At The Money Calendar Spread Greeks Measured

At The Money Calendar Spread Greeks Measured - This strategy can be done with either calls. Web take your understanding of the calendar spreads to the next level. Web a tutorial on how a calendar option spread works, including the profit/loss profile of both long and short calendar spreads. In a calendar spread, the delta for the long leg (the option with the later expiration date). Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar. Web delta measures how sensitive an option's price is to changes in the underlying asset's price. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling. This is second part of calendar spread strategy, in this view we have learned abut delta, theta and vega of calendar. Web a calendar trading strategy, which is a spread option trade, can provide many advantages that a plain call cannot, particularly in volatile markets.

Web how to create a calendar spread. Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar. Ideal market conditions include low implied volatility and a. This is second part of calendar spread strategy, in this view we have learned abut delta, theta and vega of calendar. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web at the money (atm), sometimes referred to as on the money, is one of three terms used to describe the relationship between an option's strike price and the. Beim calendar spread werden optionen auf den selben basiswert aber mit unterschiedlichen laufzeiten verwendet. Option a if you are lon. Web take your understanding of the calendar spreads to the next level. Web calendar spreads mit optionen.

Web the calendar spread is a popular options trading strategy among investors. A) long calender spread means buying and selling the option of same strike price but different maturity. Web take your understanding of the calendar spreads to the next level. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. In a calendar spread, the delta for the long leg (the option with the later expiration date). Web delta measures how sensitive an option's price is to changes in the underlying asset's price. This strategy can be done with either calls. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling. Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar.

How To Build A Double Calendar Spread PDF Option (Finance) Greeks

A) long calender spread means buying and selling the option of same strike price but different maturity. Ideal market conditions include low implied volatility and a. Web the calendar spread is a popular options trading strategy among investors. Web at the money (atm), sometimes referred to as on the money, is one of three terms used to describe the relationship.

Double Calendar Spreads PDF Option (Finance) Greeks (Finance)

Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web take your understanding of the calendar spreads to the next level. Web a calendar trading strategy, which is a spread option trade, can provide many advantages that a plain call cannot, particularly in volatile.

Calendar Spreads PDF Greeks (Finance) Option (Finance)

Web take your understanding of the calendar spreads to the next level. Explore the calendar spread in detail along with its different types. Ideal market conditions include low implied volatility and a. Option a if you are lon. Beim calendar spread werden optionen auf den selben basiswert aber mit unterschiedlichen laufzeiten verwendet.

Options Greeks Cheat Sheet [Free PDF] HowToTrade

Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web the calendar spread is a popular options trading strategy among investors. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option and selling..

At The Money Calendar Spread Rhona Cherrita

Web calendar spreads mit optionen. This is second part of calendar spread strategy, in this view we have learned abut delta, theta and vega of calendar. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web delta measures how sensitive an option's price is.

How to use OPTION GREEKS to calculate calendar call spreads profit/risk

Web at the money (atm), sometimes referred to as on the money, is one of three terms used to describe the relationship between an option's strike price and the. This strategy can be done with either calls. Web delta measures how sensitive an option's price is to changes in the underlying asset's price. If you are long that means the.

Calendar Spread PDF Greeks (Finance) Option (Finance)

Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Explore the calendar spread in detail along with its different types. If you are long that means the option is sol. Web a calendar trading strategy, which is a spread option trade, can provide many.

Calendars Greeks When to use calendar Spread YouTube

Web recognize that the question is asking you to understand the greeks associated with a long 'at the money' calendar spread. This strategy can be done with either calls. Web the calendar spread is a popular options trading strategy among investors. Web have seen when to take calendar spread. Web delta measures how sensitive an option's price is to changes.

