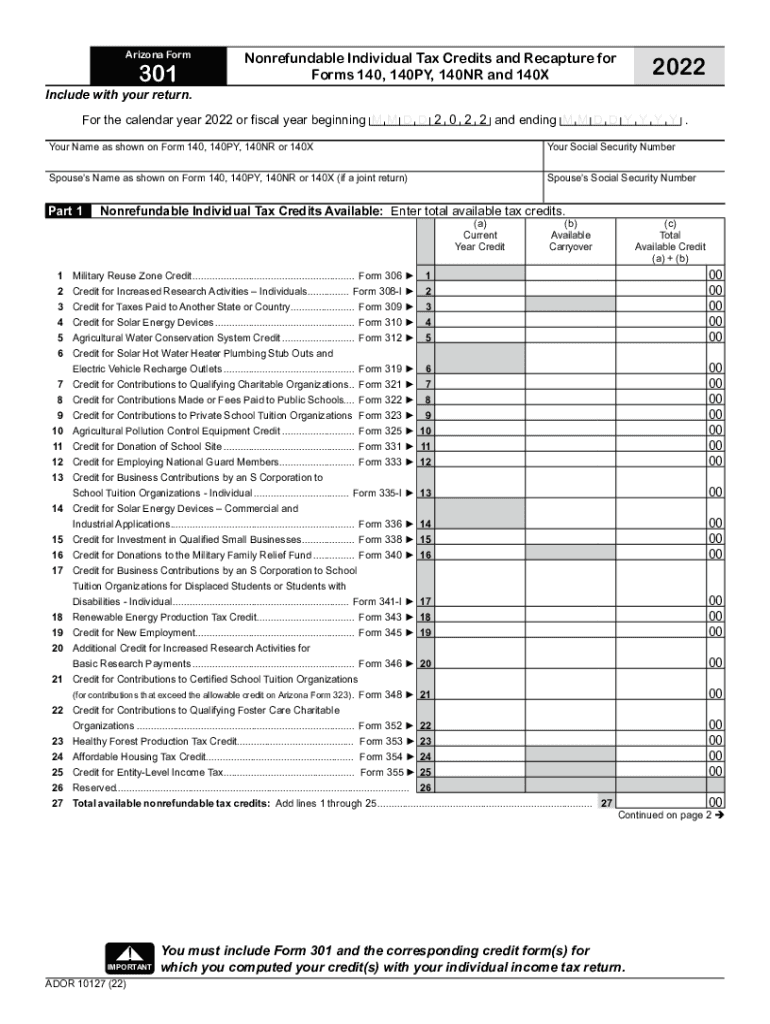

Az Form 301 For 2022

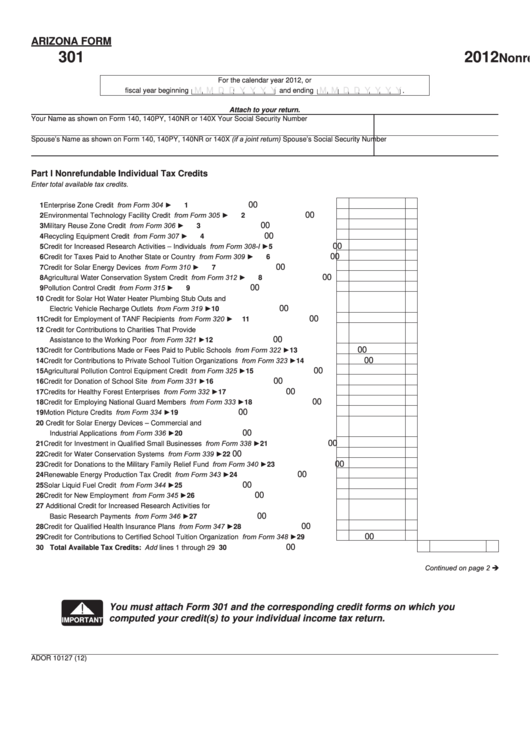

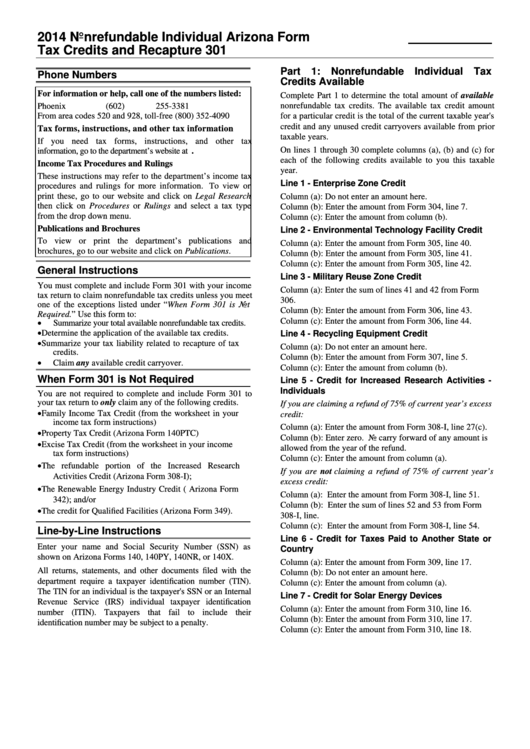

Az Form 301 For 2022 - Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web also, enter this amount on arizona form 301, part 1, line 9, column (c). Web 2022 nonrefundable individual tax credits and recapture arizona form 301 for information or help, call one of the numbers listed: Details on how to only prepare and print an. 4.8 satisfied (81 votes) az dor form 301 2021: Web generalinstructions you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless. You may carry over only that portion of the credit that is not applied to tax. Save or instantly send your ready documents. 2023may be used as a. It’s important to avoid state tax issues and potential financial liability for failing to.

Arizona has a state income tax that ranges between 2.59% and 4.5%. 4.8 satisfied (84 votes) az dor form 301 2019: You may carry over only that portion of the credit that is not applied to tax. Web a full list of arizona forms can be found here: Web 26 rows tax credits forms : Easily fill out pdf blank, edit, and sign them. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. 4.4 satisfied (136 votes) be ready to get more. Web arizona state income tax forms for tax year 2022 (jan. Details on how to only prepare and print an.

Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Web your name as shown on form 140, 140py, 140nr or 140x your social security number spouse’s name as shown on form 140, 140py, 140nr or 140x (if a joint return). Web a full list of arizona forms can be found here: Web arizona state income tax forms for tax year 2022 (jan. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Arizona has a state income tax that ranges between 2.59% and 4.5%. The current tax year is 2022, and most states will release updated tax forms between. Save or instantly send your ready documents. Web where do i see carryovers for arizona credits for form 301? This form is for income earned in tax year 2022, with tax returns due in april.

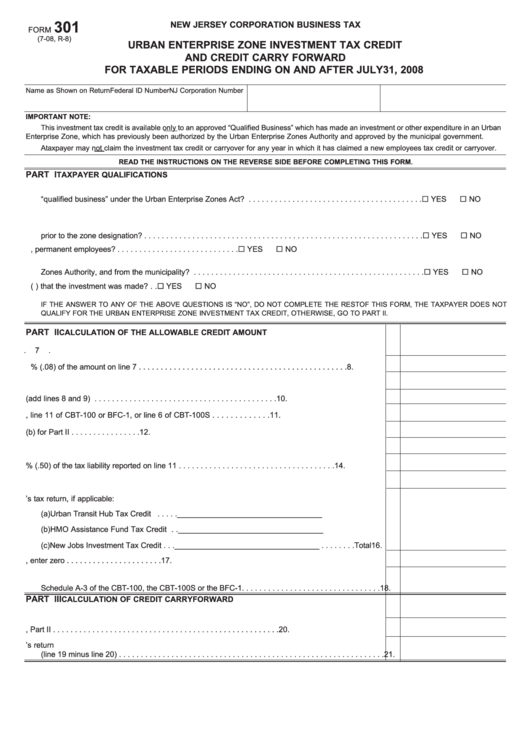

Fillable Form 301 Urban Enterprise Zone Investment Tax Credit And

The current tax year is 2022, and most states will release updated tax forms between. Web where do i see carryovers for arizona credits for form 301? Arizona has a state income tax that ranges between 2.59% and 4.5%. Web a full list of arizona forms can be found here: Form 310, credit for solar energy devices is available by.

OSHA Forms 300/301 OSHAcademy Free Online Training

Easily fill out pdf blank, edit, and sign them. Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Details on how to only prepare and print an. 4.4 satisfied (136 votes) be ready to get more. 2023may be used as a.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

4.4 satisfied (136 votes) be ready to get more. Web taxformfinder provides printable pdf copies of 96 current arizona income tax forms. Az allows carryover of unused credits. Start completing the fillable fields and carefully. 2023may be used as a.

