Arizona Form A1 R

Arizona Form A1 R - Do not submit any liability owed or try to claim refunds with this return. Payroll service providers registered with arizona can upload electronic files containing. Create legally binding electronic signatures on any device. Do not submit any liability owed or try to claim refunds due with this return. To submit additional liability or claim a refund, file amended. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, fi le. Web withholding return and reconciliation for arizona employers eligible to file and pay on an annual basis. Enter the total amount withheld during the quarter. Complete if prior 4 quarter average was not more than $1,500.

To submit additional liability or claim a refund, file amended. To submit additional liability or claim a refund, fi le. Complete if prior 4 quarter average was not more than $1,500. An employer may make its arizona withholding payments on an annual basis if all of the. Do not submit any liability owed or try to claim refunds with this return. Payroll service providers registered with arizona can upload electronic files containing. Do not submit any liability owed or try to claim refunds with this return. Web withholding return and reconciliation for arizona employers eligible to file and pay on an annual basis. Create legally binding electronic signatures on any device. To submit additional liability or claim a refund, file amended.

To submit additional liability or claim a refund, fi le. Complete if prior 4 quarter average was not more than $1,500. An employer may make its arizona withholding payments on an annual basis if all of the. Web withholding return and reconciliation for arizona employers eligible to file and pay on an annual basis. Payroll service providers registered with arizona can upload electronic files containing. Enter the total amount withheld during the quarter. Create legally binding electronic signatures on any device. Do not submit any liability owed or try to claim refunds with this return. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, file amended.

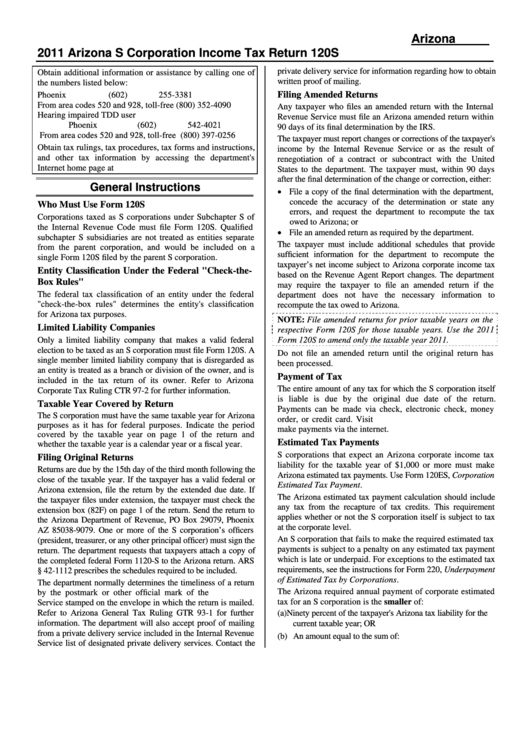

Instructions For Arizona Form 120s Arizona S Corporation Tax

Web withholding return and reconciliation for arizona employers eligible to file and pay on an annual basis. Do not submit any liability owed or try to claim refunds with this return. Payroll service providers registered with arizona can upload electronic files containing. Complete if prior 4 quarter average was not more than $1,500. Enter the total amount withheld during the.

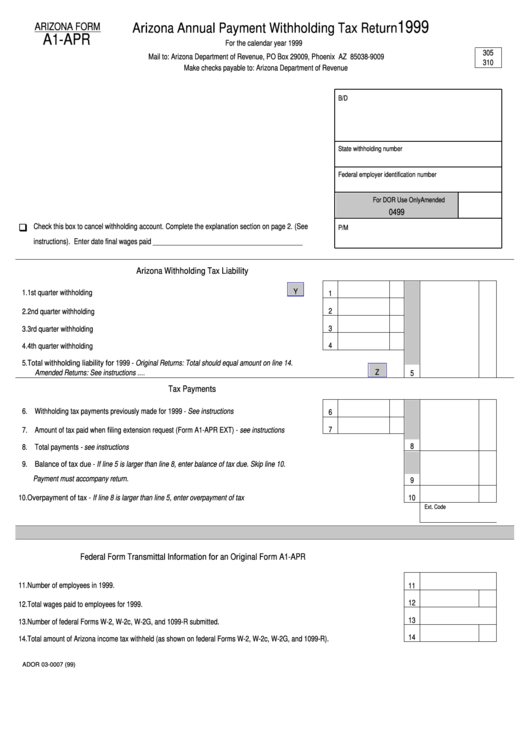

Arizona Form A1Apr Arizona Annual Payment Withholding Tax Return

Do not submit any liability owed or try to claim refunds with this return. Enter the total amount withheld during the quarter. Web withholding return and reconciliation for arizona employers eligible to file and pay on an annual basis. An employer may make its arizona withholding payments on an annual basis if all of the. Do not submit any liability.

