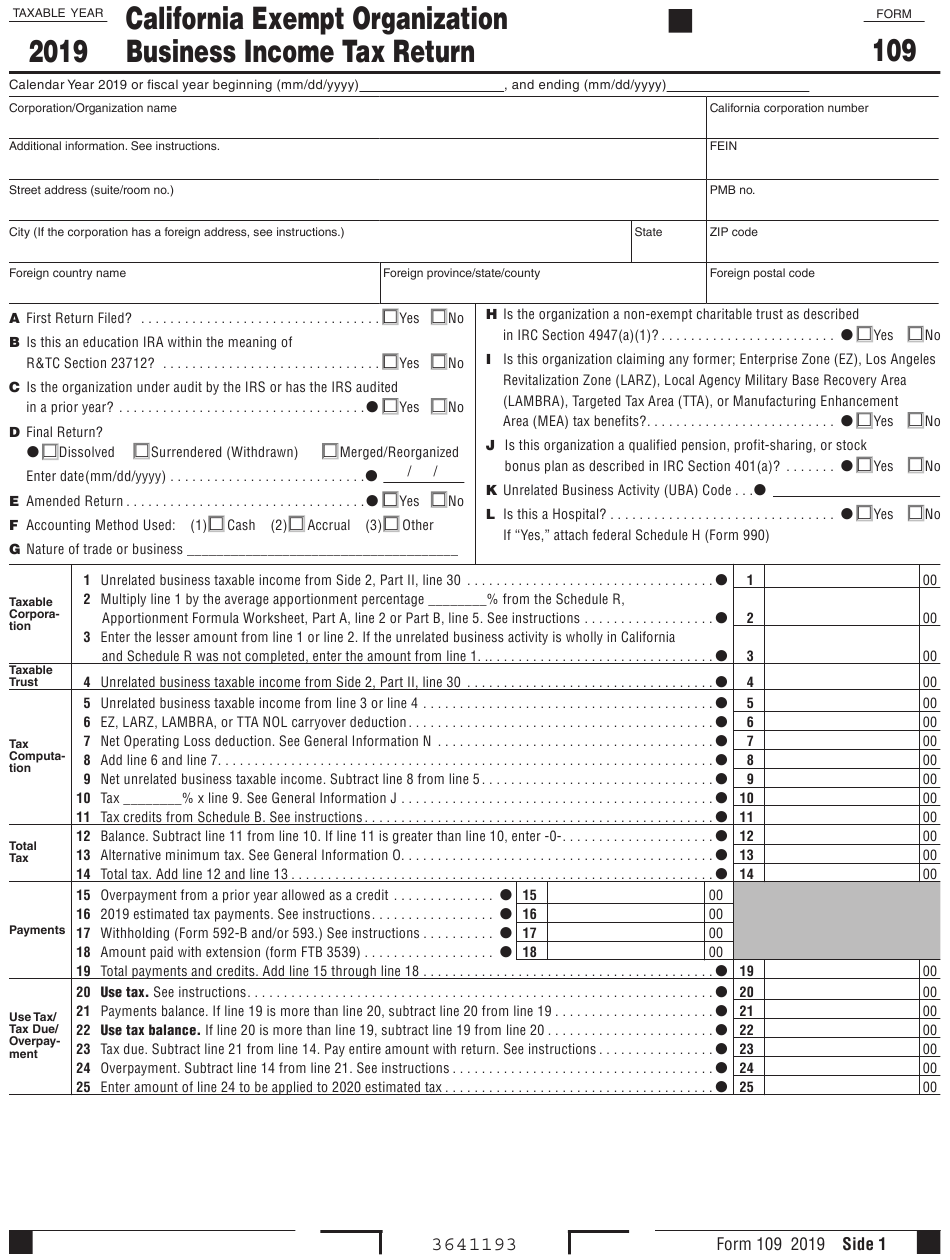

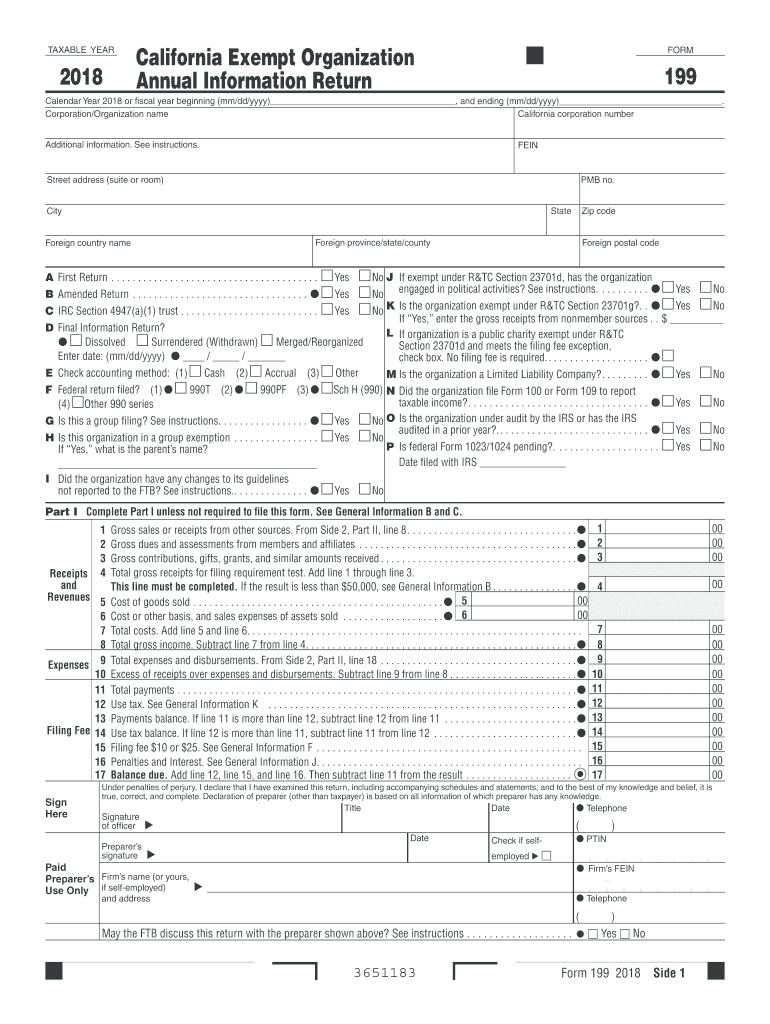

Ca Form 199

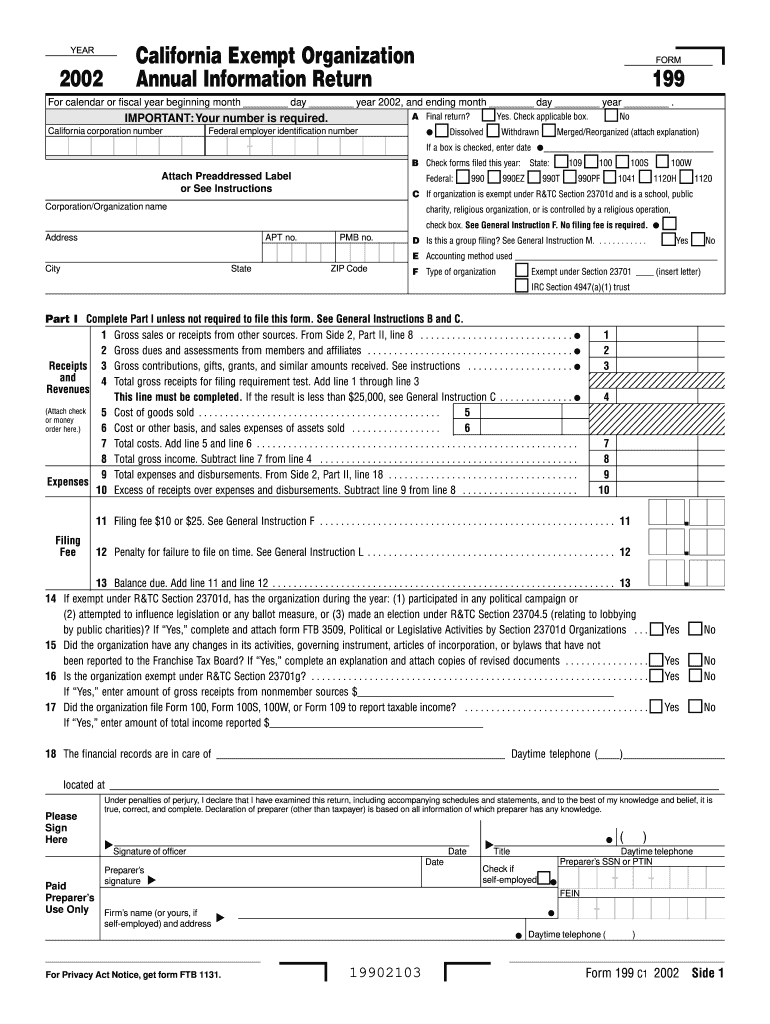

Ca Form 199 - Round your gross receipts value to the nearest whole dollar. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Web get forms, instructions, and publications. 1gross sales or receipts from other sources. For tax years 2012 and subsequent: Web 2021 form 199 california exempt organization annual information return. You can print other california tax forms here. Click here to learn more about form 199. From side 2, part ii, line 8.•100. Web the total amount the entity received from all sources during its annual account period, without subtracting any costs or expenses.

Round your gross receipts value to the nearest whole dollar. Click here to learn more about form 199. Web california form 199 has two versions, ftb 199n and form 199. The longer form 199 is as described above. An extension allows you more time to file the return, not an extension of time to pay any taxes that may be due. You can print other california tax forms here. Nonexempt charitable trusts as described in irc section 4947(a)(1). Web 2021 form 199 california exempt organization annual information return. Some types of organizations do not have a filing requirement. Web get forms, instructions, and publications.

Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Some types of organizations do not have a filing requirement. Nonexempt charitable trusts as described in irc section 4947(a)(1). The longer form 199 is as described above. Web we last updated california form 199 in january 2023 from the california franchise tax board. Round your gross receipts value to the nearest whole dollar. Web california form 199 is an annual information return filed by the following organizations to report the income & expenses. From side 2, part ii, line 8.•100. Web 2021 form 199 california exempt organization annual information return. Web get forms, instructions, and publications.

Exemption California State Tax Form 2023

Some types of organizations do not have a filing requirement. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Round your gross receipts value to the nearest whole dollar. Form 199 2021 side 1. Web 2021 form 199 california exempt organization annual information return.

