Arizona A4 Form 2023

Arizona A4 Form 2023 - This form allows individuals to determine how much of their. The withholding formula helps you. Complete, sign, print and send your tax documents easily with us legal forms. Residents who receive regularly scheduled payments from payments or annuities. This amount is applied to your arizona income. Web annuitant's request for voluntary arizona income tax withholding. You can download or print. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Electing a withholding percentage of zero you may elect an arizona withholding.

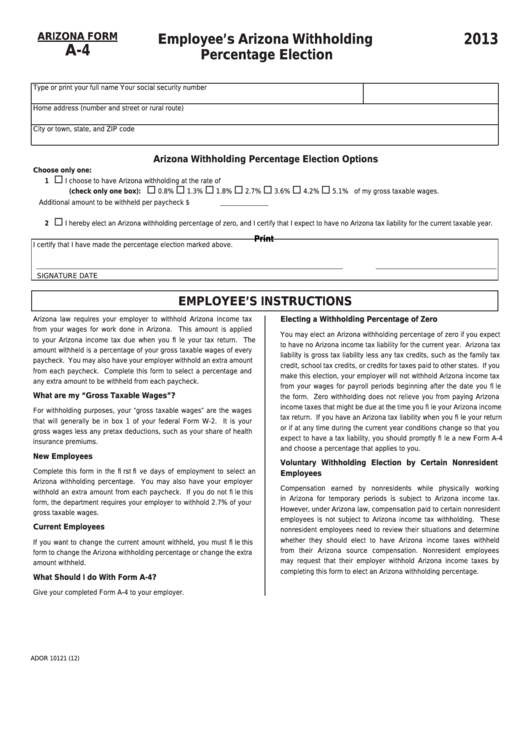

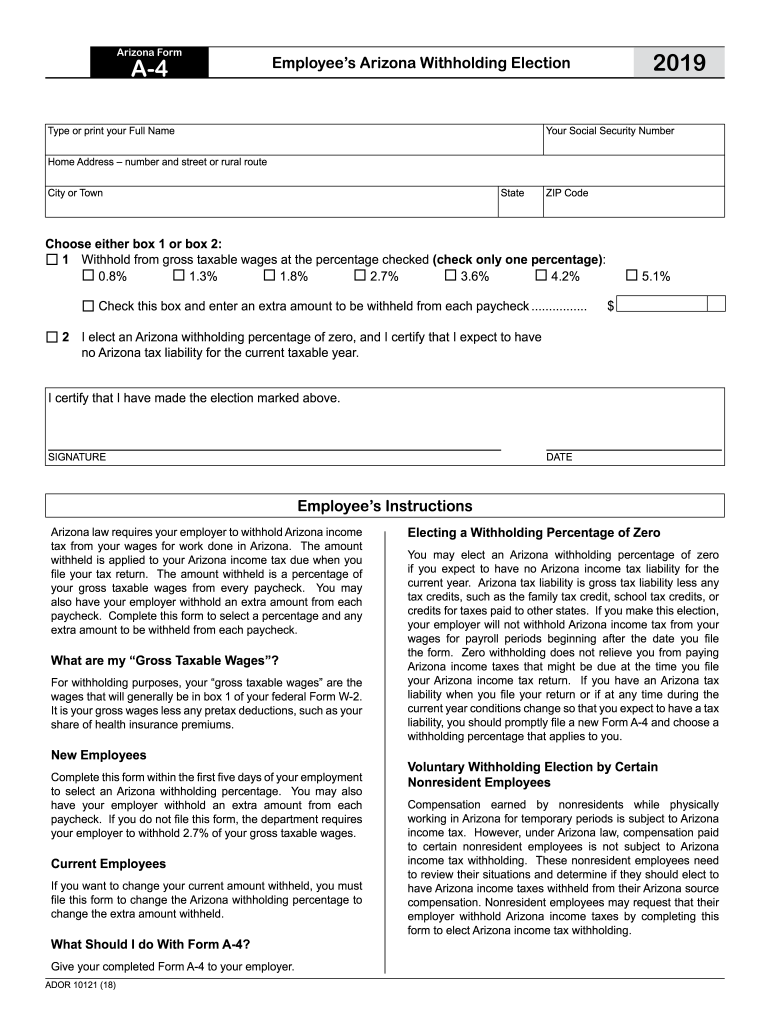

Electing a withholding percentage of zero you may elect an arizona withholding. Download blank or fill out online in pdf format. 1 withhold from gross taxable. You can download or print. Residents who receive regularly scheduled payments from payments or annuities. This form allows individuals to determine how much of their. Web use this form to request that your employer withhold arizona income taxes from your wages for work done outside of arizona. This amount is applied to your arizona income. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Choose either box 1 or box 2:

Download blank or fill out online in pdf format. This form allows individuals to determine how much of their. Choose the correct version of the editable pdf form. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): The withholding formula helps you. This amount is applied to your arizona income. Residents who receive regularly scheduled payments from payments or annuities. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Choose either box 1 or box 2: Complete, sign, print and send your tax documents easily with us legal forms.

