Az A4 Form 2023

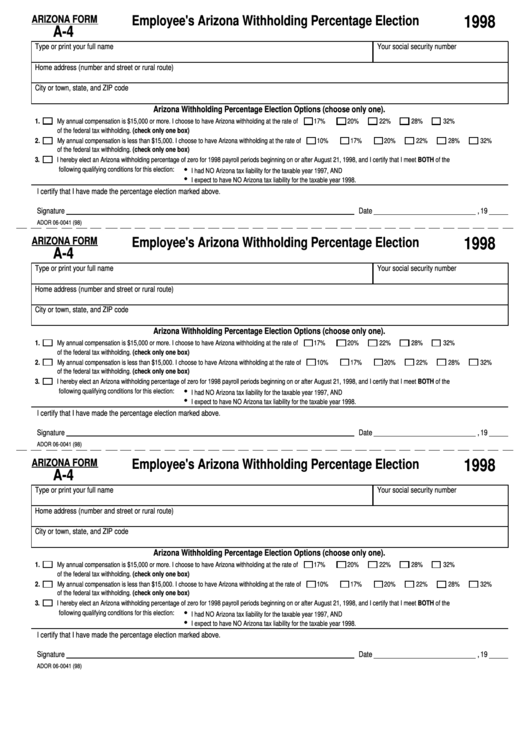

Az A4 Form 2023 - File this form to change the arizona withholding percentage or to change the extra amount withheld. Use a a4 form 2021 template to make your document workflow. The arizona department of revenue has. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department. 1 withhold from gross taxable. You can use your results. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. The tax rates used on arizona’s withholding certificates are decreasing for 2023. As a result, we are revising. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year.

Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. As a result, we are revising. Choose either box 1 or box 2: Use a a4 form 2021 template to make your document workflow. The tax rates used on arizona’s withholding certificates are decreasing for 2023. Form year form published ; Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. 1 withhold from gross taxable.

Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. You can use your results. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department. Use a a4 form 2021 template to make your document workflow. The tax rates used on arizona’s withholding certificates are decreasing for 2023. Web thursday, december 15, 2022. Form year form published ; Web 20 rows withholding forms. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year.

Printable A4 Form 2023 Fillable Form 2023 941 Tax IMAGESEE

You can use your results. Use a a4 form 2021 template to make your document workflow. As a result, we are revising. Web thursday, december 15, 2022. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%.

A4_201602_sp Form Fillable Pdf Template Download Here!

File this form to change the arizona withholding percentage or to change the extra amount withheld. Use a a4 form 2021 template to make your document workflow. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. The arizona department of revenue has..

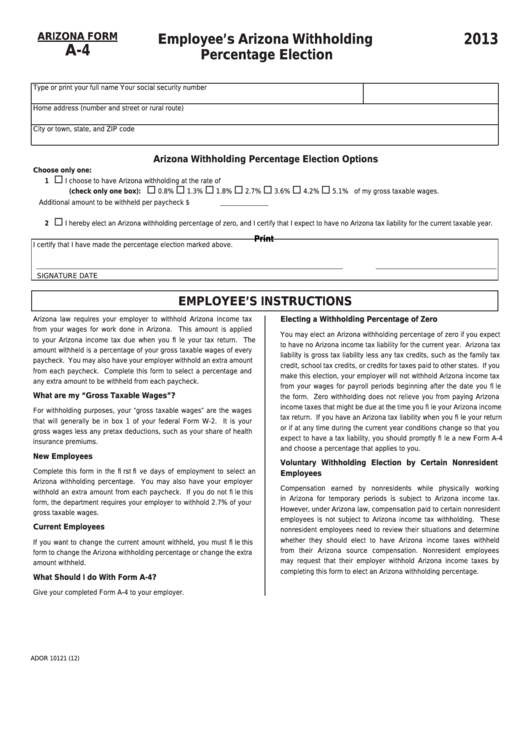

Download Arizona Form A4 (2013) for Free FormTemplate

Choose either box 1 or box 2: The arizona department of revenue has. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. 1 withhold from gross taxable. Use a a4 form 2021 template to make your document workflow.

