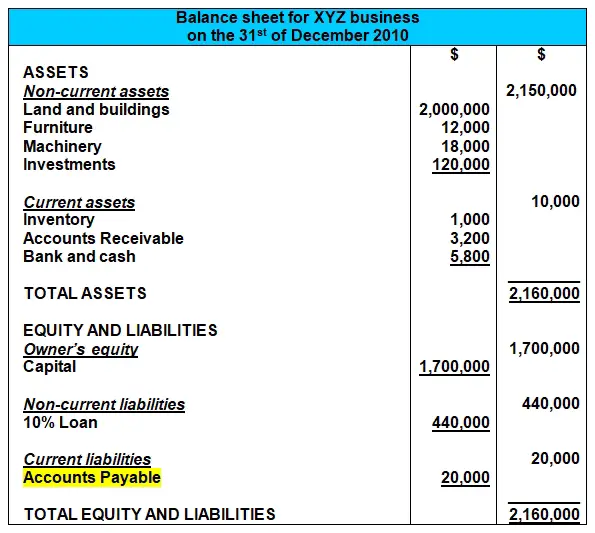

Balance Sheet Accounts Payable

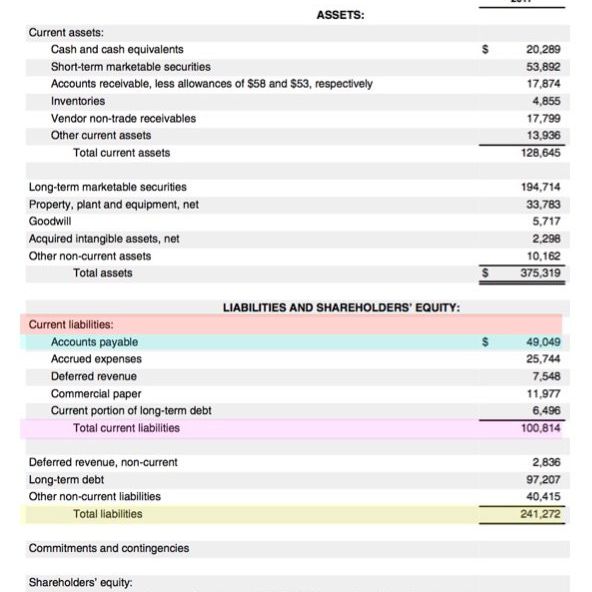

Balance Sheet Accounts Payable - Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. It can also be referred to as a statement of net worth or a statement of financial position. Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid. They appear as current liabilities on the balance sheet. The sum of all outstanding amounts owed to vendors is. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Accounts payable are the opposite of accounts receivable, which. Web ap is considered one of the most current forms of the current liabilities on the balance sheet.

Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Accounts payable are the opposite of accounts receivable, which. They appear as current liabilities on the balance sheet. The sum of all outstanding amounts owed to vendors is. Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. It can also be referred to as a statement of net worth or a statement of financial position.

Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid. Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. The sum of all outstanding amounts owed to vendors is. Accounts payable are the opposite of accounts receivable, which. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. It can also be referred to as a statement of net worth or a statement of financial position. They appear as current liabilities on the balance sheet.

Accounts Payable (A/P) Current Liability Definition

Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. Accounts payable are the opposite.

Balance sheet example Accounting Play

Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. They appear as current liabilities on the balance sheet. It can also be referred to as a statement of net worth or a statement of financial position. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative.

Everything there is to know about accounts payable

Web ap is considered one of the most current forms of the current liabilities on the balance sheet. Accounts payable are the opposite of accounts receivable, which. Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid. Accounts payables turnover is a key metric used in.

Accounts Receivable vs Accounts Payable

It can also be referred to as a statement of net worth or a statement of financial position. The sum of all outstanding amounts owed to vendors is. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Web key takeaways accounts payable.

How do accounts payable show on the balance sheet? Investopedia

Accounts payable are the opposite of accounts receivable, which. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. The sum of all outstanding amounts owed to vendors is. Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been.

Accounts Receivable Report Template (4) PROFESSIONAL TEMPLATES

Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. The sum of all outstanding amounts owed to vendors is. They appear as current liabilities on the balance sheet. Accounts payable are the opposite of accounts receivable, which. Web key takeaways accounts payable.

What is accounts payable? Definition and examples

Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. It can also be referred to as a statement of net worth.

Accounts Payable (AP) What They Are and How to Interpret Pareto Labs

The sum of all outstanding amounts owed to vendors is. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. Web the balance sheet displays.

What is accounts receivable? Definition and examples

It can also be referred to as a statement of net worth or a statement of financial position. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Accounts payables turnover is a key metric used in calculating the liquidity of a company,.

Accounts Payable Meaning, Importance, Example & Days

Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. They appear as current liabilities on the balance sheet. Web ap is considered one of the most current forms of the current liabilities on the balance sheet. Web the balance sheet displays the company’s total assets and how the assets are financed, either through.

They Appear As Current Liabilities On The Balance Sheet.

Accounts payables turnover is a key metric used in calculating the liquidity of a company, as. The sum of all outstanding amounts owed to vendors is. Web under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. Web key takeaways accounts payable (ap) are amounts due to vendors or suppliers for goods or services received that have not yet been paid.

Accounts Payable Are The Opposite Of Accounts Receivable, Which.

Web ap is considered one of the most current forms of the current liabilities on the balance sheet. Web the balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. It can also be referred to as a statement of net worth or a statement of financial position.