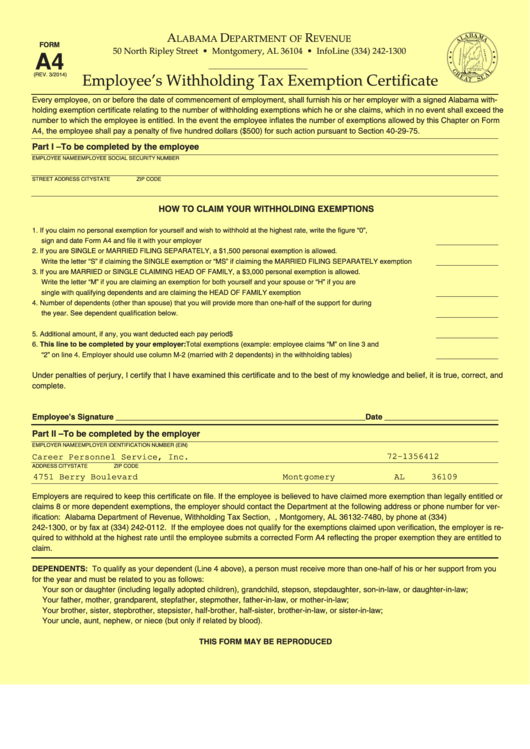

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Complete, sign, print and send your tax documents easily with us legal forms. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. The withholding formula helps you. You can download or print. This form allows individuals to determine how much of their.

A4 form Fill out & sign online DocHub

Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Complete, sign, print and send your tax documents easily with us legal forms. Electing a withholding percentage of zero you may elect an arizona withholding. Download blank or fill out online in pdf format. Residents who.

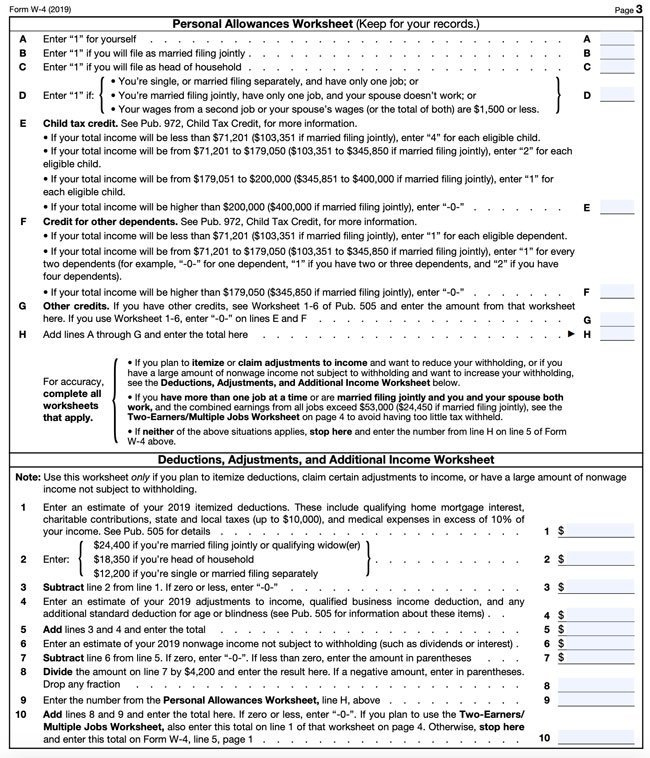

2023 IRS W 4 Form HRdirect Fillable Form 2023

Complete, sign, print and send your tax documents easily with us legal forms. Web use this form to request that your employer withhold arizona income taxes from your wages for work done outside of arizona. The withholding formula helps you. Choose either box 1 or box 2: Electing a withholding percentage of zero you may elect an arizona withholding.

DMT Test Dust A4 coarse Standard test dust Test Dusts DMTGroup

Electing a withholding percentage of zero you may elect an arizona withholding. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. Web annuitant's request for voluntary arizona income tax withholding. Complete, sign, print and send your tax documents easily with us legal forms. Web to compute the amount of tax.

California W4 Form 2022 W4 Form

Choose either box 1 or box 2: Electing a withholding percentage of zero you may elect an arizona withholding. Web arizona tax rates have decreased for 2023. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. This form allows individuals to.

Free Arizona Form A4 (2014) PDF 53KB 1 Page(s)

You can download or print. This amount is applied to your arizona income. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%..

Fillable Form A4 Employee'S Withholding Tax Exemption Certificate

Web arizona tax rates have decreased for 2023. Download blank or fill out online in pdf format. Web use this form to request that your employer withhold arizona income taxes from your wages for work done outside of arizona. Complete, sign, print and send your tax documents easily with us legal forms. This form allows individuals to determine how much.

