Arkansas Withholding Form

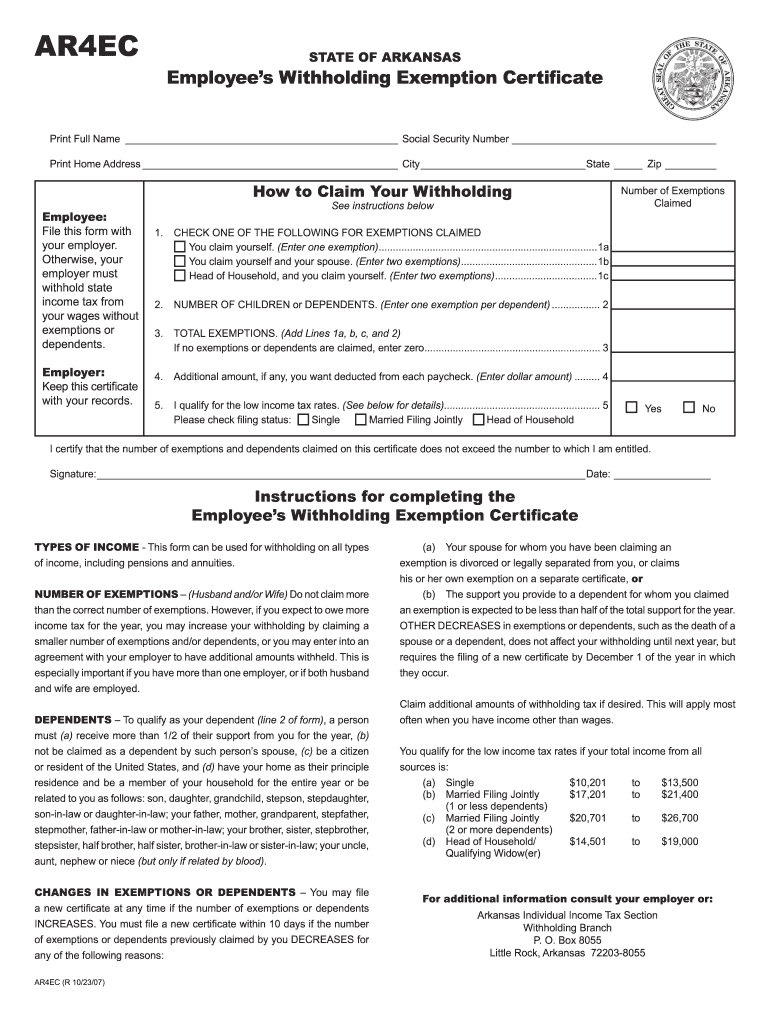

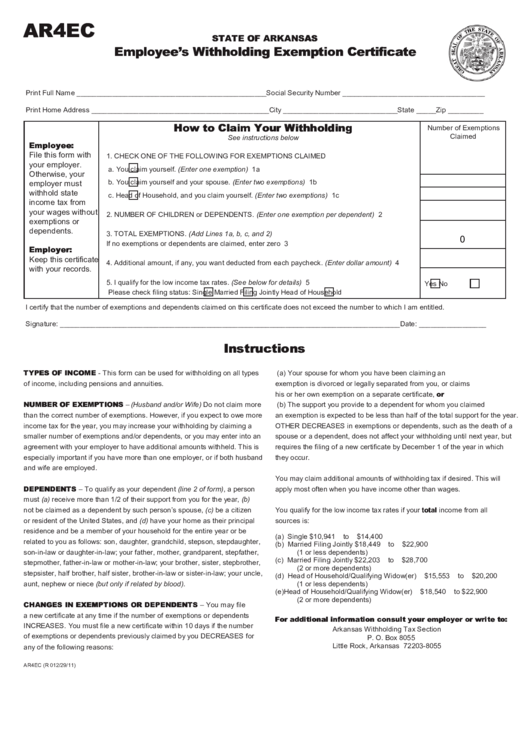

Arkansas Withholding Form - Web how to claim your withholding instructions on the reverse side 1. (b) you claim yourself and your spouse. Web withholding tax formula (effective 06/01/2023) 06/05/2023. File paper forms 1099 and 1096. File this form with your employer. Your withholding is subject to review by the irs. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web of wage and tax statements to the arkansas withholding tax section. Web individual income tax section withholding branch p.o. Web how to claim your withholding state zip number of exemptions employee:

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Web of wage and tax statements to the arkansas withholding tax section. Web how to claim your withholding state zip number of exemptions employee: Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. If too much is withheld, you will generally be due a refund. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Your withholding is subject to review by the irs. File this form with your employer. To change your address or to close your business for withholding purposes, please.

