Blank Loan Estimate Form

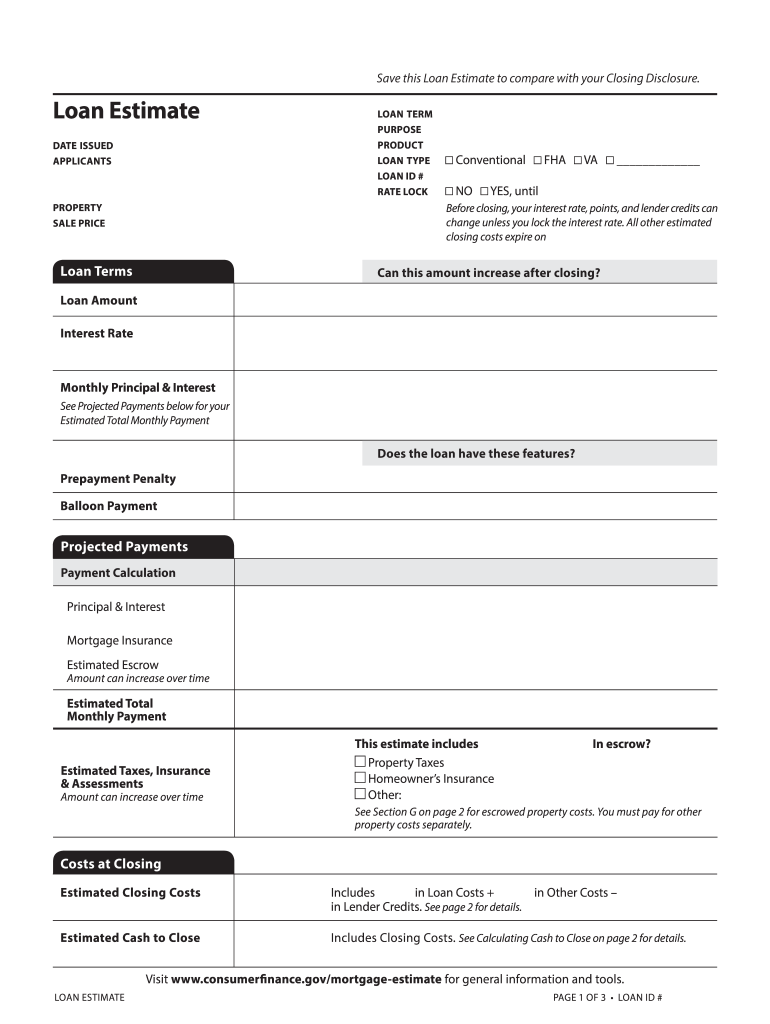

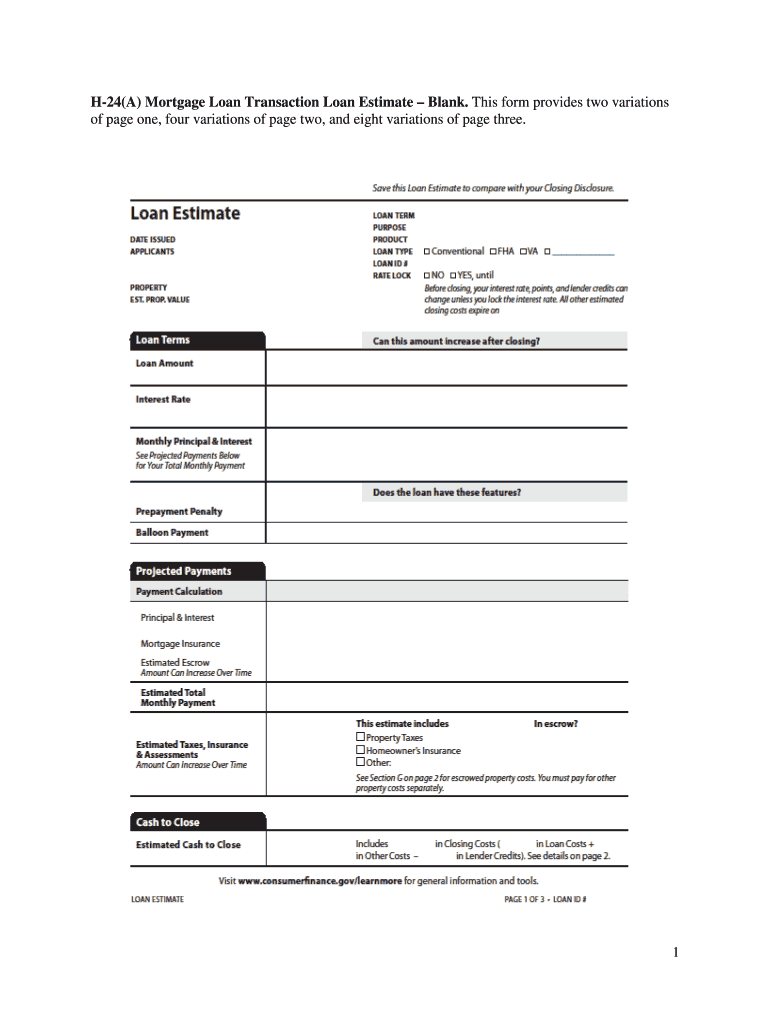

Blank Loan Estimate Form - Web this is a sample of a completed loan estimate for a fixed rate loan. A loan estimate tells you important details about a mortgage loan you have requested. The consumer has elected to lock the interest rate. Don’t choose a loan before you know it is a good one. By getting loan estimates from multiple lenders, you can compare to see which lender is offering you the best deal. The loan estimate must be provided to consumers no later than three business days after they submit a loan application. Blank loan estimate (en español) download pdf. This form provides two variations of page one, four variations of page two, and four variations of page three, reflecting the variable content requirements in 12 cfr § 1026.37. This loan is for the purchase of property at a sale price prepayment penalty equal to 2.00 percent of the outstanding principal balance of the loan for the first two years after consummation of the transaction. Blank model loan estimate that illustrates the application of the optional alternative tables for transactions without a seller.

Blank loan estimate (en español) download pdf. Blank loan estimate, with optional alternative tables for transaction without seller. Web this is a sample of a completed loan estimate for a fixed rate loan. Web the first new form (the loan estimate) is designed to provide disclosures that will be helpful to consumers in understanding the