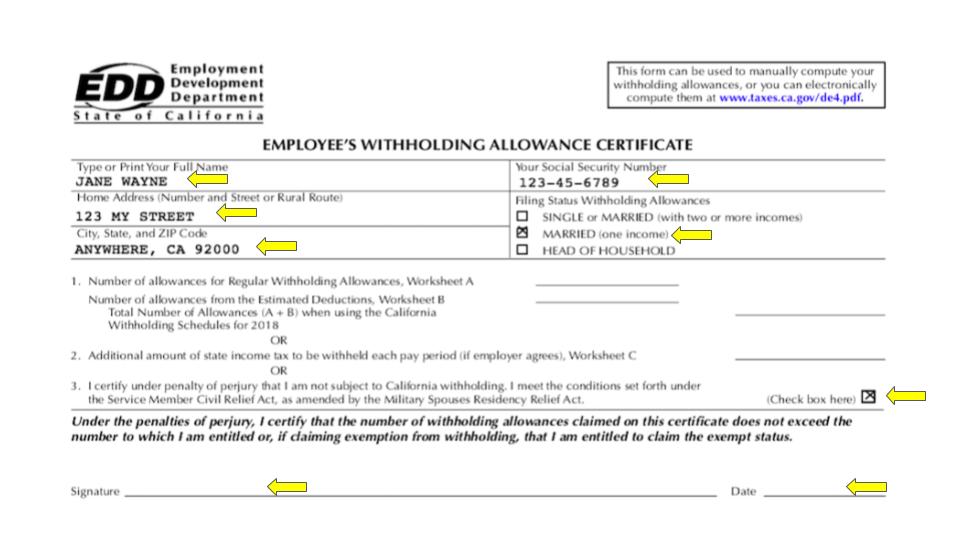

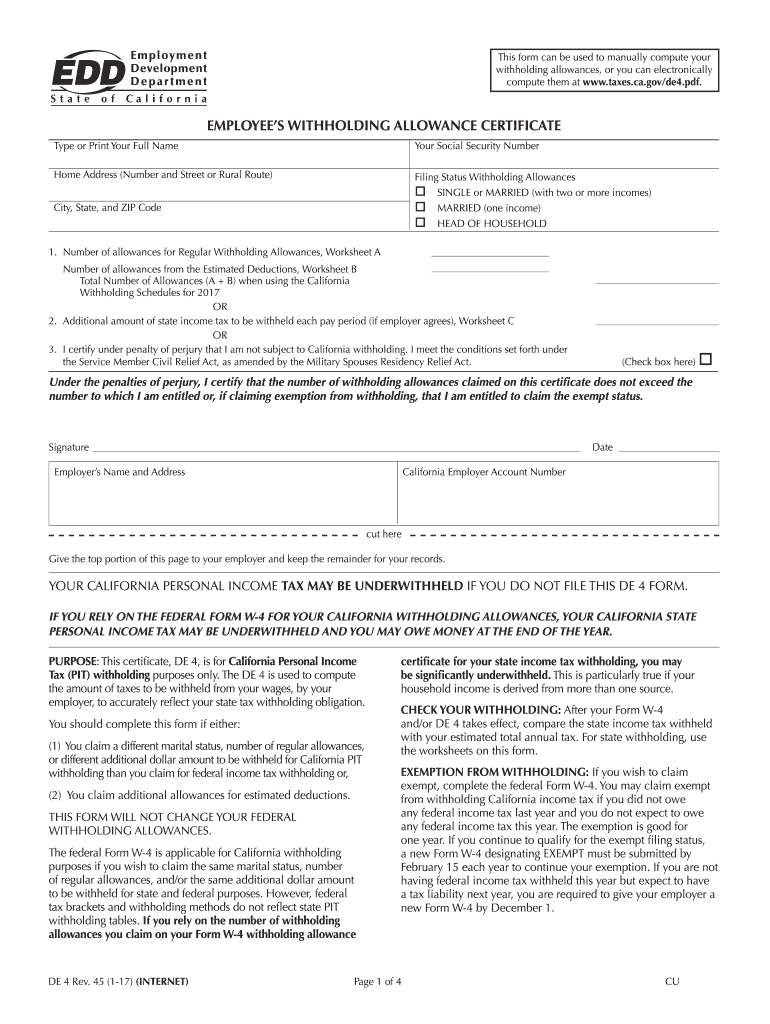

Ca De 4 Form

Ca De 4 Form - (1) claim a different number of allowances for. Web the amount of tax withheld is determined by the following. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. The amount of income subject to tax. How do i fill out a de4? Do i need to fill out a de 4? This certificate, de 4, is for california personal income tax (pit) withholdingpurposes only. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. How do i fill out a de4?

