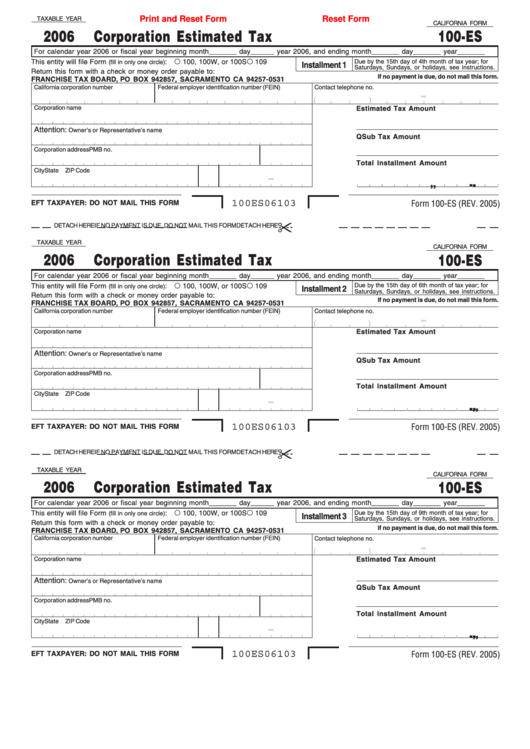

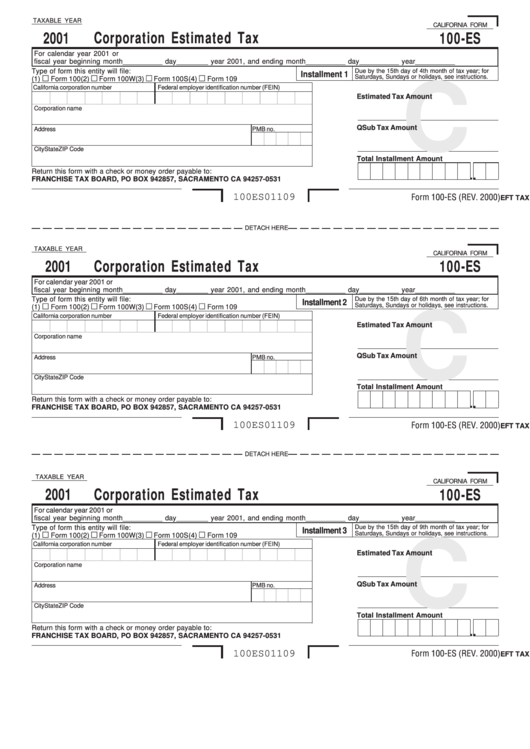

California Form 100 Es

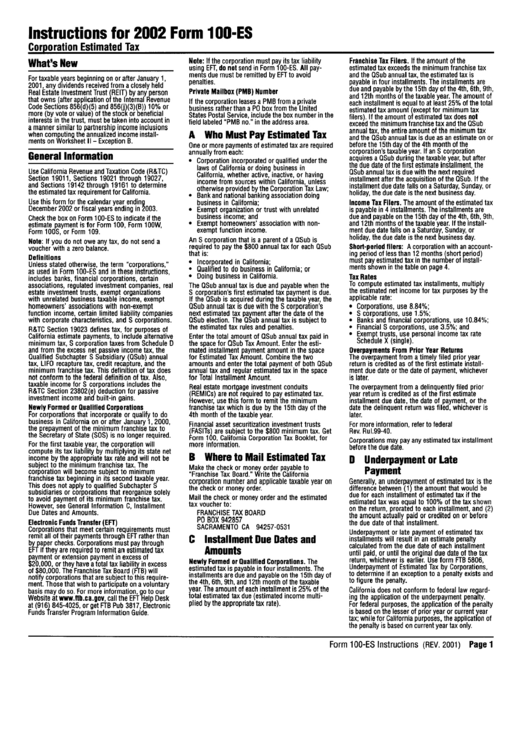

California Form 100 Es - 2023 fourth quarter estimated tax payments due for individuals. M 100, 100w, or 100s m 109 return this form with a check or money order payable to: Easily fill out pdf blank, edit, and sign them. Who must pay estimated tax. This entity will file form (check only one box): Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. The full amount of tax must be paid by the original due date. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable year. You can print other california tax forms here. One or more payments of estimated tax are required annually from each:

This entity will file form (check only one box): Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable year. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. The full amount of tax must be paid by the original due date. This form is for income earned in tax year 2022, with tax returns due in. This does not extend the time for payment of tax; Who must pay estimated tax. Save or instantly send your ready documents. M 100, 100w, or 100s m 109 return this form with a check or money order payable to: You can print other california tax forms here.

Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. The full amount of tax must be paid by the original due date. This entity will file form (check only one box): 2023 fourth quarter estimated tax payments due for individuals. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable year. M 100, 100w, or 100s m 109 return this form with a check or money order payable to: This does not extend the time for payment of tax; Easily fill out pdf blank, edit, and sign them. One or more payments of estimated tax are required annually from each: Estimated tax is the amount of tax the corporation expects to owe for the taxable year.

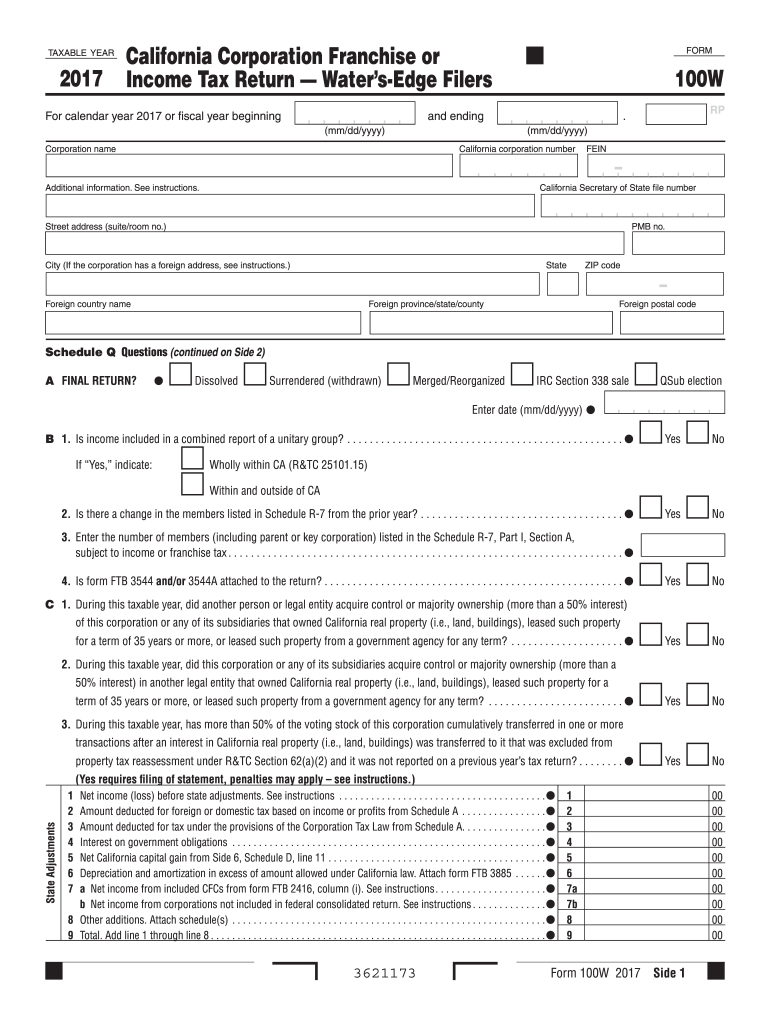

Form 100 Download Fillable PDF or Fill Online California Corporation

This does not extend the time for payment of tax; Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. 2023 fourth quarter estimated tax payments due for individuals. Easily fill out pdf blank, edit, and sign them. Original due.

14 California 100 Forms And Templates free to download in PDF

Save or instantly send your ready documents. The full amount of tax must be paid by the original due date. Go to payments/penalties > estimates. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the.