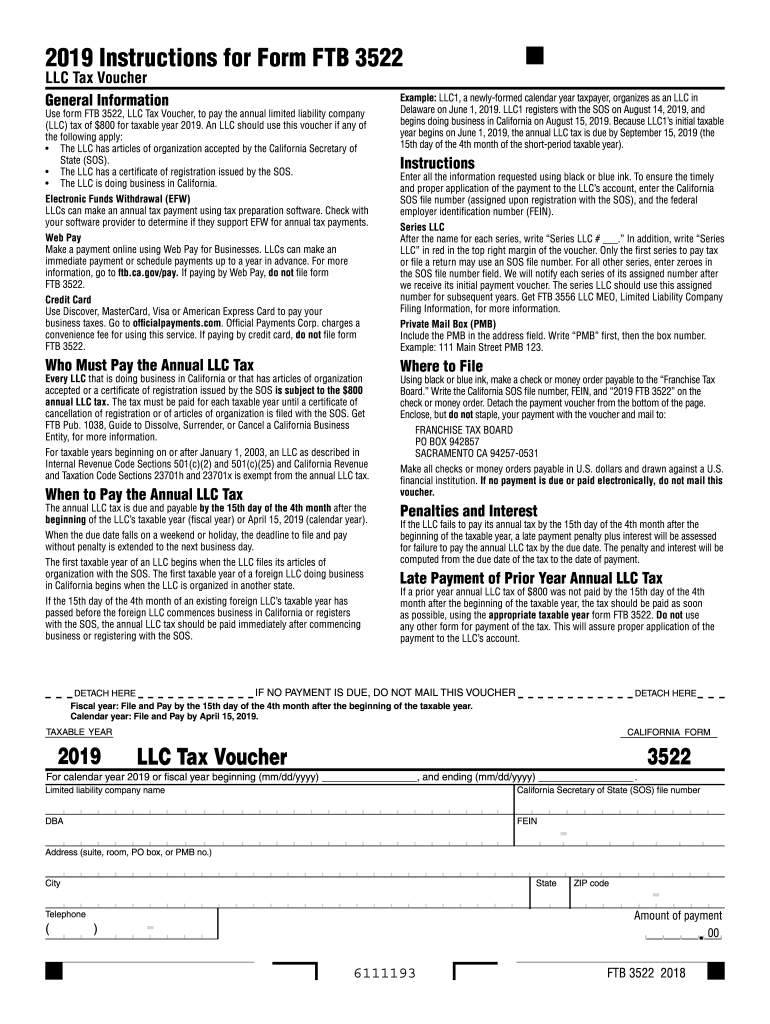

2019 Form CA FTB 3522 Fill Online, Printable, Fillable, Blank pdfFiller

2gross dues and assessments from members and affiliates.•200. Web california form 199 is an annual information return filed by the following organizations to report the income & expenses. Here are the filing thresholds: For tax years 2012 and subsequent: An extension allows you more time to file the return, not an extension of time to pay any taxes that may.

california form 199 Fill out & sign online DocHub

2gross dues and assessments from members and affiliates.•200. Web get forms, instructions, and publications. Web the total amount the entity received from all sources during its annual account period, without subtracting any costs or expenses. Web 2021 form 199 california exempt organization annual information return. Round your gross receipts value to the nearest whole dollar.

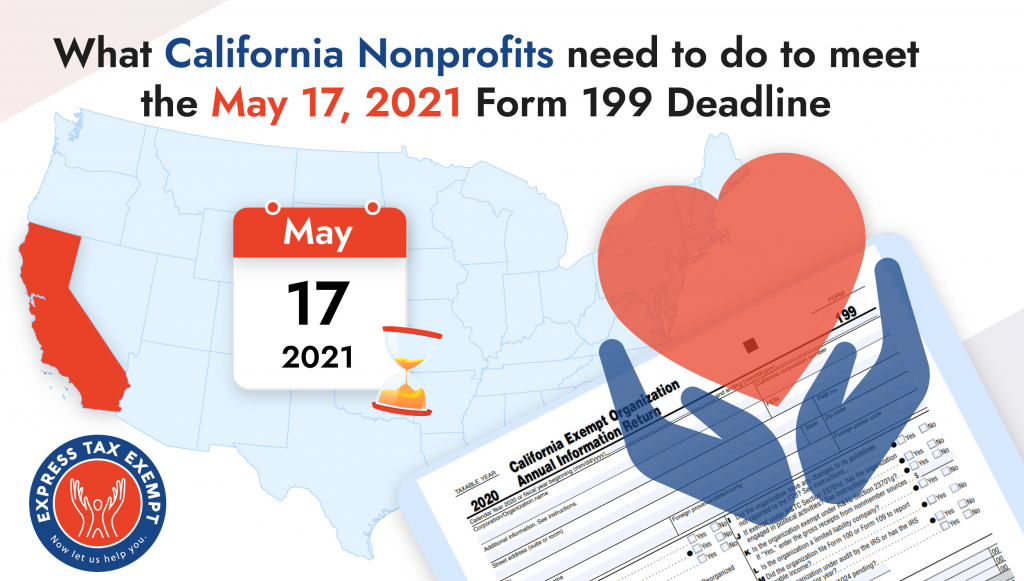

Form 199 ExpressTaxExempt Blog Efile tax Exempt Organizations for

Web the total amount the entity received from all sources during its annual account period, without subtracting any costs or expenses. Web get forms, instructions, and publications. For tax years 2012 and subsequent: Form 199 2021 side 1. An extension allows you more time to file the return, not an extension of time to pay any taxes that may be.