Web of wage and tax statements to the arkansas withholding tax section. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. File this form with your employer. Your withholding is subject to review by the irs. Web how to claim your withholding state zip number of exemptions employee: Check one of the following for exemptions claimed (a) you claim yourself. If too much is withheld, you will generally be due a refund. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. To change your address or to close your business for withholding purposes, please. (b) you claim yourself and your spouse.

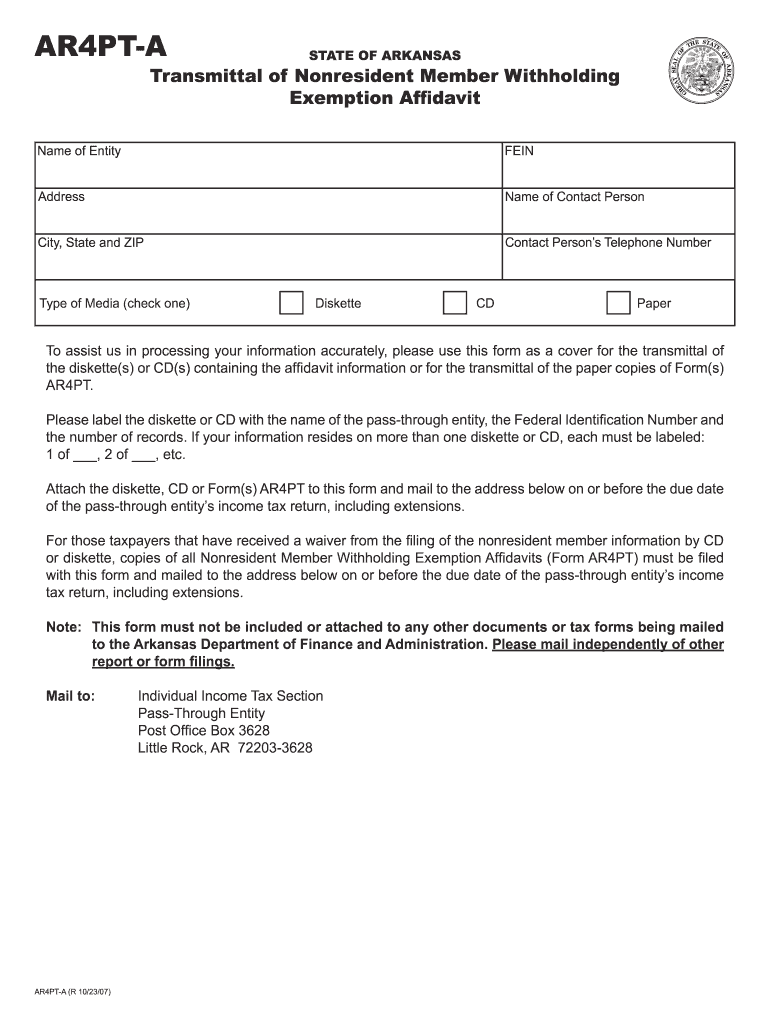

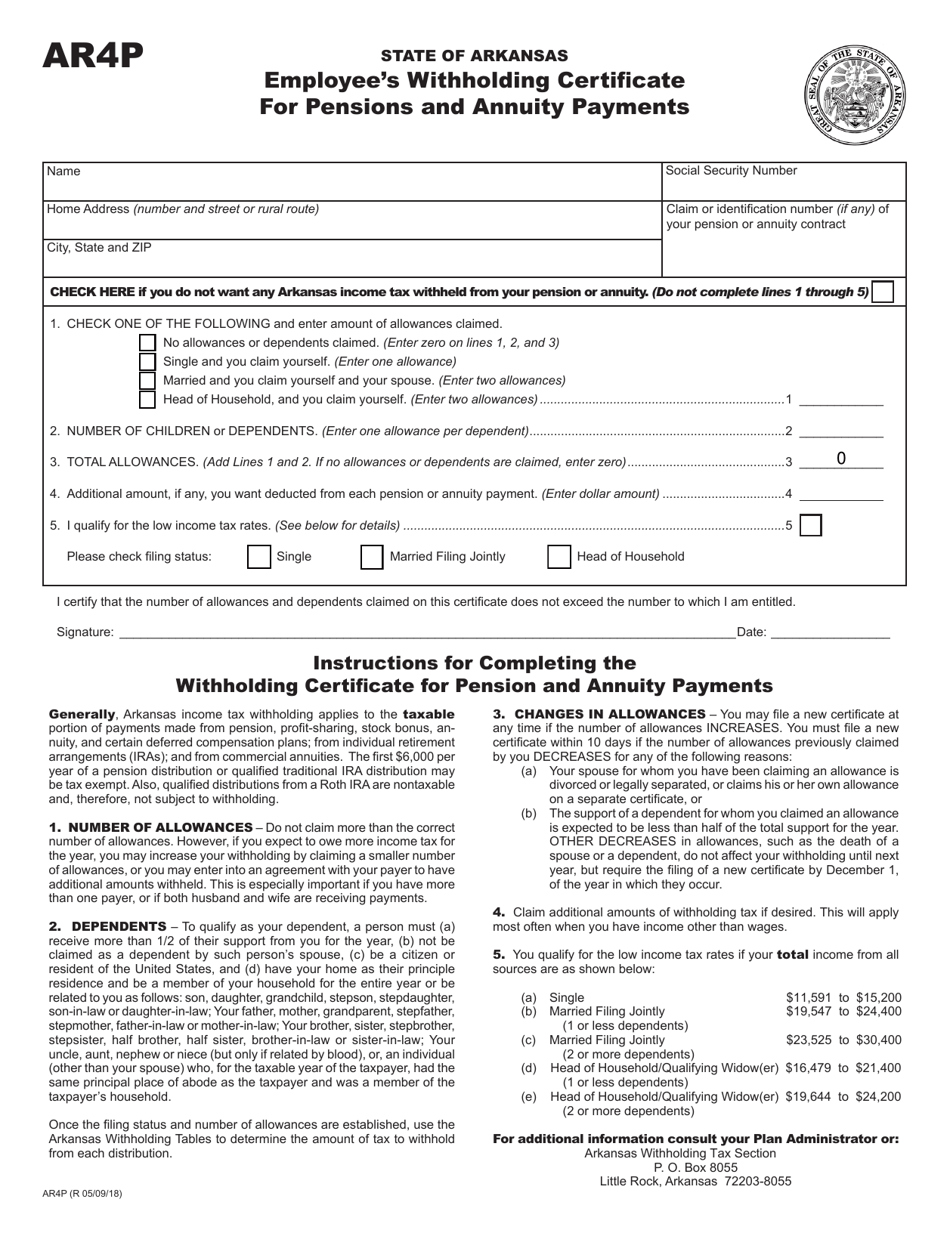

Ar4Pt Fill Out and Sign Printable PDF Template signNow

