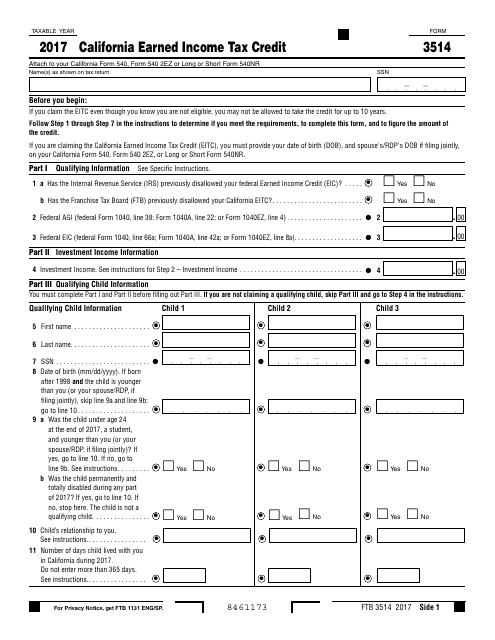

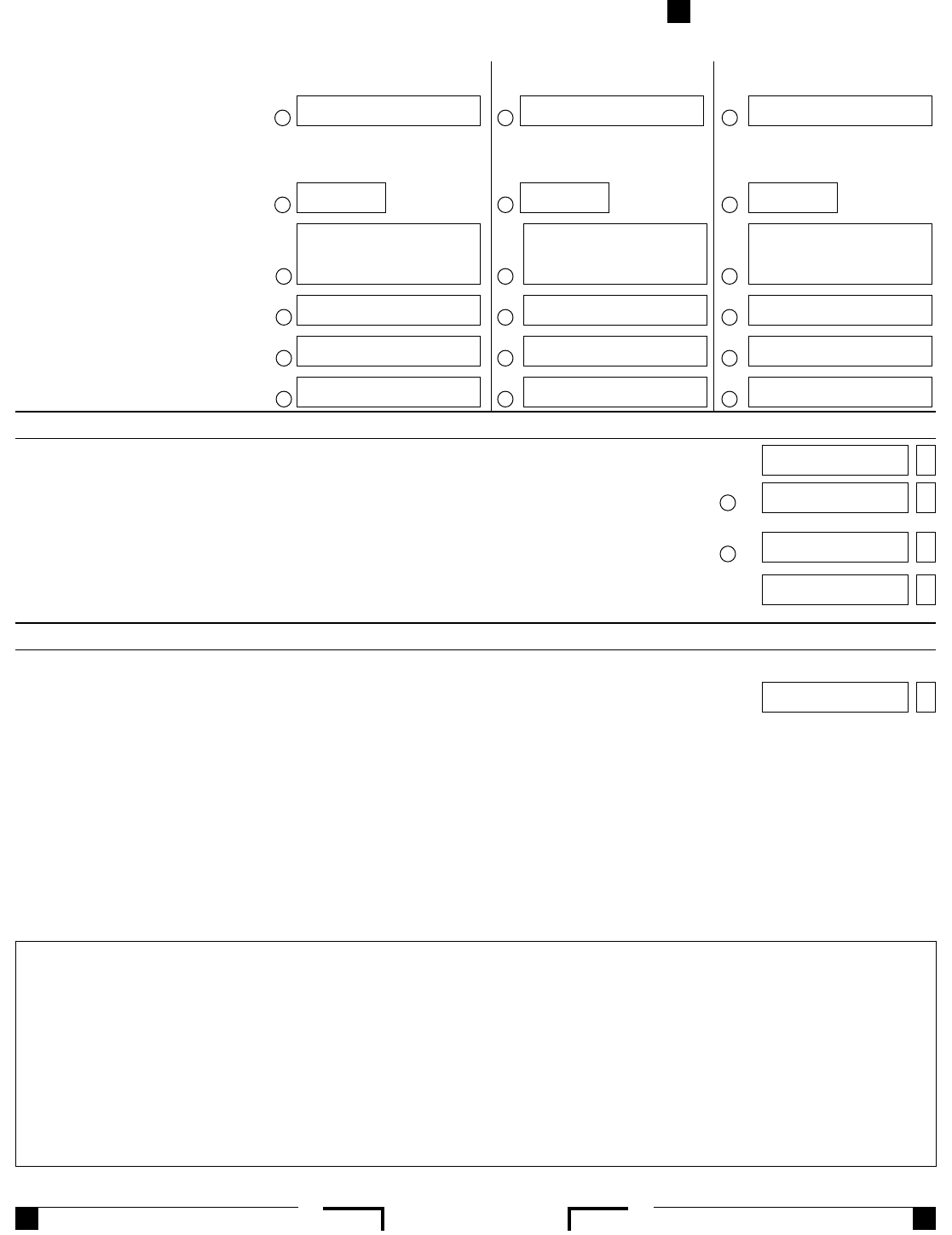

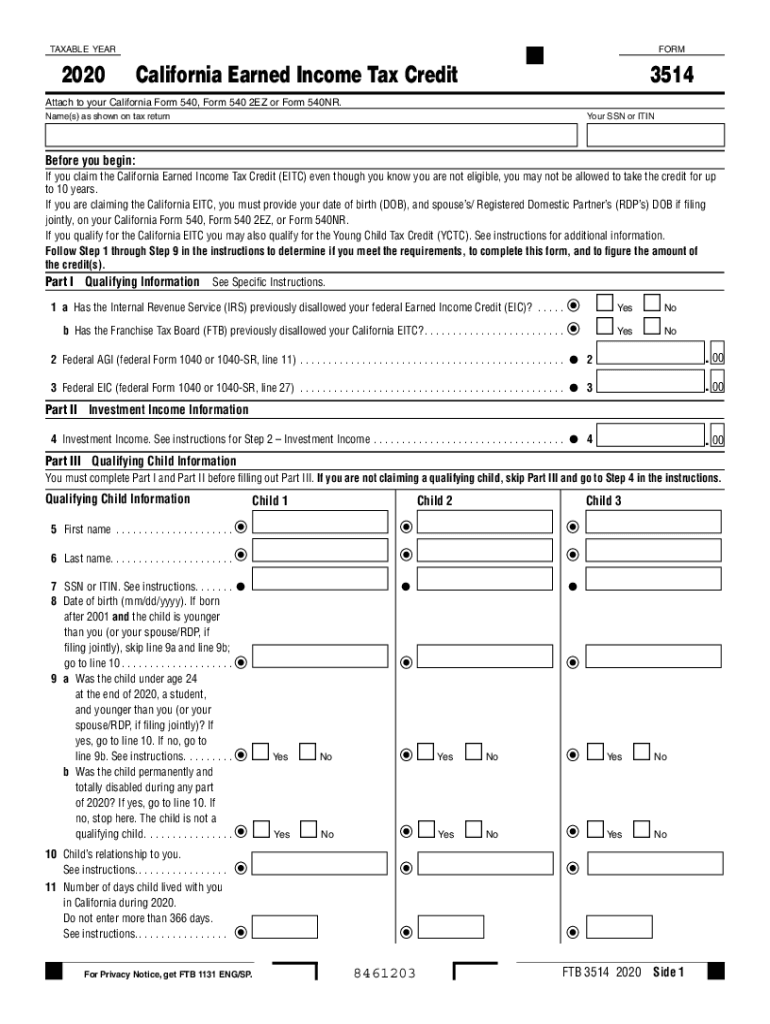

California Earned Income Tax Credit Form 3514

California Earned Income Tax Credit Form 3514 - Web ca refundable eic (3514) answer the two questions re federal eic and caleitc being disallowed. Web form 3514, is ca earned income tax credit. Web 502 rows both your earned income and federal adjusted gross income (agi) must be less than $54,884 to qualify for the federal credit, and less than $24,951 to qualify for. If the qualifying child's address is different than the taxpayer's,. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. # california allows this credit for wage income (wages, salaries, tips and other employee compensation) that is subject to. You may qualify if you have earned income of less than $13,870. Ad our federal tax credits and incentives services can be tailored to your specific needs. Web 603 rows california earned income tax credit. Web tax credit are as follows:

Web california form 3514 (california earned income tax credit. The refundable california eitc is. Web 603 rows california earned income tax credit. This form is for income earned in. Web reduces your california tax obligation, or allows a refund if no california tax is due. Ad our federal tax credits and incentives services can be tailored to your specific needs. Web follow our easy steps to get your ca ftb 3514 ready rapidly: Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. Web tax credit are as follows: You may qualify if you have earned income of less than $13,870.