Arizona Form A1R

Create legally binding electronic signatures on any device. To submit additional liability or claim a refund, fi le. Do not submit any liability owed or try to claim refunds with this return. Do not submit any liability owed or try to claim refunds with this return. Complete if prior 4 quarter average was not more than $1,500.

Arizona Form A1 QRT Fillable Az A1 Qrt Form Top Fill Out and Sign

To submit additional liability or claim a refund, file amended. To submit additional liability or claim a refund, fi le. Do not submit any liability owed or try to claim refunds due with this return. To submit additional liability or claim a refund, file amended. An employer may make its arizona withholding payments on an annual basis if all of.

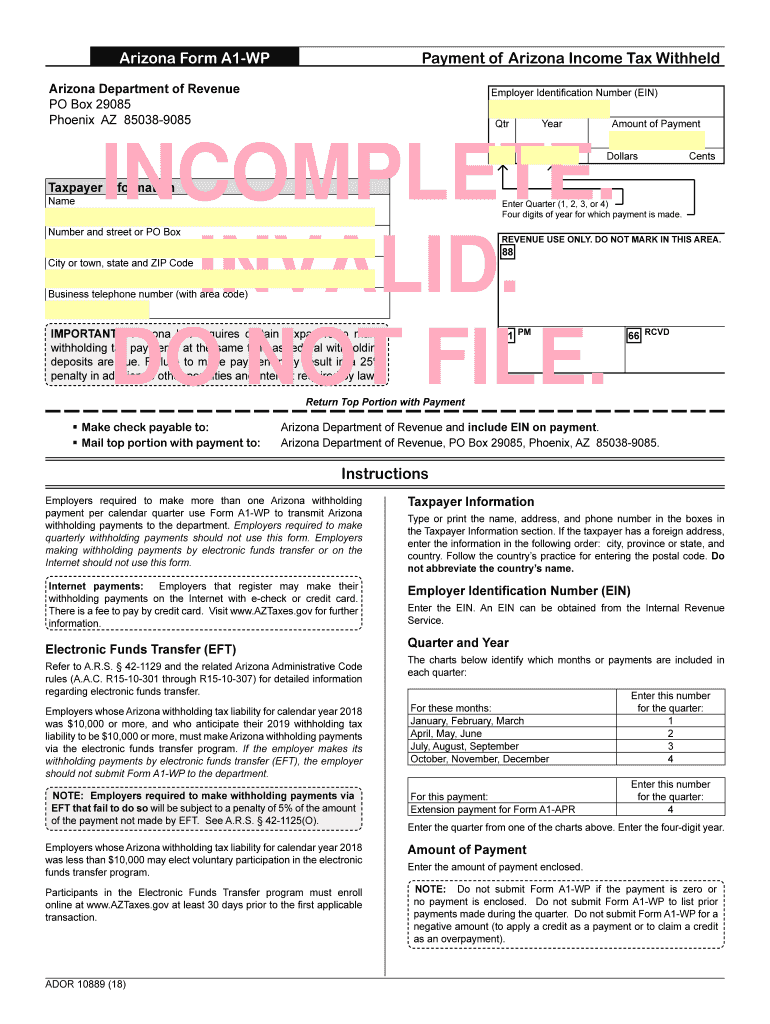