Køb DIN 6797 rustfrit stål A4, form AZ online

Web this form is for income earned in tax year 2021, with tax returns due in april 2022. The arizona department of revenue (dor). The arizona department of revenue has. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Web 20 rows.

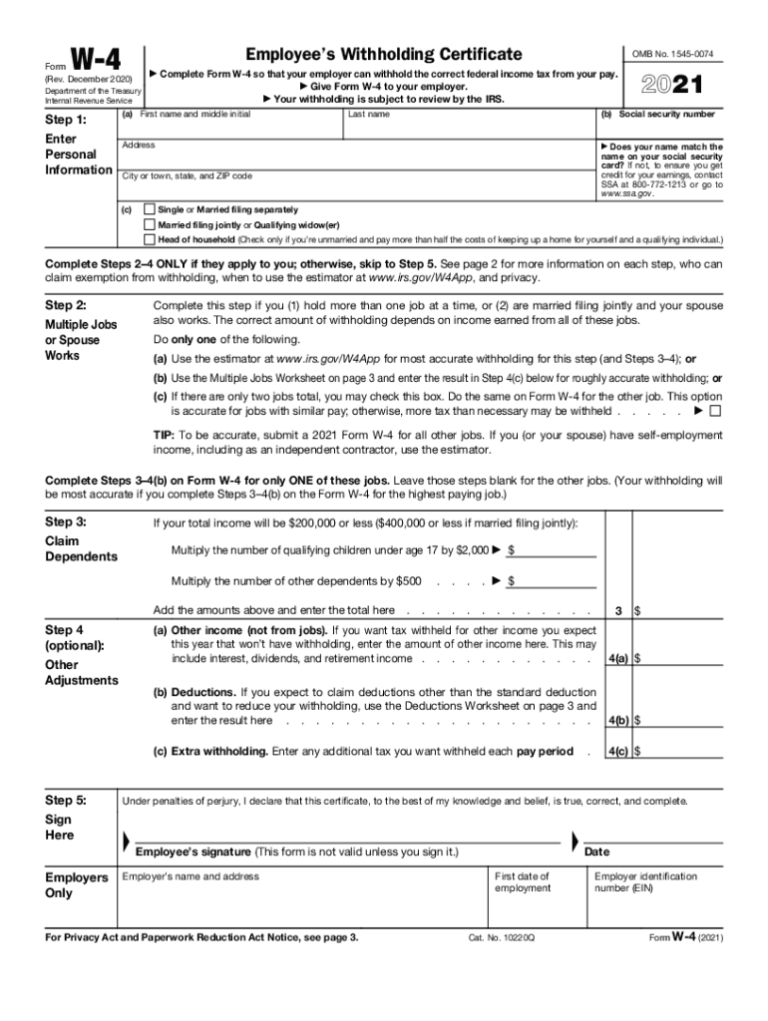

2023 IRS W 4 Form HRdirect Fillable Form 2023

The arizona department of revenue (dor). Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department. Web this form is for income earned in tax year 2021, with tax returns due in april 2022. 1 withhold from gross taxable. Web 2 i elect.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Web 20 rows withholding forms. Choose either box 1 or box 2: Web this form is for income earned in tax year 2021, with tax returns due in april 2022. File this form to change the arizona withholding percentage or to change the extra amount withheld. Web as of january 1, 2023, the new default withholding rate for the arizona.

