California Form 461

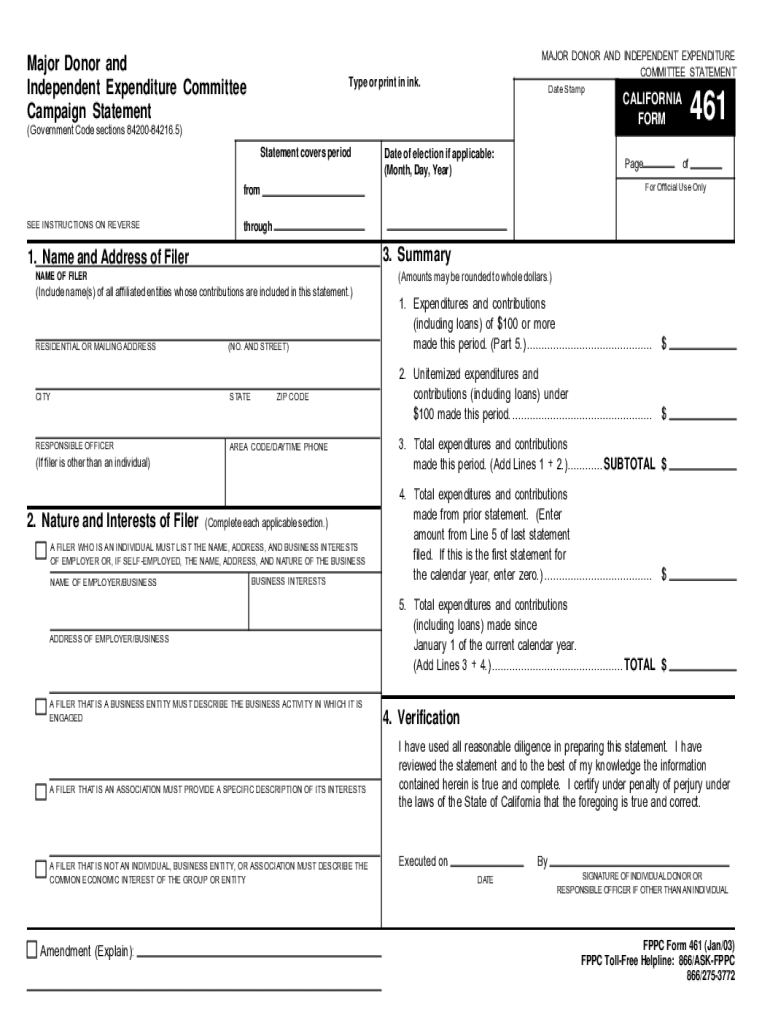

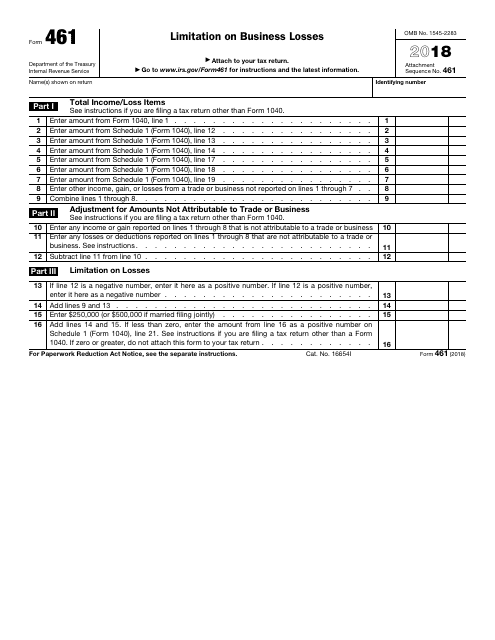

California Form 461 - Please provide your email address and it will be emailed to you. However, for california purposes, the. Statement period covered date period started date period ended date of election, if applicable. Web form 461 (major donor and independent expenditure committee campaign statement) secretary of state: Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if both: Web form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than. Web california courts | self help guide. Web forms & rules > find your court forms > browse all court forms. Use form ftb 3461 to compute the excess business loss. Web committee campaign statement 461 california form who uses form 461:* major donors • an individual or entity that makes monetary or nonmonetary contributions.