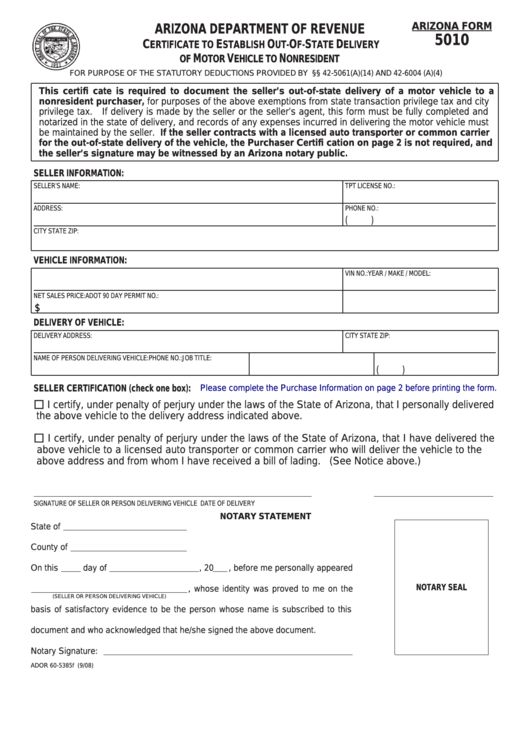

Arizona Vehicle Tax VEHICLE UOI

This form allows individuals to determine how much of their. Web the withholding formula helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. Choose the correct version of the editable pdf form. You can download or print. The withholding formula helps you.

Arizona A4 Form In Spanish ⏵ Coub

Complete, sign, print and send your tax documents easily with us legal forms. Electing a withholding percentage of zero you may elect an arizona withholding. You can download or print. Choose the correct version of the editable pdf form. Web annuitant's request for voluntary arizona income tax withholding.

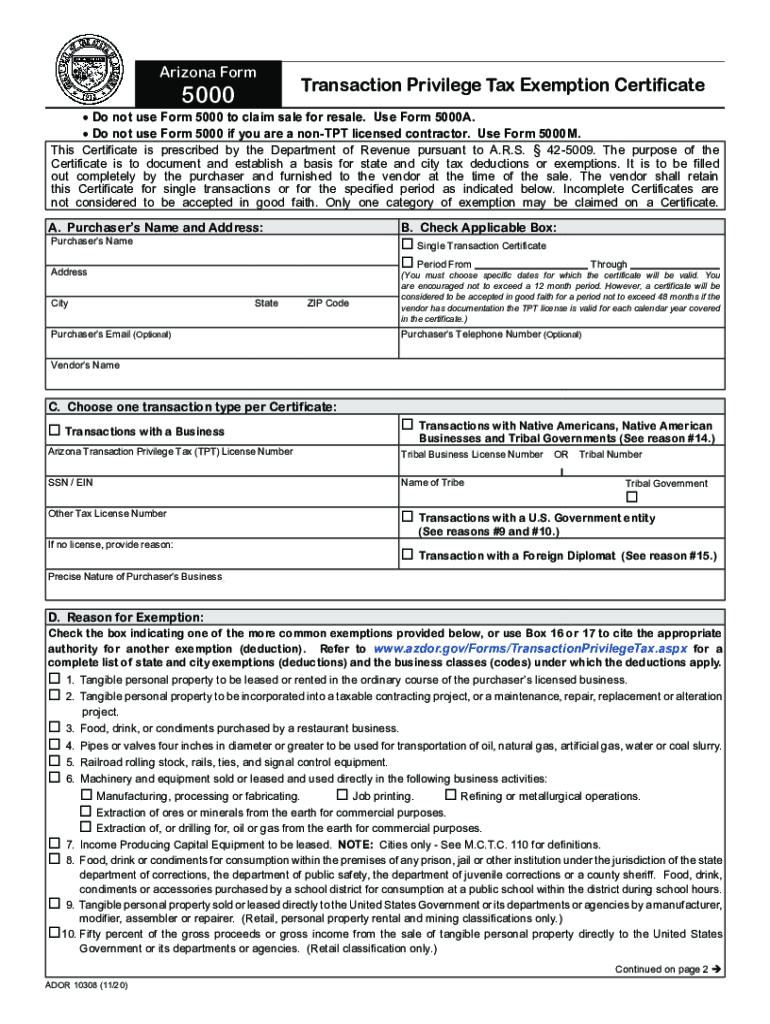

2020 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

This form allows individuals to determine how much of their. Web annuitant's request for voluntary arizona income tax withholding. Choose either box 1 or box 2: The withholding formula helps you. Electing a withholding percentage of zero you may elect an arizona withholding.

The Withholding Formula Helps You.

Web annuitant's request for voluntary arizona income tax withholding. Web use this form to request that your employer withhold arizona income taxes from your wages for work done outside of arizona. Choose the correct version of the editable pdf form. Download blank or fill out online in pdf format.

Residents Who Receive Regularly Scheduled Payments From Payments Or Annuities.

You can download or print. Web arizona tax rates have decreased for 2023. Choose either box 1 or box 2: Electing a withholding percentage of zero you may elect an arizona withholding.

Web The Withholding Formula Helps You Identify Your Tax Withholding To Make Sure You Have The Right Amount Of Tax Withheld From Your Paycheck.

Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. This amount is applied to your arizona income. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Complete, sign, print and send your tax documents easily with us legal forms.

1 Withhold From Gross Taxable.

This form allows individuals to determine how much of their. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding.