Babysitting Tax Form

Babysitting Tax Form - Web we can help pay for the child care that fits your schedule, including days, evenings, and weekends. Teen parents completing high school or ged. Don’t worry, our tips will help highlight what you. Web nanny taxes guide: Our records show we provided service (s) to <child's name> at.</p> If your babysitter earns at least $2,400 for the year, taxes will need to be taken care of. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. This helps their statistics but doesn’t. Web if your child is under 13 years of age or a disabled dependent, you can claim a tax credit of up to 35% of your qualifying expenses. Web • 5 min read have you ever wondered if babysitting is taxable in the us?

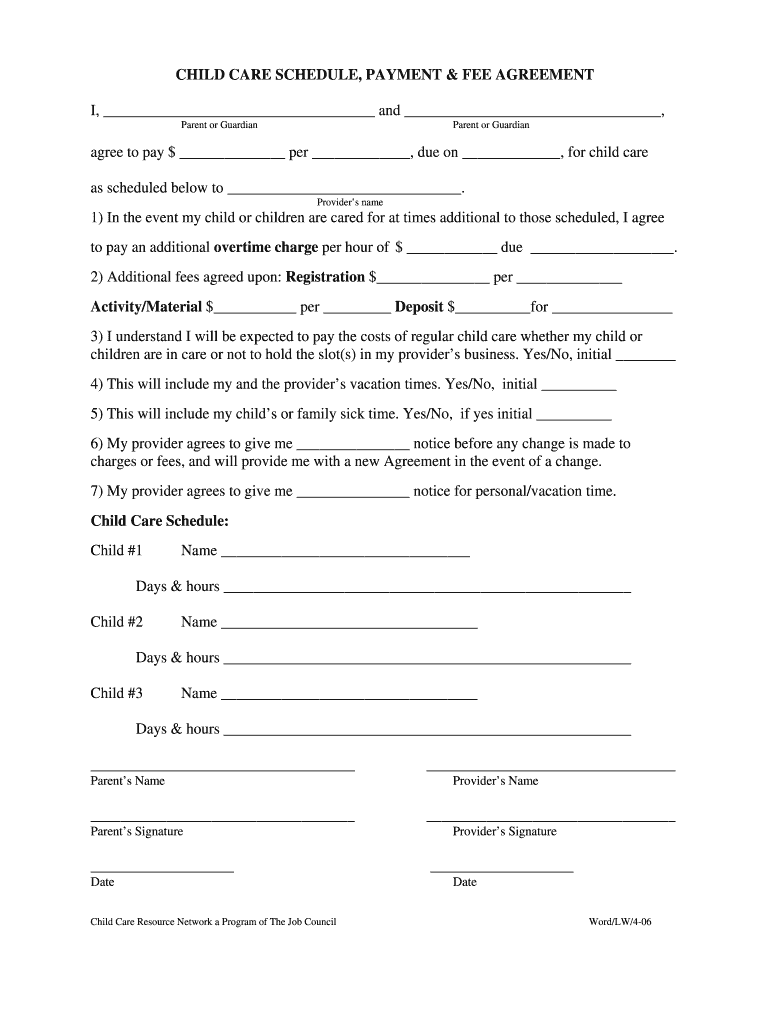

Ad payroll so easy, you can set it up & run it yourself. Erik johnson december 5, 2022. Our records show we provided service (s) to <child's name> at.</p> Form 2441 is used to by. Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent care expenses on your tax return. In these forms, you will declare. Web when the ‘nanny tax’ applies to a babysitter. Web we can help pay for the child care that fits your schedule, including days, evenings, and weekends. If you control how the work is performed, the babysitter is a household employee. You can submit your completed form(s) in one of these ways:

Web if your child is under 13 years of age or a disabled dependent, you can claim a tax credit of up to 35% of your qualifying expenses. Web when the ‘nanny tax’ applies to a babysitter. Our records show we provided service (s) to <child's name> at.</p> Web we can help pay for the child care that fits your schedule, including days, evenings, and weekends. If you’re a babysitter, the irs will ask you to enter a business tax code. Web what is the business tax code for a babysitter? Teen parents completing high school or ged. Web the child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). A qualifying expense is a care. Web nanny taxes guide:

