Arizona Withholding Form 2023

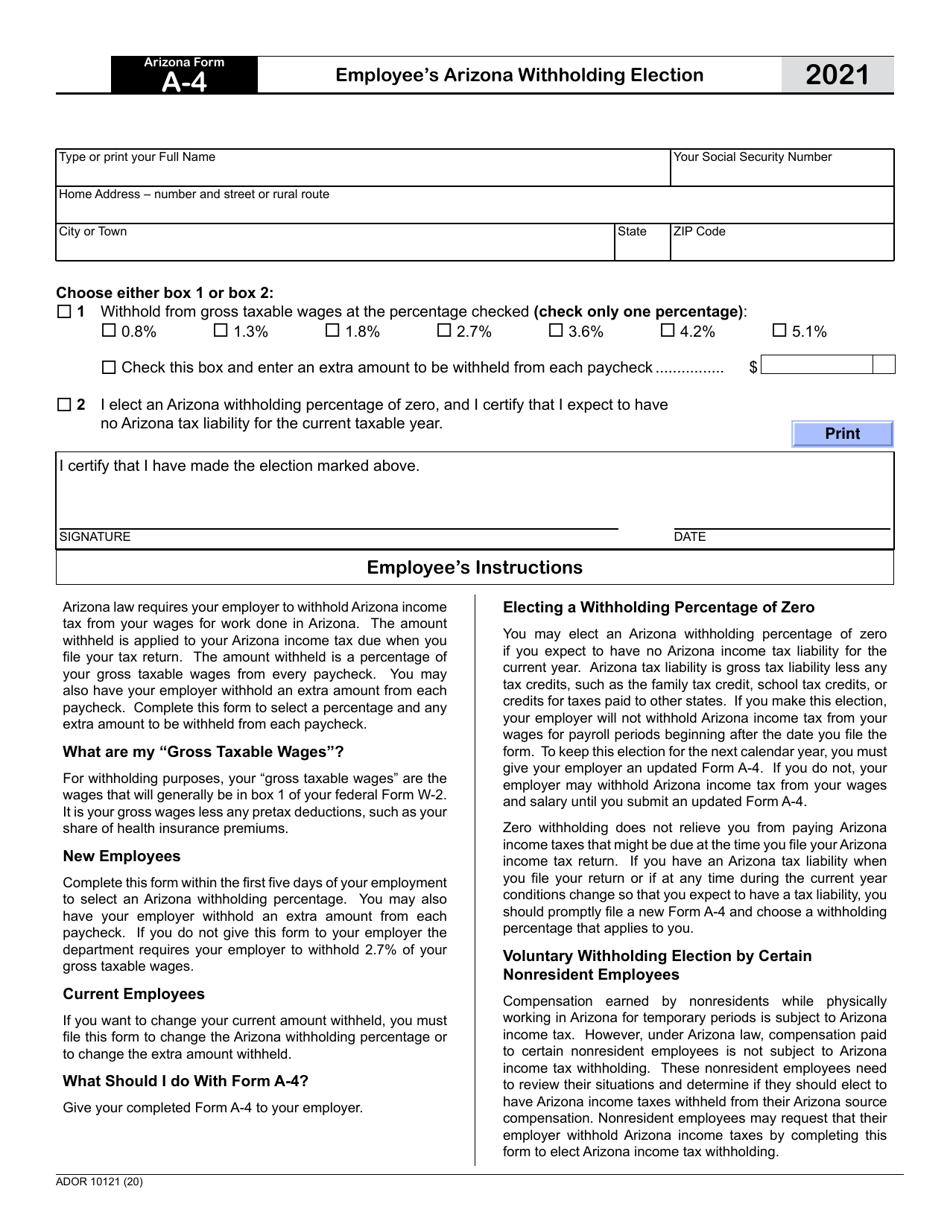

Arizona Withholding Form 2023 - Web arizona state income tax withholding is a percentage of the employee’s gross taxable wages. New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Web arizona withholding percentage election the employee completes this form to notify his/her employer of the amount of arizona withholding to be taken from his/her paycheck. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding Gross taxable wages refers to the amount that meets the federal definition of wages contained in u.s. Arizona annual payment withholding tax return: Web withholding forms : Check either box 1 or box 2: 1 i elect to have arizona income taxes withheld from my annuity or pension payments as authorized by a.r.s. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5%