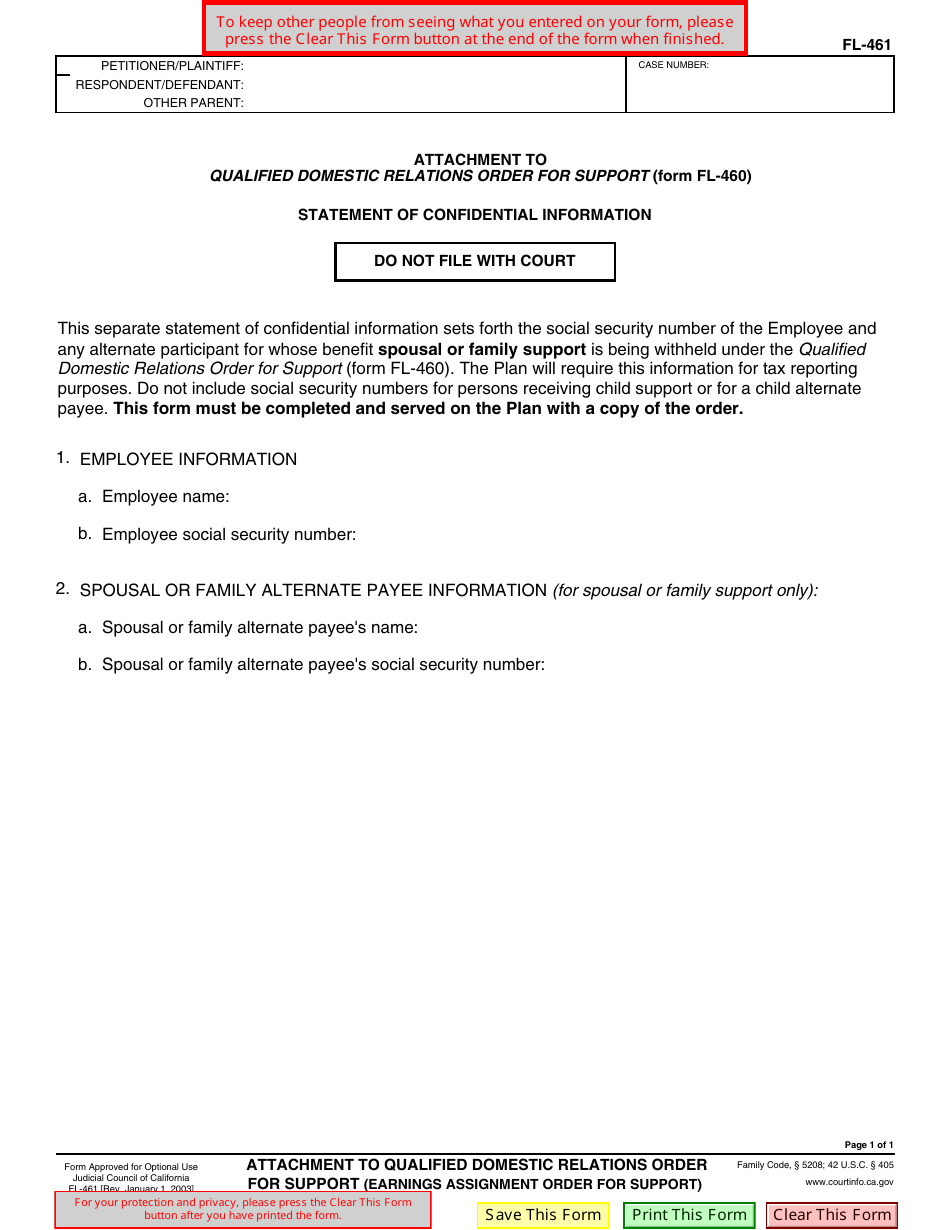

Web california courts | self help guide. Use form ftb 3461 to compute the excess business loss. Web 2020, 3461, california limitation on business losses. You are a noncorporate taxpayer your net losses from all of your trades or. Please provide your email address and it will be emailed to you. I certify under penalty of perjury under the. However, for california purposes, the. Web form approved for optional use family code, § 5208; It is attached to qualified domestic relations order. 925, passive activity and at.

You may be required to. This is only available by request. Taxpayers cannot deduct an excess business loss in the current year. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if both: Web major donor and independent expenditure committees that are required to file reports with the secretary of state must file form 461 electronically if they make contributions. Use form ftb 3461 to compute the excess business loss. Any candidate or officeholder who does not have a controlled. 2870, providing the information is necessary in order to. Web california courts | self help guide. Please provide your email address and it will be emailed to you.