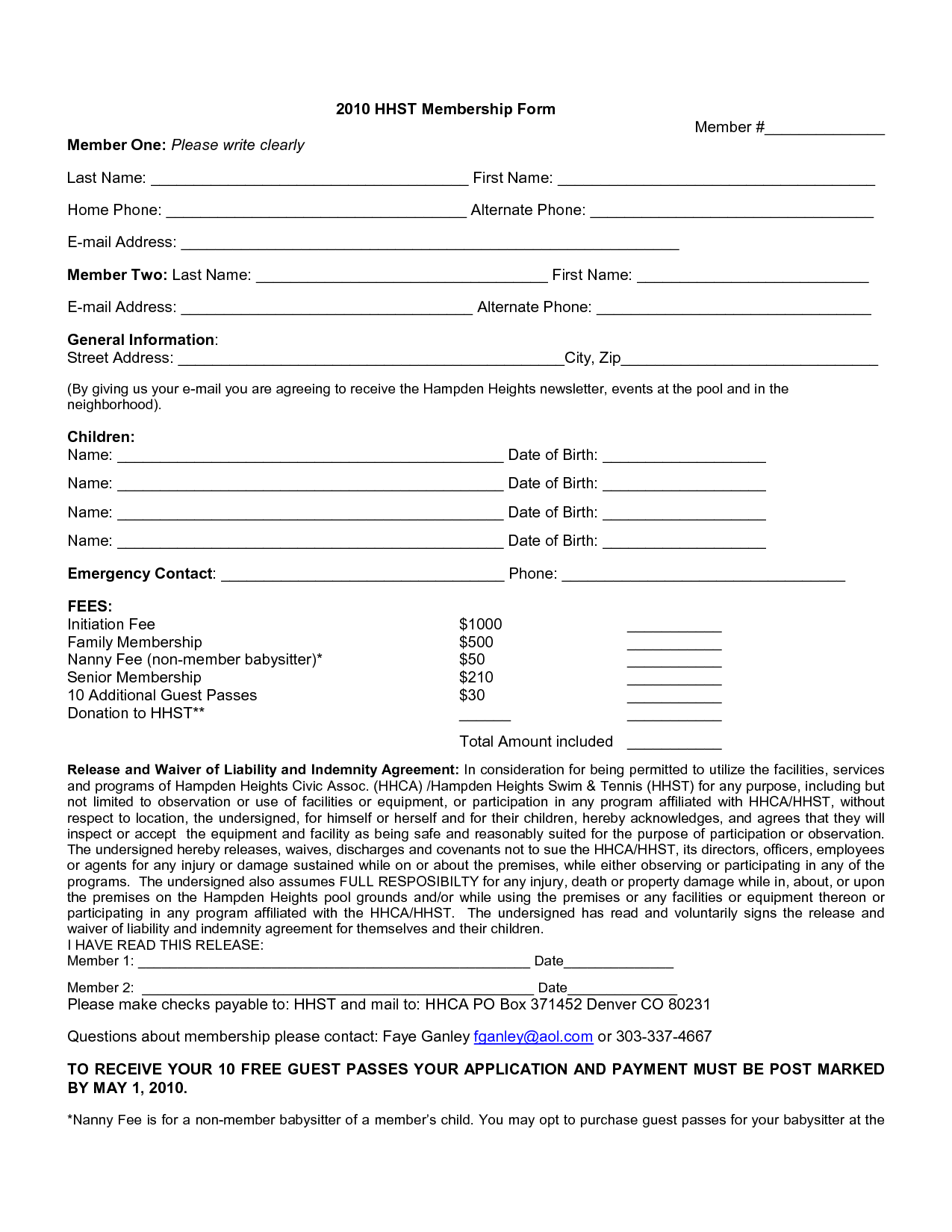

FREE 63+ Printable Application Forms in MS Word PDF Pages Google Docs

Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent care expenses on your tax return. If your babysitter earns at least $2,400 for the year, taxes will need to be taken care of. This helps their statistics but doesn’t. Web if your child is under 13 years of.

