Arkansas Franchise Tax Form

Arkansas Franchise Tax Form - Find your file number enter your federal tax id: Ar1023ct application for income tax exempt status. Web annual llc franchise tax report 2023 for the year ending 12/31/2022 reports and taxes are due on or before may 1, 2023. Make a check or money order out to the arkansas secretary of state and mail along with your paperwork. Penalty and interest will be due for reports if. The file number is located above your company name on your tax report. Web how do i pay the franchise tax for my business? Web northwest will form your llc for $39 (60% discount). Web if you have not received a franchise tax report by march 20th, please contact us via email at corporations@sos.arkansas.gov, online at. Enter your file number and federal tax id.

Web how do i pay the franchise tax for my business? Make a check or money order out to the arkansas secretary of state and mail along with your paperwork. Web $45 to form your arkansas llc (to file your llc articles of organization). Web northwest will form your llc for $39 (60% discount). Ar1023ct application for income tax exempt status. $150 in annual fees (your annual franchise tax) for an arkansas llc. Ar1100esct corporation estimated tax vouchers. Web complete your tax report online or download a paper form. Web enter your file number: Web arkansas has a state income tax that ranges between 2% and 6.6%.

Find your file number enter your federal tax id: Skip the overview and jump to the filing link ↓ 2021 confusion: Web northwest will form your llc for $39 (60% discount). Web to pay by mail, download the annual franchise tax pdf form. Web enter your file number: Web if you have not received a franchise tax report by march 20th, please contact us via email at corporations@sos.arkansas.gov, online at. $150 in annual fees (your annual franchise tax) for an arkansas llc. If you do not have a federal. Send your report and payment to the arkansas secretary of state. Web how do i pay the franchise tax for my business?