How do i fill out a de4? Web 120k views 1 year ago. Is the de 4 form required? The de 4p allows you to: Web this certificate, de 4, is for california personal income tax (pit) withholding purposes only. The number of allowances claimed on your employee’s withholding allowance. This certifi cate, de 4, is for california personal income tax (pit) withholding purposes only. Web what is california tax form de 4? Only need to adjust your state withholding allowance, go to the. Web the edd form de 4 lets employees claim withholding allowances according to their filing status, number of dependents, and deductions.

To download this form, log in using the orange sign. The de 4 is used to compute the amount of taxes to be. How many allowances should i claim california? The de 4p allows you to: Web the edd form de 4 lets employees claim withholding allowances according to their filing status, number of dependents, and deductions. The de 4 is used to compute the amount of taxes to be withheld from. Web the 2020 form de 4, employee’s withholding allowance certificate, has not yet been posted to the edd website. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Is the de 4 form required? How do i fill out a de4?

Download California Form DE 4 for Free Page 2 FormTemplate

You may be fined $500 if you file, with no reasonable. The de 4 is used to compute the amount of taxes to be withheld from. Web (de 4) to estimate the amount of income tax you want withheld from each sick pay payment. You may be fined $500 if you file, with no. The amount of income subject to.

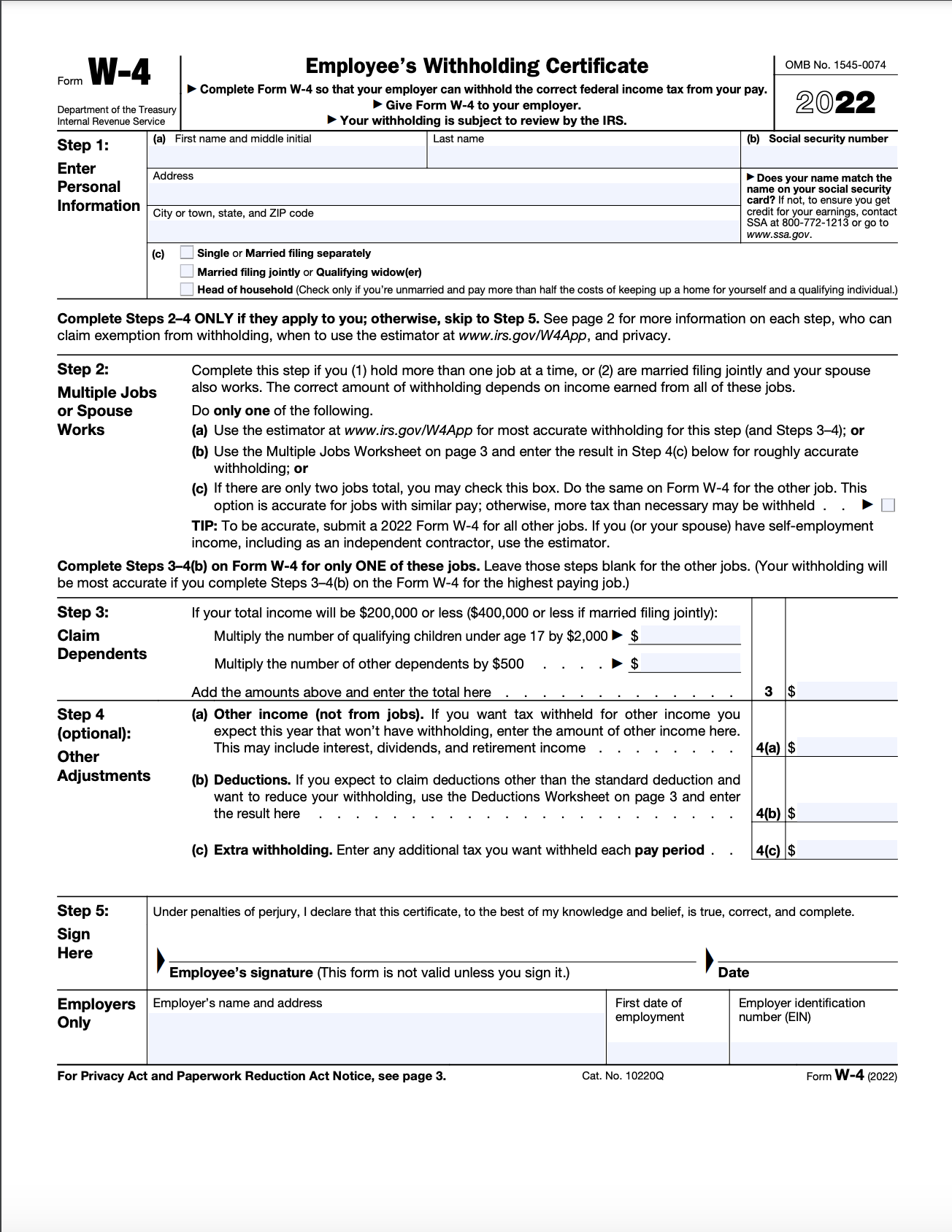

How to Complete Forms W4 Attiyya S. Ingram, AFC

Copy and distribute this form from the edd to employees so they can determine their withholding allowances. Web what is california tax form de 4? The de 4 is used to compute the amount of taxes to be withheld from. Web the amount of tax withheld is determined by the following. Web the 2020 form de 4, employee’s withholding allowance.

De4 Form Fill Online, Printable, Fillable, Blank PDFfiller

How do i fill out a de4? The de 4 is used to compute the amount of taxes to be withheld from. Web the amount of tax withheld is determined by the following. How many allowances should i claim california? Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that.

how to fill the form de 4 employees withholding allowance certificate

Copy and distribute this form from the edd to employees so they can determine their withholding allowances. This certifi cate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of taxes to be withheld from. Web what is california tax form de 4? Web (de 4) to estimate.

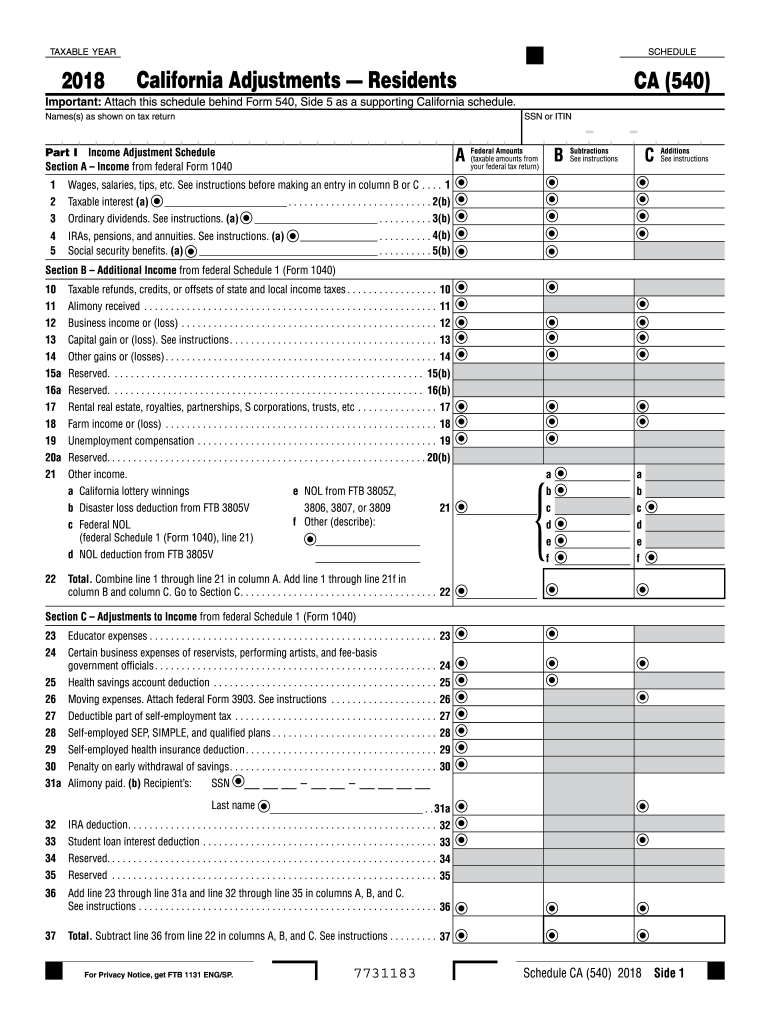

Ca Tax Forms For 2020 Free California Payroll Calculator 2020 Ca Tax

The de 4 is used to compute the amount of taxes to be withheld from. Web (de 4) to estimate the amount of income tax you want withheld from each sick pay payment. Web this certificate, de 4, is for california personal income tax (pit) withholding purposes only. Web 120k views 1 year ago. The amount of income subject to.