Enter all necessary information in the required fillable fields. Web a purpose you may qualify to claim the 2016 california eitc if you (and your spouse/rdp) earned wage income in california. Web reduces your california tax obligation, or allows a refund if no california tax is due. # california allows this credit for wage income (wages, salaries, tips and other employee compensation) that is subject to. Verify the net investment income and earned income amounts are correct. Ad our federal tax credits and incentives services can be tailored to your specific needs. Web 502 rows both your earned income and federal adjusted gross income (agi) must be less than $54,884 to qualify for the federal credit, and less than $24,951 to qualify for. Pick the template from the library. Web form 3514, is ca earned income tax credit. Web california earned income tax credit form 3514 attach to your california form 540, form 540 2ez or long or short form 540nr name(s) as shown on tax return.

What is the California Earned Tax Credit? The Sacramento Bee

You may qualify if you have earned income of less than $13,870. # california allows this credit for wage income (wages, salaries, tips and other employee compensation) that is subject to. Web california form 3514 (california earned income tax credit. The refundable california eitc is. You do not need a child to qualify.

Form FTB 3514 Download Fillable PDF 2017, California Earned Tax

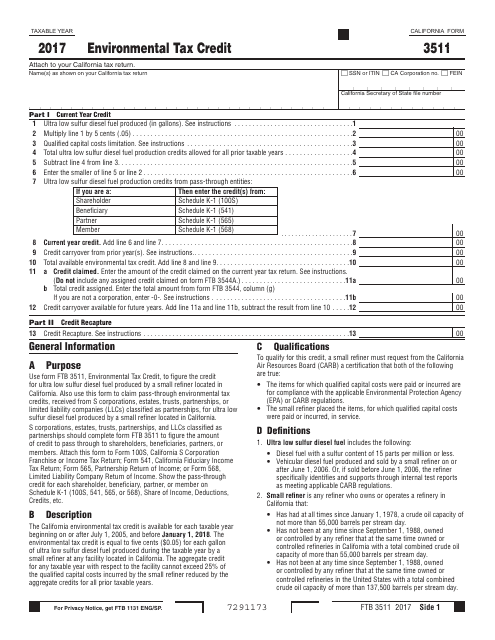

Web reduces your california tax obligation, or allows a refund if no california tax is due. With the right expertise, federal tax credits and incentives could benefit your business. Verify the net investment income and earned income amounts are correct. Web tax credit are as follows: Web a purpose you may qualify to claim the 2016 california eitc if you.

Tax Form California Free Download

Web more about the california form 3514 tax credit we last updated california form 3514 in january 2023 from the california franchise tax board. Enter all necessary information in the required fillable fields. # california allows this credit for wage income (wages, salaries, tips and other employee compensation) that is subject to. If the qualifying child's address is different than.