To change your address or to close your business for withholding purposes, please. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. File paper forms 1099 and 1096. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. Web how to claim your withholding state zip number of exemptions employee:

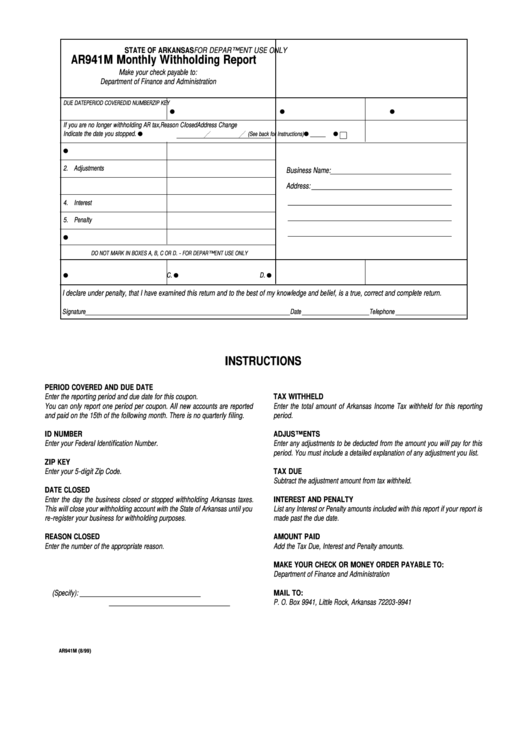

Form Ar941m State Of Arkansas Monthly Withholding Report 1999

To change your address or to close your business for withholding purposes, please. Your withholding is subject to review by the irs. Check one of the following for exemptions claimed (a) you claim yourself. Web individual income tax section withholding branch p.o. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023.