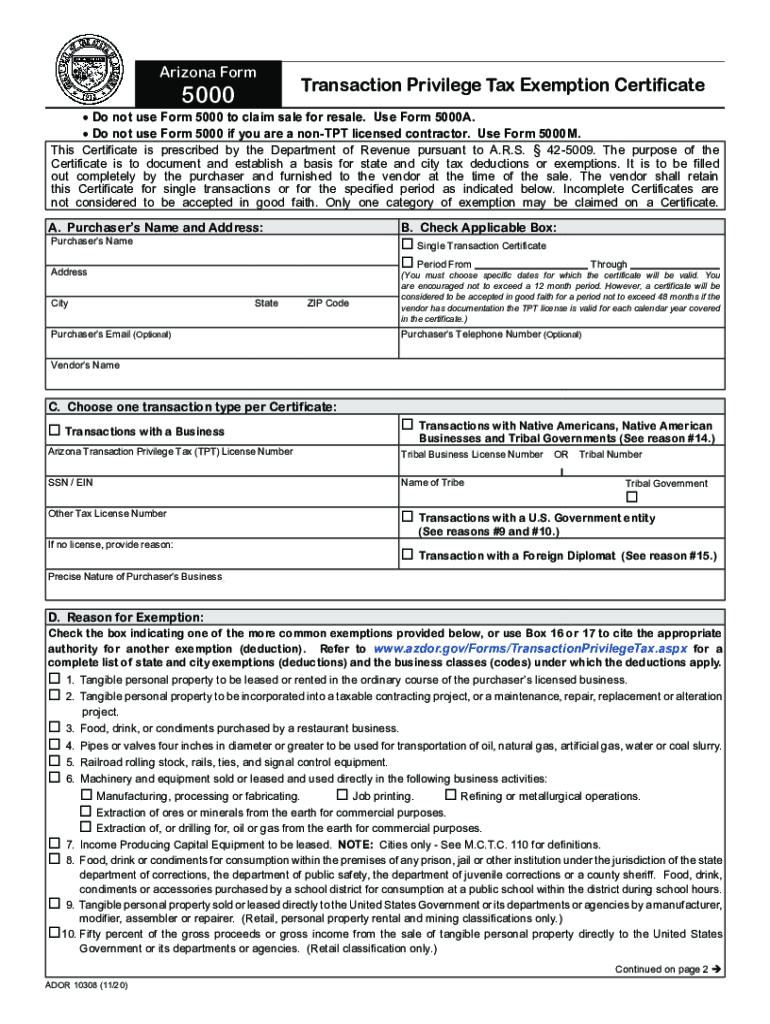

2020 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

Az allows carryover of unused credits. Use get form or simply click on the template preview to open it in the editor. 4.4 satisfied (136 votes) be ready to get more. Web a full list of arizona forms can be found here: Ad register and subscribe now to work on your az dor form 301 & more fillable forms.

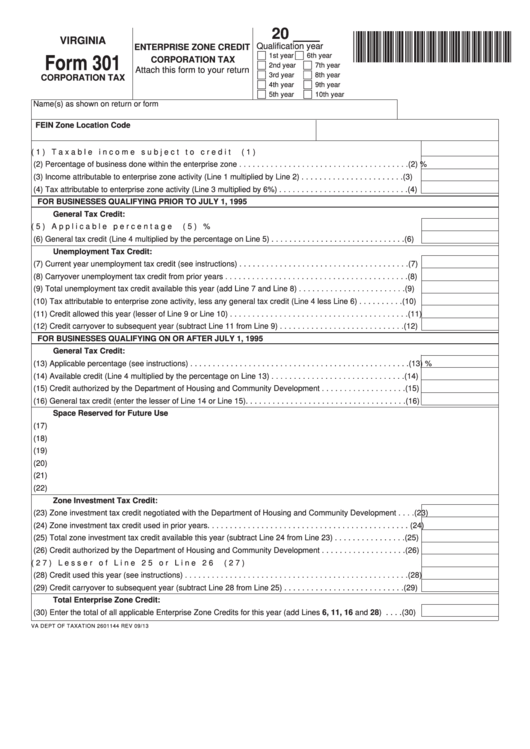

Fillable Form 301 Virginia Enterprise Zone Credit Corporation Tax

Include forms 301 and 323with your tax return to claim this. Save or instantly send your ready documents. 4.4 satisfied (136 votes) be ready to get more. Web arizona state income tax forms for tax year 2022 (jan. Details on how to only prepare and print an.