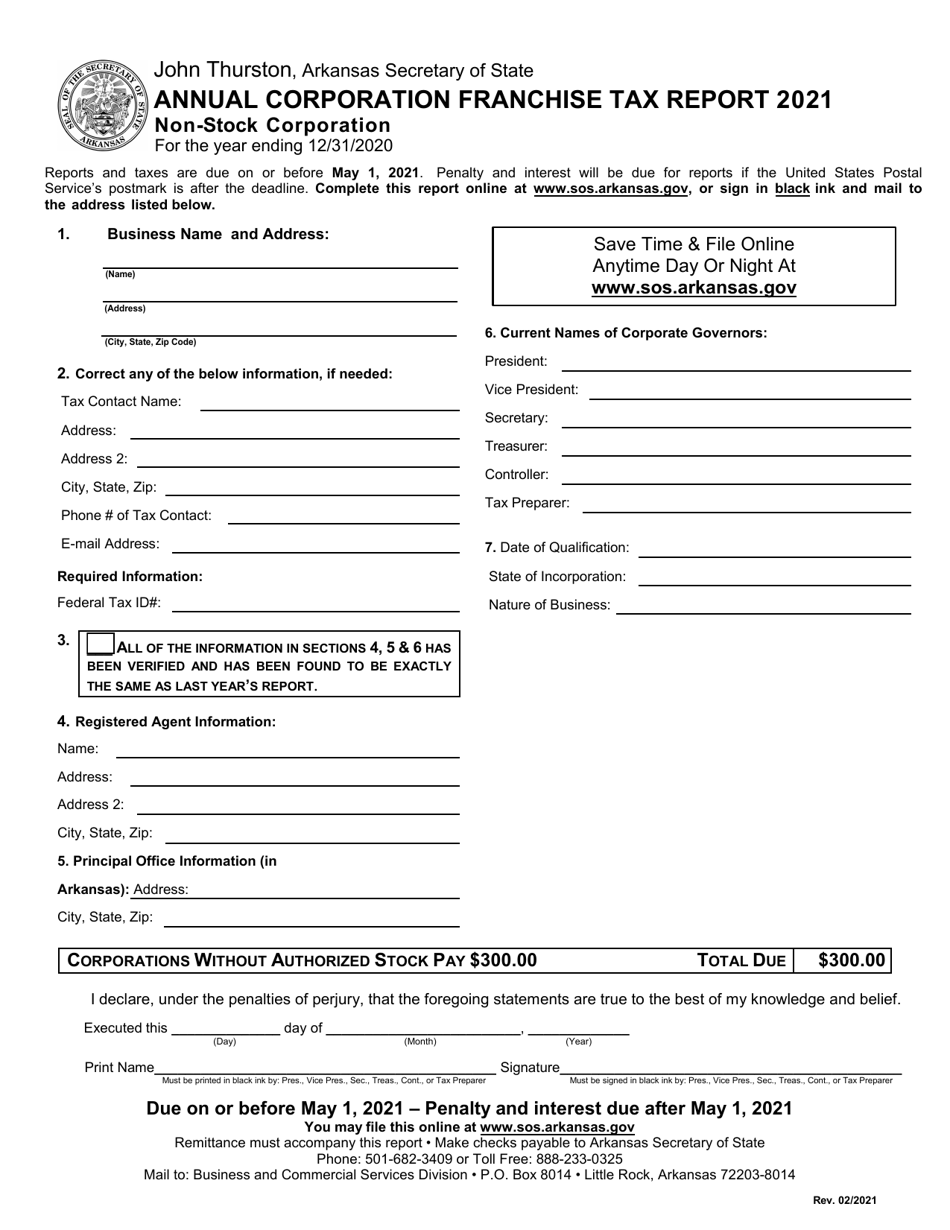

2021 Arkansas Annual Corporation Franchise Tax Report Nonstock

Penalty and interest will be due for reports if. The following instructions will guide you through the. Ar1023ct application for income tax exempt status. Web enter your file number: Web northwest will form your llc for $39 (60% discount).

