Back Door Roth Ira Form

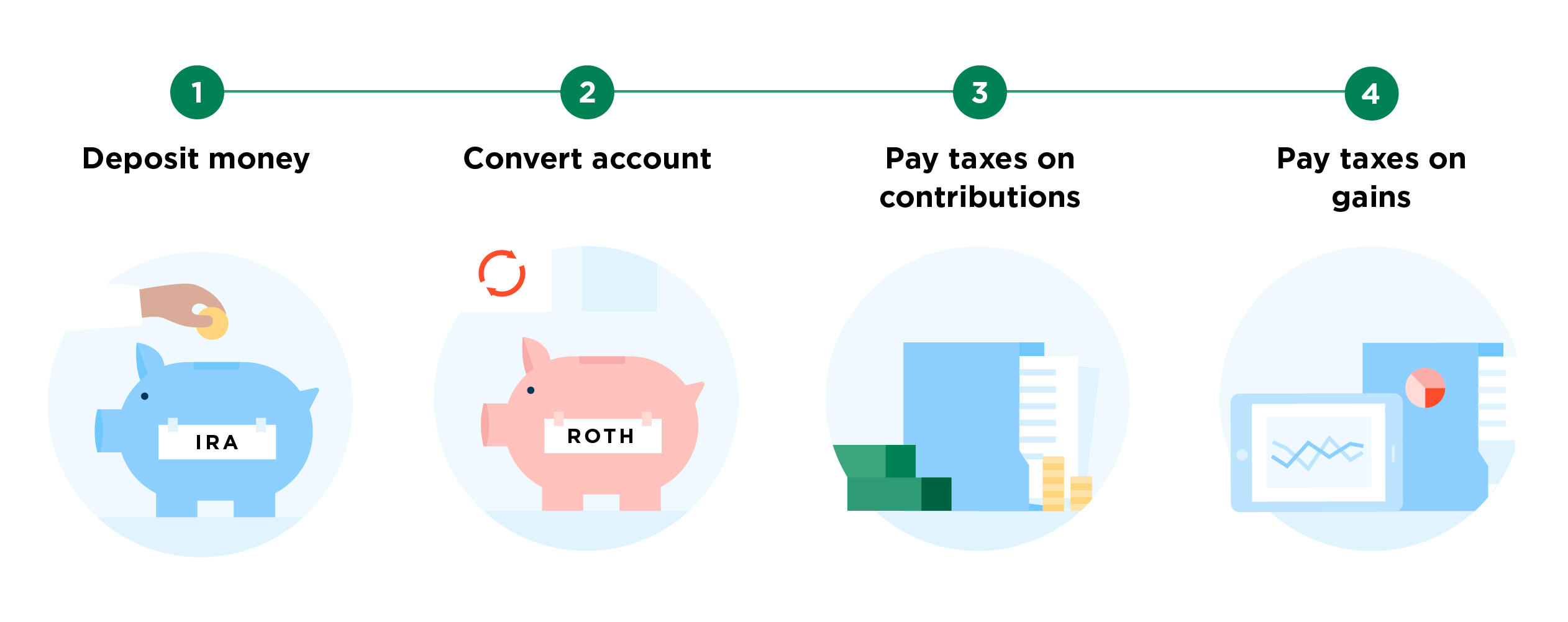

Back Door Roth Ira Form - If your conversion contains contributions made in 2022 for 2021 if your conversion. Web a roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Web 6 steps to successfully contribute to a backdoor roth ira. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Web a backdoor roth ira is a retirement savings strategy whereby you make a contribution to a traditional ira, which anyone is allowed to do, and then immediately. Basically, you put money you’ve. Nondeductible contributions you made to traditional iras. Ira and 401 (k) rules. Web learn how to fund your roth ira using a backdoor strategy for regular roth ira contributions. Web you can use a back door roth ira by completing these steps:

Web a roth ira is a great way to save for retirement. Web 6 steps to successfully contribute to a backdoor roth ira. Basically, you put money you’ve. Web a backdoor roth ira is a type of conversion that allows people with high incomes to fund a roth despite irs income limits. What it is and the benefits of setting one up. The other limit that pertains to. Web you can use a back door roth ira by completing these steps: If your conversion contains contributions made in 2022 for 2021 if your conversion. Web [1] note that there is no such ira called a backdoor roth ira, because the backdoor roth is a process or technique, not an account. The allure of the backdoor roth ira is the potential to complete the transaction and avoid any additional.