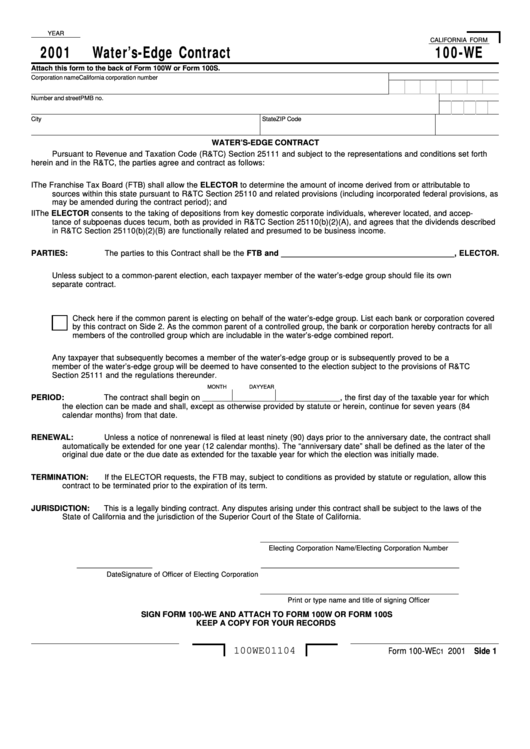

California Form 100We Water'SEdge Contract 2001 printable pdf

Go to payments/penalties > estimates. One or more payments of estimated tax are required annually from each: This does not extend the time for payment of tax; This entity will file form (check only one box): Easily fill out pdf blank, edit, and sign them.

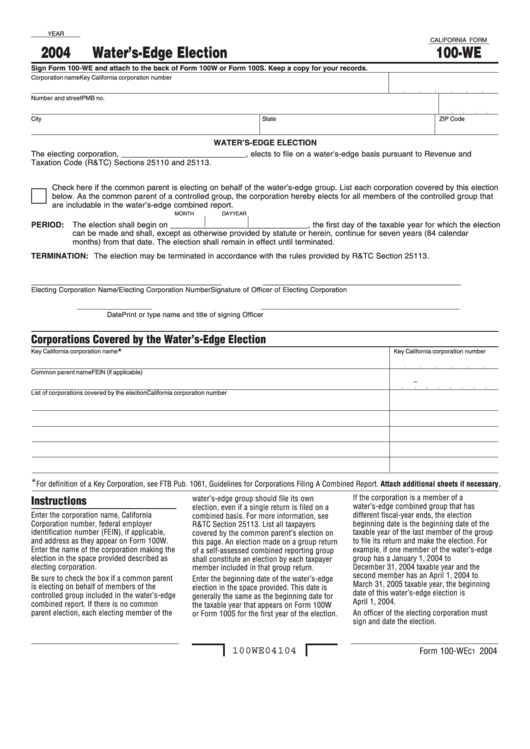

California Form 100We Water'SEdge Election 2004 printable pdf

2023 fourth quarter estimated tax payments due for individuals. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. The full amount of tax must be paid by the original due date. Estimated tax is the amount of tax the corporation expects to owe for the taxable year.

2013 Form 100Es Corporation Estimated Tax Edit, Fill, Sign Online

This does not extend the time for payment of tax; You can print other california tax forms here. One or more payments of estimated tax are required annually from each: Who must pay estimated tax. Go to payments/penalties > estimates.

California form 541 Instructions 2017 Fresh Petition Letter Template

2023 fourth quarter estimated tax payments due for individuals. One or more payments of estimated tax are required annually from each: This entity will file form (check only one box): You can print other california tax forms here. Easily fill out pdf blank, edit, and sign them.

View Document California Code of Regulations

You can print other california tax forms here. 2023 fourth quarter estimated tax payments due for individuals. Who must pay estimated tax. Save or instantly send your ready documents. This does not extend the time for payment of tax;

Fillable California Form 100Es Corporation Estimated Tax 2006

Easily fill out pdf blank, edit, and sign them. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Who must pay estimated tax. 2023 fourth quarter estimated tax payments due for individuals. This does not extend the time for.

Form 100Es Corporation Estimated Tax California printable pdf download

M 100, 100w, or 100s m 109 return this form with a check or money order payable to: Easily fill out pdf blank, edit, and sign them. The full amount of tax must be paid by the original due date. Estimated tax is the amount of tax the corporation expects to owe for the taxable year. 2023 fourth quarter estimated.

2017 Form CA FTB 100W Fill Online, Printable, Fillable, Blank pdfFiller

Save or instantly send your ready documents. This entity will file form (check only one box): Who must pay estimated tax. You can print other california tax forms here. M 100, 100w, or 100s m 109 return this form with a check or money order payable to:

Save Or Instantly Send Your Ready Documents.

This form is for income earned in tax year 2022, with tax returns due in. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Who must pay estimated tax. The full amount of tax must be paid by the original due date.

This Entity Will File Form (Check Only One Box):

This does not extend the time for payment of tax; Go to payments/penalties > estimates. M 100, 100w, or 100s m 109 return this form with a check or money order payable to: 2023 fourth quarter estimated tax payments due for individuals.

You Can Print Other California Tax Forms Here.

Estimated tax is the amount of tax the corporation expects to owe for the taxable year. Easily fill out pdf blank, edit, and sign them. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable year. One or more payments of estimated tax are required annually from each:

)