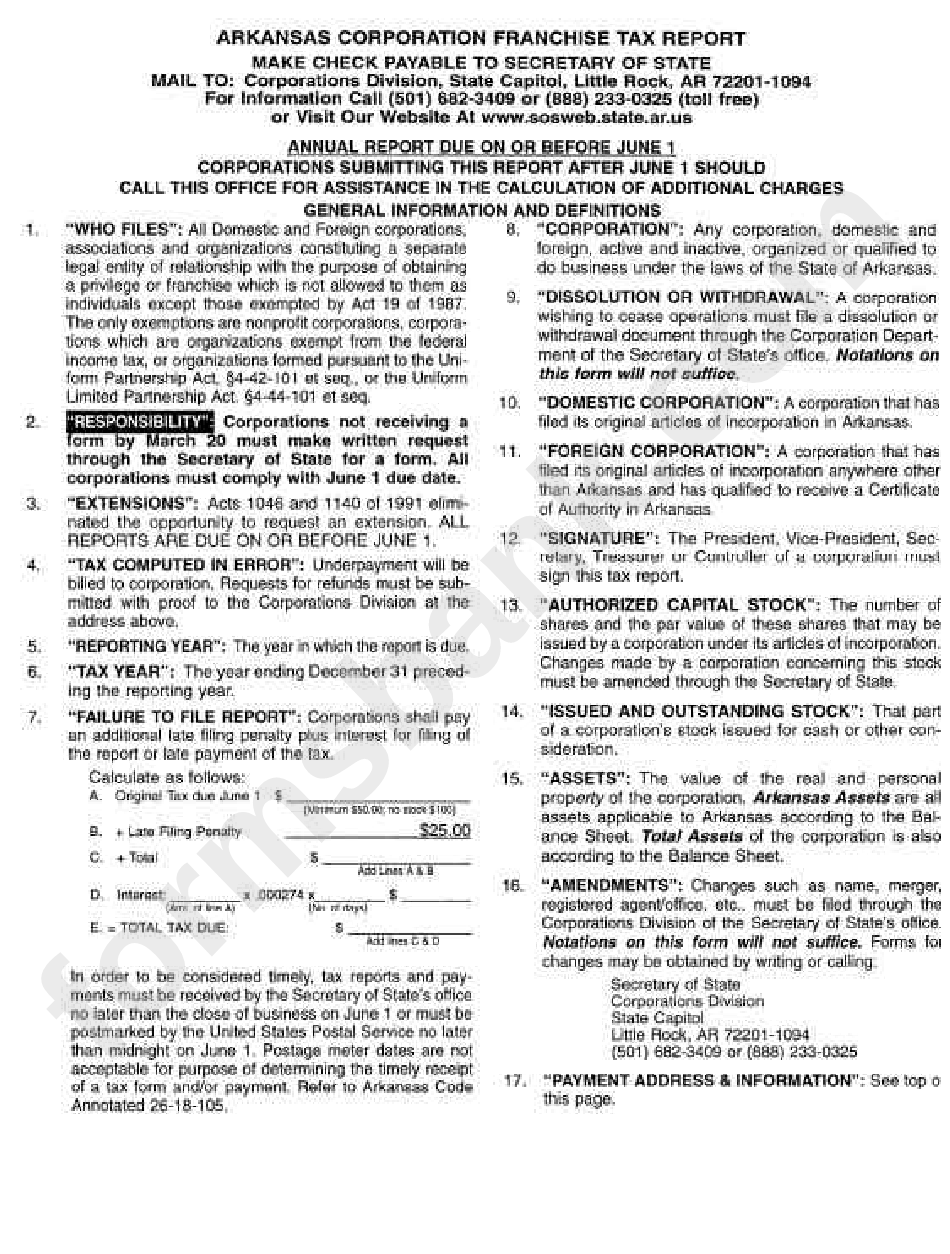

Arkansas Corporation Franchise Tax Report printable pdf download

Do i need to file an. Web arkansas limited liability company franchise tax report make checks payable to arkansas secretary of state mail to: Web enter your file number: The file number is located above your company name on your tax report. Web northwest will form your llc for $39 (60% discount).

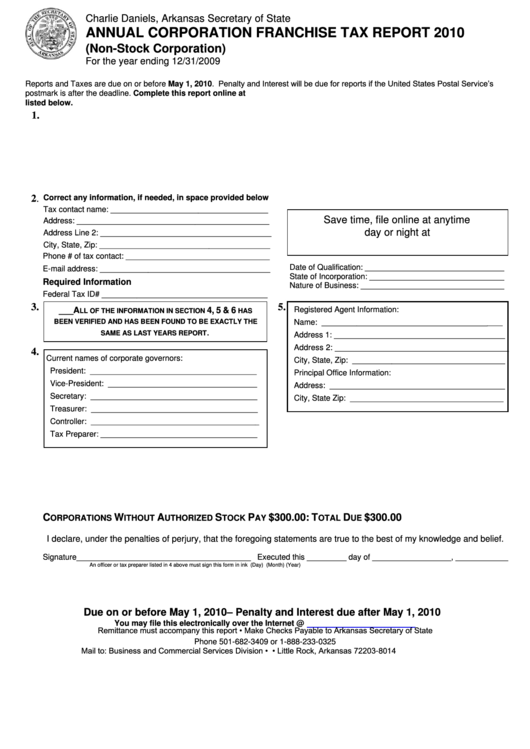

Annual Corporation Franchise Tax Report (NonStock Corporation

Web arkansas has a state income tax that ranges between 2% and 6.6%. Web department of finance and administration franchise tax section p.o. Web businesses may file and pay their annual franchise tax as early as january 1. Make a check or money order out to the arkansas secretary of state and mail along with your paperwork. Web annual llc.

Franchise Tax Arkansas What It Is and How to Pay Create Your Own LLC

Ar1100esct corporation estimated tax vouchers. Web annual llc franchise tax report 2023 for the year ending 12/31/2022 reports and taxes are due on or before may 1, 2023. Llcs (limited liability companies) and pllcs (professional limited. Find your file number enter your federal tax id: Web department of finance and administration franchise tax section p.o.

arkansas franchise tax 2022 LLC Bible

Web businesses may file and pay their annual franchise tax as early as january 1. The following instructions will guide you through the. Web how do i pay the franchise tax for my business? Ar1023ct application for income tax exempt status. Make a check or money order out to the arkansas secretary of state and mail along with your paperwork.

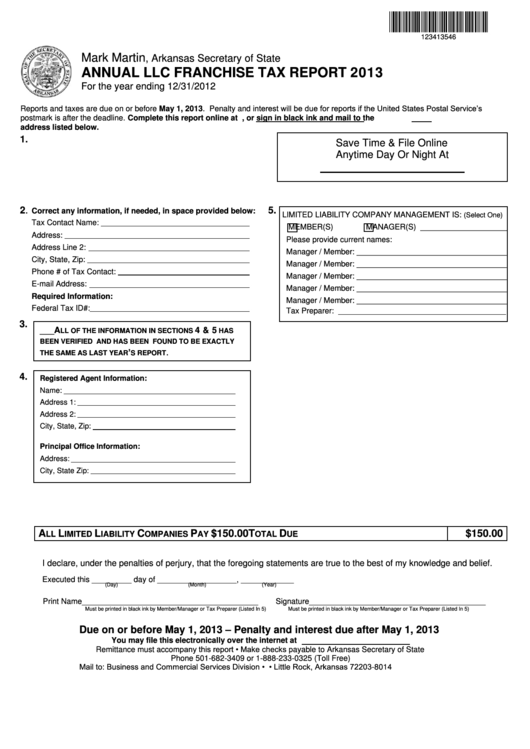

Annual Llc Franchise Tax Report Form Arkansas Secretary Of State

Web if you have not received a franchise tax report by march 20th, please contact us via email at corporations@sos.arkansas.gov, online at. If you do not have a federal. Enter your file number and federal tax id. Web annual llc franchise tax report 2023 for the year ending 12/31/2022 reports and taxes are due on or before may 1, 2023..