key features, costs, and risks of the mortgage loan for which they are applying. Web blank model loan estimate form illustrates the application of the rule’s content requirements. The consumer has elected to lock the interest rate. Web request loan estimates from multiple lenders. Use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. Requesting a loan estimate is simple and no written documentation is required. The loan estimate must be provided to consumers no later than three business days after they submit a loan application.

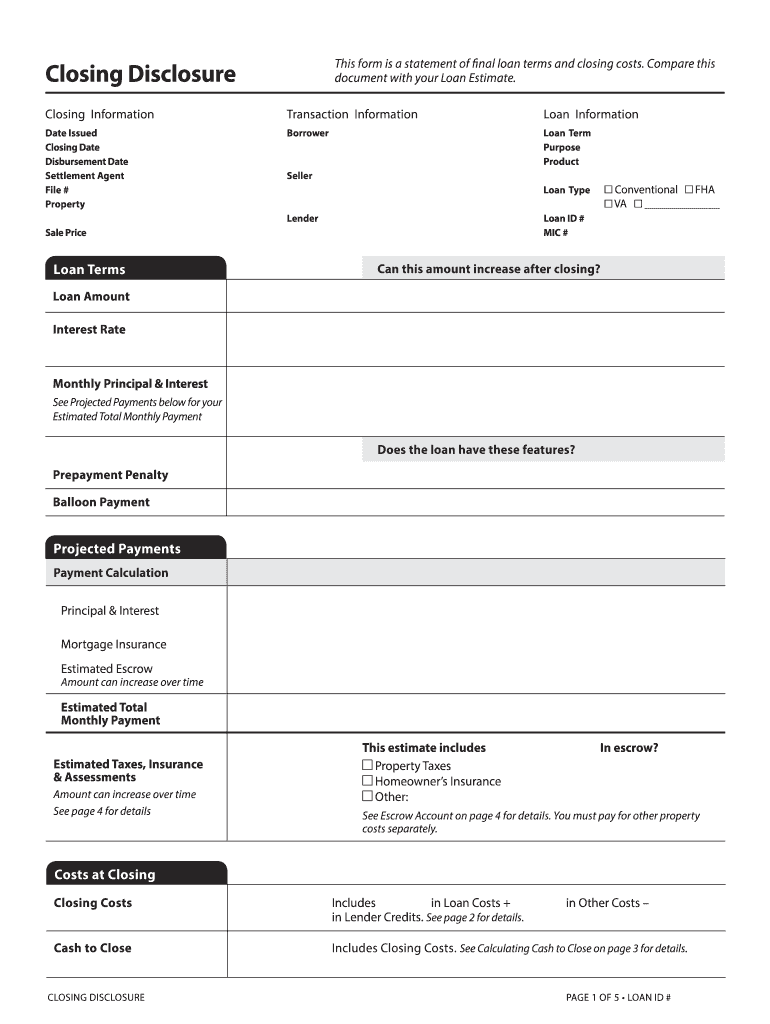

This loan is for the purchase of property at a sale price prepayment penalty equal to 2.00 percent of the outstanding principal balance of the loan for the first two years after consummation of the transaction. Web this is a blank model loan estimate that illustrates the application of the content requirements in 12 cfr § 1026.37. Compare this closing disclosure document with your loan estimate. Requesting a loan estimate is simple and no written documentation is required. Blank model loan estimate that illustrates the application of the optional alternative tables for transactions without a seller. Use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. The consumer has elected to lock the interest rate. Web request loan estimates from multiple lenders. By getting loan estimates from multiple lenders, you can compare to see which lender is offering you the best deal. Web this is a sample of a completed loan estimate for a fixed rate loan.