New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Web withholding forms : Annuitant's request for voluntary arizona income tax withholding: Web arizona state income tax withholding is a percentage of the employee’s gross taxable wages. Choose either box 1 or box 2: Web arizona withholding percentage election the employee completes this form to notify his/her employer of the amount of arizona withholding to be taken from his/her paycheck. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Arizona annual payment withholding tax return: 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% Check either box 1 or box 2:

You can use your results from the formula to help you complete the form and adjust your income tax withholding. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as authorized by a.r.s. Web arizona withholding percentage election the employee completes this form to notify his/her employer of the amount of arizona withholding to be taken from his/her paycheck. Check either box 1 or box 2: Gross taxable wages refers to the amount that meets the federal definition of wages contained in u.s. New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Arizona annual payment withholding tax return: Annuitant's request for voluntary arizona income tax withholding: 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Choose either box 1 or box 2:

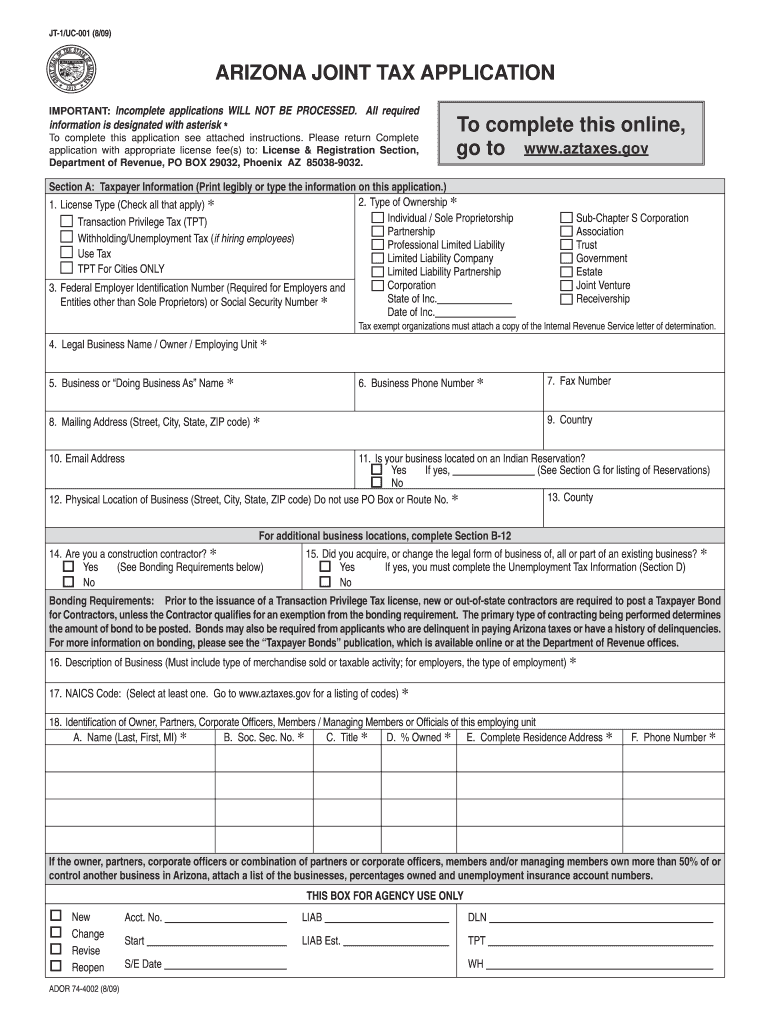

Download Arizona Form A4 (2013) for Free FormTemplate

Check either box 1 or box 2: 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 1 withhold from gross taxable wages at the percentage checked (check only one percentage): You can use your results from the formula to help you complete the form and adjust your income tax withholding. Gross taxable wages refers to the amount that meets the federal definition.