Tax Information · Career Training USA · InterExchange

The de 4 is used to compute the amount of taxes to be. Web the edd form de 4 lets employees claim withholding allowances according to their filing status, number of dependents, and deductions. This certificate, de 4, is for. The de 4 is used to compute the amount of taxes to be withheld from. Do i need to fill.

form 4

Web withholding allowance certificate (de 4) beginning january 1, 2020, the internal revenue service (irs) employee’s withholding allowance certiicate (form w. Web the 2020 form de 4, employee’s withholding allowance certificate, has not yet been posted to the edd website. Is the de 4 form required? The amount of income subject to tax. California personal income tax (pit) withholding.

Fill Free fillable State of California EDD Employee's Withholding

You may be fined $500 if you file, with no reasonable. How do i fill out a de4? To download this form, log in using the orange sign. Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Web the 2020 form de 4, employee’s withholding allowance certificate, has not yet been.

California DE4 App

The amount of income subject to tax. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of taxes to be withheld from. You may be fined $500 if you file, with no. The de 4 is used to compute the amount of taxes to be.

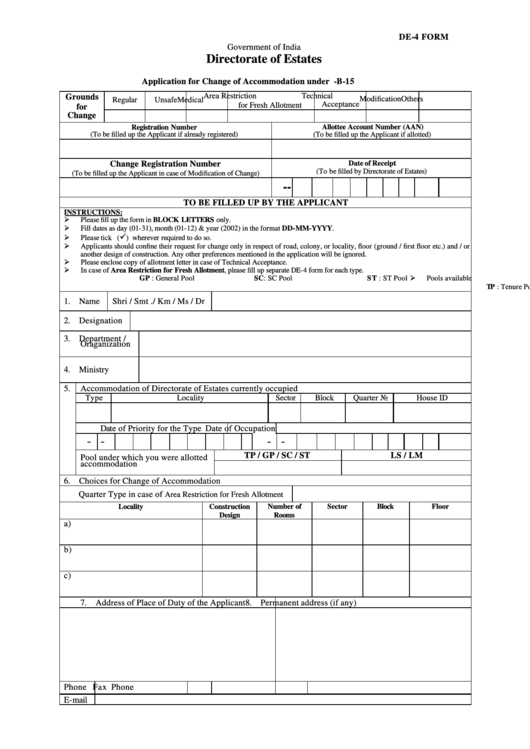

De4 Form Directorate Of Estates Form printable pdf download

The de 4 is used to compute the amount of taxes to be withheld from. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of taxes to be. This video is all about the california de 4 form and i will show you how to fill.

You May Be Fined $500 If You File, With No Reasonable.

The de 4p allows you to: The de 4 is used to compute the amount of taxes to be withheld from. Web the amount of tax withheld is determined by the following. This video is all about the california de 4 form and i will show you how to fill it out in 2021.

The De 4 Is Used To Compute The Amount Of Taxes To Be.

The de 4 is used to compute the amount of taxes to be withheld from your wages,. You may be fined $500 if you file, with no. Web the 2020 form de 4, employee’s withholding allowance certificate, has not yet been posted to the edd website. This certificate, de 4, is for california personal income tax (pit) withholding purposes only.

Web (De 4) To Estimate The Amount Of Income Tax You Want Withheld From Each Sick Pay Payment.

The de 4 is used to compute the amount of taxes to be withheld from. The de 4s is not valid unless you sign it. Copy and distribute this form from the edd to employees so they can determine their withholding allowances. This certificate, de 4, is for california personal income tax (pit) withholding purposes only.

To Download This Form, Log In Using The Orange Sign.

This certificate, de 4, is for. Web what is california tax form de 4? This certificate, de 4, is for california personal income tax (pit) withholdingpurposes only. The amount of income subject to tax.