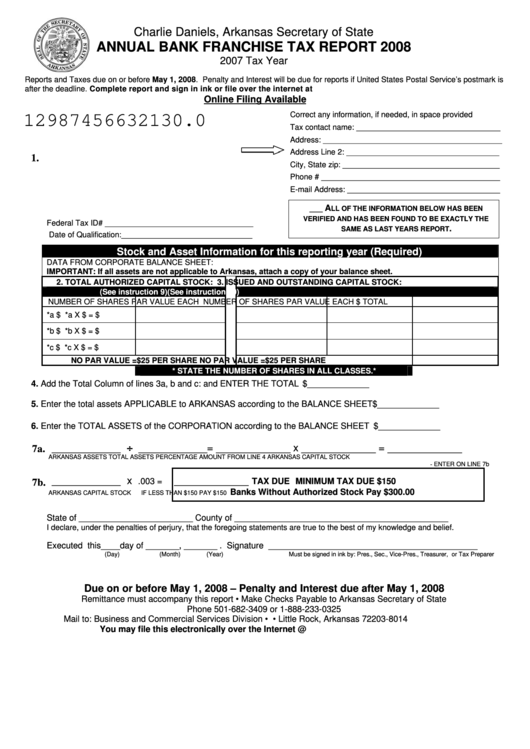

Annual Bank Franchise Tax Report Arkansas Secretary Of State 2008

Web department of finance and administration franchise tax section p.o. Send your report and payment to the arkansas secretary of state. If you do not have a federal. $150 in annual fees (your annual franchise tax) for an arkansas llc. Web complete your tax report online or download a paper form.

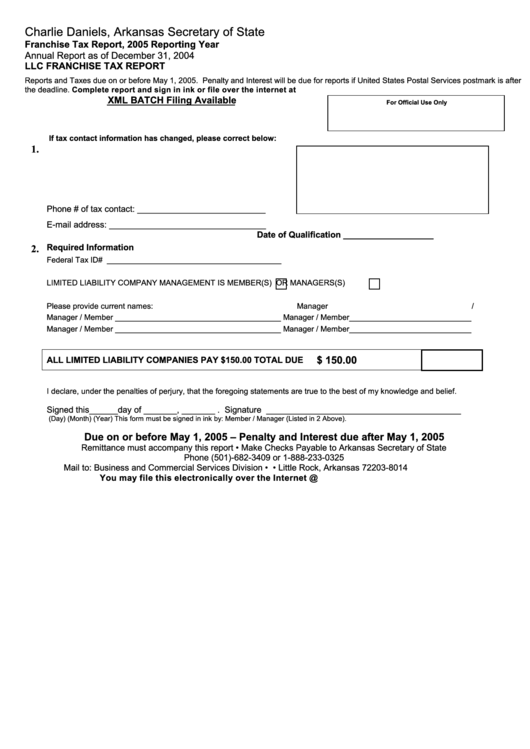

Llc Franchise Tax Report Form Arkansas Secretary Of State 2005

Llcs (limited liability companies) and pllcs (professional limited. Ar1100esct corporation estimated tax vouchers. $150 in annual fees (your annual franchise tax) for an arkansas llc. The file number is located above your company name on your tax report. If you do not have a federal.