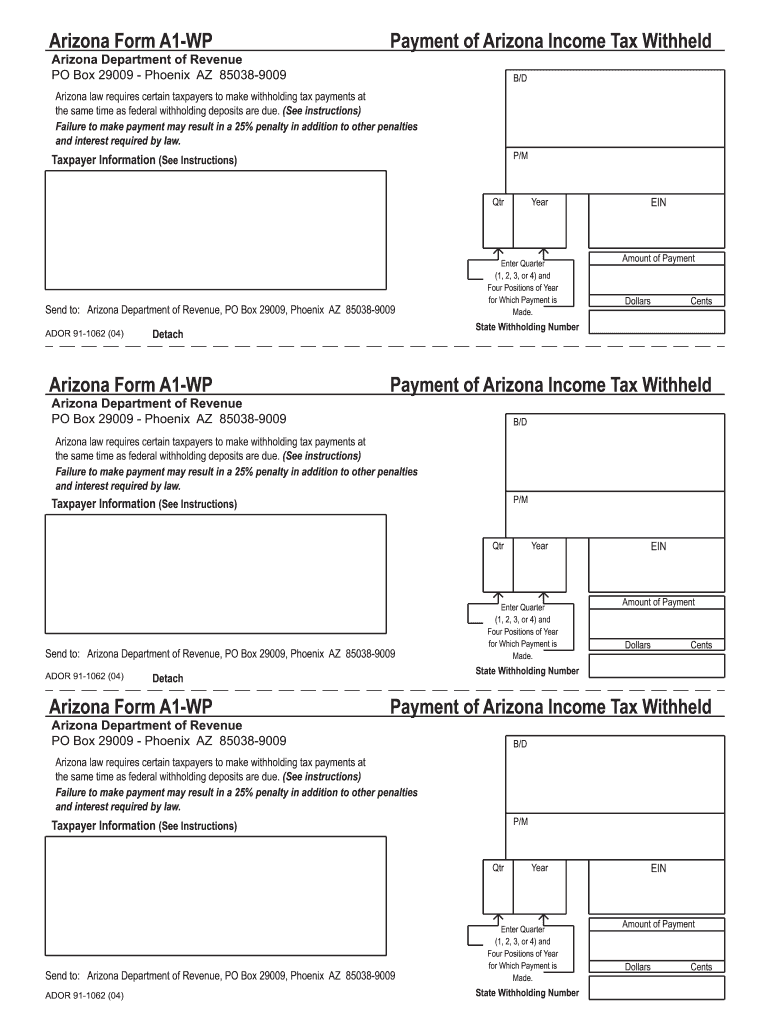

20182020 Form AZ ADOR A1WP Fill Online, Printable, Fillable, Blank

An employer may make its arizona withholding payments on an annual basis if all of the. Web withholding return and reconciliation for arizona employers eligible to file and pay on an annual basis. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, file amended. To submit additional.

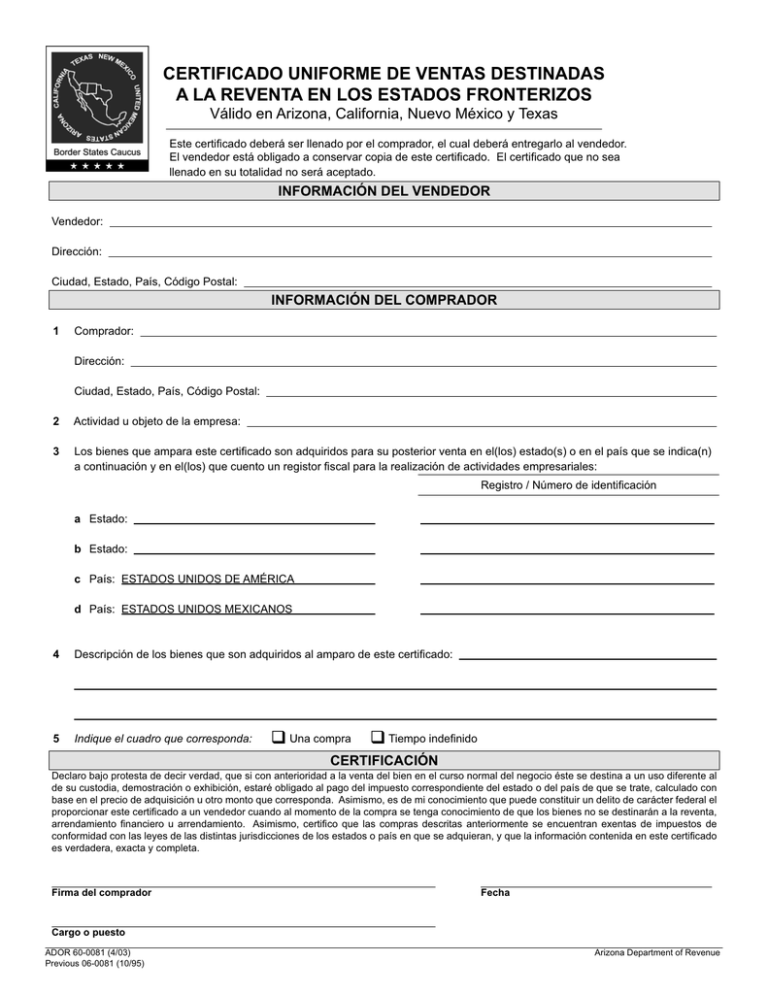

Arizona Form 5000a Fillable 2020 Fill and Sign Printable Template

Create legally binding electronic signatures on any device. Enter the total amount withheld during the quarter. Do not submit any liability owed or try to claim refunds due with this return. Do not submit any liability owed or try to claim refunds with this return. To submit additional liability or claim a refund, file amended.