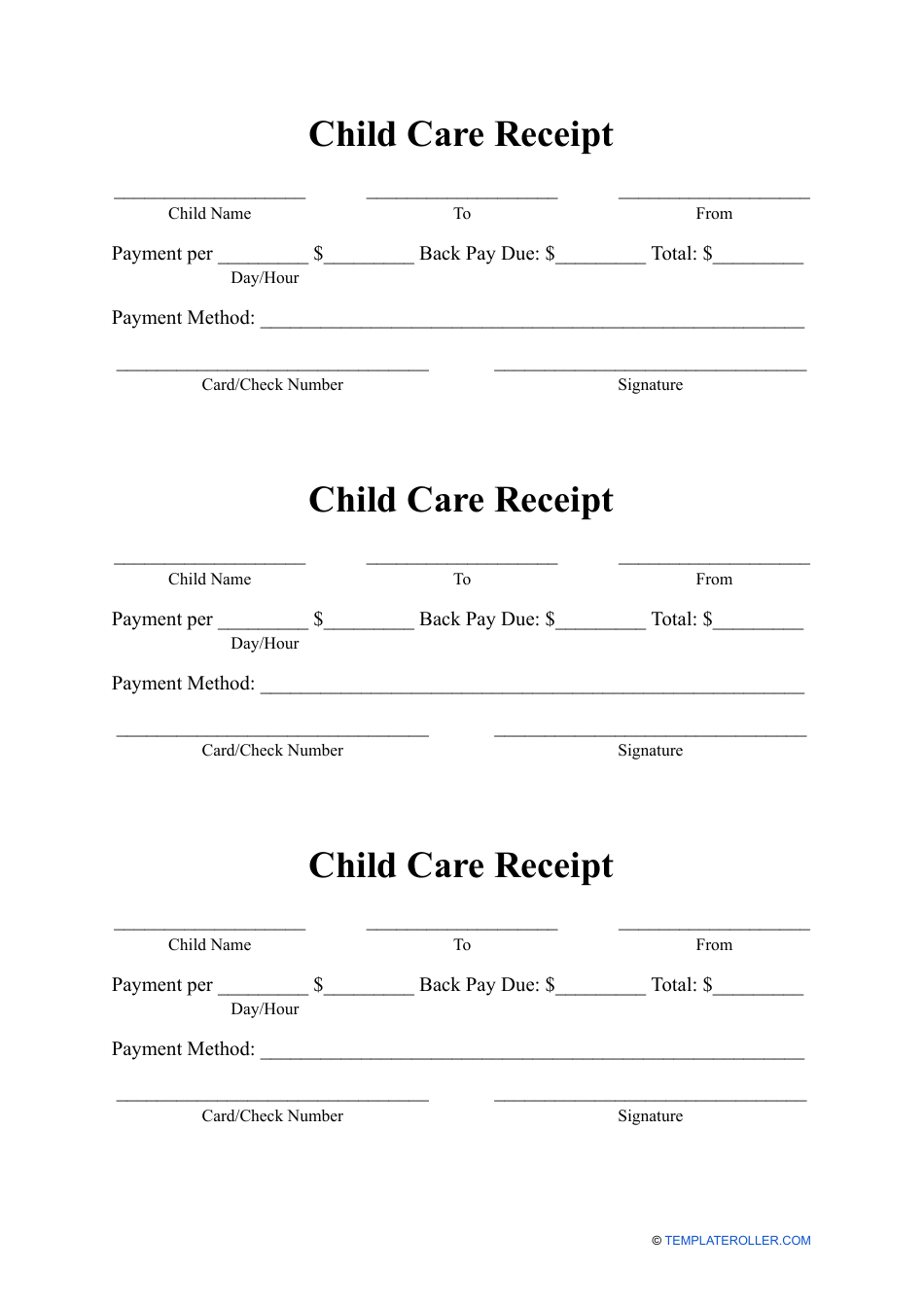

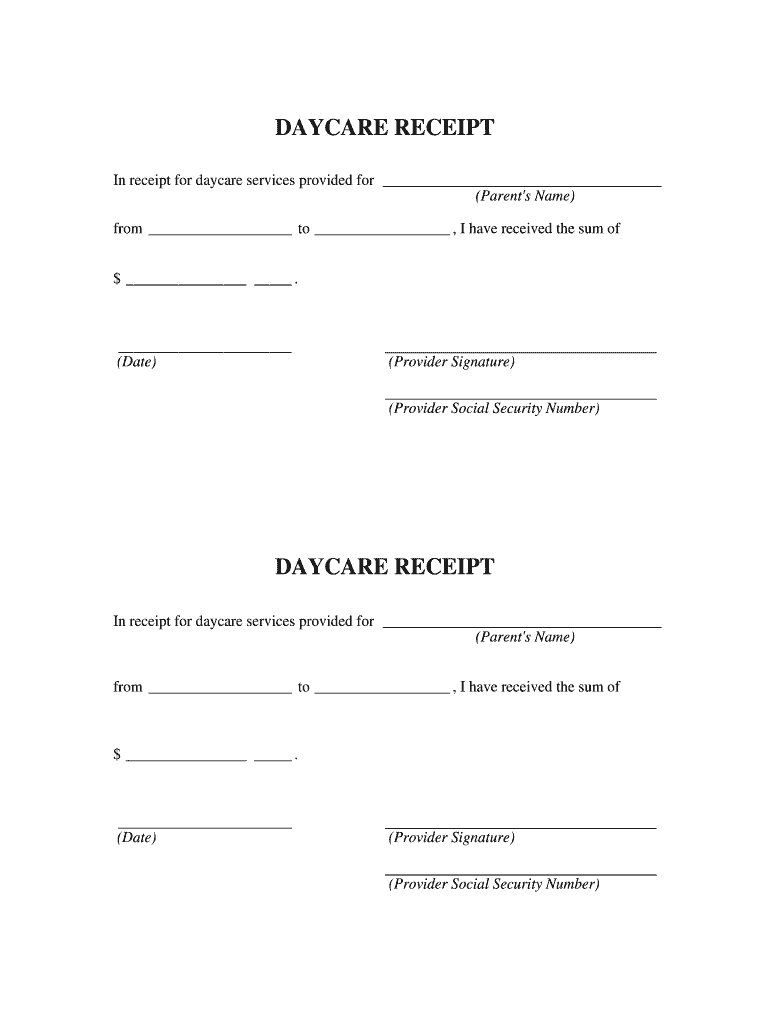

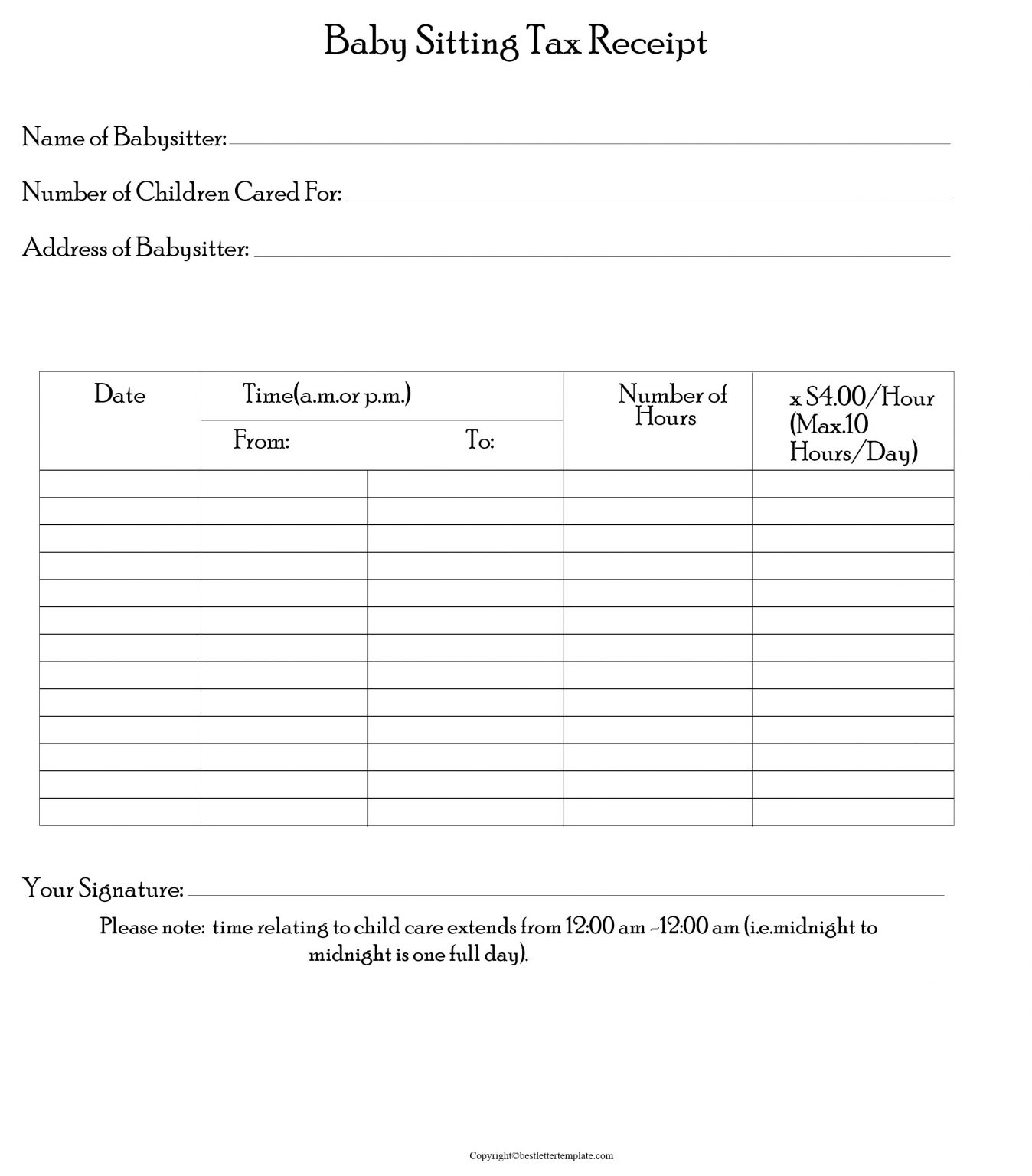

Fantastic Daycare Receipt For Taxes Template Google Awesome Receipt

Ad over 25 years of helping families save time and stress on nanny taxes. Ad payroll so easy, you can set it up & run it yourself. A qualifying expense is a care. Erik johnson december 5, 2022. Web to claim your babysitting expenses, you'll need to fill out schedule c of your tax form and attach it to your.

Printable Babysitter Receipts Fillable and Print and Write PDF Etsy

Web the child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents (qualifying persons). This helps their statistics but doesn’t. If your babysitter earns at least $2,400 for the year, taxes will need to be taken care of. Web you may use this form to get the.

Babysitting 20202021 Fill and Sign Printable Template Online US

Web when the ‘nanny tax’ applies to a babysitter. Teen parents completing high school or ged. Erik johnson december 5, 2022. Web nanny taxes guide: If the babysitter controls how the work is performed, the.

