Calendar Vs Fiscal Year

Calendar Vs Fiscal Year - Find out the advantages and disadvantages. Find out how to choose the best system for your business. Learn when you should use each. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. Web learn the meaning, relevance, period, and tax reporting of calendar year and fiscal year. Find out the pros and cons of using a fiscal year, and the tax. This year can differ from. Web is the fiscal year the same as a calendar year? Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. An individual can adopt a fiscal year if the.

Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. This year can differ from. Web the fiscal year can differ from the calendar year, which ends dec. Find out the advantages and disadvantages. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. Web is the fiscal year the same as a calendar year? Web a fiscal year differs from a calendar year in that it doesn't coincide with the weeks, months, and quarters a calendar year uses. Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. Learn when you should use each. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year.

Web while the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12. Web learn what a fiscal year is, how it differs from a calendar year, and how to pick one for your business. Web learn the difference between a fiscal year and a calendar year, and how they affect accounting, tax and budgeting. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. An individual can adopt a fiscal year if the. Generally, taxpayers filing a version of form 1040 use the calendar year. Find out how to choose the best system for your business. Web is the fiscal year the same as a calendar year? A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. Web what is the difference between a fiscal year and calendar year?

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Web what is the difference between a fiscal year and calendar year? An individual can adopt a fiscal year if the. What is a fiscal year? This year can differ from. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year.

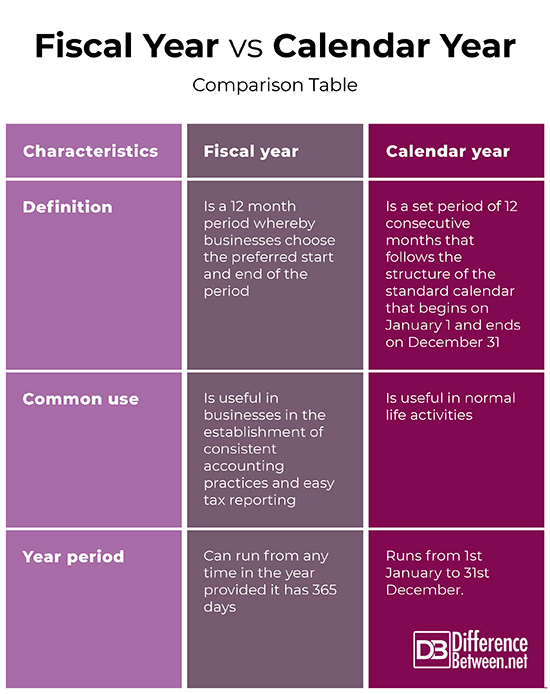

Fiscal Year vs Calendar Year Difference and Comparison

Web calendar year is the period from january 1st to december 31st. Web the fiscal year can differ from the calendar year, which ends dec. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. What is a fiscal year? Find out how to choose the best system for your.

Fiscal Year vs Calendar Year Difference and Comparison

Web while the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period..

Fiscal Year vs Calendar Year What's The Difference?

The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web learn the meaning, relevance, period, and tax reporting of calendar year and fiscal.