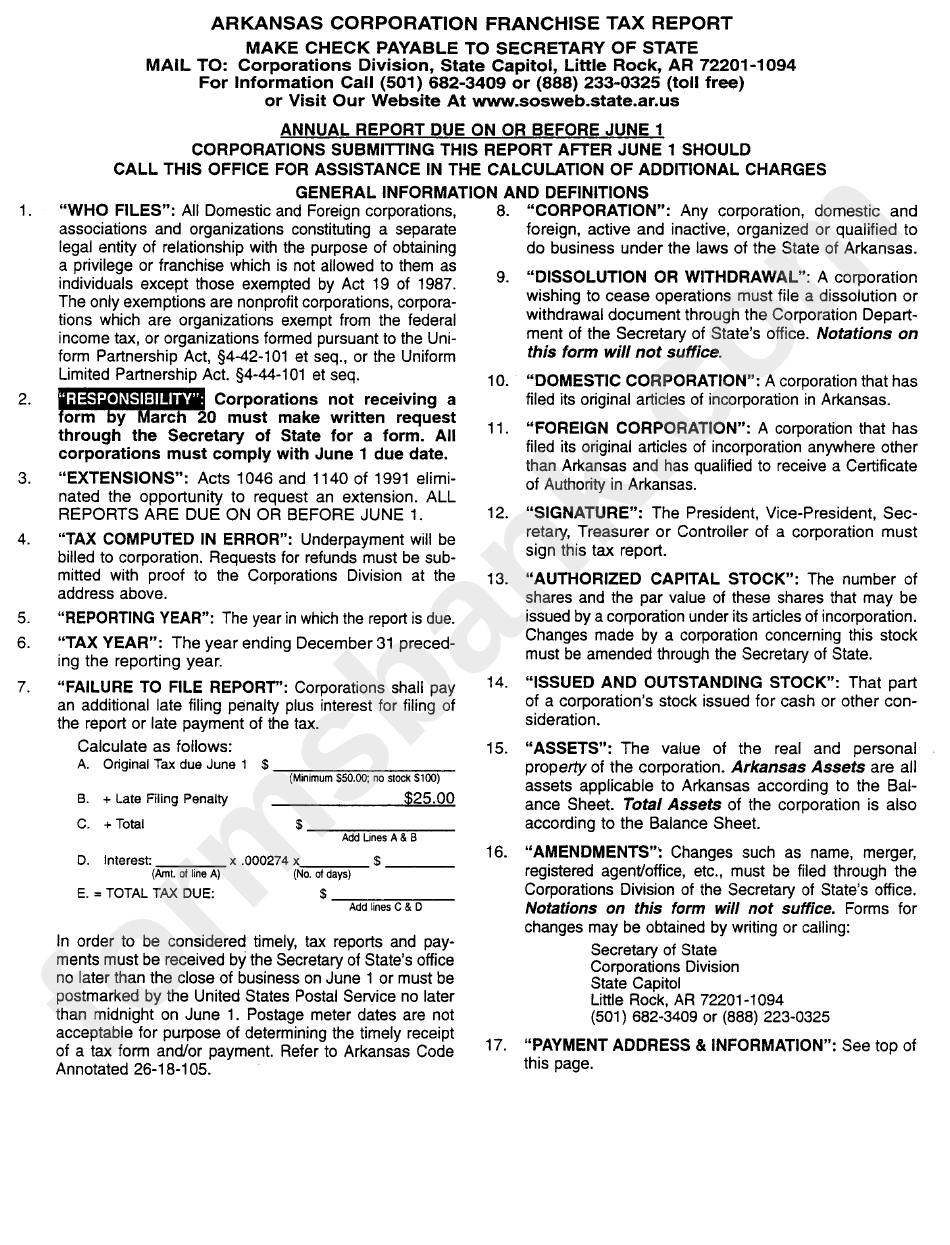

Arkansas Corporation Franchise Tax Report Form Instructions printable

Penalty and interest will be due for reports if. Web military personnel and military spouse information 2023 tax year forms 2022 tax year forms 2021 tax year forms 2020 tax year forms 2019 tax year forms Web if you have not received a franchise tax report by march 20th, please contact us via email at corporations@sos.arkansas.gov, online at. Web annual.

Fillable Form Ar1055 Arkansas Request For Extension Of Time For

Web northwest will form your llc for $39 (60% discount). Send your report and payment to the arkansas secretary of state. Web how do i pay the franchise tax for my business? Web enter your file number: Ar1100esct corporation estimated tax vouchers.

Make A Check Or Money Order Out To The Arkansas Secretary Of State And Mail Along With Your Paperwork.

Web annual llc franchise tax report 2023 for the year ending 12/31/2022 reports and taxes are due on or before may 1, 2023. Web to pay by mail, download the annual franchise tax pdf form. Web if you have not received a franchise tax report by march 20th, please contact us via email at corporations@sos.arkansas.gov, online at. The file number is located above your company name on your tax report.

Web How Do I Pay The Franchise Tax For My Business?

Find your file number enter your federal tax id: Web businesses may file and pay their annual franchise tax as early as january 1. Do i need to file an. If you do not have a federal.

Skip The Overview And Jump To The Filing Link ↓ 2021 Confusion:

Ar1023ct application for income tax exempt status. Llcs (limited liability companies) and pllcs (professional limited. Ar1100esct corporation estimated tax vouchers. Web $45 to form your arkansas llc (to file your llc articles of organization).

Web Department Of Finance And Administration Franchise Tax Section P.o.

Web enter your file number: Penalty and interest will be due for reports if. Web arkansas limited liability company franchise tax report make checks payable to arkansas secretary of state mail to: Enter your file number and federal tax id.