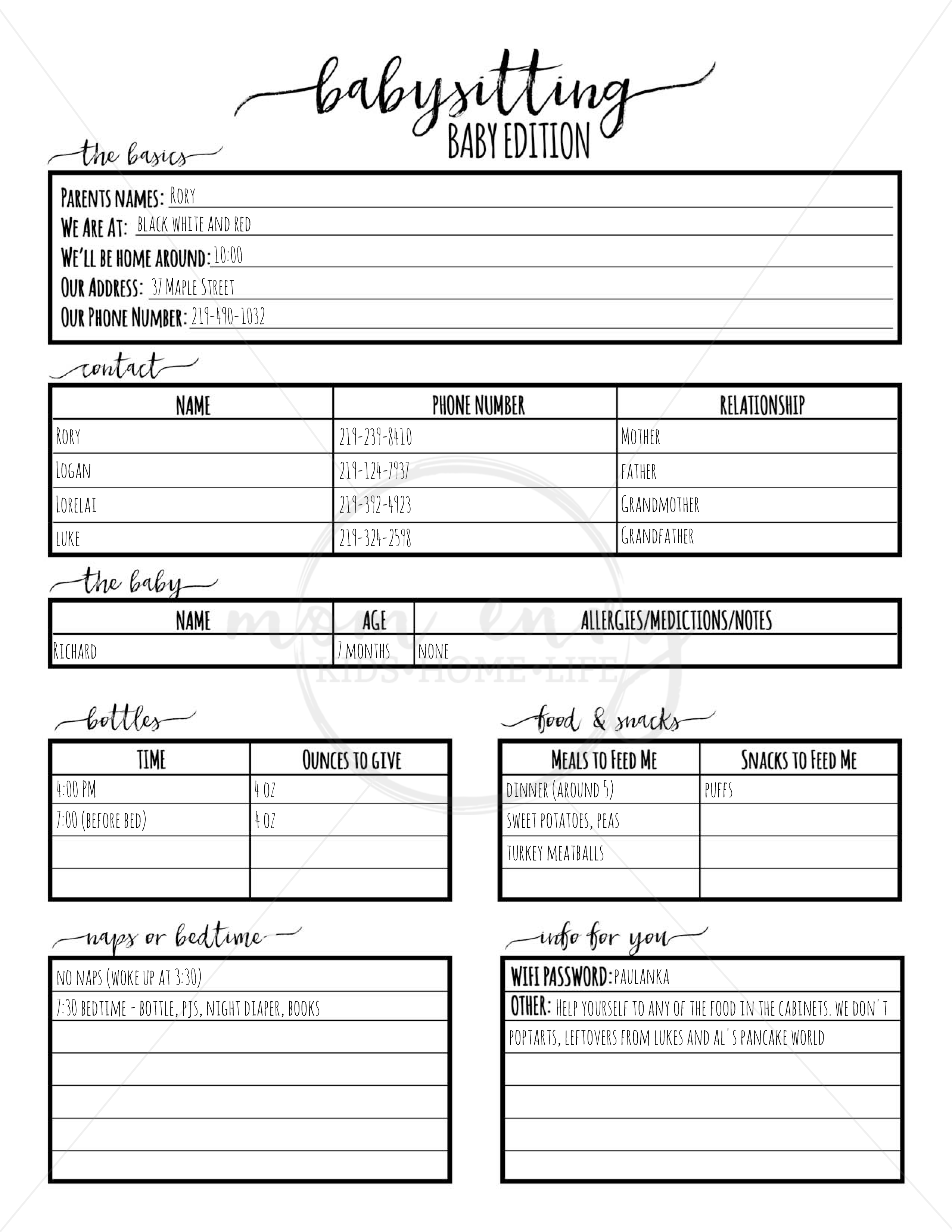

Babysitter Forms, Daycare Forms, & Other Parent Forms

Do you know how to file taxes for babysitting income? Our records show we provided service (s) to <child's name> at.</p> Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Teen parents completing high school or.