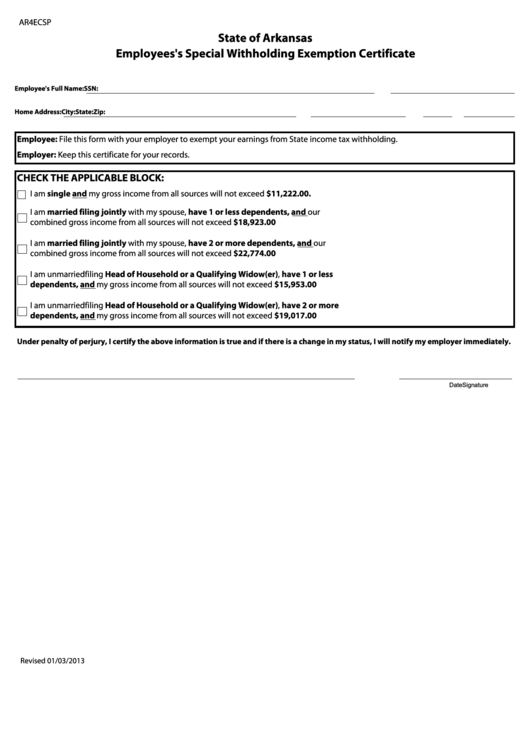

Ar4ec Form Fill Online, Printable, Fillable, Blank pdfFiller

(b) you claim yourself and your spouse. Web individual income tax section withholding branch p.o. Web how to claim your withholding instructions on the reverse side 1. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. File this form with your employer.

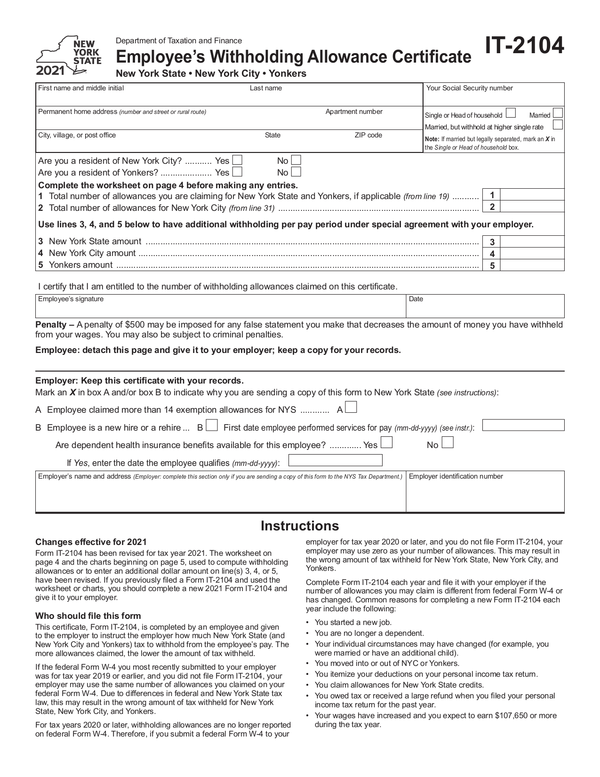

Arkansas State Withholding Form 2022

Web of wage and tax statements to the arkansas withholding tax section. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Otherwise, your employer must withhold state income tax from your wages without see instructions below check one of the following for exemptions claimed you claim yourself. If too little is withheld,.

Arkansas State Tax Withholding Tables 2018

Web how to claim your withholding state zip number of exemptions employee: Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. To change your address or to close your business for withholding purposes, please. If too much is withheld, you will generally be due a refund. If too little is withheld, you will generally owe tax when you file your tax.

Form AR4P Download Fillable PDF or Fill Online Employee's Withholding

Web how to claim your withholding instructions on the reverse side 1. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. To change your address or to close your business for withholding purposes, please. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Check one of the following for.