2022 AZ DoR Form 301 Fill Online, Printable, Fillable, Blank pdfFiller

Web generalinstructions you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless. 2023may be used as a. Web 2022 nonrefundable individual tax credits and recapture arizona form 301 for information or help, call one of the numbers listed: Easily fill out pdf blank, edit, and sign.

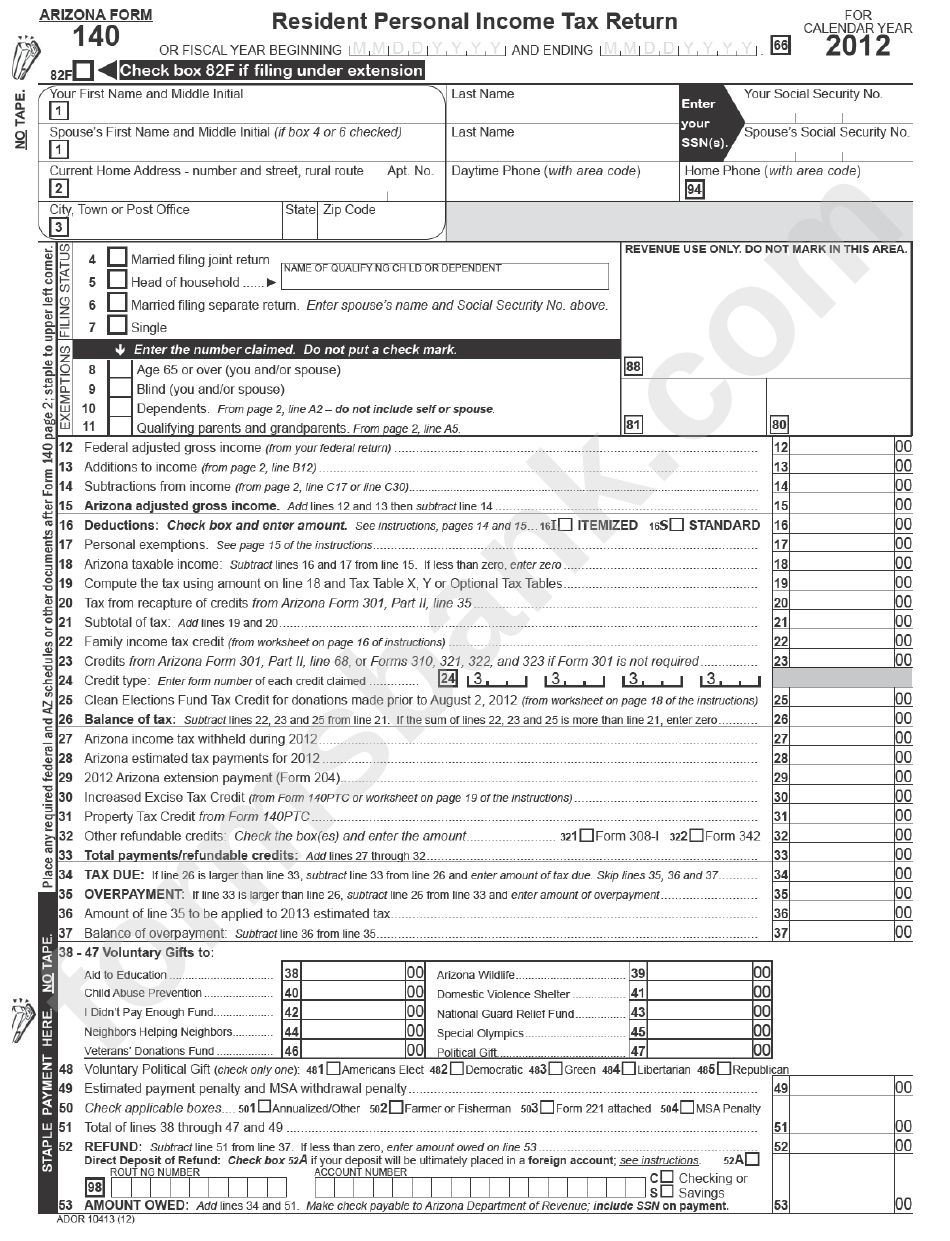

Printable Az 140 Tax Form Printable Form 2022

Easily fill out pdf blank, edit, and sign them. You may carry over only that portion of the credit that is not applied to tax. The current tax year is 2022, and most states will release updated tax forms between. Start completing the fillable fields and carefully. Nonrefundable corporate tax credits and.