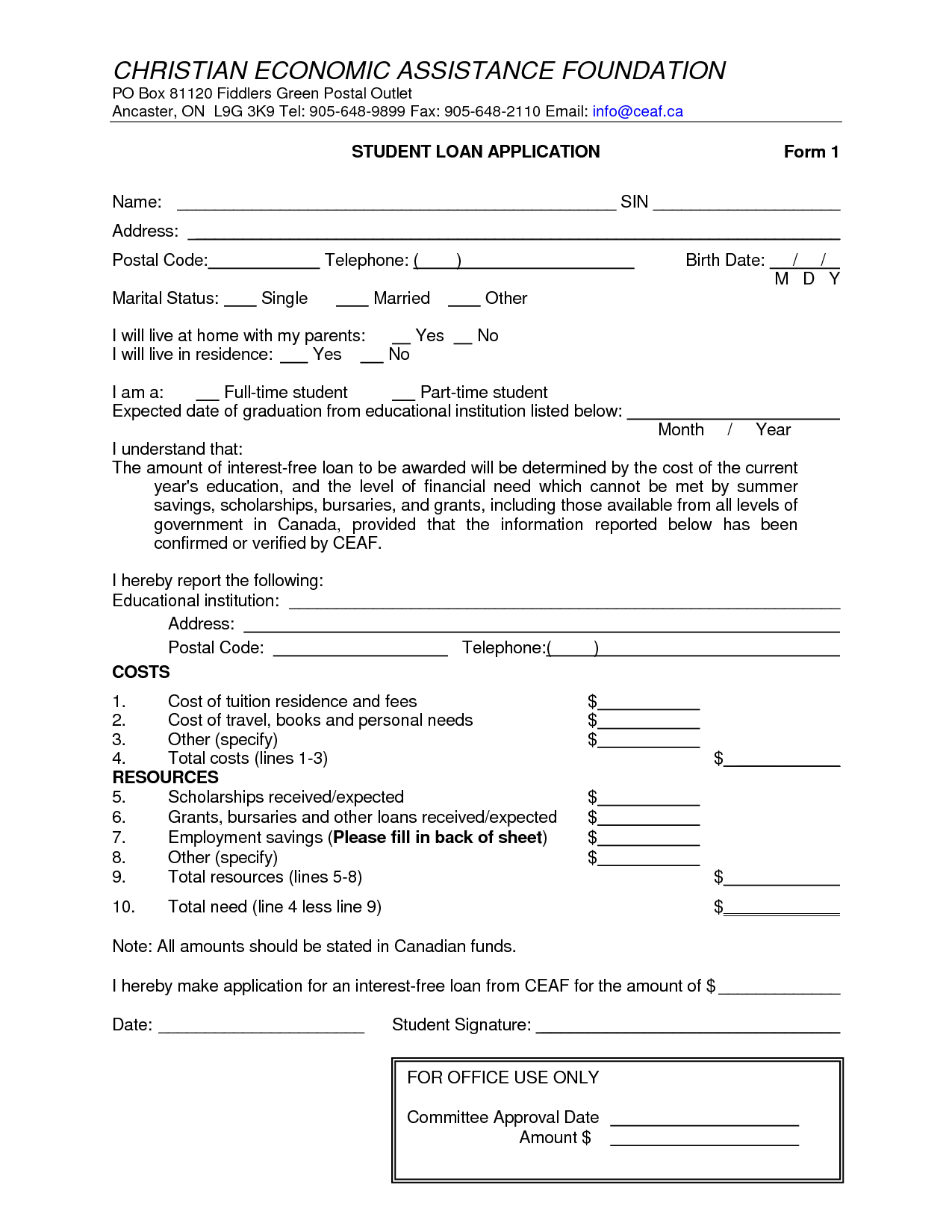

Free Printable Personal Loan Forms Free Printable A to Z

Compare this closing disclosure document with your loan estimate. Blank model loan estimate that illustrates the application of the optional alternative tables for transactions without a seller. The loan estimate must be provided to consumers no later than three business days after they submit a loan application. The forms also provide more information to help consumers decide whether they can.