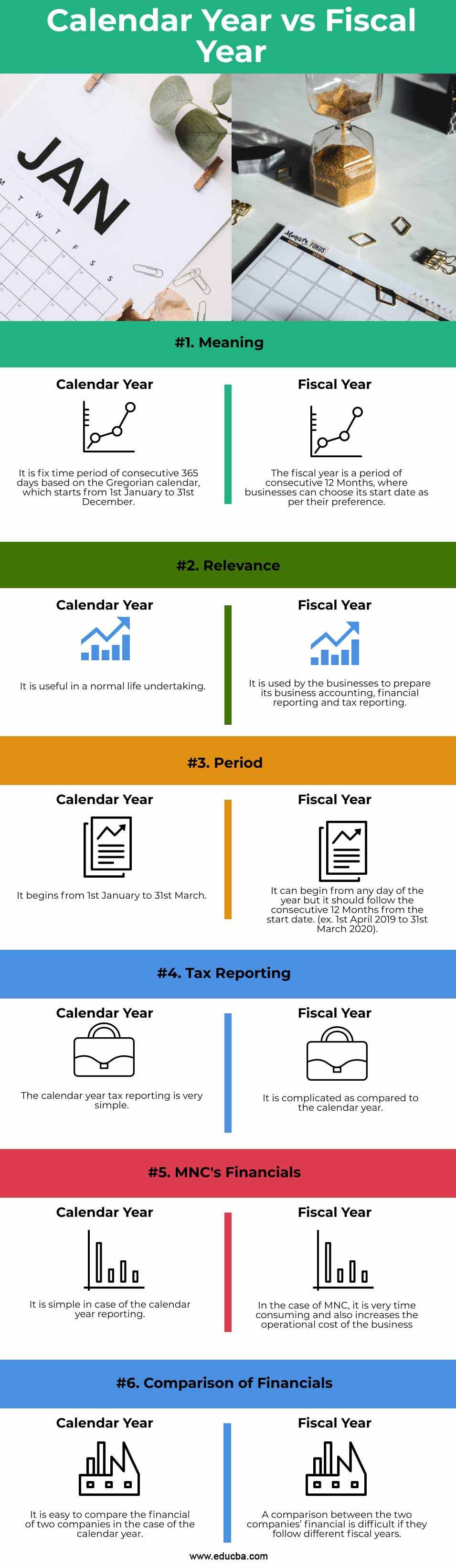

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Web the fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: Web while the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12. Find out how to choose the best system.

Fiscal Year Vs Calendar Year What's Best for Your Business?

A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. Find out the pros and cons of using a fiscal year, and the tax. Web learn the meaning, relevance, period, and tax reporting of calendar year and fiscal year. Web while the fiscal year is a 12 month period whereby.

The Differences Between Calendar Year And Fiscal Year www.vrogue.co

Web the fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: Compare the advantages and disadvantages of each type of year for. What is a fiscal year? Find out how to choose the best system for your business. Web what is the difference between a fiscal year and calendar.

What is a Fiscal Year? Your GoTo Guide

Web what is the difference between a fiscal year and calendar year? Find out the advantages and disadvantages. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. An individual can adopt a fiscal year if the. Compare the advantages and disadvantages of each type of year for.

Difference Between Fiscal Year and Calendar Year Difference Between

Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. 31, and is chosen by the company when it incorporates based on its needs and the seasonality of. Web learn the meaning, relevance, period, and tax reporting of calendar year.

What is the Difference Between Fiscal Year and Calendar Year

Web the fiscal year can differ from the calendar year, which ends dec. Generally, taxpayers filing a version of form 1040 use the calendar year. A fiscal year, on the other hand, is any. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the. Web the fiscal year, a period of 12 months ending.

Find Out How To Choose The Best System For Your Business.

What is a fiscal year? Learn the difference between a calendar year and a fiscal year, and how they affect taxation and accounting. Generally, taxpayers filing a version of form 1040 use the calendar year. Web calendar year is the period from january 1st to december 31st.

Web While The Fiscal Year Is A 12 Month Period Whereby Businesses Choose The Preferred Start And End Of The Period, The Calendar Year Is A Set Period Of 12.

Web the fiscal year can differ from the calendar year, which ends dec. Find out the pros and cons of using a fiscal year, and the tax. Web what is the difference between a fiscal year and calendar year? A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes.

Find Out The Advantages And Disadvantages.

Web a fiscal year differs from a calendar year in that it doesn't coincide with the weeks, months, and quarters a calendar year uses. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web learn what a fiscal year is, how it differs from a calendar year, and how to pick one for your business. This year can differ from.

Learn When You Should Use Each.

Web different countries and companies use different fiscal years (often referred to in financial records with the acronym fy), and the fiscal year need not align with the. Web the fiscal year and the calendar year are two distinct ways of measuring time, each with its own purpose and characteristics: Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web learn the difference between a fiscal year and a calendar year, and how they affect accounting, tax and budgeting.