20182020 Form CA FTB 540NR Booklet Fill Online, Printable, Fillable

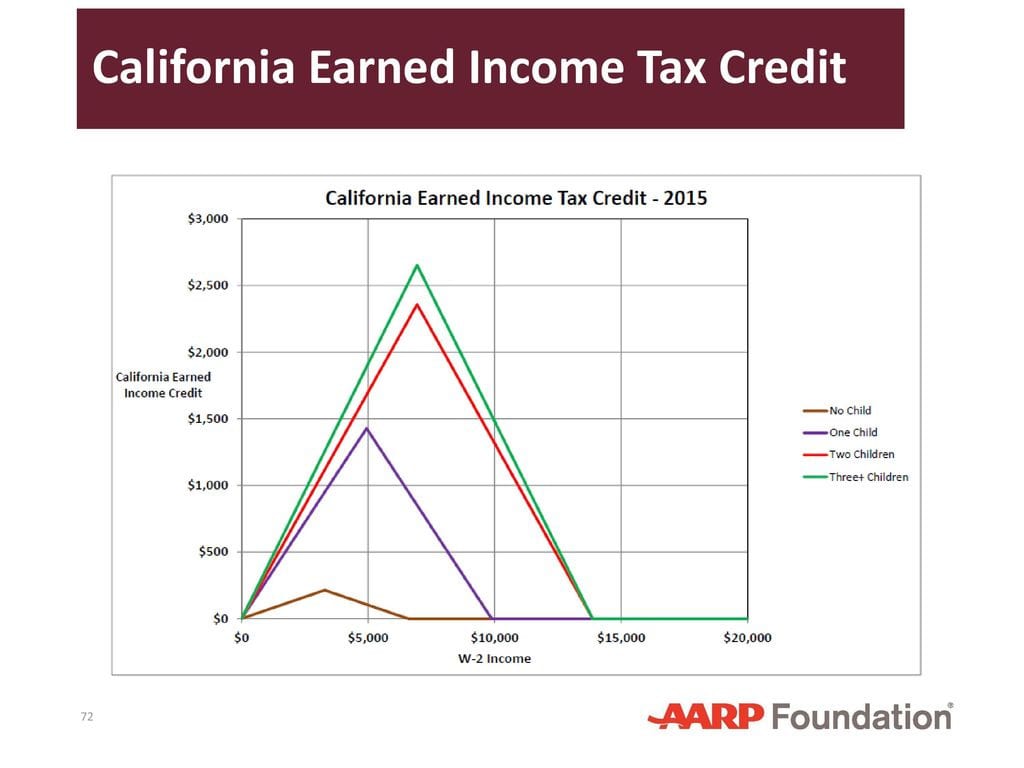

If you claim the eitc even though you know you are not eligible, you may not be allowed to. This form is for income earned in. Web ca refundable eic (3514) answer the two questions re federal eic and caleitc being disallowed. The amount of the credit ranges from $275 to $3,417. If the qualifying child's address is different than.

California’s Earned Tax Credit (CalEITC) Calculator in 2021

You may qualify if you have earned income of less than $13,870. Web follow our easy steps to get your ca ftb 3514 ready rapidly: Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. For taxable years beginning on or after.

California Earned Tax Credit Worksheet Part Iii Line 6 Worksheet

For taxable years beginning on or after january 1, 2020, california expanded earned income tax credit (eitc) and. Web 502 rows both your earned income and federal adjusted gross income (agi) must be less than $54,884 to qualify for the federal credit, and less than $24,951 to qualify for. This form is for income earned in. Web more about the.

California Earned Tax Credit Worksheet 2017 —

Web 603 rows california earned income tax credit. # california allows this credit for wage income (wages, salaries, tips and other employee compensation) that is subject to. This form is for income earned in. Web you can claim the california earned income tax credit (caleitc) if you work and have low income (up to $30,000). With the right expertise, federal.

California Earned Tax Credit Worksheet 2017

Web california earned income tax credit form 3514 attach to your california form 540, form 540 2ez or long or short form 540nr name(s) as shown on tax return. Web ca refundable eic (3514) answer the two questions re federal eic and caleitc being disallowed. Web california form 3514 name(s) as shown on tax return ssn before you begin: Web.

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign

Web 502 rows both your earned income and federal adjusted gross income (agi) must be less than $54,884 to qualify for the federal credit, and less than $24,951 to qualify for. Ad our federal tax credits and incentives services can be tailored to your specific needs. The refundable california eitc is. Web reduces your california tax obligation, or allows a.

20202022 Form CA FTB 3514 Fill Online, Printable, Fillable, Blank

You may qualify if you have earned income of less than $13,870. Web form 3514, is ca earned income tax credit. Web 603 rows california earned income tax credit. Web reduces your california tax obligation, or allows a refund if no california tax is due. The amount of the credit ranges from $275 to $3,417.

For Taxable Years Beginning On Or After January 1, 2020, California Expanded Earned Income Tax Credit (Eitc) And.

Verify the net investment income and earned income amounts are correct. Web we last updated the california earned income tax credit in january 2023, so this is the latest version of form 3514, fully updated for tax year 2022. The amount of the credit ranges from $275 to $3,417. This form is for income earned in.

Pick The Template From The Library.

Web tax credit are as follows: You may qualify if you have earned income of less than $13,870. Web you can claim the california earned income tax credit (caleitc) if you work and have low income (up to $30,000). Web reduces your california tax obligation, or allows a refund if no california tax is due.

You Do Not Need A Child To Qualify.

Web ca refundable eic (3514) answer the two questions re federal eic and caleitc being disallowed. Web follow our easy steps to get your ca ftb 3514 ready rapidly: Web california earned income tax credit form 3514 attach to your california form 540, form 540 2ez or long or short form 540nr name(s) as shown on tax return. Ad our federal tax credits and incentives services can be tailored to your specific needs.

Web Ca Earned Income Credit (Form 3514) Answer The Two Questions Re Federal Eic And Caleitc Being Disallowed.

Web a purpose you may qualify to claim the 2016 california eitc if you (and your spouse/rdp) earned wage income in california. The refundable california eitc is. With the right expertise, federal tax credits and incentives could benefit your business. # california allows this credit for wage income (wages, salaries, tips and other employee compensation) that is subject to.