If your conversion contains contributions made in 2022 for 2021 if your conversion. Ira and 401 (k) rules. Web for now, though, getting familiar with the backdoor roth strategy and the role that irs form 8606 plays in implementing it could be a great way to give you. This ira has no income limits preventing you from. The allure of the backdoor roth ira is the potential to complete the transaction and avoid any additional. Also note that the irs does. Web use form 8606 to report: Web 6 steps to successfully contribute to a backdoor roth ira. Basically, you put money you’ve. The other limit that pertains to.

Back Door Roth IRA H&R Block

Web for now, though, getting familiar with the backdoor roth strategy and the role that irs form 8606 plays in implementing it could be a great way to give you. The other limit that pertains to. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to.

When BackDoor Roth IRAs Cause More Harm Than Good Wrenne Financial

This ira has no income limits preventing you from. If your conversion contains contributions made in 2022 for 2021 if your conversion. Web to check the results of your backdoor roth ira conversion, see your form 1040: Basically, you put money you’ve. Web for now, though, getting familiar with the backdoor roth strategy and the role that irs form 8606.

How Does Roth IRA Compound Interest?

Roth iras are retirement savings vehicles. Web you can use a back door roth ira by completing these steps: Web a backdoor roth ira is a type of conversion that allows people with high incomes to fund a roth despite irs income limits. But they are closed off to high earners—unless you use the back door. Also note that the.

How to Set Up a Backdoor Roth IRA NerdWallet

Distributions from traditional, sep, or simple iras, if you have ever made. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Basically, you put money you’ve. Nondeductible contributions you made to traditional iras. Web 6 steps to successfully.

Back Door Roth IRA YouTube

Here’s what a backdoor roth ira is,. Basically, you put money you’ve. Web 6 steps to successfully contribute to a backdoor roth ira. Ira and 401 (k) rules. Web if your income makes you ineligible for a direct roth ira contribution, you may need to consider a backdoor roth ira strategy.

Backdoor Roth IRA steps Roth ira, Ira, Roth ira contributions

Make a nondeductible contribution to a traditional ira. Web a roth ira is a great way to save for retirement. This ira has no income limits preventing you from. Web a roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Web backdoor roth ira pitfall #1:

5 Essential Backdoor Roth IRA Facts That You Need to Know Tony Florida

Web for now, though, getting familiar with the backdoor roth strategy and the role that irs form 8606 plays in implementing it could be a great way to give you. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings.

Backdoor Roth IRA A HowTo Guide Biglaw Investor

This ira has no income limits preventing you from. Web [1] note that there is no such ira called a backdoor roth ira, because the backdoor roth is a process or technique, not an account. Web a backdoor roth ira is a type of conversion that allows people with high incomes to fund a roth despite irs income limits. The.

Backdoor Roth IRA and Why You Need One illumedati Senior Resident

Web a backdoor roth ira is a retirement savings strategy whereby you make a contribution to a traditional ira, which anyone is allowed to do, and then immediately. But they are closed off to high earners—unless you use the back door. Do you want to make a regular roth ira contribution but your income. Schwab offers multiple types of iras..

How to do BackDoor Roth IRA ODs on Finance

But they are closed off to high earners—unless you use the back door. Web a roth ira is a great way to save for retirement. Web [1] note that there is no such ira called a backdoor roth ira, because the backdoor roth is a process or technique, not an account. Web for now, though, getting familiar with the backdoor.

Web A Backdoor Roth Ira Is A Type Of Conversion That Allows People With High Incomes To Fund A Roth Despite Irs Income Limits.

This ira has no income limits preventing you from. What it is and the benefits of setting one up. Web [1] note that there is no such ira called a backdoor roth ira, because the backdoor roth is a process or technique, not an account. Basically, you put money you’ve.

Do You Want To Make A Regular Roth Ira Contribution But Your Income.

Web to check the results of your backdoor roth ira conversion, see your form 1040: Here’s what a backdoor roth ira is,. If your conversion contains contributions made in 2022 for 2021 if your conversion. Also note that the irs does.

Web For Now, Though, Getting Familiar With The Backdoor Roth Strategy And The Role That Irs Form 8606 Plays In Implementing It Could Be A Great Way To Give You.

You cannot deduct contributions to a roth ira. Web backdoor roth ira pitfall #1: Schwab offers multiple types of iras. Web 6 steps to successfully contribute to a backdoor roth ira.

Web You Can Use A Back Door Roth Ira By Completing These Steps:

Web if your income makes you ineligible for a direct roth ira contribution, you may need to consider a backdoor roth ira strategy. The allure of the backdoor roth ira is the potential to complete the transaction and avoid any additional. Roth iras are retirement savings vehicles. Web a roth ira is a great way to save for retirement.