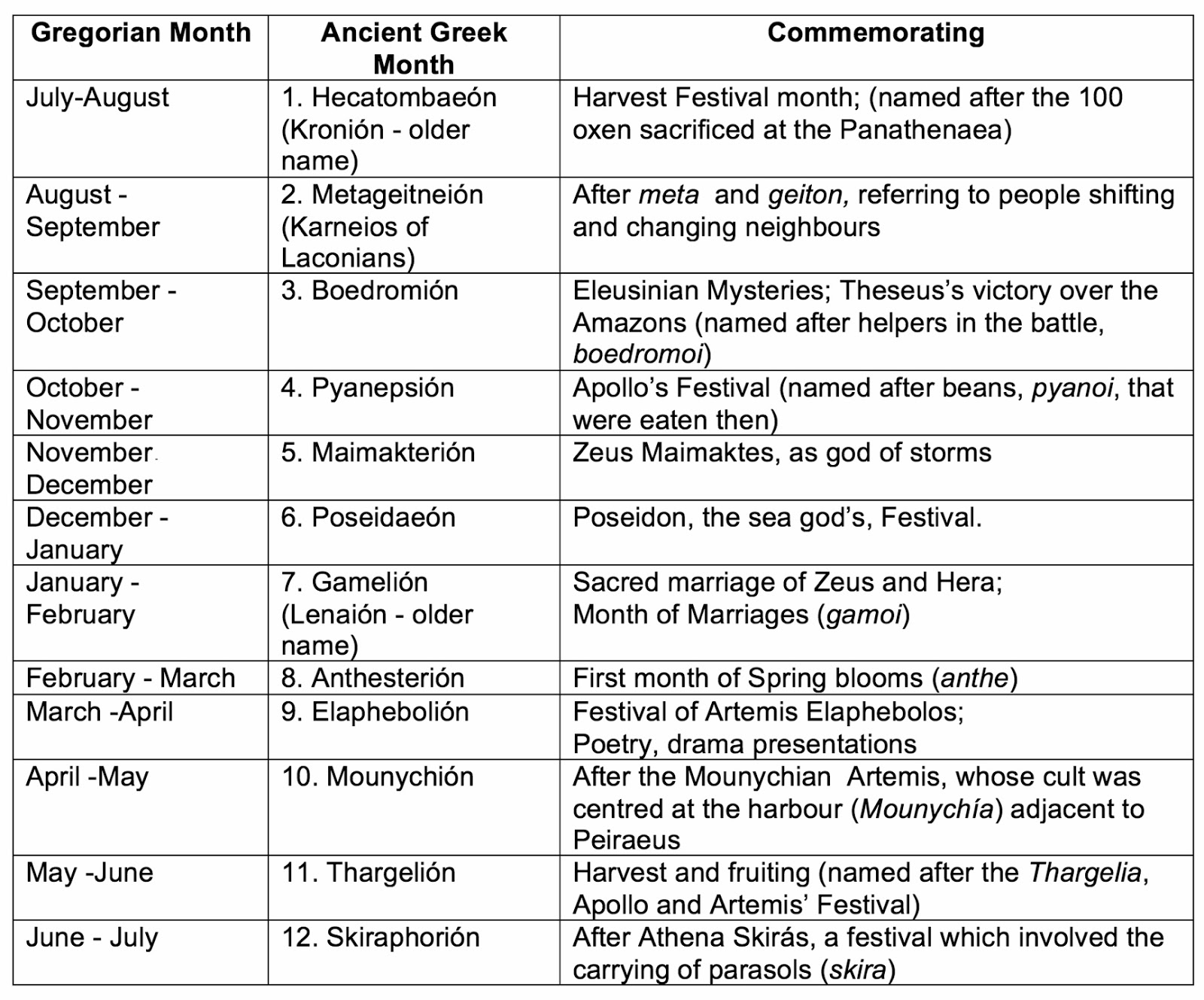

Intelliblog THE ANCIENT GREEK CALENDAR

Ideal market conditions include low implied volatility and a. Web calendar spreads mit optionen. Web recognize that the question is asking you to understand the greeks associated with a long 'at the money' calendar spread. If you are long that means the option is sol. Web a calendar trading strategy, which is a spread option trade, can provide many advantages.

Long Call Calendar Spread PDF Greeks (Finance) Option (Finance)

Web calendar spreads mit optionen. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web how to create a calendar spread. A calendar spread, sometimes called a time spread or a horizontal spread, is an option strategy that involves buying one option.

Web A Long Calendar Call Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Calls With The Purchased Call Expiring One Month Later.

Web take your understanding of the calendar spreads to the next level. This is second part of calendar spread strategy, in this view we have learned abut delta, theta and vega of calendar. Ideal market conditions include low implied volatility and a. Explore the impact greeks have, specifically theta (time decay) and vega (volatility), on the calendar.

A) Long Calender Spread Means Buying And Selling The Option Of Same Strike Price But Different Maturity.

Web delta measures how sensitive an option's price is to changes in the underlying asset's price. Web calendar spreads mit optionen. Option a if you are lon. This strategy can be done with either calls.

Web A Calendar Trading Strategy, Which Is A Spread Option Trade, Can Provide Many Advantages That A Plain Call Cannot, Particularly In Volatile Markets.

Beim calendar spread werden optionen auf den selben basiswert aber mit unterschiedlichen laufzeiten verwendet. Web how to create a calendar spread. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. In a calendar spread, the delta for the long leg (the option with the later expiration date).

A Calendar Spread, Sometimes Called A Time Spread Or A Horizontal Spread, Is An Option Strategy That Involves Buying One Option And Selling.

Web at the money (atm), sometimes referred to as on the money, is one of three terms used to describe the relationship between an option's strike price and the. If you are long that means the option is sol. Web a tutorial on how a calendar option spread works, including the profit/loss profile of both long and short calendar spreads. Explore the calendar spread in detail along with its different types.

![Options Greeks Cheat Sheet [Free PDF] HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/options-greeks-cheat-sheet-860x608.png)