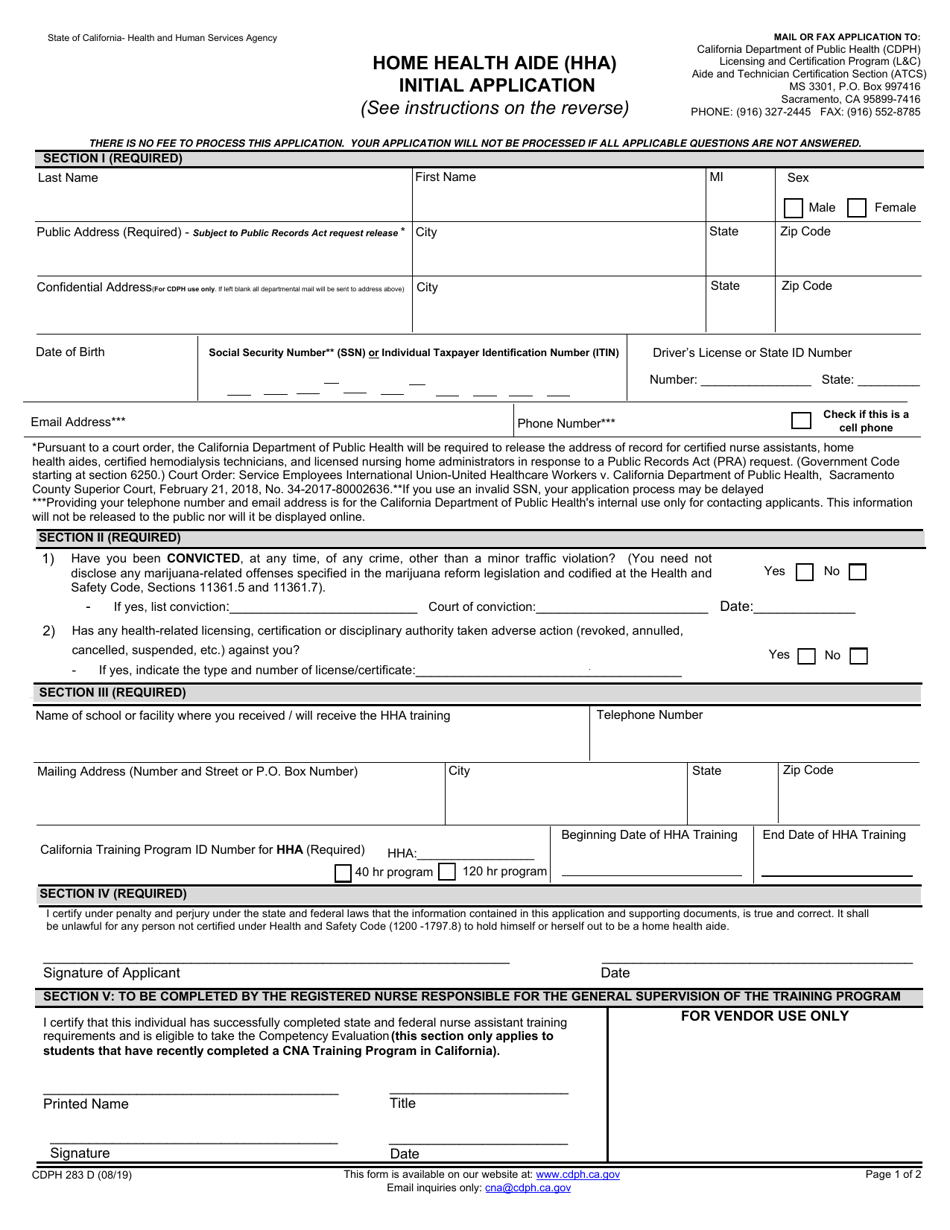

Form CDPH283D Download Fillable PDF or Fill Online Home Health Aide

Round your gross receipts value to the nearest whole dollar. The longer form 199 is as described above. Web california form 199 has two versions, ftb 199n and form 199. Your organization is not suspended on. Form 199 2021 side 1.

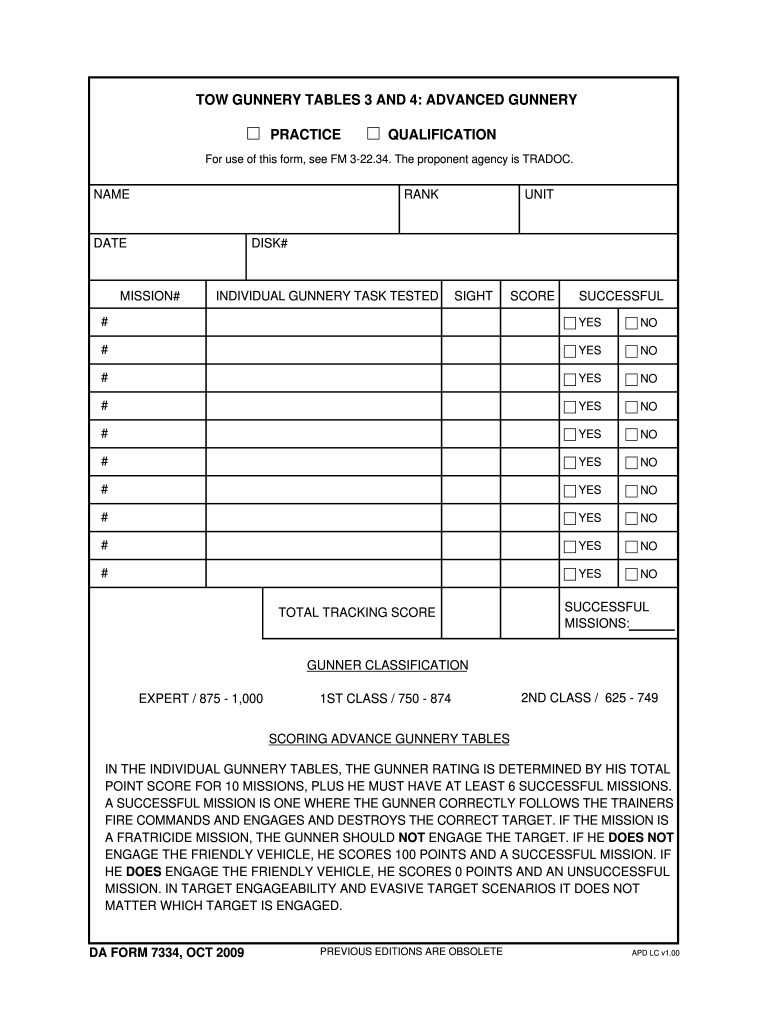

Da Form 199 Fill Out and Sign Printable PDF Template signNow

The longer form 199 is as described above. Round your gross receipts value to the nearest whole dollar. Nonexempt charitable trusts as described in irc section 4947(a)(1). This form is for income earned in tax year 2022, with tax returns due in april 2023. Web california form 199 is an annual information return filed by the following organizations to report.

Ca Form 199 Fill Out and Sign Printable PDF Template signNow

Click here to learn more about form 199. Here are the filing thresholds: Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. For tax years 2012 and subsequent: Nonexempt charitable trusts as described in irc section 4947(a)(1).

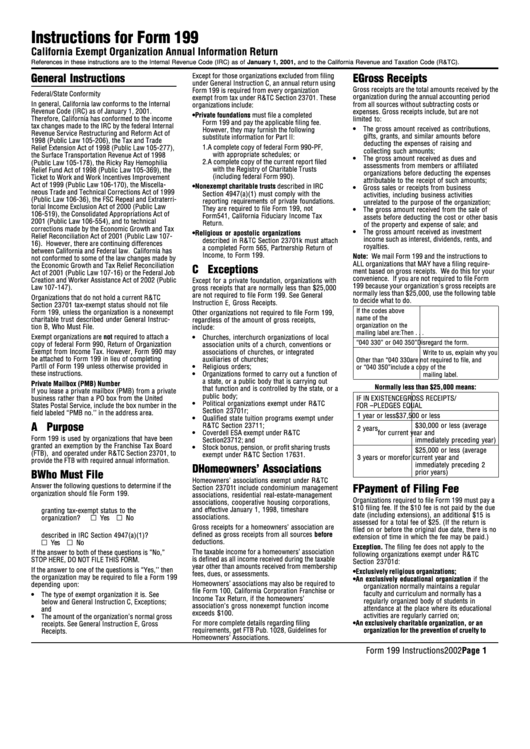

Instructions For Form 199 printable pdf download

From side 2, part ii, line 8.•100. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Nonexempt charitable trusts as described in irc section 4947(a)(1). Web the total amount the entity received from all sources during its annual account period, without subtracting any costs.

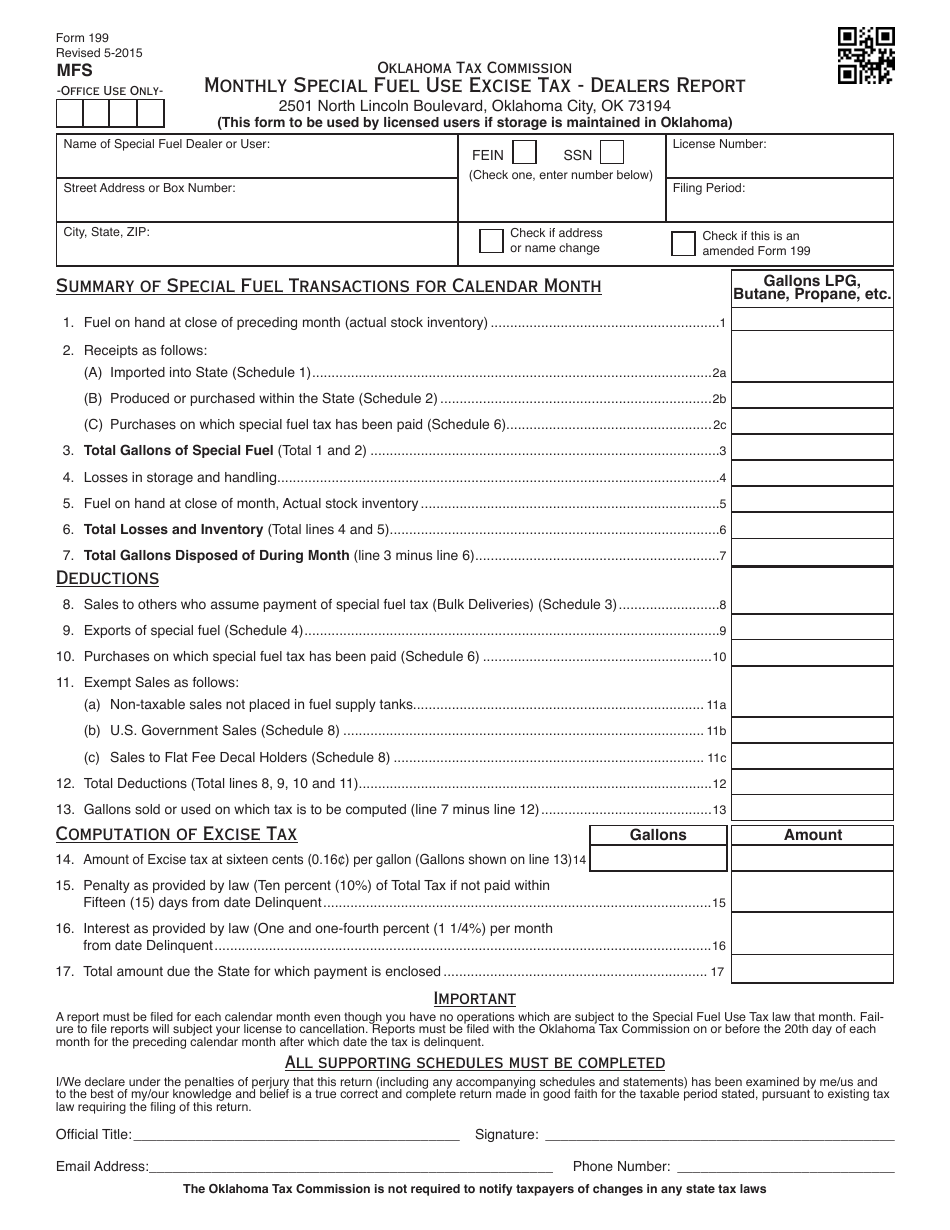

OTC Form 199 Download Fillable PDF or Fill Online Monthly Special Fuel

1gross sales or receipts from other sources. From side 2, part ii, line 8.•100. Web we last updated california form 199 in january 2023 from the california franchise tax board. An extension allows you more time to file the return, not an extension of time to pay any taxes that may be due. The longer form 199 is as described.

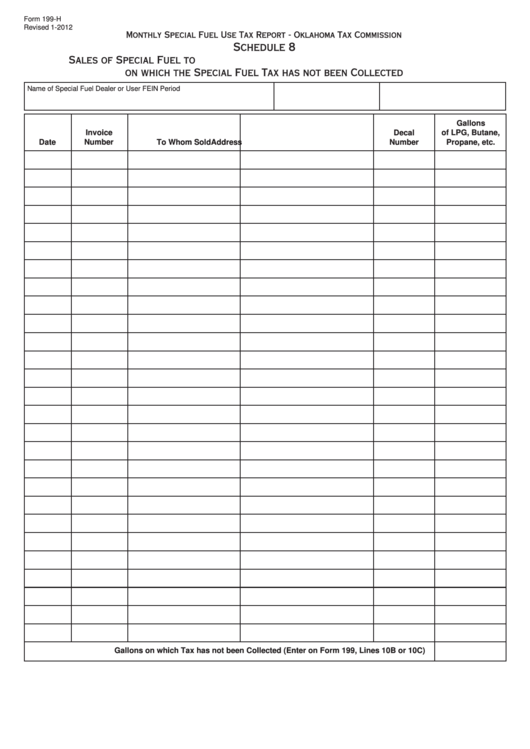

Fillable Form 199H Schedule 8 Sales Of Special Fuel To U.s

2gross dues and assessments from members and affiliates.•200. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Web california form 199 has two versions, ftb 199n and form 199. The longer form 199 is as described above. Round your gross receipts.

Nonexempt Charitable Trusts As Described In Irc Section 4947(A)(1).

2gross dues and assessments from members and affiliates.•200. Here are the filing thresholds: You can print other california tax forms here. For tax years 2012 and subsequent:

Round Your Gross Receipts Value To The Nearest Whole Dollar.

From side 2, part ii, line 8.•100. Web we last updated the exempt organization annual information return in january 2023, so this is the latest version of form 199, fully updated for tax year 2022. Form 199 is used by the following organizations: Web california form 199 has two versions, ftb 199n and form 199.

Web We Last Updated California Form 199 In January 2023 From The California Franchise Tax Board.

Web the total amount the entity received from all sources during its annual account period, without subtracting any costs or expenses. This form is for income earned in tax year 2022, with tax returns due in april 2023. Your organization is not suspended on. Click here to learn more about form 199.

An Extension Allows You More Time To File The Return, Not An Extension Of Time To Pay Any Taxes That May Be Due.

Form 199 2021 side 1. 1gross sales or receipts from other sources. Web 2021 form 199 california exempt organization annual information return. Web get forms, instructions, and publications.