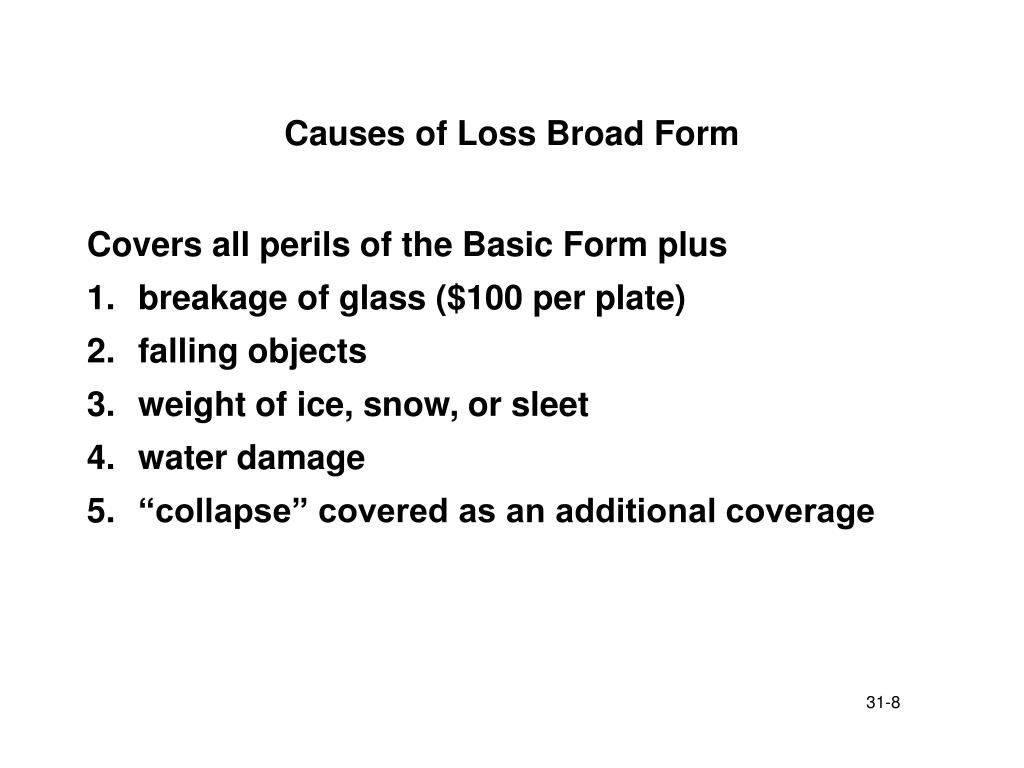

Broad Causes Of Loss Form

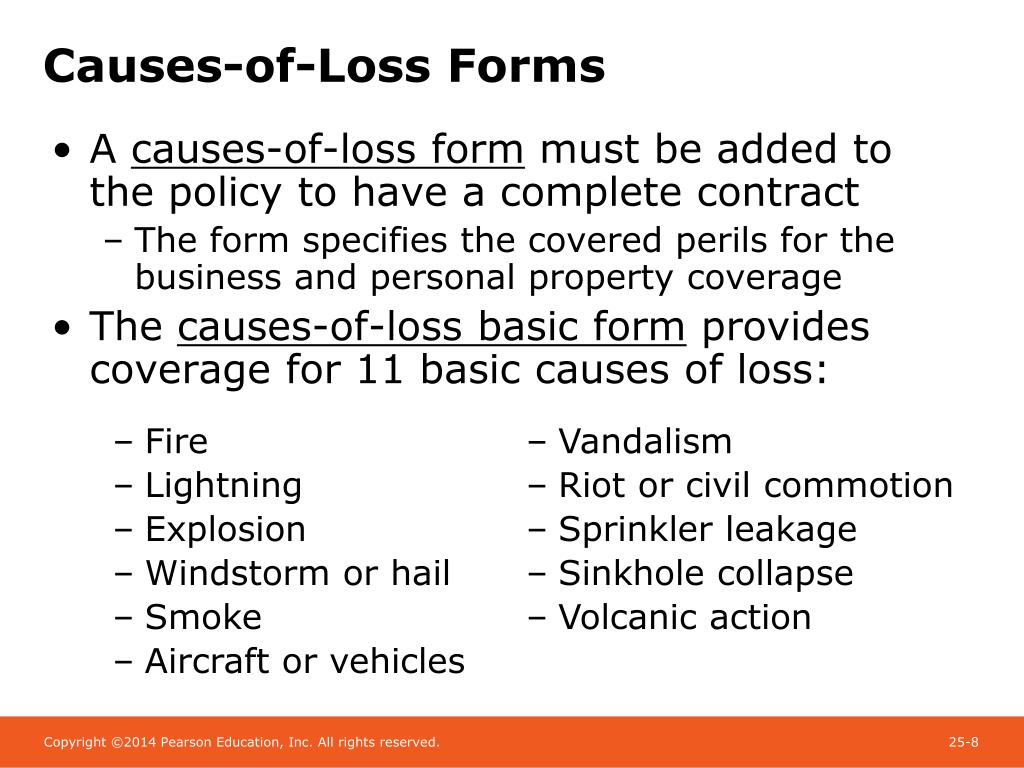

Broad Causes Of Loss Form - Web special causes of loss eligibility requirements. Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles,. Web there are three types of causes of loss forms that are named perils: Basic broad earthquake in this approach, the insured must prove that the named peril caused the. Web the broad causes of loss form is one of the three insurance services office, inc. Web there are three causes of loss forms policyholders can choose from for their commercial property coverage: Like on the broad causes of loss form, the special causes of loss form requires that coinsurance be at least 80% for property. Causes of loss forms causes of loss forms are insurance services office,. Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils: Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property.

