Calendar Spread Strategy

Calendar Spread Strategy - Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. Web calendar spreads are considered an advanced option trading strategy, so it’s important to have a handle on how they work and the potential risks. Web a calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or. Web mechanics of calendar spreads. Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. In the options strategy version, calendar spreads are set up within the same. At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. Web how to set up a call calendar spread.

They are also called time spreads, horizontal. Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. In the options strategy version, calendar spreads are set up within the same. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. Web mechanics of calendar spreads. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können.

Web what is a calendar spread? They are also called time spreads, horizontal. Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. If you’re unfamiliar with a horizontal spread, it’s an options strategy that involves. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. A calendar spread is a type of horizontal spread. Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. In the options strategy version, calendar spreads are set up within the same. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

Web how to set up a call calendar spread. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web calendar spreads are considered an advanced option trading strategy, so it’s important to have a handle on how they work and the potential.

Long Calendar Spread with Puts Strategy With Example

Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. They are also called time spreads, horizontal. Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads. Web what is a calendar spread? Web.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

Web a calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the same type (either calls or. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. Web calendar spreads are.

Everything You Need to Know about Calendar Spreads

Web learn how to use calendar spreads, a net debit options strategy that capitalizes on time decay and volatility, with or without a directional bias. Web how to set up a call calendar spread. In the options strategy version, calendar spreads are set up within the same. Web a calendar spread, also known as a time spread, is an options.

Calendar Spread Options Strategy VantagePoint

Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. Web in this article, we’ll review.

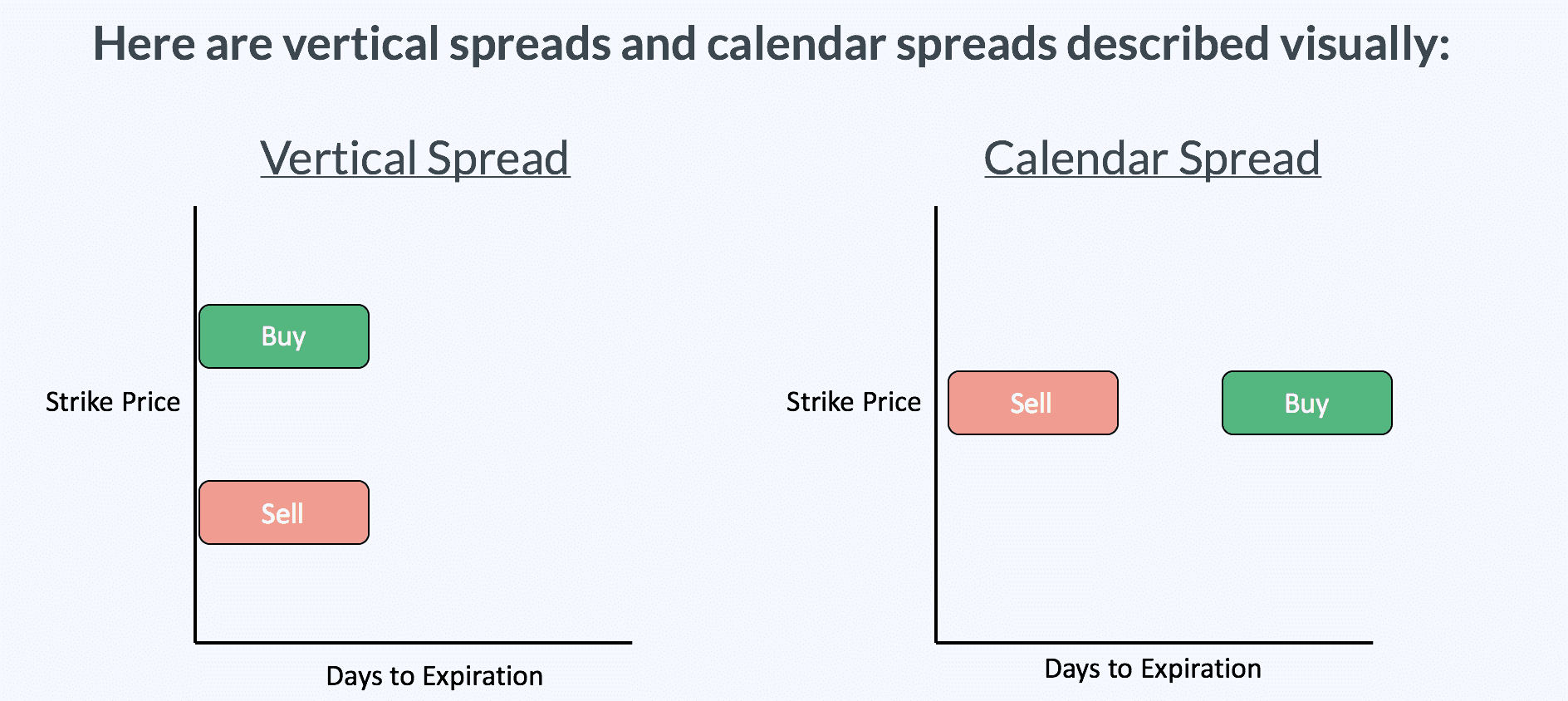

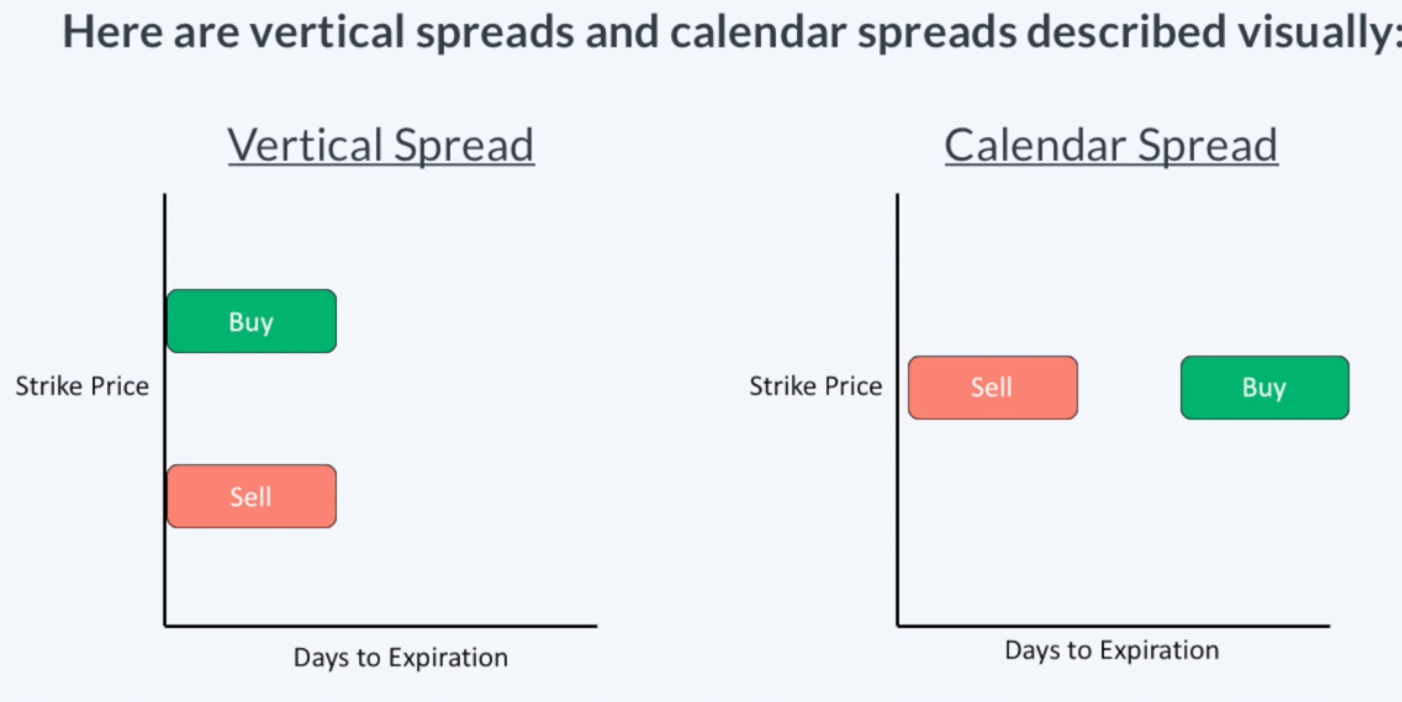

How to Trade Options Calendar Spreads (Visuals and Examples)

They are also called time spreads, horizontal. Web how to set up a call calendar spread. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. A calendar spread is a type of horizontal spread. Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’.

How Calendar Spreads Work (Best Explanation) projectoption

In the options strategy version, calendar spreads are set up within the same. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web how to set up a call calendar spread. They are also called time spreads, horizontal. If you’re unfamiliar with.

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web how to set up a call calendar spread. At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web how to set up a call calendar spread. At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. Web in diesem artikel erfahren sie, was die calendar spread optionsstrategie ist, und wie sie sie für sich gewinnbringend einsetzen können. Web a long calendar call spread is seasoned option.

Calendar Spread Options Trading Strategy In Python

In the options strategy version, calendar spreads are set up within the same. Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web a calendar spread, also known.

Web Learn How To Use Calendar Spreads, A Net Debit Options Strategy That Capitalizes On Time Decay And Volatility, With Or Without A Directional Bias.

A calendar spread is a type of horizontal spread. Web calendar spreads are also known as ‘time spreads’, ‘counter spreads’ and ‘horizontal spreads’. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web calendar spreads are considered an advanced option trading strategy, so it’s important to have a handle on how they work and the potential risks.

If You’re Unfamiliar With A Horizontal Spread, It’s An Options Strategy That Involves.

They are also called time spreads, horizontal. In the options strategy version, calendar spreads are set up within the same. Web how to set up a call calendar spread. Web in this article, we’ll review how to collect weekly or monthly income using long call option calendar spreads.

Web A Calendar Spread, Also Known As A Time Spread, Is An Options Trading Strategy That Involves Buying And Selling Two Options Of The Same Type (Either Calls Or.

Web a calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type (calls or puts) and strike. Web what is a calendar spread? At the heart of calendar spreads lies the strategic use of options with different expiration dates but the same strike price. Web mechanics of calendar spreads.