Form 461 Instructions Fill Out and Sign Printable PDF Template signNow

925, passive activity and at. Web committee campaign statement 461 california form who uses form 461:* major donors • an individual or entity that makes monetary or nonmonetary contributions. Electronically and paper original* non. You are a noncorporate taxpayer your net losses from all of your trades or. Use form ftb 3461 to compute the excess business loss.

Freddie Mac 1000 / Fannie Mae 1007 19882021 Fill and Sign Printable

Web form approved for optional use family code, § 5208; However, for california purposes, the. Web 2020, 3461, california limitation on business losses. Web forms & rules > find your court forms > browse all court forms. Taxpayers cannot deduct an excess business loss in the current year.

Fill Free fillable Form 461 Limitation on Business Losses (IRS) PDF form

Web special filings unit, p.o. 2870, providing the information is necessary in order to. It is attached to qualified domestic relations order. Any candidate or officeholder who does not have a controlled. I certify under penalty of perjury under the.

Da Form 461 5 ≡ Fill Out Printable PDF Forms Online

Web forms & rules > find your court forms > browse all court forms. Taxpayers cannot deduct an excess business loss in the current year. Web tells the retirement plan information about the employee and the person receiving spousal or partner support. You are a noncorporate taxpayer your net losses from all of your trades or. Electronically and paper original*.

Free California Advance Directive Form PDF eForms

It is attached to qualified domestic relations order. 2870, providing the information is necessary in order to. Web file form 461 if you’re a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $270,000 ($540,000 for married. Web tells the retirement plan information about the employee and the person receiving spousal or partner.

IRS Form 461 Download Fillable PDF or Fill Online Limitation on

Please provide your email address and it will be emailed to you. Use form ftb 3461 to compute the excess business loss. Taxpayers cannot deduct an excess business loss in the current year. However, for california purposes, the. Web special filings unit, p.o.

Form FL461 Download Fillable PDF or Fill Online Attachment to

Web form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than. Use form ftb 3461 to compute the excess business loss. Any candidate or officeholder who does not have a controlled. You may be required to. Please provide your email address and.

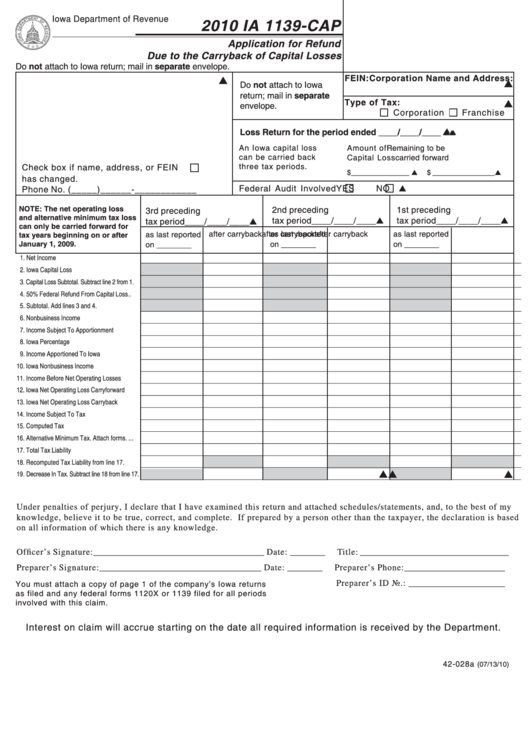

Form Ia 1139Cap Application For Refund Due To The Carryback Of

Web file form 461 if you’re a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $270,000 ($540,000 for married. Web california courts | self help guide. I certify under penalty of perjury under the. Taxpayers cannot deduct an excess business loss in the current year. 925, passive activity and at.