Form A1r Arizona Withholding Reconciliation Tax Return 149

An employer may make its arizona withholding payments on an annual basis if all of the. To submit additional liability or claim a refund, file amended. Do not submit any liability owed or try to claim refunds due with this return. Complete if prior 4 quarter average was not more than $1,500. Create legally binding electronic signatures on any device.

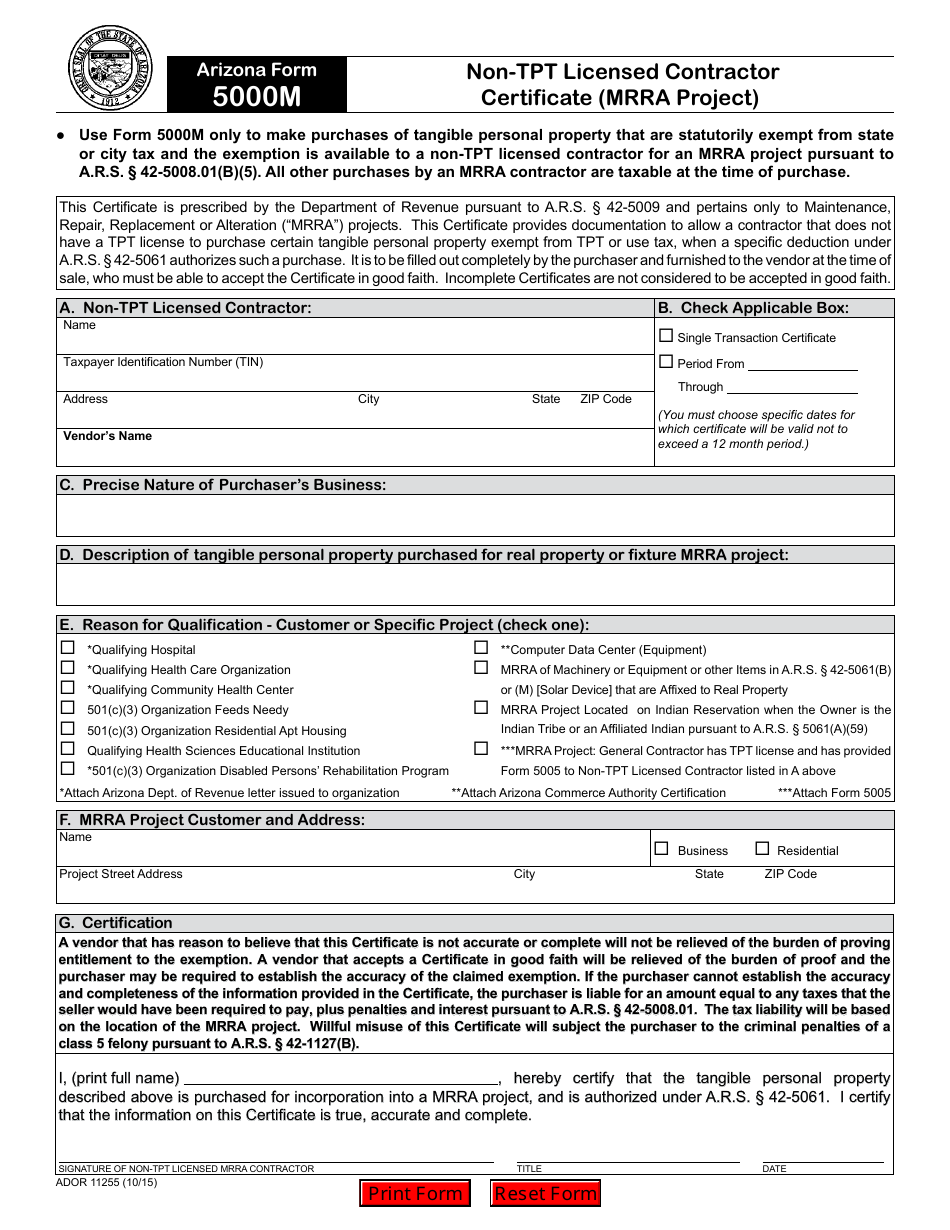

Arizona Form 5000M (ADOR11255) Download Fillable PDF or Fill Online Non

To submit additional liability or claim a refund, file amended. Payroll service providers registered with arizona can upload electronic files containing. Complete if prior 4 quarter average was not more than $1,500. To submit additional liability or claim a refund, file amended. Do not submit any liability owed or try to claim refunds due with this return.

