity’s annual gross contributions exceed $300,000 or it used a paid.

Form Ag990 Il 2017 Fresh 2017 tour De France

See 6 below for simplified filing option for small organizations. Illinois charitable organization annual report form. All forms are printable and downloadable. Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Web we would like to show you a description here but the.

Form Ag990Il Illinois Charitable Organization Annual Report 1999

Web we would like to show you a description here but the site won’t allow us. Web summary of all paid fundraiser and consultant activities: Forms for lake land college browse lake land college forms Use fill to complete blank online others pdf forms for free. Summary of all revenue items during the year:

Form Ag990 Il 2017 Fresh Home

Use fill to complete blank online others pdf forms for free. And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses r) net received by.

ads/responsive.txt Form Ag990 Il 2017 New Bentley Continental Gt

Web summary of all paid fundraiser and consultant activities: Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: And copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed. Once completed you can sign your fillable form or.

Once Completed You Can Sign Your Fillable Form Or Send For Signing.

Web summary of all paid fundraiser and consultant activities: Illinois charitable organization annual report (lake land college) form is 2 pages long and contains: Charity annual report extensions these are the instructions for requesting and receiving. Web we would like to show you a description here but the site won’t allow us.

Forms For Lake Land College Browse Lake Land College Forms

See 6 below for simplified filing option for small organizations. Illinois charitable organization annual report form. Use fill to complete blank online others pdf forms for free. Copy of the federal returns for the last three years (irs form 990 and irs form 990pf), if filed or if no federal returns were filed.

And Copy Of The Federal Returns For The Last Three Years (Irs Form 990 And Irs Form 990Pf), If Filed Or If No Federal Returns Were Filed.

Reports should also include audited financial statements if the charity’s annual gross contributions exceed $300,000 or it used a paid professional fundraiser that raised contributions in excess of $25,000. Summary of all revenue items during the year: All forms are printable and downloadable. One for each pfr.) p) total amount raised by paid professional fundraisers q) total fundraisers fees and expenses r) net received by the charity (p.