Good Faith Estimate Fill Online, Printable, Fillable, Blank pdfFiller

Web this is a blank model loan estimate that illustrates the application of the content requirements in 12 cfr § 1026.37. Use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. Web blank model loan estimate form illustrates the application of the rule’s content requirements. Don’t choose a loan before you.

Cfpb Model Form Fill Online, Printable, Fillable, Blank pdfFiller

The consumer has elected to lock the interest rate. Sample of completed loan estimate for interest only, adjustable rate loan. Blank loan estimate (en español) download pdf. Blank model loan estimate that illustrates the application of the optional alternative tables for transactions without a seller. Don’t choose a loan before you know it is a good one.

Mortgage Page Four Get Fill Out and Sign Printable PDF Template signNow

Use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. Sample of completed loan estimate for interest only, adjustable rate loan. The forms also provide more information to help consumers decide whether they can afford the loan and to compare the cost of different loan offers, including the cost of the.

Loan Estimate Blank Form NOALIS

Don’t choose a loan before you know it is a good one. By getting loan estimates from multiple lenders, you can compare to see which lender is offering you the best deal. Sample of completed loan estimate for interest only, adjustable rate loan. Web blank model loan estimate form illustrates the application of the rule’s content requirements. Requesting a loan.

Roofing Estimates Templates FREE DOWNLOAD Auto repair estimates

Web this is a sample of a completed loan estimate for a fixed rate loan. Web request loan estimates from multiple lenders. Web this is a blank model loan estimate that illustrates the application of the content requirements in 12 cfr § 1026.37. Blank model loan estimate that illustrates the application of the optional alternative tables for transactions without a.

The Loan Estimate Form Required By The Trid Rule Must Be Delivered To

Sample of completed loan estimate for interest only, adjustable rate loan. Blank loan estimate, with optional alternative tables for transaction without seller. Compare this closing disclosure document with your loan estimate. Blank model loan estimate that illustrates the application of the optional alternative tables for transactions without a seller. Don’t choose a loan before you know it is a good.

Blank Loan Estimate Pdf

Sample of completed loan estimate for interest only, adjustable rate loan. Web this is a sample of a completed loan estimate for a fixed rate loan. The forms also provide more information to help consumers decide whether they can afford the loan and to compare the cost of different loan offers, including the cost of the loans over time. Web.

47 FORM LOAN ESTIMATE FormLoan

Web this is a blank model loan estimate that illustrates the application of the content requirements in 12 cfr § 1026.37. Compare this closing disclosure document with your loan estimate. Convert and save your loan estimate form as pdf (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). A loan estimate tells you important details about a mortgage loan.

Loan Estimate Form Template Free Download

A loan estimate tells you important details about a mortgage loan you have requested. Blank loan estimate (en español) download pdf. Compare this closing disclosure document with your loan estimate. Web this form is a statement of final loan terms and closing costs. Web request loan estimates from multiple lenders.

This Form Provides Two Variations Of Page One, Four Variations Of Page Two, And Four Variations Of Page Three, Reflecting The Variable Content Requirements In 12 Cfr § 1026.37.

Blank model loan estimate that illustrates the application of the optional alternative tables for transactions without a seller. Blank loan estimate (en español) download pdf. This loan is for the purchase of property at a sale price prepayment penalty equal to 2.00 percent of the outstanding principal balance of the loan for the first two years after consummation of the transaction. Use this tool to review your loan estimate to make sure it reflects what you discussed with the lender.

The Loan Estimate Must Be Provided To Consumers No Later Than Three Business Days After They Submit A Loan Application.

Web blank model loan estimate form illustrates the application of the rule’s content requirements. Blank loan estimate, with optional alternative tables for transaction without seller. Web request loan estimates from multiple lenders. Compare this closing disclosure document with your loan estimate.

Web This Is A Sample Of A Completed Loan Estimate For A Fixed Rate Loan.

Web the first new form (the loan estimate) is designed to provide disclosures that will be helpful to consumers in understanding the key features, costs, and risks of the mortgage loan for which they are applying. Convert and save your loan estimate form as pdf (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). By getting loan estimates from multiple lenders, you can compare to see which lender is offering you the best deal. The forms also provide more information to help consumers decide whether they can afford the loan and to compare the cost of different loan offers, including the cost of the loans over time.

If Something Looks Different From What You Expected, Ask Why.

Don’t choose a loan before you know it is a good one. Web this form is a statement of final loan terms and closing costs. A loan estimate tells you important details about a mortgage loan you have requested. Web this is a blank model loan estimate that illustrates the application of the content requirements in 12 cfr § 1026.37.