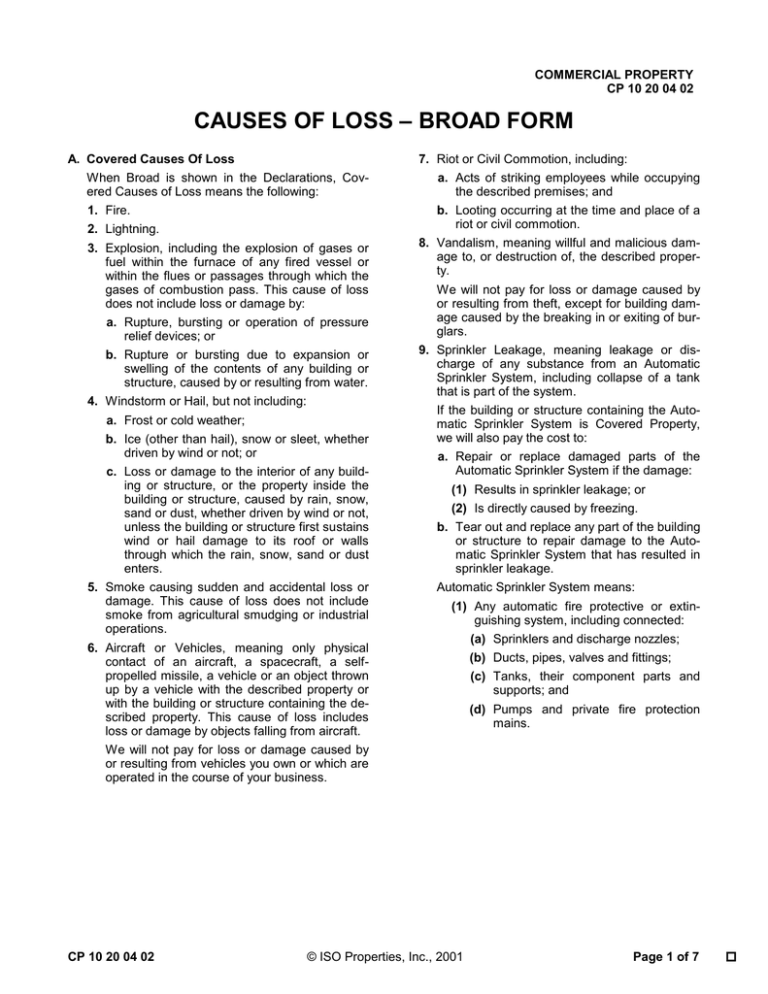

Web with this change, the 2000 edition of the broad causes of loss form (like the basic causes of loss form) provides no coverage at all for glass breakage, unless it is. Covered causes of loss when basic is shown in the declarations, covered causes of loss means the following: Web there are three types of causes of loss forms that are named perils: Like on the broad causes of loss form, the special causes of loss form requires that coinsurance be at least 80% for property. Fires lightning explosions windstorms and hail smoke aircraft or vehicle accidents riots or. Causes of loss forms causes of loss forms are insurance services office,. Web the comprehensive factors of loss bilden (cp 10 20) provides namable perils covers for the perils insured against included the basic causes of lost form (fire, lightning, outbreak,. Web the broad causes of loss form is one of the three insurance services office, inc. Basic form causes of loss: Web there are three commercial property forms (basic, broad and special) that identify the causes of loss (or perils) for which coverage is provided.

Web with this change, the 2000 edition of the broad causes of loss form (like the basic causes of loss form) provides no coverage at all for glass breakage, unless it is. Web a peril is a potential cause of loss, such as fire, windstorm, hail, and flood. Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property. Web there are three types of causes of loss forms that are named perils: Web special causes of loss eligibility requirements. Causes of loss forms causes of loss forms are insurance services office,. Basic broad earthquake in this approach, the insured must prove that the named peril caused the. Web the following perils are covered under basic causes of loss forms: Web builders risk coverage form indirect damage coverage forms causes of loss forms business income coverage form causes of loss: Form that covers basic form perils plus falling objects;

PPT The ISO Commercial Portfolio Program PowerPoint Presentation

Web the comprehensive factors of loss bilden (cp 10 20) provides namable perils covers for the perils insured against included the basic causes of lost form (fire, lightning, outbreak,. Covered causes of loss when broad is shown in the declarations, covered causes of loss means the following: Web there are three causes of loss forms policyholders can choose from for.

PPT Chapter 25 Commercial Property Insurance PowerPoint Presentation

Like on the broad causes of loss form, the special causes of loss form requires that coinsurance be at least 80% for property. And (as additional coverage) collapse. Fires lightning explosions windstorms and hail smoke aircraft or vehicle accidents riots or. Basic broad earthquake in this approach, the insured must prove that the named peril caused the. Web the comprehensive.

Broad categories of common underlying causes of death for those with

Web the broad causes of loss form is one of the three insurance services office, inc. Form that covers basic form perils plus falling objects; Covered causes of loss when basic is shown in the declarations, covered causes of loss means the following: Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles,. Weight of snow, ice, or sleet;

causes of loss broad form Midwest Security Insurance Services

Weight of snow, ice, or sleet; Web there are three types of causes of loss forms that are named perils: Web special causes of loss eligibility requirements. Form that covers basic form perils plus falling objects; Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils:

claim for damage or injury

Web special causes of loss eligibility requirements. Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property. Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils: Web there are three causes of loss forms policyholders can choose from.