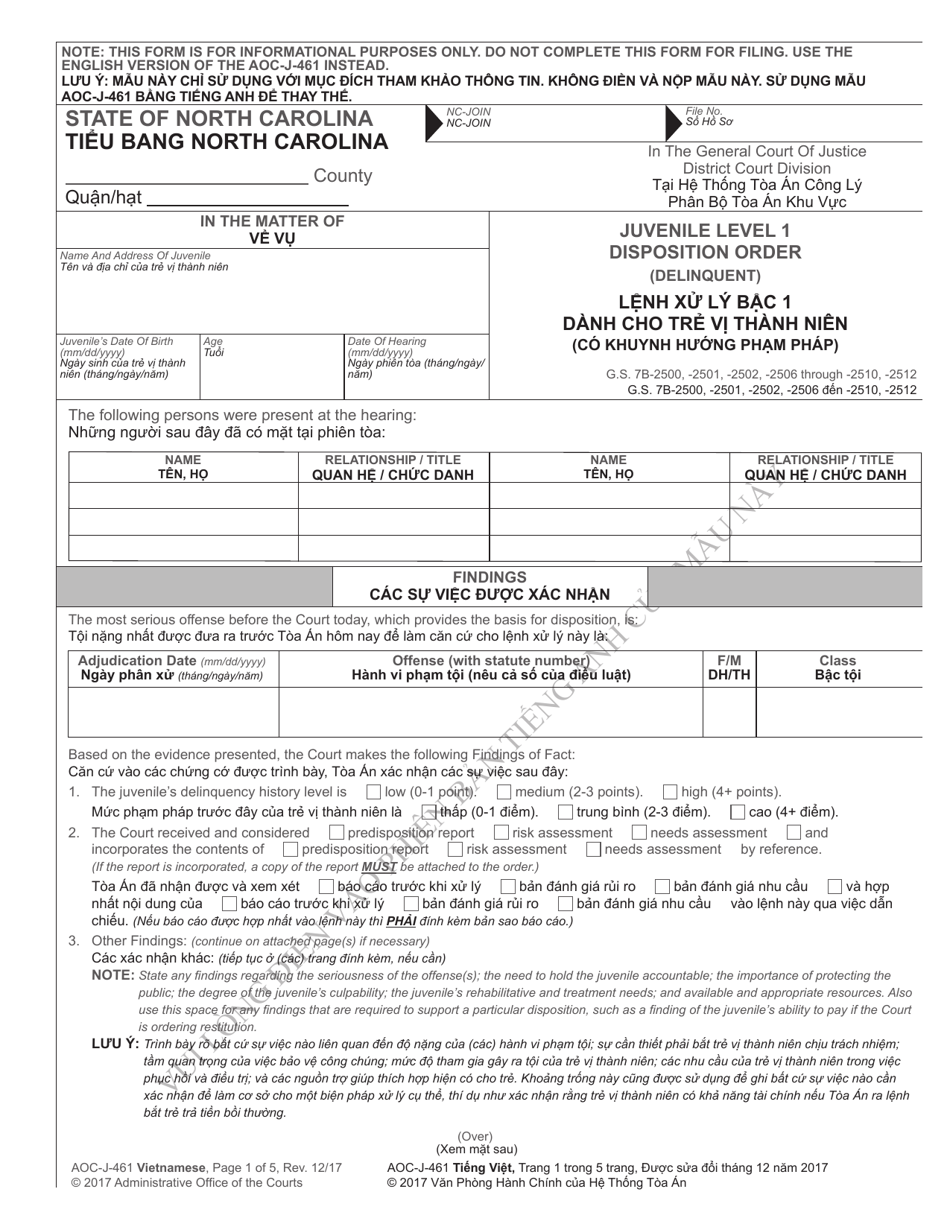

Form AOCJ461 Download Printable PDF or Fill Online Juvenile Level 1

You are a noncorporate taxpayer your net losses from all of your trades or. Web tells the retirement plan information about the employee and the person receiving spousal or partner support. Electronically and paper original* non. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if both: Web california courts | self help guide.

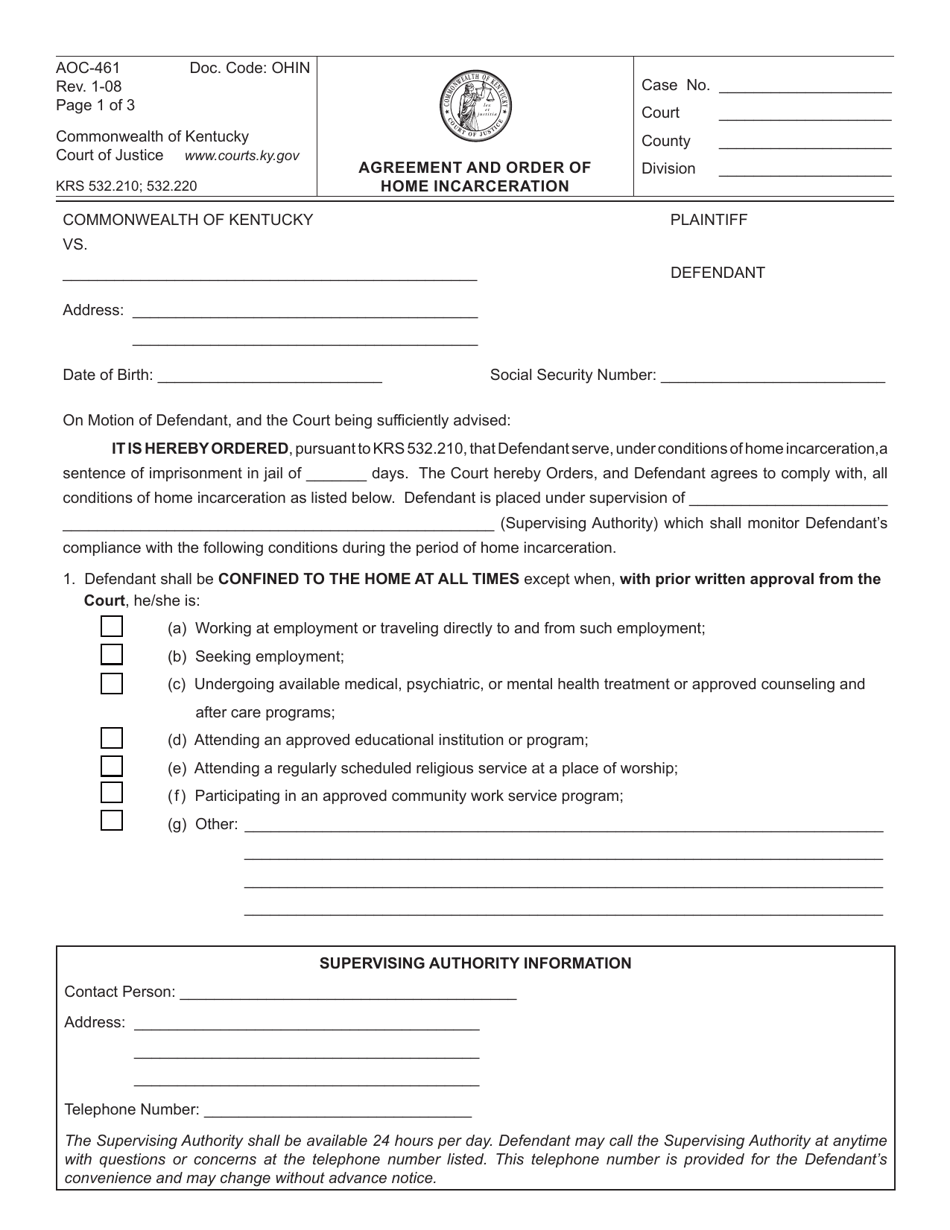

Form AOC461 Download Fillable PDF or Fill Online Agreement and Order

Web form 461 (major donor and independent expenditure committee campaign statement) secretary of state: Please provide your email address and it will be emailed to you. You may be required to. Any candidate or officeholder who does not have a controlled. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if both:

Electronically And Paper Original* Non.

Web committee campaign statement 461 california form who uses form 461:* major donors • an individual or entity that makes monetary or nonmonetary contributions. Web major donor and independent expenditure committees that are required to file reports with the secretary of state must file form 461 electronically if they make contributions. Taxpayers cannot deduct an excess business loss in the current year. Web form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than.

Web Special Filings Unit, P.o.

It is attached to qualified domestic relations order. Web forms & rules > find your court forms > browse all court forms. You are a noncorporate taxpayer your net losses from all of your trades or. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if both:

However, For California Purposes, The.

I certify under penalty of perjury under the. Web california courts | self help guide. This is only available by request. Web form approved for optional use family code, § 5208;

Statement Period Covered Date Period Started Date Period Ended Date Of Election, If Applicable.

Please provide your email address and it will be emailed to you. Web file form 461 if you’re a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $270,000 ($540,000 for married. Use form ftb 3461 to compute the excess business loss. Web 2020, 3461, california limitation on business losses.