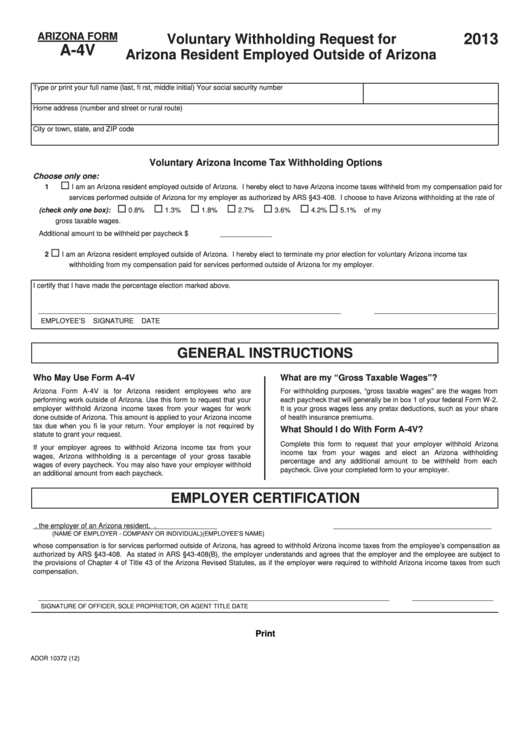

Fillable Arizona Form A4v Voluntary Withholding Request For Arizona

You can use your results from the formula to help you complete the form and adjust your income tax withholding. Web withholding forms : 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding Annuitant's request for voluntary arizona income tax withholding:

How to Report Backup Withholding on Form 945

Withhold from the taxable amount of distribution at the percentage checked (check only one percentage): New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Annuitant's request for voluntary arizona income tax withholding: 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 1 i am an arizona resident employed outside of arizona.

Arizona Separate Withholding Form Required State Tax

Annuitant's request for voluntary arizona income tax withholding: You can use your results from the formula to help you complete the form and adjust your income tax withholding. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as authorized by a.r.s. Gross taxable wages refers to the amount that meets the federal definition of.

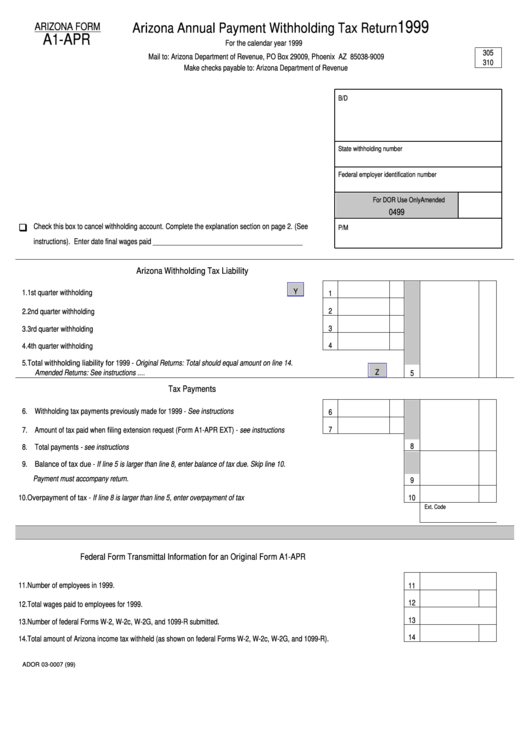

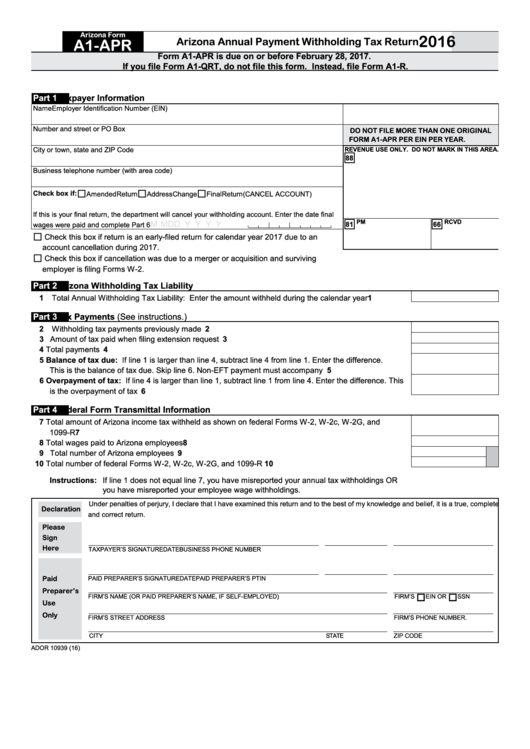

Arizona Form A1Apr Arizona Annual Payment Withholding Tax Return

Web arizona state income tax withholding is a percentage of the employee’s gross taxable wages. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% Web arizona withholding percentage election the employee completes this form to notify his/her employer of the amount of arizona withholding to be taken from his/her paycheck. Arizona annual payment withholding tax return: 0.5% 1.0% 1.5% 2.0% 2.5% 3.0%.