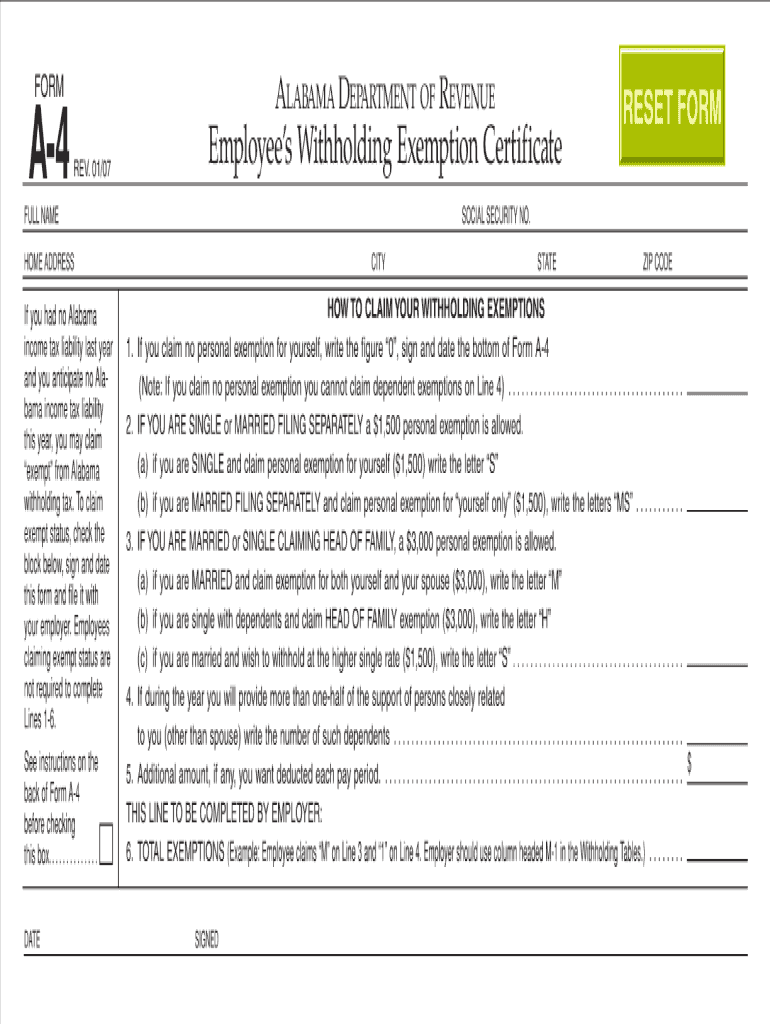

2007 Form AL DoR A4 Fill Online, Printable, Fillable, Blank pdfFiller

Web 20 rows withholding forms. 1 withhold from gross taxable. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department. Use a a4 form 2021 template to make your document workflow. Web thursday, december 15, 2022.

A4 form Fill out & sign online DocHub

Web thursday, december 15, 2022. The arizona department of revenue (dor). Form year form published ; Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. The tax rates used on arizona’s withholding certificates are decreasing for 2023.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Use a a4 form 2021 template to make your document workflow. File this form to change the arizona withholding percentage or to change the extra amount withheld. The arizona department of revenue has. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department..

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department. Web thursday, december 15, 2022. Choose either box 1 or box 2: Web 20.

The Arizona Department Of Revenue (Dor).

Web thursday, december 15, 2022. Web 2 i elect an arizona withholding percentage of zero, and i certify that i expect to have no arizona tax liability for the current taxable year. Choose either box 1 or box 2: Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department.

Web 2 I Elect An Arizona Withholding Percentage Of Zero, And I Certify That I Expect To Have No Arizona Tax Liability For The Current Taxable Year.

Web 20 rows withholding forms. Web as of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. Web this form is for income earned in tax year 2021, with tax returns due in april 2022. Form year form published ;

You Can Use Your Results.

Use a a4 form 2021 template to make your document workflow. As a result, we are revising. The arizona department of revenue has. 1 withhold from gross taxable.

File This Form To Change The Arizona Withholding Percentage Or To Change The Extra Amount Withheld.

The tax rates used on arizona’s withholding certificates are decreasing for 2023.