Top 16 Arkansas Withholding Form Templates free to download in PDF format

Check one of the following for exemptions claimed (a) you claim yourself. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. (b) you claim yourself and your spouse. Web of wage and tax statements to the arkansas withholding tax section. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

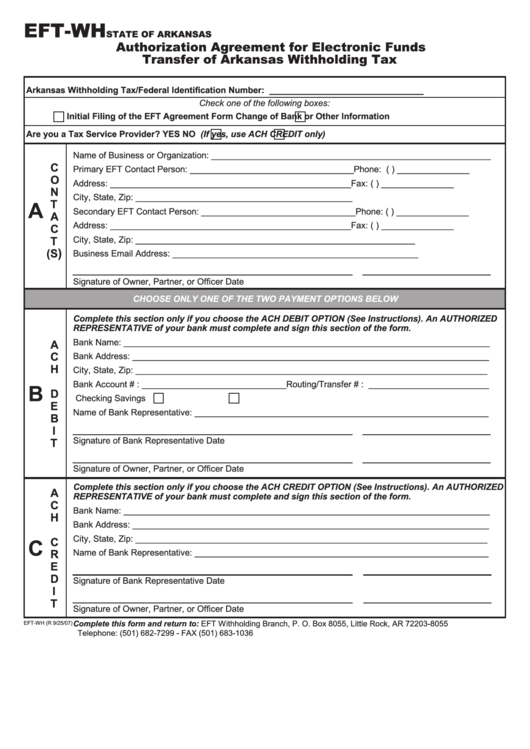

Form EftWh Authorization Agreement For Electronic Funds Transfer Of

If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. To change your address or to close your business for withholding purposes, please. Web of wage and tax statements to the arkansas withholding tax section. Withholding tax instructions for employers (effective 10/01/2022) 09/02/2022. File this form with your employer.

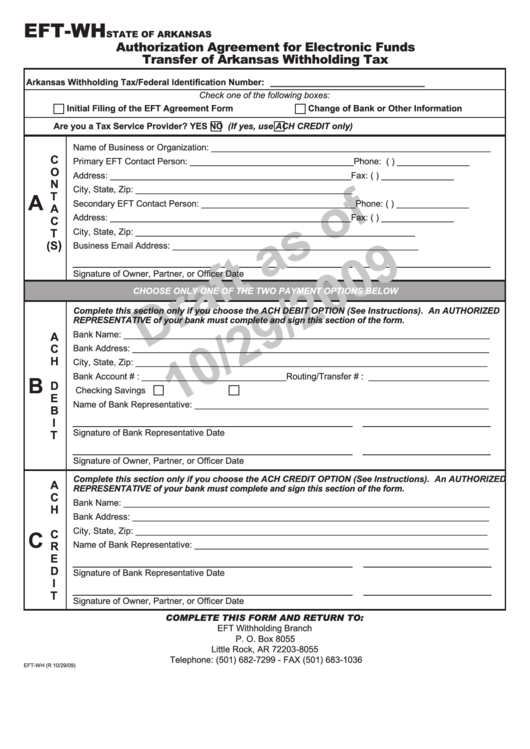

Form EftWh Draft Authorization Agreement For Electronic Funds

File this form with your employer. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Your withholding is subject to review by the irs. Web withholding tax formula (effective 06/01/2023) 06/05/2023. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023.

Fillable State Of Arkansas Employee's Withholding Exemption Certificate

If too much is withheld, you will generally be due a refund. Your withholding is subject to review by the irs. To change your address or to close your business for withholding purposes, please. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. File paper forms 1099 and 1096.

Your Withholding Is Subject To Review By The Irs.

Web withholding tax formula (effective 06/01/2023) 06/05/2023. If too much is withheld, you will generally be due a refund. To change your address or to close your business for withholding purposes, please. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

Withholding Tax Instructions For Employers (Effective 10/01/2022) 09/02/2022.

Web how to claim your withholding instructions on the reverse side 1. Withholding tax tables for low income (effective 06/01/2023) 06/05/2023. Withholding tax tables for employers (effective 06/01/2023) 06/05/2023. Check one of the following for exemptions claimed (a) you claim yourself.

Web Individual Income Tax Section Withholding Branch P.o.

File this form with your employer. Web of wage and tax statements to the arkansas withholding tax section. Web how to claim your withholding state zip number of exemptions employee: File paper forms 1099 and 1096.

Otherwise, Your Employer Must Withhold State Income Tax From Your Wages Without See Instructions Below Check One Of The Following For Exemptions Claimed You Claim Yourself.

(b) you claim yourself and your spouse.