Arizona Form A4 (ADOR10121) Download Fillable PDF or Fill Online

Gross taxable wages refers to the amount that meets the federal definition of wages contained in u.s. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% Web withholding forms : 1 i elect to have arizona income taxes withheld from my annuity or pension payments as authorized by a.r.s. New arizona income tax withholding rates effective for wages paid after december 31,.

Arizona State Tax withholding form 2018 Fresh 3 21 111 Chapter Three

0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% Voluntary withholding request for arizona resident employed outside of arizona: Withhold from the taxable amount of distribution at the percentage checked (check only one percentage): Gross taxable wages refers to the amount that meets the federal definition of wages contained in u.s. Web withholding forms :

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

Gross taxable wages refers to the amount that meets the federal definition of wages contained in u.s. 1 i elect to have arizona income taxes withheld from my annuity or pension payments as authorized by a.r.s. Web arizona withholding percentage election the employee completes this form to notify his/her employer of the amount of arizona withholding to be taken from.

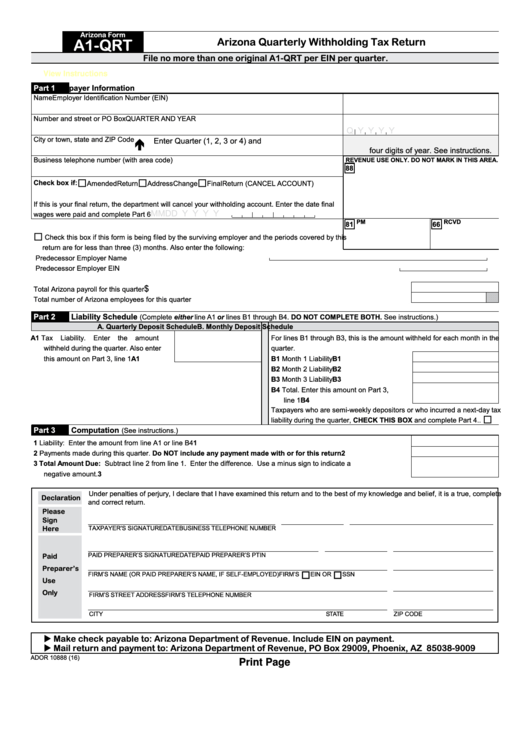

Fillable Arizona Quarterly Withholding Tax Return (Arizona Form A1Qrt

0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% Voluntary withholding request for arizona resident employed outside of arizona: Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding Annuitant's request for voluntary arizona income tax withholding:

New Employee Sample Form 2023 Employeeform Net Kentucky State

1 i am an arizona resident employed outside of arizona. 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding 1 i elect to have arizona.

Choose Either Box 1 Or Box 2:

0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% You can use your results from the formula to help you complete the form and adjust your income tax withholding. Web arizona withholding percentage election the employee completes this form to notify his/her employer of the amount of arizona withholding to be taken from his/her paycheck. 1 i am an arizona resident employed outside of arizona.

1 I Elect To Have Arizona Income Taxes Withheld From My Annuity Or Pension Payments As Authorized By A.r.s.

Check either box 1 or box 2: Annuitant's request for voluntary arizona income tax withholding: Web withholding forms : Voluntary withholding request for arizona resident employed outside of arizona:

Web Questions And Answers For New Arizona Form A 4 (2023) Changes To Arizona Income Tax Withholding

Gross taxable wages refers to the amount that meets the federal definition of wages contained in u.s. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Arizona annual payment withholding tax return: Web arizona state income tax withholding is a percentage of the employee’s gross taxable wages.

Withhold From The Taxable Amount Of Distribution At The Percentage Checked (Check Only One Percentage):

0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% New arizona income tax withholding rates effective for wages paid after december 31, 2022 | department of administration human resources