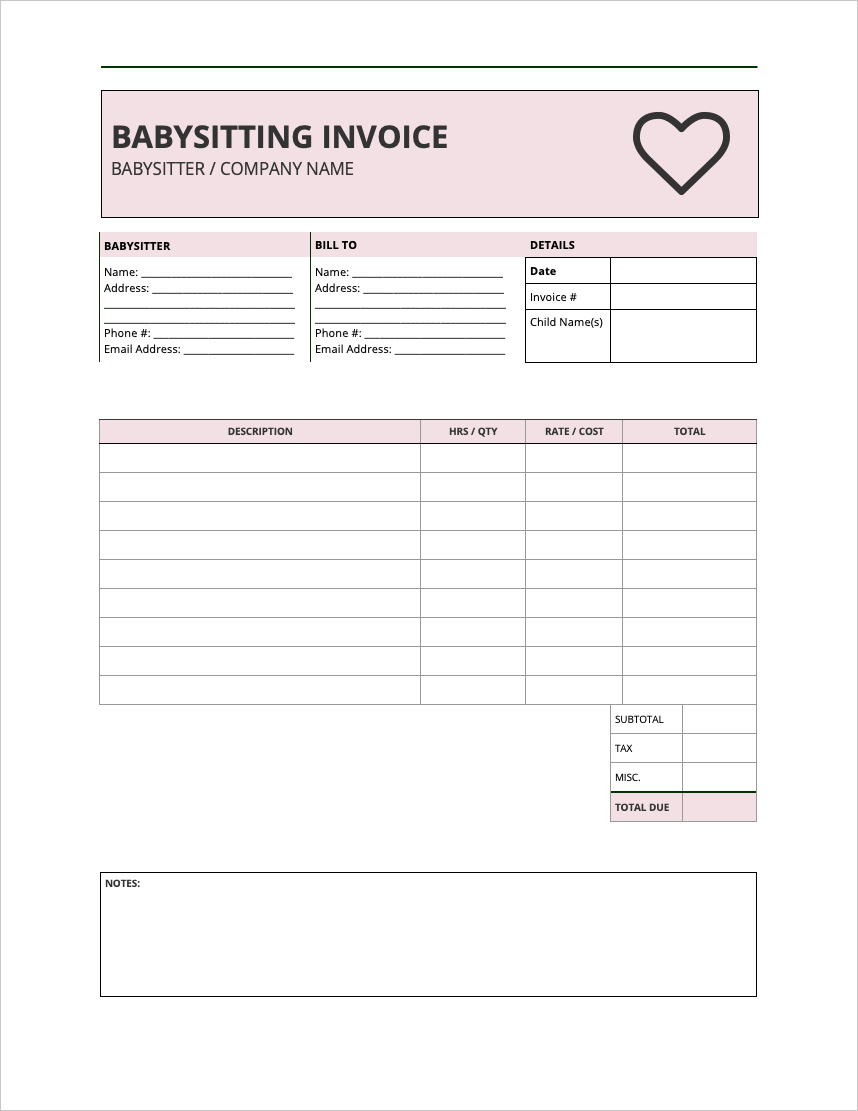

Free Babysitting (Nanny) Invoice Template PDF WORD EXCEL

Ad payroll so easy, you can set it up & run it yourself. Listing of child care staff member (s)/ household member (s) medical examination report for caregivers & staff. Web nanny taxes guide: Form 2441 is used to by. You can submit your completed form(s) in one of these ways:

Free Blank Printable Tax Receipt Template with Example in PDF

You found the perfect nanny for your. Web you may use this form to get the correct name, address and taxpayer identification number (tin) from each person or organization that provides care for your. Listing of child care staff member (s)/ household member (s) medical examination report for caregivers & staff. Ad payroll so easy, you can set it up.

7 Best Images of Free Printable Baby Sitter Forms Free Printable

Form 2441 is used to by. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web you may use this form to get the correct name, address and taxpayer identification number (tin) from each person or.

Do We Need To Give Our Babysitter A 1099 Tax Form? 1099 tax form, Tax

If you control how the work is performed, the babysitter is a household employee. To whom it may concern: Do you know how to file taxes for babysitting income? Web we can help pay for the child care that fits your schedule, including days, evenings, and weekends. Web infant and toddler feeding and care plan.

Babysitting Contract Fill Online, Printable, Fillable, Blank pdfFiller

If you control how the work is performed, the babysitter is a household employee. This helps their statistics but doesn’t. Ad payroll so easy, you can set it up & run it yourself. If the babysitter controls how the work is performed, the. You found the perfect nanny for your.

Web If Your Child Is Under 13 Years Of Age Or A Disabled Dependent, You Can Claim A Tax Credit Of Up To 35% Of Your Qualifying Expenses.

Don’t worry, our tips will help highlight what you. You can submit your completed form(s) in one of these ways: A qualifying expense is a care. If the babysitter controls how the work is performed, the.

Web Nanny Taxes Guide:

Teen parents completing high school or ged. Ad payroll so easy, you can set it up & run it yourself. This helps their statistics but doesn’t. Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent care expenses on your tax return.

Web • 5 Min Read Have You Ever Wondered If Babysitting Is Taxable In The Us?

Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web you may use this form to get the correct name, address and taxpayer identification number (tin) from each person or organization that provides care for your. Do you know how to file taxes for babysitting income? Web we can help pay for the child care that fits your schedule, including days, evenings, and weekends.

If You’re A Babysitter, The Irs Will Ask You To Enter A Business Tax Code.

You found the perfect nanny for your. Web when the ‘nanny tax’ applies to a babysitter. Listing of child care staff member (s)/ household member (s) medical examination report for caregivers & staff. Web to claim your babysitting expenses, you'll need to fill out schedule c of your tax form and attach it to your form 1040 for a regular personal income tax return.