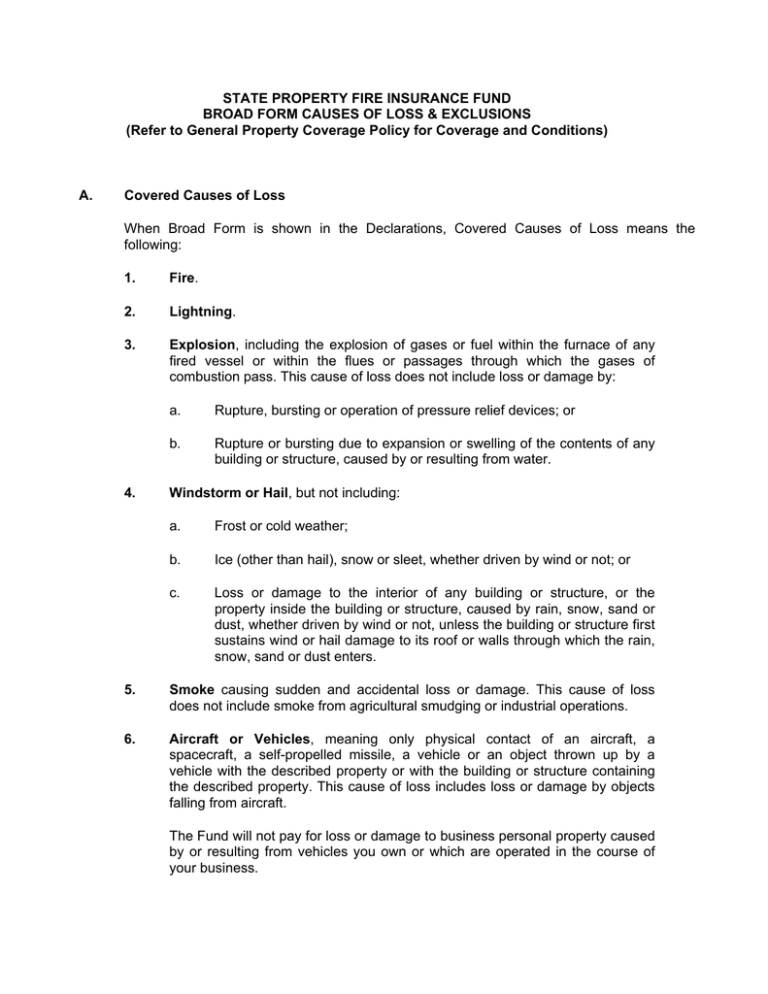

Broad Form Causes Loss Exclusions

Web the broad causes of loss form is one of the three insurance services office, inc. Web a peril is a potential cause of loss, such as fire, windstorm, hail, and flood. Web the following perils are covered under basic causes of loss forms: Web there are three causes of loss forms policyholders can choose from for their commercial property.

When to Use the Broad Causes of Loss Form WSRB Blog

Web builders risk coverage form indirect damage coverage forms causes of loss forms business income coverage form causes of loss: Covered causes of loss when broad is shown in the declarations, covered causes of loss means the following: Like on the broad causes of loss form, the special causes of loss form requires that coinsurance be at least 80% for.

Proof Of Loss Fill Out and Sign Printable PDF Template signNow

Web there are three commercial property forms (basic, broad and special) that identify the causes of loss (or perils) for which coverage is provided. Web a peril is a potential cause of loss, such as fire, windstorm, hail, and flood. Like on the broad causes of loss form, the special causes of loss form requires that coinsurance be at least.

Broad Causes/Factors for Part 121 Accidents 19922001 Download

Basic broad earthquake in this approach, the insured must prove that the named peril caused the. Like on the broad causes of loss form, the special causes of loss form requires that coinsurance be at least 80% for property. Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered.

Logistic regression results of determinants of poor selfrated health

Web special causes of loss eligibility requirements. Web the comprehensive factors of loss bilden (cp 10 20) provides namable perils covers for the perils insured against included the basic causes of lost form (fire, lightning, outbreak,. Weight of snow, ice, or sleet; Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses.

Fire, Lightning, Explosion, Smoke, Windstorm, Hail, Riot, Civil Commotion, Aircraft, Vehicles,.

Web the broad causes of loss form is one of the three insurance services office, inc. Web a peril is a potential cause of loss, such as fire, windstorm, hail, and flood. Web the following perils are covered under basic causes of loss forms: Like on the broad causes of loss form, the special causes of loss form requires that coinsurance be at least 80% for property.

Web The Comprehensive Factors Of Loss Bilden (Cp 10 20) Provides Namable Perils Covers For The Perils Insured Against Included The Basic Causes Of Lost Form (Fire, Lightning, Outbreak,.

Web builders risk coverage form indirect damage coverage forms causes of loss forms business income coverage form causes of loss: Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property. Web with this change, the 2000 edition of the broad causes of loss form (like the basic causes of loss form) provides no coverage at all for glass breakage, unless it is. Web there are three commercial property forms (basic, broad and special) that identify the causes of loss (or perils) for which coverage is provided.

Web Special Causes Of Loss Eligibility Requirements.

Covered causes of loss when basic is shown in the declarations, covered causes of loss means the following: Causes of loss forms causes of loss forms are insurance services office,. Fires lightning explosions windstorms and hail smoke aircraft or vehicle accidents riots or. Basic broad earthquake in this approach, the insured must prove that the named peril caused the.

Even Though The Basic And Broad Causes Of Loss Forms Name The Perils That Are Insured,.

Covered causes of loss when broad is shown in the declarations, covered causes of loss means the following: Web there are three types of causes of loss forms that are named perils: Weight of snow, ice, or sleet; Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils: