Ca Form 592-Pte

Ca Form 592-Pte - Do not use form 592 if any of the following apply: Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. No payment, distribution or withholding occurred. Do not use form 592 if any of the following apply: General information, check if total withholding at end of year. If the partnership has foreign partners, the withholding tax must be paid using. Cch axcess™ tax and cch® prosystem fx® tax: Web form 592 is also used to report withholding payments for a resident payee. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding. Corporation name, street address, city, state code, corporation telephone number.

Corporation name, street address, city, state code, corporation telephone number. General information, check if total withholding at end of year. Web form 592 is also used to report withholding payments for a resident payee. Use get form or simply click on the template preview to open it in the editor. 2021 california 3804 and 3893. Cch axcess™ tax and cch® prosystem fx® tax: Do not use form 592 if any of the following apply: Web form 592 is also used to report withholding payments for a resident payee. No payment, distribution or withholding occurred. Web how it works open the form 592 pte and follow the instructions easily sign the california state tax form with your finger send filled & signed california state tax or save rate the.

Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. Web form 592 is also used to report withholding payments for a resident payee. Start completing the fillable fields and carefully. If the partnership has foreign partners, the withholding tax must be paid using. Either state form 565 or 568 should be generated. General information, check if total withholding at end of year. No payment, distribution or withholding occurred. Corporation name, street address, city, state code, corporation telephone number. Do not use form 592 if any of the following apply: 2021 california 3804 and 3893.

Form 592 Pte Fill Out and Sign Printable PDF Template signNow

Web form 592 is also used to report withholding payments for a resident payee. Web form 592 is also used to report withholding payments for a resident payee. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding. No payment, distribution or withholding.

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

Web how it works open the form 592 pte and follow the instructions easily sign the california state tax form with your finger send filled & signed california state tax or save rate the. Do not use form 592 if any of the following apply: 2021 california 3804 and 3893. Start completing the fillable fields and carefully. 2023 ca form.

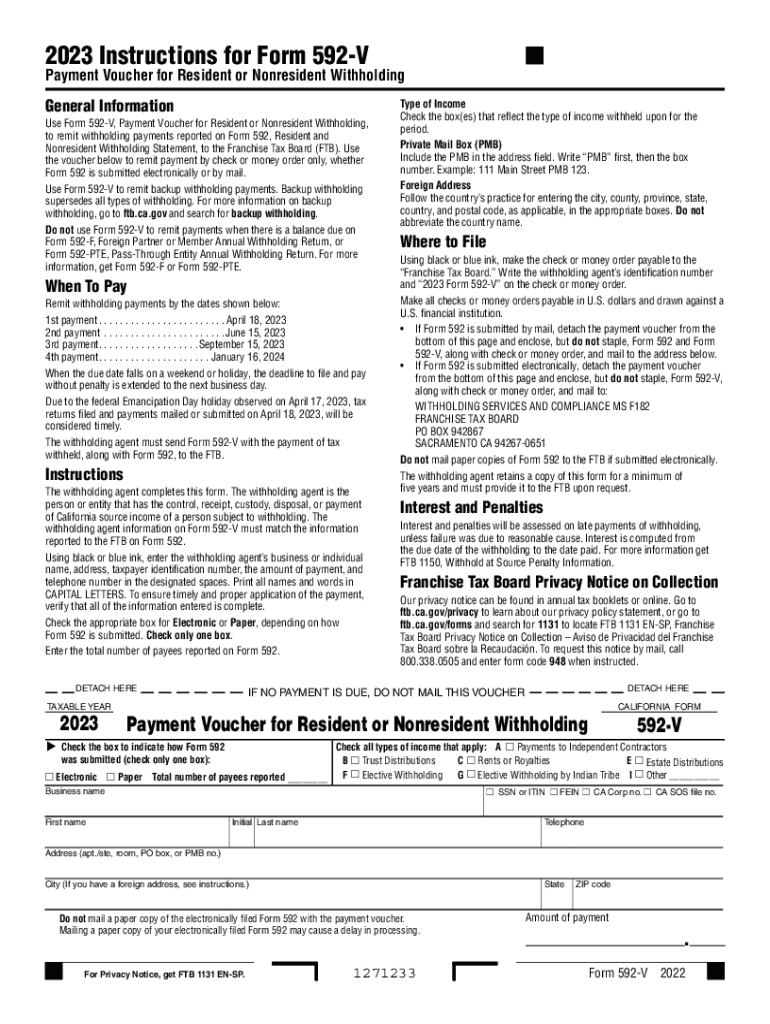

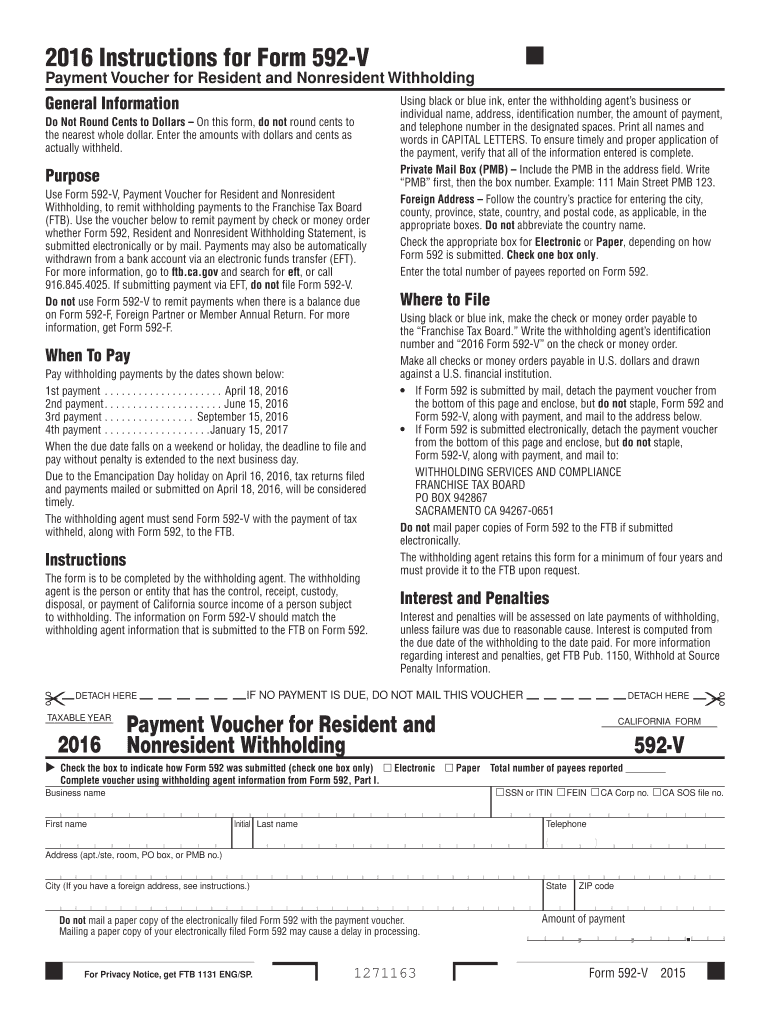

592 V Fill Out and Sign Printable PDF Template signNow

No payment, distribution or withholding occurred. Do not use form 592 if any of the following apply: Start completing the fillable fields and carefully. Web form 592 is also used to report withholding payments for a resident payee. Web form 592 is also used to report withholding payments for a resident payee.

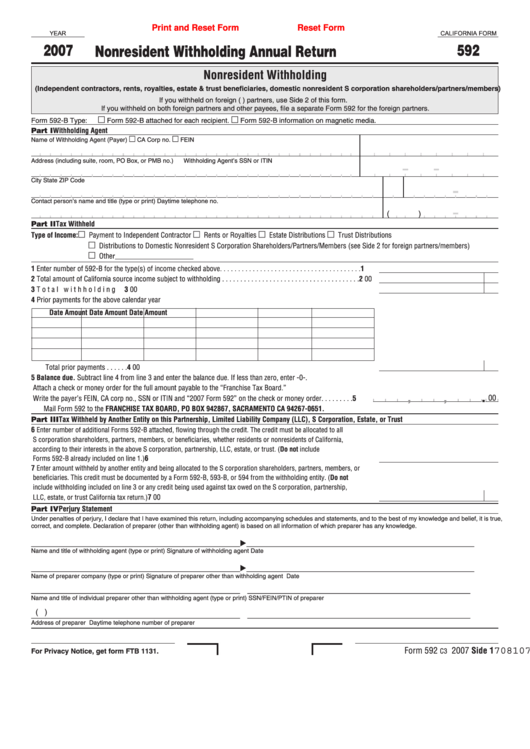

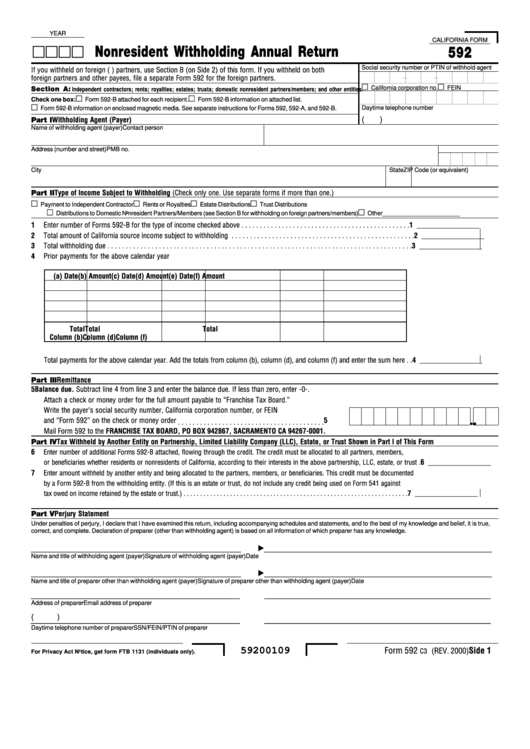

California Form 592 Nonresident Withholding Annual Return 2007

Corporation name, street address, city, state code, corporation telephone number. Web form 592 is also used to report withholding payments for a resident payee. General information, check if total withholding at end of year. No payment, distribution or withholding occurred. Cch axcess™ tax and cch® prosystem fx® tax:

Form 592 Draft Nonresident Withholding Annual Return 2007 printable

Cch axcess™ tax and cch® prosystem fx® tax: 2021 california 3804 and 3893. Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. 2023 ca form 592, resident and nonresident. General information, check if total withholding at end of year.

California Form 592 Nonresident Withholding Annual Return printable

2023 ca form 592, resident and nonresident. Cch axcess™ tax and cch® prosystem fx® tax: Either state form 565 or 568 should be generated. Do not use form 592 if any of the following apply: Web form 592 is also used to report withholding payments for a resident payee.

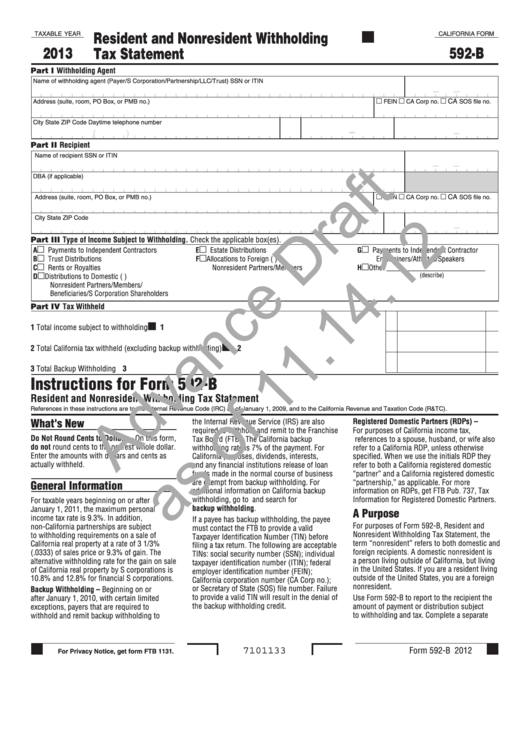

California Form 592B Draft Resident And Nonresident Withholding Tax

Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. Do not use form 592 if any of the following apply: No payment, distribution or withholding occurred. Either state form 565 or 568 should be generated. If the partnership has foreign partners, the withholding tax must be paid using.

Standard Form 592 T Fill Online, Printable, Fillable, Blank pdfFiller

Do not use form 592 if any of the following apply: Start completing the fillable fields and carefully. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding. Web form 592 is also used to report withholding payments for a resident payee. Cch.

2011 Form CA FTB 592A Fill Online, Printable, Fillable, Blank pdfFiller

Corporation name, street address, city, state code, corporation telephone number. If the partnership has foreign partners, the withholding tax must be paid using. Do not use form 592 if any of the following apply: Use get form or simply click on the template preview to open it in the editor. No payment, distribution or withholding occurred.

2013 Form CA FTB 592 Fill Online, Printable, Fillable, Blank pdfFiller

General information, check if total withholding at end of year. No payment, distribution or withholding occurred. If the partnership has foreign partners, the withholding tax must be paid using. Either state form 565 or 568 should be generated. Cch axcess™ tax and cch® prosystem fx® tax:

No Payment, Distribution Or Withholding Occurred.

No payment, distribution or withholding occurred. If the partnership has foreign partners, the withholding tax must be paid using. Click the links below to see the form instructions. Web form 592 is also used to report withholding payments for a resident payee.

Web How It Works Open The Form 592 Pte And Follow The Instructions Easily Sign The California State Tax Form With Your Finger Send Filled & Signed California State Tax Or Save Rate The.

Cch axcess™ tax and cch® prosystem fx® tax: Use get form or simply click on the template preview to open it in the editor. Do not use form 592 if any of the following apply: Web in order to pay the withholding tax to the state of california, form 592 needs to be completed.

Start Completing The Fillable Fields And Carefully.

2023 ca form 592, resident and nonresident. Do not use form 592 if any of the following apply: General information, check if total withholding at end of year. Web form 592 is also used to report withholding payments for a resident payee.

Web Form 592 Includes A Schedule Of Payees Section, On Side 2, That Requires The Withholding Agent To Identify The Payees, The Income Amounts, And The Withholding.

Either state form 565 or 568 should be generated. Corporation name, street address, city, state code, corporation telephone number. 2021 california 3804 and 3893.