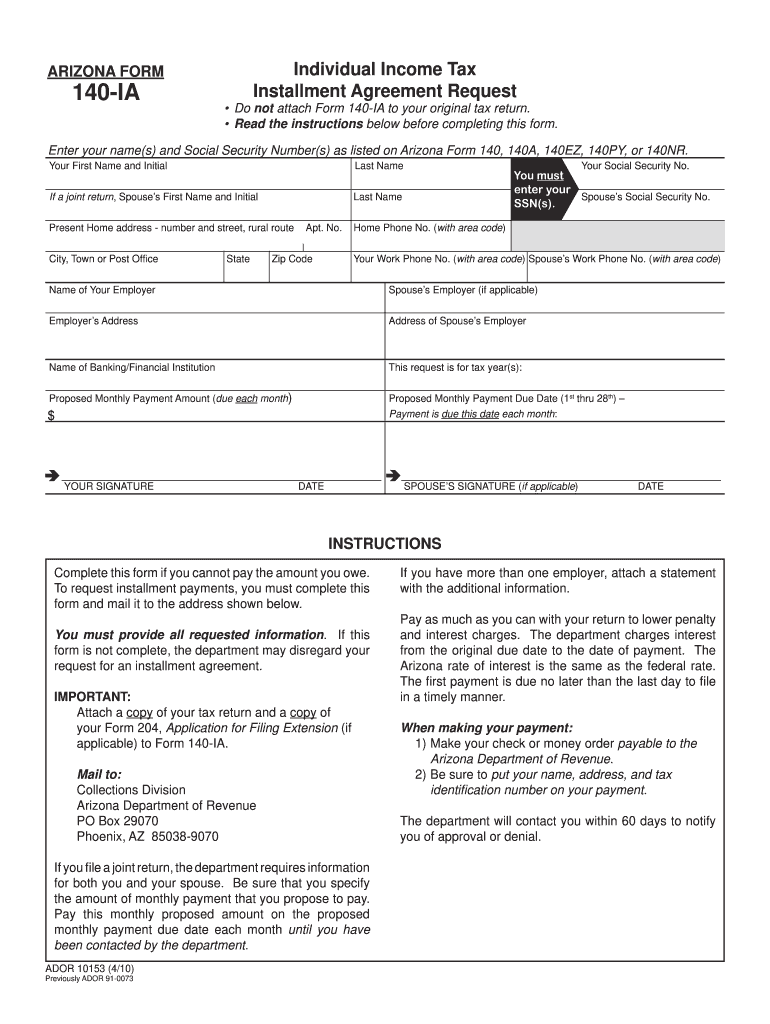

Fillable Online Arizona Form 140IA Arizona Department of Revenue Fax

An employer may make its arizona withholding payments on an annual basis if all of the. Complete if prior 4 quarter average was not more than $1,500. Payroll service providers registered with arizona can upload electronic files containing. Do not submit any liability owed or try to claim refunds with this return. Enter the total amount withheld during the quarter.

2004 Form AZ ADOR A1WP Fill Online, Printable, Fillable, Blank pdfFiller

To submit additional liability or claim a refund, file amended. Payroll service providers registered with arizona can upload electronic files containing. An employer may make its arizona withholding payments on an annual basis if all of the. Create legally binding electronic signatures on any device. Enter the total amount withheld during the quarter.

Do Not Submit Any Liability Owed Or Try To Claim Refunds With This Return.

To submit additional liability or claim a refund, fi le. Create legally binding electronic signatures on any device. To submit additional liability or claim a refund, file amended. To submit additional liability or claim a refund, file amended.

An Employer May Make Its Arizona Withholding Payments On An Annual Basis If All Of The.

Do not submit any liability owed or try to claim refunds with this return. Payroll service providers registered with arizona can upload electronic files containing. Complete if prior 4 quarter average was not more than $1,500. Web withholding return and reconciliation for arizona employers eligible to file and pay on an annual basis.

Enter The Total Amount Withheld During The Quarter.

Do not submit any liability owed or try to claim refunds with this return. Do not submit any liability owed or try to claim refunds due with this return.