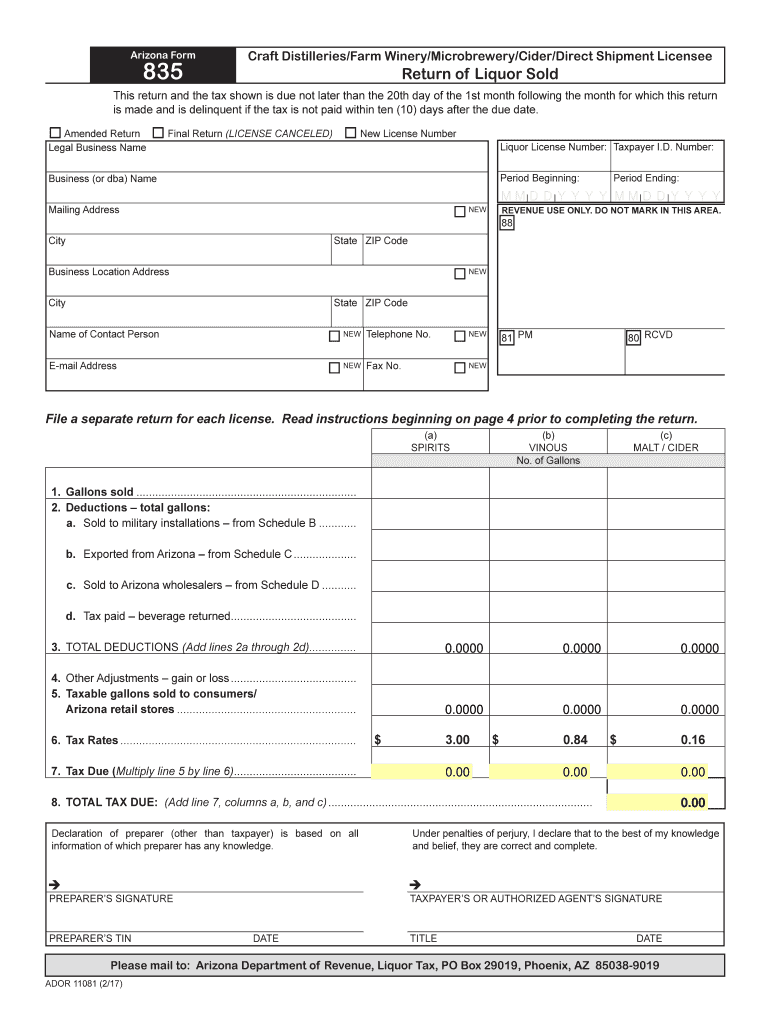

AZ Form 835 20172022 Fill out Tax Template Online US Legal Forms

This form is for income earned in tax year 2022, with tax returns due in april. Start completing the fillable fields and carefully. You may carry over only that portion of the credit that is not applied to tax. Web a full list of arizona forms can be found here: Web also complete arizona form 301, nonrefundable individual tax credits.

Arizona Form 301 Nonrefundable Individual Tax Credits And Recapture

4.8 satisfied (84 votes) az dor form 301 2019: You may carry over only that portion of the credit that is not applied to tax. Nonrefundable corporate tax credits and. Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Web az dor form.

AZ Form 140 20202021 Fill out Tax Template Online US Legal Forms

4.4 satisfied (136 votes) be ready to get more. Web taxformfinder provides printable pdf copies of 96 current arizona income tax forms. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web generalinstructions you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to.

Details On How To Only Prepare And Print An.

Use get form or simply click on the template preview to open it in the editor. 4.8 satisfied (81 votes) az dor form 301 2021: Web 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return. Nonrefundable corporate tax credits and.

Ad Register And Subscribe Now To Work On Your Az Dor Form 301 & More Fillable Forms.

Web your name as shown on form 140, 140py, 140nr or 140x your social security number spouse’s name as shown on form 140, 140py, 140nr or 140x (if a joint return). Arizona has a state income tax that ranges between 2.59% and 4.5%. Save or instantly send your ready documents. You may carry over only that portion of the credit that is not applied to tax.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web 26 rows tax credits forms : Easily fill out pdf blank, edit, and sign them. 2023may be used as a. Include forms 301 and 323with your tax return to claim this.

Form 310, Credit For Solar Energy Devices Is Available By Selecting The 2Nd Option On The Screen Titled Other Nonrefundable Credits.

Web also complete arizona form 301, nonrefundable individual tax credits and recapture, and. Web 2022 nonrefundable individual tax credits and recapture arizona form 301 for information or help, call one of the numbers listed: 4.4 satisfied (136 votes) be ready to get more. 4.8 satisfied (84 votes) az dor form 301 2019: